(Part of the IFA Master Curriculum)

Key Question for Physicians

You’ve likely heard about the Immediate Financing Arrangement (IFA) as a tax-efficient strategy for your MPC. But if it’s so effective, why isn’t it the right choice for every physician?

- A Clear Insurance Purpose: The strategy is a way to finance a permanent life insurance policy; it is not a standalone investment. A successful IFA requires a clear, long-term estate planning or wealth transfer goal that necessitates the insurance in the first place.

- Significant Financial Scale: An IFA is a strategy for substantial goals. Lenders typically require minimum annual premiums of at least $50,000 for a decade or more, making it suitable only for physicians with significant, stable corporate cash flow.

- Comfort with Complexity and Leverage: This is a multi-decade leveraged strategy that is not “set-and-forget”. It requires a physician who is comfortable with borrowing to invest and who has a collaborative advisory team (accountant, wealth advisor) to manage the annual complexities.

As a busy physician, you are constantly balancing the demands of your practice with the need to manage your personal and corporate finances effectively. You have likely heard about various strategies designed to enhance tax-efficient growth, including the Immediate Financing Arrangement (IFA).

Perhaps you’ve seen presentations that seemed overly optimistic or left you with more questions than answers. If you’ve ever thought a strategy sounded “too good to be true”, you were right to be skeptical.

This guide is for you. It provides a balanced, no-nonsense look at the IFA, moving beyond the sales pitch to give you the details you need to make an informed decision.

Page Contents

Why You Might Be Wary (And Why It’s a Good Thing)

Many IFA presentations are built on generic templates that highlight the potential upside while glossing over the risks, costs, and ongoing requirements. They can feel superficial because they often are.

Your skepticism is a valuable filter. A properly structured IFA is a powerful strategy, but it’s also a complex one. We believe that a confident decision requires a balanced perspective. That means focusing as much on the “why nots” as the “whys”.

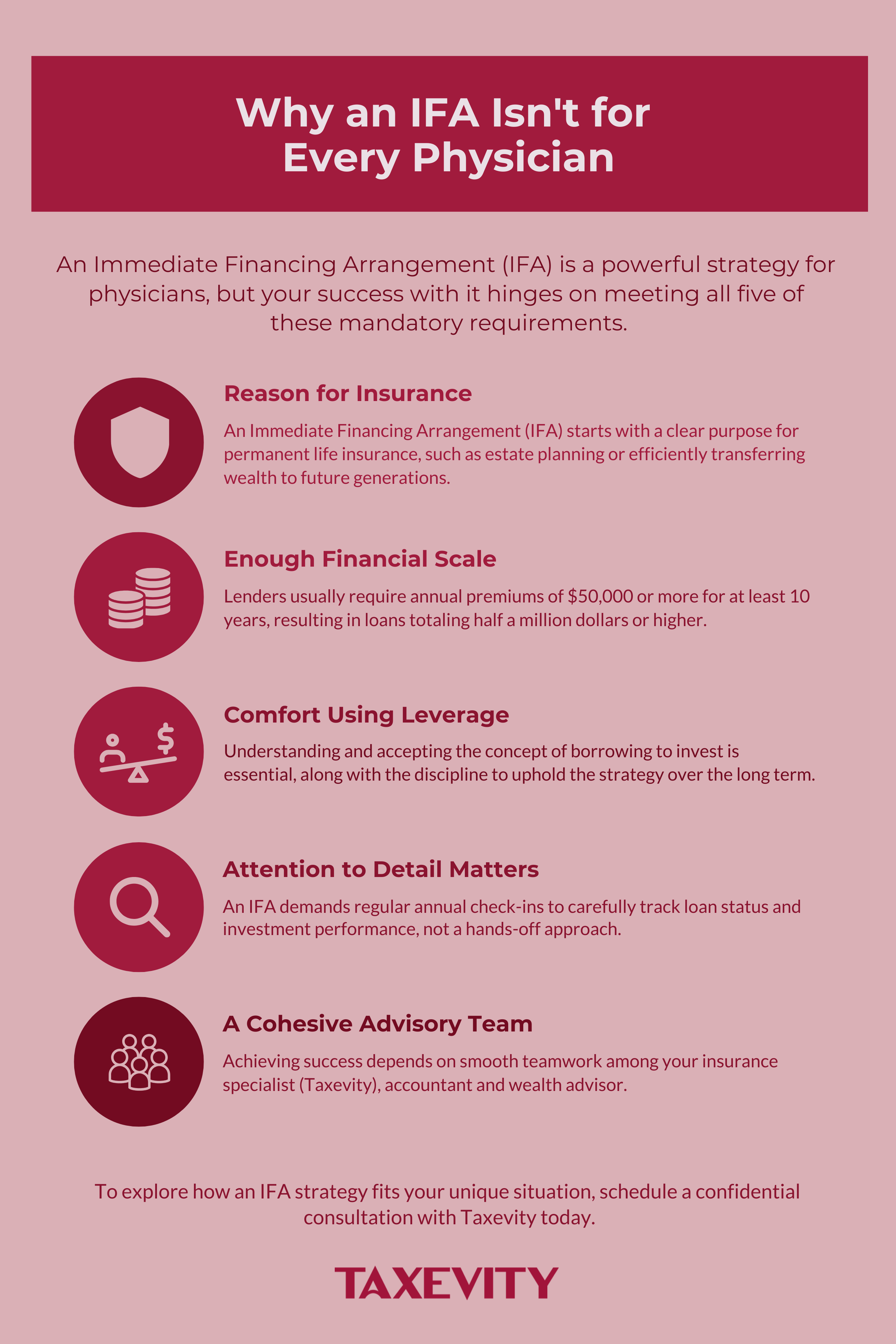

Why an IFA Isn’t For Every Physician

An IFA is a specialized tool, not a universal solution for successful physicians. Here are the key reasons it may or may not be the right fit for you and your practice:

- Reason for Insurance: The foundation of an IFA is a reason for permanent life insurance, such as estate planning or tax-efficiently passing wealth to the next generation. This is essential for the integrity of the strategy.

- Minimum Scale: An IFA is designed for substantial financial goals. Lenders typically require annual premiums of at least $50,000 for 10 years, creating a total loan of $500,000 or more.

- Comfort with Leverage: An IFA involves borrowing to invest. A key part of this strategy is ensuring the investment loan’s interest is tax-deductible, which requires meeting the CRA’s ‘purpose test’. While this can amplify tax benefits and returns, it also introduces risk. You must be comfortable with the principles of leverage and have the discipline to maintain the strategy long-term.

- Attention to Detail: An IFA is not a passive investment. The strategy requires annual reviews with your advisory team to monitor the loan, track the performance of the insurance policy and the investments, and ensure everything remains aligned with your goals.

- A Cohesive Advisory Team: An IFA is not a standalone product; it’s a coordinated strategy. Success requires your accountant and wealth advisor to be informed, comfortable, and collaborative. A common hurdle is an advisor who is unsupportive, often because they are unfamiliar with the strategy, which is why we’ve created dedicated resources for accountants and wealth advisors.

Addressing the Fine Print: A Look at Key Risks

A balanced look means examining the potential downsides. Here are the key risks we review with physicians:

- Interest Rate Volatility: A sharp rise in interest rates can reduce the positive spread between your investment returns and the after-tax cost of the loan. Our projections model a higher-than-current loan rate to build confidence in the strategy’s resilience.

- Lender & Loan Risk: We can make introductions to major Canadian financial institutions that have dedicated IFA programs. However, any commercial loan has renewal terms and conditions, which we help you understand from the outset.

- Policy Performance: Our projections are built on conservative assumptions, using a whole life dividend scale below the insurer’s current one to stress-test the plan against underperformance.

- The Exit Strategy: An IFA is designed to be a lifelong strategy. While you can unwind it early, doing so can be complex and trigger taxes, negating many of the benefits. A long-term commitment is essential.

Your Time is Valuable. So is Your Financial Future

Your primary focus is on your patients and your practice. Our focus is on helping you and your advisory team evaluate complex insurance-based financial strategies with clarity and confidence.

Whether you believe an IFA might be the right fit for your corporation or would like a second opinion on a proposal you’ve received, we invite you to connect with us.

For more on how IFAs can be structured for incorporated professionals, please see our dedicated articles: