Key Question for Accountants

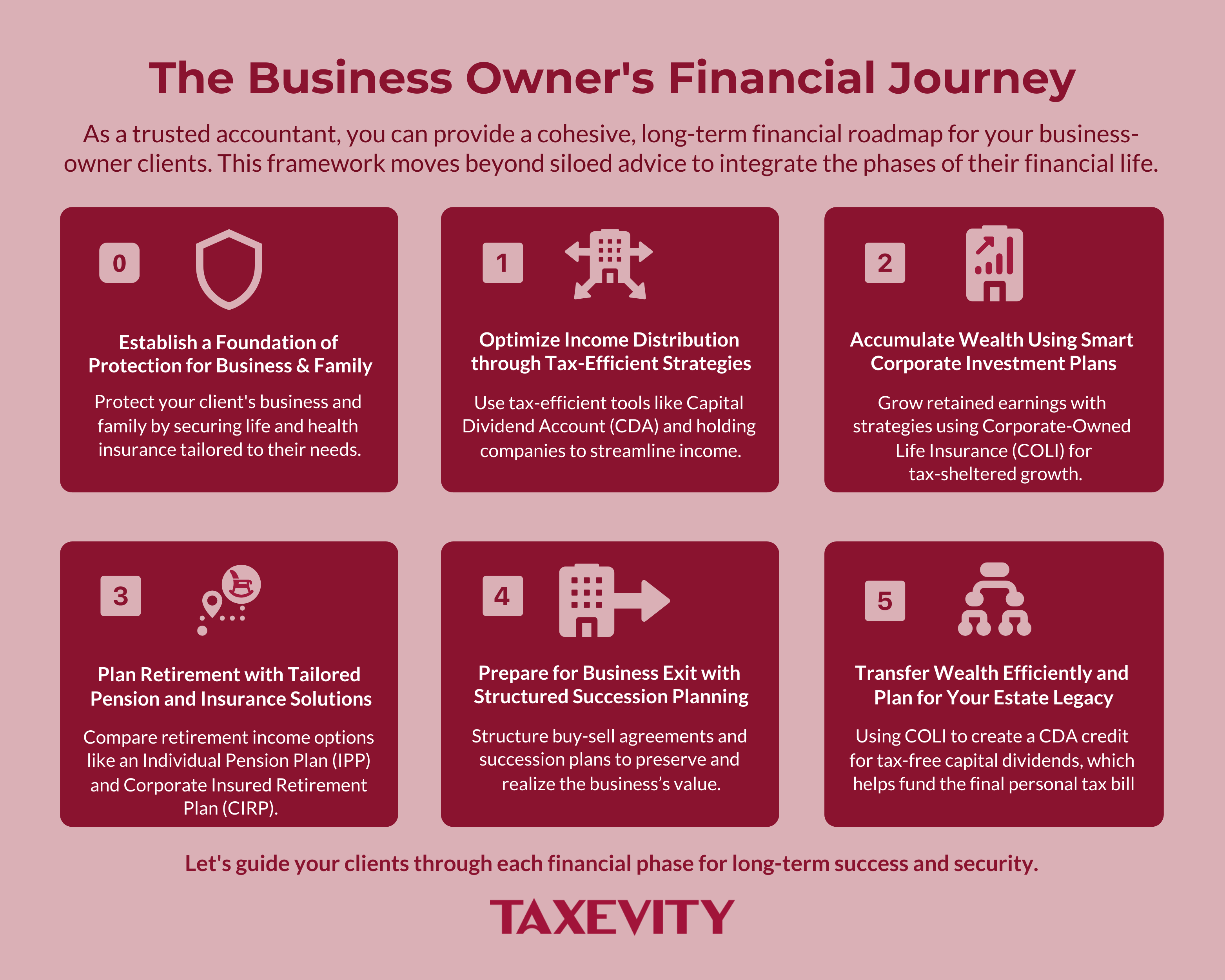

As a trusted advisor, how can you move beyond siloed advice and provide a cohesive, long-term financial roadmap that addresses every stage of your business owner client’s journey?

- The Challenge of Siloed Advice: Financial planning often treats tax, investment, and risk management as separate disciplines , leaving clients with a patchwork of products rather than a cohesive, long-term strategy.

- A Unifying Framework: The Business Owner’s Financial Journey provides a model that integrates the distinct stages of a client’s financial life into a logical progression, anchored in the core philosophy of Protection-Growth-Impact.

- Proactive & Insightful Guidance: This framework equips you to proactively identify challenges and opportunities, critically evaluate strategies, and have more insightful conversations with your clients about their long-term goals.

As a trusted accountant, you navigate the complexities of your clients’ corporate finances daily. From compliance and tax minimization to compensation strategies, you provide the critical guidance that incorporated professionals and business owners depend on. Yet, the financial landscape is often siloed. Tax planning, investment management, risk mitigation, and legacy planning are treated as separate disciplines, leaving clients with a patchwork of products rather than a cohesive, long-term strategy.

This guide provides a unifying framework: The Business Owner’s Financial Journey.

This model integrates the distinct stages of your client’s financial life into a logical progression, providing a roadmap to proactively identify challenges and opportunities. Underpinning this journey is our core Protection-Growth-Impact philosophy. We believe major financial decisions should be anchored in securing what a client has built (Protection), strategically amplifying their wealth (Growth), and finally, enabling them to make their desired mark on the world (Impact).

This guide goes beyond mere definitions, equipping you to critically evaluate strategies and have more insightful conversations with your clients.

Page Contents

- 1 The Foundational Principle: Tax Integration

- 2 Stage 0: The Foundation of Protection

- 3 Stage 1: Earning & Distributing Income

- 4 Stage 2: Accumulating & Amplifying Wealth

- 5 Stage 3: Saving for Retirement

- 6 Stage 4: Business Exit & Succession

- 7 Stage 5: Wealth Transfer & Estate Planning

- 8 From Theory to Practice

The Foundational Principle: Tax Integration

Before exploring specific strategies, it’s crucial to ground the conversation in the foundational theory of Canada’s tax system: the principle of integration. In theory, this principle is meant to ensure that an individual is indifferent to earning income personally versus earning it through a corporation and then paying it out to themselves. The total tax paid should be roughly the same.

In practice, however, integration is imperfect. Differences in federal and provincial tax rates create gaps and inconsistencies. It is within this imperfect implementation that corporate tax planning exists. The “salary vs. dividend” debate, the use of holding companies, and various retirement strategies are all designed to navigate the realities of a system that doesn’t work as cleanly in practice as it does in theory. Acknowledging this provides the essential context for all subsequent stages.

Stage 0: The Foundation of Protection

Before any discussion of growth, a client’s financial foundation must be secure. An unexpected illness or injury can derail the most meticulous financial plan, forcing asset liquidation and jeopardizing their business and family. This stage is the embodiment of the Protection pillar.

The cornerstones of this foundation are life and health insurance solutions that safeguard against catastrophic events:

- Disability Insurance: Protects their income stream if they are unable to work due to an illness or injury by providing monthly tax-free benefits.

- Critical Illness Insurance: Provides a lump-sum, tax-free payment upon diagnosis of a covered illness.

- Term Life Insurance: Ensures their family’s financial needs are met if they pass away unexpectedly.

For routine health expenses, a Private Health Services Plan (PHSP) can be a tax-effective vehicle to flow funds through the corporation for costs like dental care.

Accountant’s Insight: Overcoming Client Inertia

Your clients are wired to focus on growth and tax minimization. Sophisticated corporate strategies are implicitly built on the assumption that the client will remain healthy and be able to generate income. Without this foundation, the entire structure is at risk. Your role as a trusted and influential advisor is crucial in reframing this conversation. By endorsing the importance of foundational protection, you give clients the nudge they need to overcome inertia and secure the viability of the very financial plan you are helping them build.

Framing the Conversation:

- When a client says, “Insurance is too expensive…” you can frame it as, “Let’s compare the known, manageable cost of the premium against the unknown and potentially catastrophic cost of a long-term disability. This isn’t an expense; it’s a financing strategy for a worst-case scenario.”

- When a client says, “I’m healthy, I’ll deal with it later…” a helpful response is, “That’s exactly why we’re discussing it now. Insurance is one of the few things you can only buy when you don’t need it. The goal is to lock in your good health to protect your future.”

Stage 1: Earning & Distributing Income

Once the foundation is secure, the focus shifts to optimizing cash flow out of the corporation, navigating the imperfect tax integration discussed earlier. Key strategies for tax-efficient distribution include:

- The Capital Dividend Account (CDA): A powerful tool for extracting funds tax-free, typically credited with the non-taxable portion of corporate capital gains.

- Shareholder Loans: Offer flexibility but require repayment within one year from the end of the corporation’s fiscal year in which the loan was made to avoid income inclusion.

- Holding Companies: Can offer superior creditor protection, income-splitting opportunities, and help purify assets to qualify for the Lifetime Capital Gains Exemption (LCGE).

Accountant’s Insight: A Holistic View

These tools are interconnected. A holding company can alter the dynamics of shareholder loans and CDA planning. Your value lies in helping clients see this interplay, building a corporate structure that is efficient today and flexible enough for the entire journey. It’s about architecting a response to the reality of imperfect tax integration.

Stage 2: Accumulating & Amplifying Wealth

As a client’s corporation accumulates retained earnings, leaving them in cash is inefficient due to inflation. While investing retained earnings is better, it comes with the downside of high tax on passive investment income (close to or above 50% across Canada). A uniquely powerful asset for corporate investment is permanent cash value life insurance, which combines protection with tax-sheltered growth, preservation of the Small Business Deduction, and the capacity to accept large premiums.

Life insurance, however, presents a common challenge: the capital locked inside the policy creates an opportunity cost. An Immediate Financing Arrangement (IFA) solves this by improving capital efficiency. An IFA is a strategy where the corporate-owned policy is used as collateral for an investment loan, allowing the corporation to put its capital to work in two places at once.

Accountant’s Insight: A Tool for the Right Client

An IFA is a leveraging strategy, and with leverage comes risk. It is better for a high-income earner in a stable profession with a long investment horizon and a high risk tolerance. Crucially, the strategy’s value is not solely dependent on the leveraged investment’s performance because the collateral is the cash surrender value of the policy. Your role is to serve as a crucial checkpoint, validating that the strategy fits the client’s actual risk profile. We can help you evaluate these complex proposals to ensure they are structured properly.

You can find more detail in our posts: Foundational Guide to Immediate Financing Arrangement (IFA) and Corporate-Owned Life Insurance in Canada.

Stage 3: Saving for Retirement

This stage is the long-term culmination of the Growth pillar. However, it is rife with conventional wisdom that often obscures the mathematical reality of the strategies involved. A critical evaluation is essential.

Accountant’s Insight: Comparing Retirement Strategies

The Individual Pension Plan (IPP) is often positioned as the superior alternative to an RRSP. While its higher contribution limits are appealing, several less-discussed aspects warrant a closer look:

- The Tax Arbitrage: Contributions are deducted at the low corporate tax rate (e.g., ~12-27% in Ontario), but retirement income is later taxed at the client’s high marginal personal rate (e.g., ~40-54%).

- Investment Performance Sensitivity: Poor investment returns may require additional tax-deductible contributions, forcing more capital into a struggling plan. Conversely, strong returns can reduce or eliminate future contribution room.

- Locked-In Capital: Funds allocated to an IPP are locked-in and unavailable for other corporate opportunities.

A complementary strategy that addresses these issues is a Corporate Insured Retirement Plan (CIRP), which can supplement retirement income with tax-free personal loans against the policy’s cash surrender value.

The table below offers a critical framework for comparing the two:

| Factor | Individual Pension Plan (IPP) | Corporate Insured Retirement Plan (CIRP) |

| Ideal Client | Age 45+, high T4 income, primary goal is maximizing current tax deductions, understands the future personal tax liability. | Clients with a long-term horizon (typically 20+ years until retirement) seeking to supplement retirement with a stream of tax-free cash flow. |

| Tax Treatment | Deduction at low corporate rate (~12%). Retirement income is fully taxable at high personal rates (~54%). | Premiums are paid with after-tax corporate dollars (an “88-cent dollar”), which is more efficient than using heavily taxed personal dollars. Retirement income is accessed via tax-free personal loans and may require a guarantee fee for use of a corporate asset. Loan interest is typically added to the loan balance (capitalized) and the entire loan is repaid from the tax-free death benefit. |

| Investment | Subject to market volatility. Poor returns require top-ups; strong returns reduce future room. | Managed by the insurance carrier within a whole life policy. Growth is stable, predictable, and tax-exempt. |

| Complexity | High. Requires actuarial calculations, formal documents, and annual reporting. | Low to moderate. Involves establishing a policy and a collateral loan at retirement. |

An IPP creates immediate corporate tax deductions. A CIRP creates tax-free cash flow in retirement. A key estate planning advantage of the CIRP is that the tax-free insurance proceeds create a significant credit to the Capital Dividend Account (CDA) at death, a benefit not offered by an IPP.

The two strategies can also be used together.

Stage 4: Business Exit & Succession

As clients near retirement, their focus shifts to crystallizing the value they’ve built. This stage involves both Protection—safeguarding the business’s value—and Impact, as a liquidity event, like selling a business, is a prime opportunity for philanthropy.

Accountant’s Insight: Structuring the Buy-Sell

When funding a buy-sell agreement with life insurance, the structure—corporate redemption vs. criss-cross—has a significant impact on the Adjusted Cost Base (ACB) of the surviving shareholders’ stock. A corporate redemption model, while administratively simpler, generally does not result in an ACB step-up for the survivors. A criss-cross arrangement does. Your role is crucial in modeling these outcomes to ensure the chosen structure aligns with the partners’ long-term tax and estate planning goals.

Some of the cash generated from a business sale could go directly to a charity, while some could go towards purchasing a permanent life insurance policy with the charity as a beneficiary. Life insurance magnifies the premium dollars that would have been otherwise donated, at the cost of the charity needing to wait until the client passes away. A combination of donation strategies may best satisfy a client’s philanthropic desires.

Stage 5: Wealth Transfer & Estate Planning

The final stage is about transferring wealth efficiently. The primary challenge at death is the deemed disposition of shares, which can trigger a significant capital gains tax liability. Corporate-owned life insurance provides the solution by creating a large credit to the Capital Dividend Account (CDA), allowing a tax-free dividend to be paid to the estate to cover the tax bill.

Accountant’s Insight: Certainty and Fairness

The Capital Dividend Account is the linchpin of an efficient corporate estate plan. Relying on market-based assets to create the CDA credit needed to pay an estate tax bill is a gamble; it assumes the assets will have the necessary gains and that liquidating them won’t cause other problems. Life insurance, by contrast, delivers a pre-determined, tax-free amount of capital at the exact moment it’s needed, replacing uncertainty with surety.

This certainty is also crucial for estate equalization. For clients with one child active in the business and another who is not, a corporate-owned life insurance policy can provide a tax-free cash inheritance to the non-involved child, equal to their share of the business’s value. This allows the business shares to pass intact to the active child, ensuring fairness for all heirs without forcing a sale of the enterprise.

Framing the Conversation:

- When a client says, “My estate can just sell some assets to pay the final tax bill…” you can respond with, “They certainly could, but that forces them to sell on the CRA’s timeline, not their own. What if the market is down or the assets are illiquid? Life insurance provides immediate, tax-free cash, giving the estate the flexibility to sell assets at the most opportune time, preserving their full value for your beneficiaries.”

From Theory to Practice

This framework provides a structured and critical approach to client conversations. We specialize in designing and implementing insurance-based solutions that are critical at each stage of this journey, and we work in partnership with you to provide independent, specialized expertise for your clients.

Let’s connect to discuss how these strategies apply to your clients. Schedule a consultation at your convenience.