(Part of the IFA Master Curriculum)

Key Question for Accountants

When reviewing a client’s Immediate Financing Arrangement (IFA), why is insisting on a whole life insurance policy a critical point of your due diligence for ensuring the strategy’s long-term stability?

- The Lender’s Requirement: The entire IFA strategy is built on a lender’s willingness to extend a significant, long-term line of credit. Their primary concern is the quality and predictability of the collateral; they need certainty about its value decades from now to de-risk the transaction.

- Whole Life’s Contractual Certainty: Whole life insurance is uniquely suited to be institutional-grade collateral because its value is based on contractual guarantees, not market speculation. These include guaranteed cash value growth , fixed premiums , and a guaranteed death benefit , providing a level of predictability that volatile alternatives like Universal Life cannot match.

- Your Due Diligence Mandate: For the client, the stability of whole life provides crucial protection against collateral calls that could otherwise collapse the strategy unexpectedly. Your role is to ensure the IFA is built on this solid foundation by confirming the policy is specifically structured for high early cash value (HECV) and that its projections have been stress-tested using a reduced dividend scale.

An Immediate Financing Arrangement (IFA) is a sophisticated financial strategy, and like any high-performance machine, it relies on a powerful and exceptionally reliable engine. While the IFA structure itself—the chassis—provides the framework for leverage and capital efficiency, the life insurance policy at the core determines whether the strategy will perform reliably for decades or falter unexpectedly.

For accountants advising clients, the central question is not just how an IFA works, but why it’s built a certain way. The choice of insurance is not a matter of preference; it’s a structural necessity. This is why Whole Life insurance is the indispensable engine for a properly structured Immediate Financing Arrangement (IFA). For accountants, understanding this distinction is a matter of professional due diligence, ensuring a client’s leveraged strategy is built on a foundation of contractual certainty, not market speculation.

Page Contents

- 1 The Lender’s Dilemma: The Need for Reliable Collateral

- 2 The Unmatched Guarantees of Whole Life Insurance

- 3 The Borrower’s Perspective: Stability for Long-Term Planning

- 4 Not All Whole Life Policies Are Created Equal

- 5 Why Alternative Insurance Policies Fall Short

- 6 Key Due Diligence Questions for Accountants

- 7 The Accountant’s Verdict: A Non-Negotiable Foundation

- 8 From Theory to Practice

The Lender’s Dilemma: The Need for Reliable Collateral

To understand the role of Whole Life, you must first look at the IFA from the lender’s perspective. The entire strategy is predicated on a financial institution’s willingness to extend a significant, long-term line of credit. A lender’s primary concern is the quality and predictability of the collateral securing that loan. They need to know, with a high degree of certainty, what that collateral will be worth not just next year, but 10, 20, and 30 years from now.

This long-term certainty is the foundation that allows lenders to offer the favourable terms—such as loan-to-value ratios up to 100% of the cash surrender value (CSV)—that make the IFA viable. The specific details of the loan are critical, as covered in our guide, Anatomy of an IFA Loan: A Look at Renewals, Guarantees, and Lender Security. Without institutional-grade collateral, the strategy simply doesn’t work.

The Unmatched Guarantees of Whole Life Insurance

Whole Life insurance is uniquely suited to solve the lender’s dilemma because it is defined by a series of contractual guarantees that provide a level of predictability unmatched by other financial instruments.

- Fixed Premiums: From the day the policy is issued, the premiums are fixed and guaranteed never to increase. This provides absolute certainty regarding the funding commitment, which is critical for long-term financial modeling.

- Guaranteed Cash Surrender Value (CSV) Growth: A portion of every premium payment is contractually designated to increase the policy’s CSV. This value is guaranteed to grow each year at a fixed rate specified in the insurance contract, insulated from external market volatility.

- Guaranteed Death Benefit: The policy features a contractually guaranteed death benefit, which provides the ultimate backstop for the loan repayment. This assures the lender that the funds to extinguish the debt will be available precisely when needed.

The Borrower’s Perspective: Stability for Long-Term Planning

While satisfying the lender is key to initiating the IFA, the stability of Whole Life is equally vital for the borrower. A client enters into a decades-long strategy with two primary objectives: to maintain access to the leveraged capital without disruption and to have the underlying life insurance policy perform its intended function for their estate or business succession plan.

The predictable, non-volatile growth of the Whole Life CSV provides crucial protection against collateral calls. Unlike a market-based asset that could decline in value and force a lender to demand repayment, the CSV’s steady appreciation ensures the loan remains well-secured. This gives the borrower peace of mind that the strategy won’t be unexpectedly collapsed, forcing the premature sale of assets or triggering a significant tax liability. This stability is a key component of having the right IFA mindset.

Furthermore, this reliable growth ensures the policy achieves its long-term purpose. At death, the tax-free insurance proceeds repay the loan, leaving the investments purchased with the borrowed funds intact for the estate or corporation. The power of the strategy is amplified by the fact that the life insurance creates a surplus CDA credit (see The IFA-Enhanced CDA: A Foundational Guide for Accountants), allowing for a significant amount of wealth to be distributed tax-free to shareholders.

Not All Whole Life Policies Are Created Equal

While Whole Life is the correct type of policy, the specific design is critical for an IFA’s success. For an IFA to be effective from day one, the policy must be structured to generate high early cash values (HECV). This is often achieved by using a additional deposit option (ADO), which accelerates the growth of the policy’s collateral value in the initial years. It is sometimes possible to use an existing policy, a topic we explore in Using an Existing Life Insurance Policy for an IFA: An Accountant’s Guide (coming soon).

Furthermore, while there is guaranteed CSV growth, a significant portion of the long-term performance comes from non-guaranteed dividends. For this reason, your partners at Taxevity stress-test the IFA by modeling correlated market risks, which includes running projections using a reduced dividend scale. Our conservative approach helps ensure the IFA remains viable even if the insurer’s future dividend performance is lower than today’s scale, as detailed in How an IFA Performs in Different Economic Climates.

These non-guaranteed dividends reflect the performance of an insurer-managed investment account. Unlike most investments, gains and losses inside the account are allowed to spread over a period of years, which reduces volatility in projected performance significantly by eliminating the spikes and dips of market-based investments.

Beyond the policy’s structure, the choice of insurance carrier is important. Factors like the insurer’s long-term financial stability, their history of dividend payments, and their administrative service levels for complex arrangements are critical due diligence points we consider when evaluating The Players in an IFA: Who Are the Insurance Companies and Lenders? (coming soon).

Why Alternative Insurance Policies Fall Short

To cement the case for Whole Life, it’s essential to understand why other common types of insurance are structurally unsuitable for an IFA.

- Universal Life (UL): While also a form of permanent insurance that builds cash value, UL is designed for flexibility at the cost of guarantees. Its cash value growth is not guaranteed in the same way as Whole Life; it is typically tied to fluctuating short-term interest rates or the performance of a stock market index. This volatility makes it less attractive collateral for a lender who prioritizes certainty. The flexibility that is a feature for the policyowner is a drawback for the lender, undermining the stable foundation required for a decades-long IFA. For a deeper comparison of strategies, see IFA vs. IRP: An Accountant’s Guide to Strategic Selection. As we’ve discussed, an IFA isn’t for everyone, and using a volatile asset as its foundation increases risk for all parties.

- Term Life Insurance: This type of policy is fundamentally incompatible with an IFA because it builds no cash surrender value. Without a CSV, there is no accumulating asset to pledge as collateral. However, some term policies can be converted to permanent insurance without new medical underwriting. It is best to confirm these conversion options before putting coverage in place, as restrictions may apply.

| Feature | Whole Life | Universal Life | Term Life |

| Collateral Quality | Excellent (Guaranteed) | Fair to Poor (Volatile) | None |

| Predictability | High | Low | N/A |

| IFA Suitability | Ideal | Risky / Unsuitable | Incompatible |

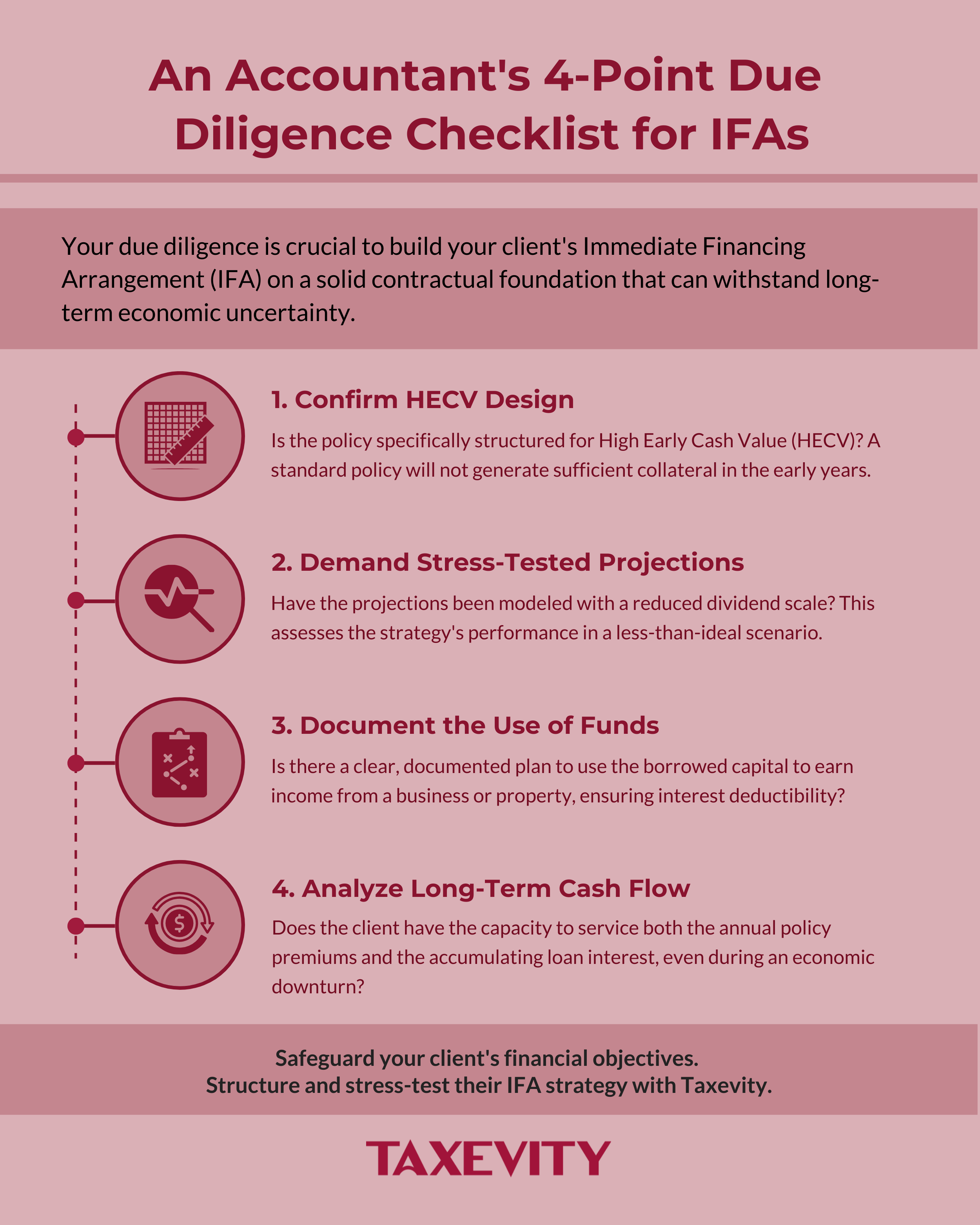

Key Due Diligence Questions for Accountants

As the trusted advisor, your role is to vet the structural integrity of the IFA. Here are key due diligence questions to guide your review:

- Is the policy designed for High Early Cash Value (HECV)? A standard policy will not generate sufficient collateral in the early years. Confirm that the policy has been specifically structured for the IFA.

- Have the projections been stress-tested? Insist on seeing illustrations that model a reduced dividend scale to assess the strategy’s performance in a less-than-ideal scenario.

- Is there a clear plan for the borrowed funds? To ensure interest deductibility, the client must have a documented plan to use the capital to earn income from a business or property.

- Has the client’s long-term cash flow been analyzed? The client must have the capacity to service both the annual premiums and the accumulating loan interest, even during periods of economic downturn.

The Accountant’s Verdict: A Non-Negotiable Foundation

For an accountant, the core responsibility is to guide clients toward financially sound, defensible strategies. The choice of Whole Life insurance as the foundation for an IFA aligns perfectly with this mandate. It transforms the arrangement from a speculative leveraged play into a structured, predictable financial tool. By insisting on a properly designed HECV policy and modeling conservative, stress-tested projections, you provide significant due diligence. This ensures the strategy is built not on hope, but on a contractual foundation solid enough to withstand decades of economic uncertainty, safeguarding your client’s long-term financial objectives.

From Theory to Practice

Understanding the mechanics is the first step. The next is applying that knowledge to a specific client file. We invite you to a peer-level discussion to model how a properly structured IFA could apply to a real-world client scenario, ensuring it aligns with their objectives for protection, growth, and impact.

Book a call at your convenience to begin the conversation.