(Part of the IFA Master Curriculum)

Key Question for Accountants

As your client’s trusted advisor, how do you move beyond simply comparing interest rates to conduct rigorous due diligence and select the right long-term IFA lending partner?

- The Strategic Partnership: The selection process is best framed as a critical strategic decision to secure a stable, long-term partner for a strategy that can span decades. This perspective prioritizes stability and partnership, accounting for the significant costs that a premature exit from the arrangement can trigger.

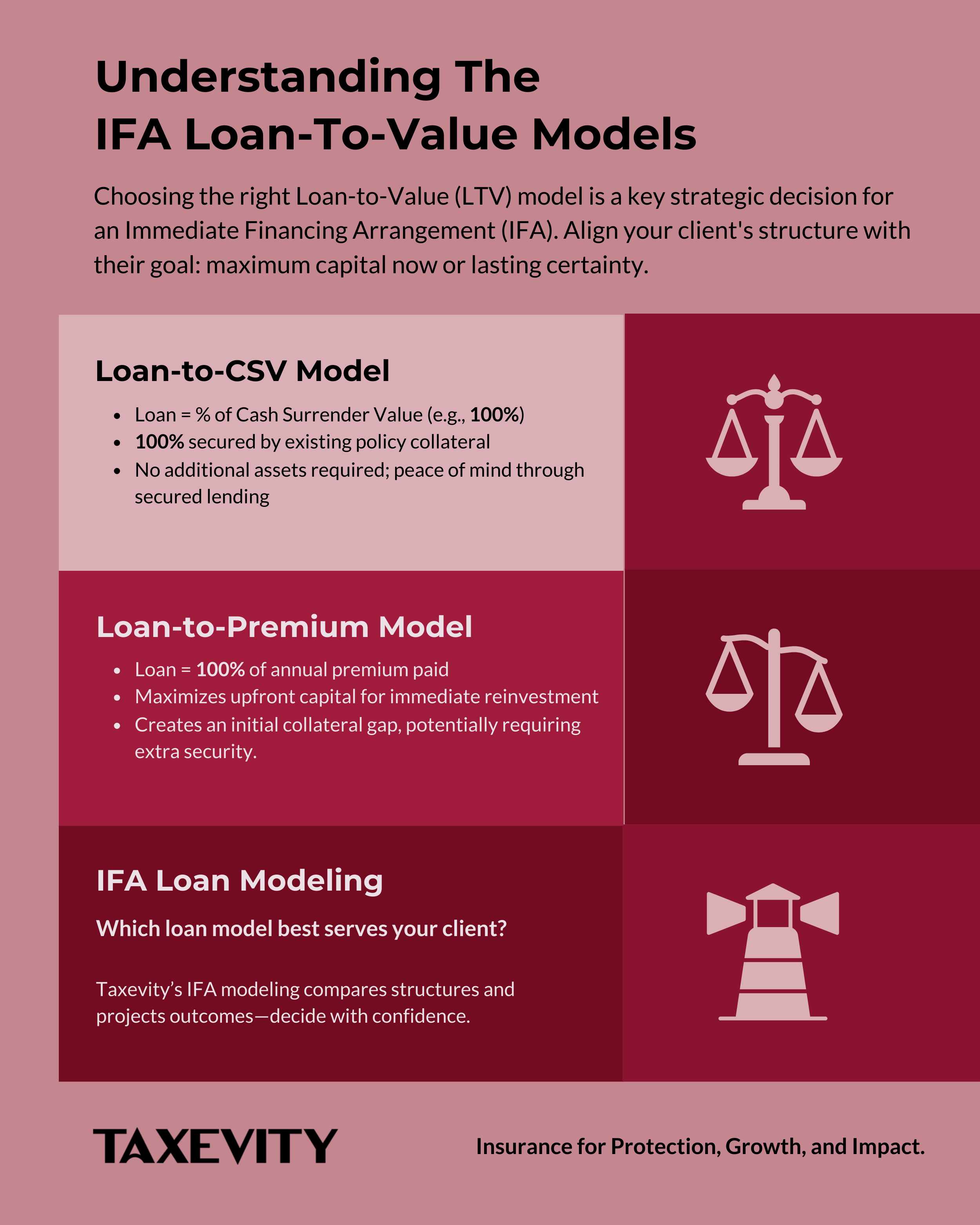

- The Core Differentiator: A major differentiator in the evaluation is the lender’s Loan-to-Value (LTV) model. This creates a fundamental choice between the straightforward Loan-to-Cash-Surrender-Value model, which is always fully secured by the policy’s collateral value, and the Loan-to-Premium model, which provides more immediate capital but can create a “collateral gap” requiring the client to post other assets.

- The Client-Centric Outcome: The goal of this diligence is to strategically match the lender with your client’s primary objective. This process aligns the lending structure to the client’s goal, whether that is maximizing immediate capital for reinvestment or prioritizing maximum certainty and simplicity to provide “valuable peace of mind”.

As an accountant, your clients rely on you to vet complex financial strategies. For an Immediate Financing Arrangement (IFA), the choice of lender is a critical strategic decision, not just a search for a loan. The right lender is a long-term partner in a financial strategy that can span decades, and this decision requires rigorous diligence. An IFA is a sophisticated structure, and the lender’s expertise, stability, and flexibility are crucial to its success.

This guide provides a comprehensive framework for evaluating and selecting an IFA lender in Canada, equipping you to advise your clients effectively. It builds on the core principles from our foundational IFA due diligence guide for accountants by offering practical tools to guide the decision-making process.

Page Contents

- 1 The Lender: A Strategic Partner, Not Just a Capital Provider

- 2 A Multi-Factor Evaluation Model

- 3 Strategic Matching: Aligning the Lender with the Client’s Goal

- 4 The Lender Engagement and Selection Process

- 5 Identifying Key Red Flags

- 6 Practical Tools for Your Practice

- 7 Next Steps: Applying This Framework for Your Clients

The Lender: A Strategic Partner, Not Just a Capital Provider

An IFA creates a triangular relationship between your client (the policyowner), the life insurer, and a third-party lender. The loan is typically repaid from the insurance policy’s tax-free death benefit, meaning this partnership is designed to last a lifetime. This long-term horizon reframes the selection process from a transactional search for the lowest interest rate to a strategic quest for a stable and knowledgeable partner. A premature exit from this long-term arrangement can have significant costs, which underscores the importance of choosing the right partners from the outset. For more, see our guide on the true after-tax cost of a premature IFA exit.

A reputable lender also acts as an essential gatekeeper. The IFA process involves two independent underwriting reviews: one by the insurer for mortality risk and another by the lender for credit risk. Securing financing from an experienced IFA lender provides a powerful third-party validation that your client’s financial profile is suited for a long-term leveraged strategy. Difficulty in obtaining financing should be seen as a critical warning sign.

Specialized Lenders vs. Major Banks

The Canadian market offers a spectrum of lenders, which can be broadly categorized. It’s crucial to understand the distinction to guide your client to the right fit.

- Specialized Lenders: These are institutions like DUCA Credit Union, Equitable Bank, or Manulife Bank, who have built a significant part of their business model around IFA and insurance lending. Their processes, from underwriting to administration, are purpose-built for these arrangements, often resulting in a more streamlined and efficient experience.

- Major Banks (Generalist Lenders): The major Canadian banks also provide IFA financing, typically through specialized teams within their private banking or commercial divisions, not at the branch level. While these teams are knowledgeable, IFA lending is a small part of the bank’s overall business. There’s a risk the file can get “lost in the rounding” or be subjected to broader institutional policy changes that aren’t tailored to the nuances of IFAs.

Choosing a lender with a dedicated, core focus on IFAs can mitigate risks and help ensure the loan is structured correctly. While using a client’s existing bank may seem convenient, defaulting to that option without comparing it to specialized lenders can mean missing out on more favourable terms or a smoother process.

A Multi-Factor Evaluation Model

A thorough evaluation of potential IFA lenders requires a multi-faceted approach that goes beyond interest rates. The ideal lender offers a superior blend of competitive financial terms, institutional strength, and structural flexibility.

Quantitative Analysis: The Financial Terms

- Interest Rate Structures: Most IFA loans have a variable interest rate, typically priced as the lender’s Prime Rate plus a spread (e.g., Prime + 1%). The spread can vary based on the loan size and your client’s creditworthiness.

- Fee Schedules: Look beyond the interest rate to account for all associated fees. These can include one-time setup or application fees, annual administration fees, and third-party legal costs.

- Lending Ratios (LTV): A critical point of comparison is how the lender determines the maximum loan amount, governed by their Loan-to-Value (LTV) ratio. The two primary models are:

- Loan-to-CSV Model: The loan is a percentage (e.g., 90-100%) of the policy’s current Cash Surrender Value (CSV). In this model, the loan is always fully secured by the current collateral value. While the available loan in the early years is less than the total premiums paid, the CSV eventually outgrows the cumulative premiums, meaning the available loan amount will also become larger.

- Loan-to-Premium Model: The loan equals 100% of the annual premium your client has paid. In the policy’s early years, this creates a “collateral gap,” where the loan amount exceeds the collateral value (the CSV), often requiring your client to post additional collateral. Some lenders may not require this for small collateral gaps and instead offset the additional risk with higher interest rate spreads.

Case Study: LTV in Action

Consider a client with a $100,000 annual premium. In Year 1, the policy’s CSV is $70,000.

- Lender A (Loan-to-CSV @ 100%): Can lend $70,000. The loan is fully secured by the policy’s cash value.

- Lender B (Loan-to-Premium @ 100%): Lends the full $100,000 premium. This creates a $30,000 collateral gap ($100,000 loan – $70,000 CSV), which the client may need to secure with other assets or by paying a higher loan rate.

- Minimum Thresholds: The IFA market is designed for affluent clients. Lenders typically require a minimum total loan facility of $500,000 to $1,000,000, with minimum annual loan advances of $50,000 to $100,000 until that facility is reached. These loan requirements, in turn, dictate the need for significant annual insurance premiums to generate sufficient collateral over time.

Qualitative Analysis: Institutional Strength and Service

- Expertise and Track Record: Prioritize institutions with specialized teams and a long history in the IFA market. This longevity suggests stability and reduces the risk of the lender exiting the market.

- Underwriting Philosophy: A superior lender will have a transparent and efficient underwriting process tailored to IFAs.

- Advisor and Client Service Model: Assess the lender’s service model. Will your client have a dedicated relationship manager? What are the communication protocols?

- Speed of Funding: A faster funding process means your client’s capital can be deployed into their intended investments sooner.

Structural Analysis: Loan Terms and Flexibility

- Collateral Requirements: This is a major differentiator between lenders and a key consideration for your client.

- Repayment and Exit Flexibility: Most IFA loans are revolving lines of credit requiring monthly interest-only payments. Look for the flexibility to make principal repayments without penalty.

- The Demand Loan Clause: Virtually all IFA loans are legally structured as “demand loans,” meaning the lender can demand full repayment at any time. This is a significant underlying risk that your client must understand.

A Note on Interest Deductibility: As the client’s accountant, remember that the deductibility of the loan interest is determined by the use of the borrowed funds—they must be used for the purpose of earning income from a business or property. The lender’s terms do not establish deductibility. Your role in documenting this direct link between the loan and a qualifying investment is critical for ensuring CRA compliance. For a detailed review, see our accountant’s companion to interest deductibility.

Strategic Matching: Aligning the Lender with the Client’s Goal

The selection process should be driven by your client’s primary objective. As we discussed in our guide to IFA insurers and lenders, the art of the IFA is matching the right institutions to the client’s goal.

- For the client prioritizing Maximum Immediate Capital: You would lean towards lenders offering a 100% Loan-to-Premium model. These lenders facilitate immediate access to the full premium amount for reinvestment, making them ideal for business expansion or opportunistic investments. This often requires the client to be comfortable posting additional collateral in the early years.

- For the client prioritizing Maximum Certainty and Simplicity: You would favour lenders with a straightforward Loan-to-CSV model and, crucially, those who offer multi-year funding commitments. This approach minimizes risk, eliminates the need for additional collateral, and reduces annual administrative friction, providing valuable peace of mind.

The Lender Engagement and Selection Process

As the client’s trusted financial steward, the accountant’s role in this process is pivotal. You are uniquely positioned to review and package the required financial documentation, evaluate the impact of different loan structures on the client’s balance sheet, and act as a key liaison with the lender. Your involvement is central to the due diligence process, as outlined in our guide on the accountant’s role on the IFA Core Advisory Team.

The engagement process can be broken down into three phases:

- Prequalification and Shortlisting: The process begins with the advisory team determining the appropriate life insurance amount and policy structure. Before a formal application, it’s prudent to prequalify with potential lenders to gauge the likelihood of approval. Based on these discussions and the evaluation criteria, the team can shortlist two to three lenders.

- Formal Application and Due Diligence (One-Time Setup): Once a primary candidate lender is chosen, the formal application process begins, with the insurance and loan applications proceeding in parallel. The advisory team assists the client in completing the lender’s comprehensive application package. If successful, the lender issues a conditional approval, which becomes final once the first premium is paid and the policy is issued.

- Ongoing Relationship (Annual Transactions): The selection process must also consider the long-term relationship. The lender will conduct an annual review of the facility, requiring updated financial information. A good lender will make this process clear and efficient, and some may even pre-approve the funding facility for several years, reducing annual friction.

Identifying Key Red Flags

During your due diligence, be alert for these warning signs:

- Lack of Transparency: Vague or evasive answers regarding fees, risks, or specific clauses in the loan agreement. A trustworthy lender will be open and clear about all aspects of the arrangement.

- Downplaying Risks: Any attempt to dismiss legitimate concerns about interest rate volatility, the demand nature of the loan, or the possibility of a collateral call. A credible lender acknowledges these risks and discusses their mitigation processes.

- High-Pressure Tactics: Pushing for a quick decision or discouraging a full review by the client’s complete advisory team is a major red flag.

- Poor Communication: Unresponsiveness, an inability to answer detailed technical questions, or a lack of familiarity with IFA-specific concepts indicates a lack of necessary expertise.

Practical Tools for Your Practice

Comparative Lender Analysis Matrix

Use the following matrix as a worksheet during your due diligence process to compare potential lenders side-by-side with your client.

| Evaluation Metric | Lender A | Lender B | Lender C |

| Target Client Profile | |||

| Minimum Annual Premium | |||

| Minimum Loan Facility | |||

| Interest Rate Basis | |||

| Setup / Application Fee | |||

| Annual / Review Fees | |||

| Primary LTV Basis | |||

| Dedicated IFA Team? | |||

| Key Differentiator |

Due Diligence Checklist: Key Questions for Lenders

- Can you provide a comprehensive schedule of all potential fees?

- What factors determine my client’s interest rate spread, and can it change?

- What is your precise formula for calculating the Loan-to-Value (LTV) ratio?

- Under what circumstances would you call a loan that is in good standing?

- Who will be my client’s dedicated point of contact for the duration of the loan?

- What is your average processing time from application to funding?

- What does your annual review process entail?

Client Conversation Talking Points

- “We need to look beyond just the interest rate. We’re choosing a long-term partner, so their expertise in this specific type of lending and their service model are just as important.”

- “A key decision is how we structure the loan. One option gives us a smaller loan that’s fully secured by the policy from day one. Another gives us a larger loan upfront but may require us to pledge other assets for the first few years. Let’s discuss your comfort level with that.”

- “It’s important to understand this is a ‘demand loan.’ This is standard for these arrangements and means the bank has the right to ask for repayment. While it’s rare for a loan in good standing, it’s a risk we need to acknowledge.”

- “The lender will do an annual review. This is a normal part of the process to ensure the strategy remains on track. A good lender will make this a straightforward process.”

The final selection should not be based solely on the lowest interest rate. The optimal partner provides the best integrated solution across all criteria.

Next Steps: Applying This Framework for Your Clients

This guide provides the framework for lender due diligence. The next step is to apply it to a specific client file. A collaborative discussion can help model the impact of different lending structures and clarify the path forward.

Schedule a call at your convenience to begin the conversation.