(Part of the IFA Master Curriculum)

Key Question for Canadians

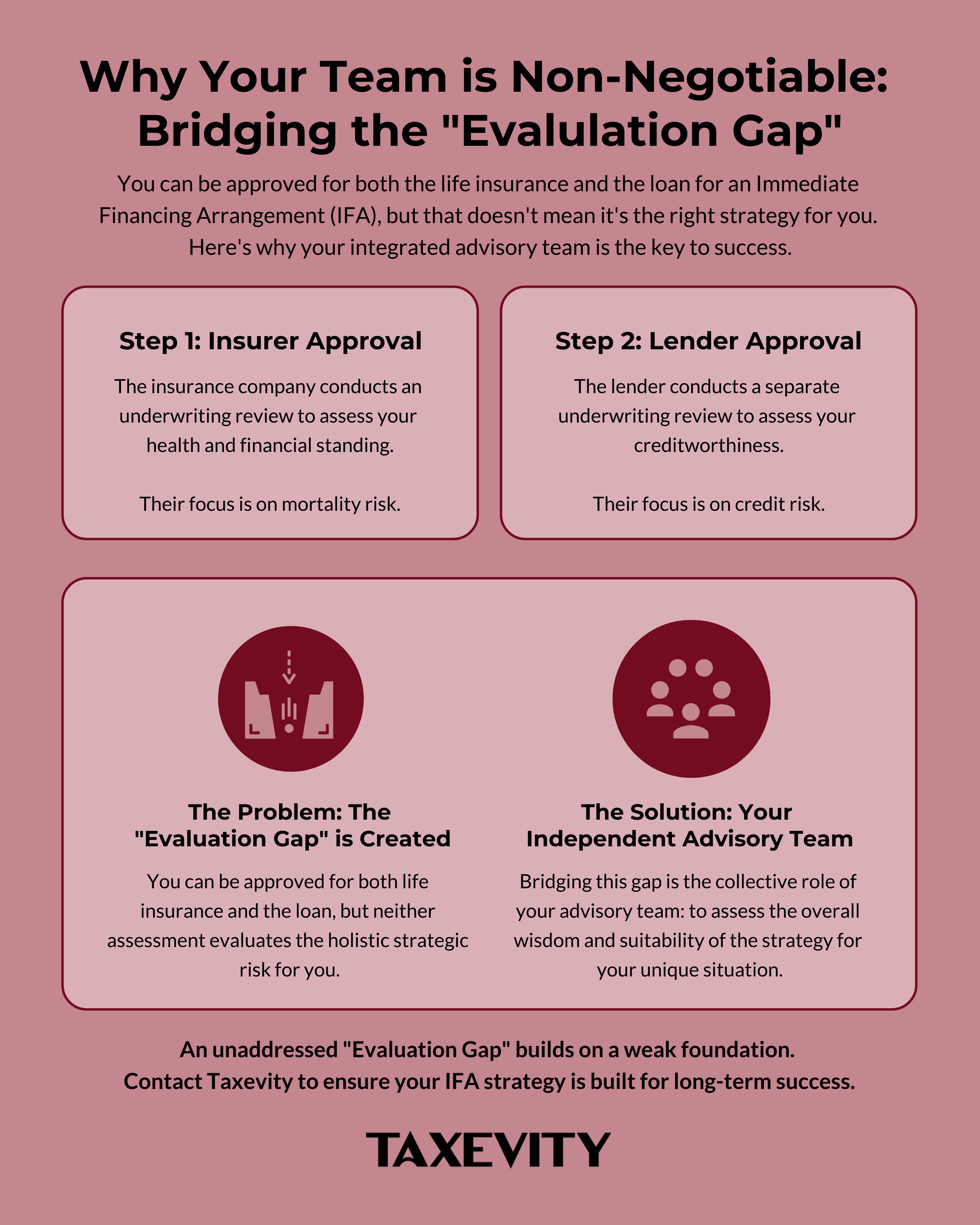

You can be approved for both the insurance and the loan for an Immediate Financing Arrangement (IFA), but who is assessing the overall strategic risk to ensure the strategy is truly suitable for your unique situation?

- The “Evaluation Gap”: An insurer assesses mortality risk and a lender assesses credit risk, but neither evaluates the holistic strategic risk for you. This gap means you can be approved for both components but still be a poor candidate for an IFA if the strategy doesn’t align with your goals or risk tolerance.

- Your Coordinated Team: The success of an IFA strategy is inextricably linked to the expertise and seamless coordination of a dedicated team of independent advisors. A successful IFA requires five coordinated specialists: the Architect (Insurance & Modeling), the Guardian (Accountant), the Strategist (Wealth Advisor), the Advocate (Legal Counsel), and the Integrator who drives the process forward.

- A Strategy for Growth & Impact: A properly managed IFA uses a foundational Protection asset (a permanent life insurance policy) to secure certainty and control. This protective asset is then leveraged to enable tax-advantaged Growth, ultimately expanding your ability to create a lasting legacy and achieve greater philanthropic Impact.

The Immediate Financing Arrangement (IFA) is one of the most powerful financial strategies available to successful business owners, incorporated professionals, and high-net-worth Canadians. However, it is crucial to understand that an IFA is not a generic off-the-shelf product but a sophisticated, customized financial process. An IFA integrates a permanent life insurance policy with third-party lending to solve a complex capital allocation problem: how to secure life insurance for your estate planning without tying up capital that could be generating higher returns elsewhere.

The success of an IFA strategy is inextricably linked to the expertise and seamless coordination of a dedicated team of independent advisors. Within the Taxevity framework, a properly managed IFA aligns with the three core pillars of wealth management. It begins with the foundation of Protection, using a permanent life insurance policy to secure certainty and control. This protective asset is then leveraged to enable tax-advantaged Growth through the strategic investment of loan proceeds. Ultimately, this enhanced financial capacity expands your ability to create a lasting legacy and achieve greater philanthropic Impact.

This guide provides a blueprint for assembling and managing the Core Advisory Team required to navigate the complexities of an IFA and ensure its long-term success.

Page Contents

The Evaluation Gap: Your Team’s Most Critical Role

A fundamental truth of the IFA is that you must undergo two separate and distinct underwriting reviews: one with the insurance company to assess your health and financial standing, and another with the lender to assess your creditworthiness. The insurer assesses mortality risk, while the lender assesses credit risk.

Neither assessment evaluates the holistic strategic risk for you. This omission creates a potential “evaluation gap”. You can be approved for both the insurance and the loan but still be a poor candidate for an IFA if the strategy doesn’t align with your goals or risk tolerance. This gap can only be bridged by your independent advisory team, whose collective role is to assess the overall wisdom and suitability of the strategy for your unique situation.

The Core Roles: Assembling Your Core Advisory Team

Successful execution of an IFA hinges on a symphony of specialists, each playing a distinct but coordinated role. While assembling this team requires a deliberate effort, it is a high-return investment. A well-integrated team doesn’t just mitigate risk; it unlocks opportunity by ensuring every component of the strategy is optimized and working in concert, maximizing the potential for long-term value creation.

- The Insurance & Modeling Specialist: The Architect

At Taxevity, we act as the Architect of the foundational insurance asset. Our role involves the meticulous design of the policy, sophisticated financial modeling to stress-test the strategy, and clear explanation of the mechanics to you and your team.

Learn more in our detailed guide: The Architect’s Role on the IFA Core Advisory Team. - The Accountant (CPA): The Guardian

The Accountant serves as the Guardian of tax compliance. They perform critical due diligence on the proposal’s assumptions and ensure the structure adheres to CRA rules for interest and premium deductibility.

Learn more in our detailed guide: The Accountant’s Role on the IFA Core Advisory Team. - The Wealth Advisor: The Strategist

The Wealth Advisor is the Strategist for the invested loan proceeds. They are responsible for designing and managing a portfolio that achieves growth while meeting the strict “income-earning purpose test” required for tax deductibility.

Learn more in our detailed guide: The Wealth Advisor’s Role on the IFA Core Advisory Team. - The Legal Counsel: The Advocate

The Legal Advocate constructs the sound legal architecture that underpins the IFA. They protect your interests by reviewing all contracts and guarantees, and ensure the policy ownership structure is optimized for your estate planning goals.

Learn more in our detailed guide: The Legal Advocate’s Role on the IFA Core Advisory Team.

The Critical Fifth Role: The Integrator

Beyond these four technical specialists, a successful IFA requires a fifth functional role: The Integrator. This is not necessarily a separate person but a crucial function that one member of the Core Advisory Team must formally accept. The Integrator is the designated coordinator responsible for facilitating joint meetings, ensuring all advisors are operating from the same set of facts, and driving the process forward.

Given the complexity of an IFA, it’s easy for decision gridlock to set in, causing you to remain in the suboptimal status quo. The Integrator acts as the client’s advocate, helping to overcome this inertia and move the plan into action. This role is often filled by the Wealth Advisor or Accountant, who typically have the most holistic view of the client’s finances. The key is that this person must be formally designated at the outset to prevent miscommunication and ensure accountability.

Frequently Asked Questions (FAQ)

- Do I really need all four advisors for an IFA?

Yes. Each advisor manages a critical and distinct risk: the insurance specialist manages policy design risk, the accountant manages tax compliance risk, the wealth advisor manages investment risk, and the lawyer manages contractual and structural risk. Attempting an IFA without any one of them leaves you dangerously exposed. - Who is typically the “Integrator” on the team?

This role is most often filled by the Wealth Advisor or the Accountant, as they usually have the most comprehensive view of your overall financial picture. However, a proactive client can also take on this role. The most important thing is that the role is formally assigned so one person is responsible for coordination. - What is the first step in assembling my Core Advisory Team?

The first step is to identify a clear reason for life insurance for estate planning. If the idea originates with your wealth advisor or accountant, the next step is to get integrated insurance and IFA modeling from Taxevity.

Conclusion: Integration is the Only Path to Success

An Immediate Financing Arrangement (IFA) is not a product you buy, but a sophisticated ongoing process that must be managed by a collaborative team of independent, expert advisors. The risks of a disjointed or incomplete team—from tax compliance failures to significant investment losses—are too great to ignore.

Your most important role is to act as the CEO of your plan, taking the lead in assembling, vetting, and ensuring the coordination of your advisory council. By following a structured process and asking tough questions, you can navigate the complexities of the IFA with confidence. This integrated approach is the only reliable path to ensuring the strategy successfully transforms a foundational Protection tool into a powerful engine for tax-advantaged Growth and a significant multiplier for your ultimate philanthropic and legacy Impact.

Ready to build your team?

If you or your advisors are exploring how an IFA could fit into your financial plan, contact us. We specialize in the foundational modeling and insurance structuring that make this strategy work, and we collaborate seamlessly with your existing team of trusted professionals.