Key Question for Incorporated Physicians

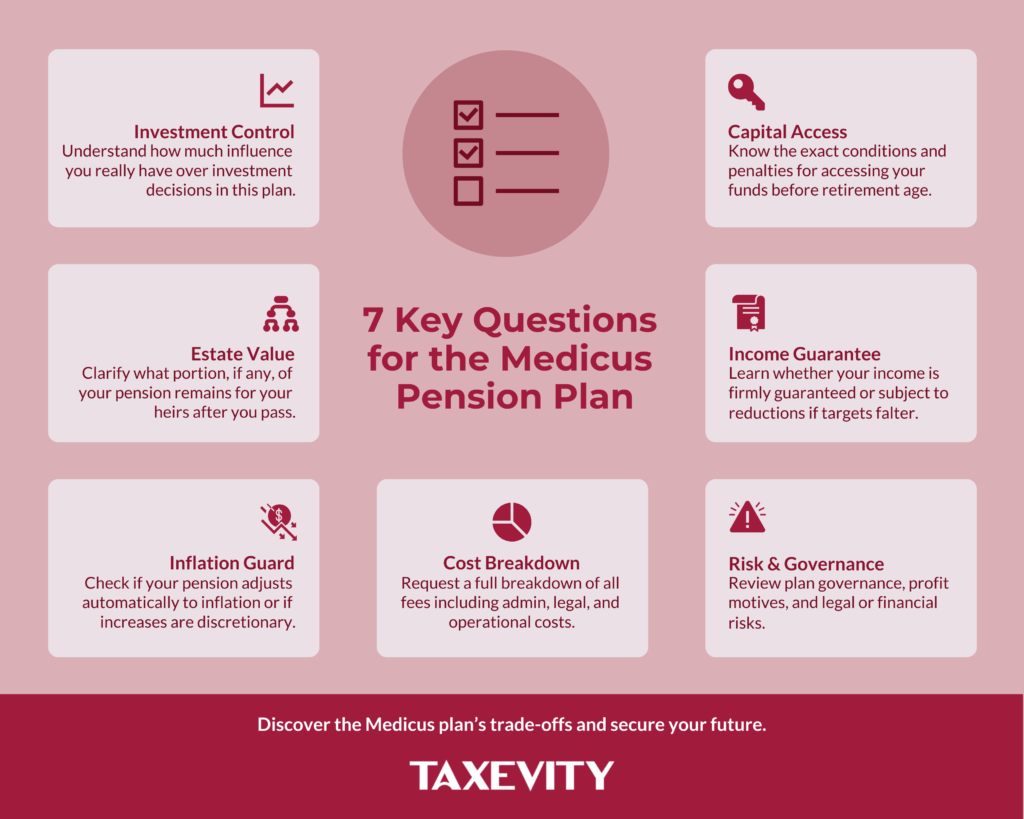

The Medicus Pension Plan is presented as a “hands-off” solution for your MPC , but what are the specific trade-offs you are making in control, capital access, and income guarantees in exchange for this simplicity?

- The “Simplicity” Trade-Off: This “hands-off” plan requires ceding all investment control and accepting that the capital is “locked in” until retirement, which prevents access for other personal or investment uses.

- Income Guarantees: You must clarify if the “predictable, lifetime pension” is a ‘contractual guarantee’ or a ‘target benefit’ that can be reduced, and whether inflation protection is automatic or discretionary.

- Value to Your Estate: You need to ask what residual value, if any, is passed to your beneficiaries , as the estate outcomes are vastly different from an IPP, which leaves a taxable value , or a CIRP, which can create a large, tax-free credit to the Capital Dividend Account (CDA).

For incorporated physicians, the Medicus Pension Plan from Scotiabank is presented as a simple, “hands-off” solution for your Medical Professional Corporation (MPC). The claims of corporate tax deductions, professional management, and survivor benefits are appealing.

However, as with any major financial decision, it’s crucial to look beyond the sales pitch. The most strategic differences between retirement plans aren’t just about the initial deduction; they’re about investment control, capital access, income guarantees, and the net value passed to your estate.

Because detailed, independent information on the Medicus plan is limited, the most prudent approach is to ask the plan administrator specific, direct questions. Here is a due diligence framework to help you get the clarity you need before committing.

Instead of asking “Is Medicus good?” a better question is, “What are the specific trade-offs I am making to get this simplicity?”

Page Contents

What Are You Giving Up for Simplicity?

This first set of questions clarifies what you are trading away—in terms of control, liquidity, and value—in exchange for the “hands-off” nature of the plan.

1. The Question of Control

- What You’ll Hear: Medicus is simple and “hands-off”.

- Ask Medicus: “What input or control do I have over the plan’s investment strategy, asset mix, or the selection of investment managers?”

- Ask Yourself: “Am I comfortable ceding 100% of this control for the life of the plan?”

- Why it matters: In an Individual Pension Plan (IPP), you have full control over the investment strategy. In this plan, you have none.

2. The Question of Access

- What You’ll Hear: Your corporation gets an immediate tax deduction.

- Ask Medicus: “Under what specific circumstances, if any, can I access the capital in my account before the stated retirement age? What are the penalties for doing so, and what is the process?”

- Ask Yourself: “Am I comfortable having this capital locked in, or is future liquidity for personal or investment use more important?”

- Why it matters: This capital is locked in. This is a stark contrast to a Corporate Insured Retirement Plan (CIRP) paired with an Immediate Financing Arrangement (IFA), which is specifically designed to provide capital liquidity for personal or investment use. (See An Accountant’s Guide to Strategic Selection).

3. The Question of Estate Value

- What You’ll Hear: The plan provides survivor benefits.

- Ask Medicus: “After my spouse and I have both passed away, what is the residual value, if any, passed on to my estate or beneficiaries? Or, once the survivor pension ends, is the asset fully depleted?”

- Ask Yourself: “Is my primary goal to secure a simple lifetime pension, or is it to maximize the tax-efficient transfer of wealth to my heirs?”

- Why it matters: An IPP leaves a taxable residual value. A CIRP provides a significant tax-free death benefit to your corporation, creating a large credit to your Capital Dividend Account (CDA). The estate outcomes are vastly different.

What Are You Paying in Costs & Risks?

This second set of questions clarifies what you are “paying” for simplicity—not just in explicit fees, but in the hidden costs of risk, uncertainty, and opaque governance.

4. The Question of Guarantees

- What You’ll Hear: Medicus provides a “predictable, lifetime pension”.

- Ask Medicus: “Is the pension income a ‘contractual guarantee’ from the plan sponsor, or is it a ‘target benefit’? If it is a ‘target benefit,’ under what specific scenarios (e.g., poor investment performance, changing actuarial assumptions) can my accrued benefits or future payments be reduced?”

- Ask Yourself: “Am I seeking a truly guaranteed income, or am I comfortable with a target income that could be reduced if the plan underperforms or members live longer than projected?”

- Why it matters: “Predictable” is not the same as “guaranteed.” This is the single most important question to ask. (Note: A predictable, guaranteed income is available by purchasing a life annuity, an option available within an RRSP or IPP.)

5. The Question of Inflation

- What You’ll Hear: The plan protects your retirement income.

- Ask Medicus: “Are cost-of-living adjustments (COLA) to protect my pension from inflation guaranteed and automatic, or are they discretionary and granted only if the plan has sufficient surplus?”

- Ask Yourself: “How important is guaranteed inflation protection to my long-term retirement plan?”

- Why it matters: A non-indexed pension can lose 50% of its purchasing power over 25 years at just 3% inflation.

6. The Question of Costs

- What You’ll Hear: The plan is cost-effective.

- Ask Medicus: “Can you provide a full Total Expense Ratio (TER), not just the Investment Management Fee (IMF)? This TER should include all administrative, legal, actuarial, and operational costs. Also, how are these total costs itemized and disclosed to me as a member each year?”

- Ask Yourself: “Am I comfortable with a bundled, opaque fee structure, or do I prefer a transparent, itemized list of all costs?”

- Why it matters: Unlike an IPP where fees are transparent, the all-in costs of a pooled plan can be opaque.

7. The Question of Risk & Governance

- What You’ll Hear: The plan is secure and well-managed.

- Ask Medicus: “Can you clarify the governance structure? Specifically, is the plan sponsored by a for-profit or non-profit entity? How does the ‘physician-only’ membership model account for the concentrated longevity risk? And finally, can you provide a statement on the $700 million lawsuit filed by Blue Pier and any potential risk it poses to members?”

- Ask Yourself: “What is my comfort level with these documented risks (a for-profit sponsor’s power to amend the plan, actuarial concentration, and outstanding legal challenges)?”

- Why it matters: Due diligence includes all material risks. The sponsor’s motive (profit vs. member benefit), the plan’s actuarial risks, and outstanding legal challenges are all fundamental to your long-term security.

Your Priorities: A Self-Assessment Checklist

Use this checklist to clarify what matters most to you. This will help you see if your priorities align with the trade-offs of a “hands-off” plan.

| Your Priority | Low Priority (I’ll concede this) | Neutral | High Priority (This is a must-have) |

| Full Investment Control | ⚪️ | ⚪️ | ⚪️ |

| Pre-Retirement Capital Access | ⚪️ | ⚪️ | ⚪️ |

| Maximizing Estate Value for Heirs | ⚪️ | ⚪️ | ⚪️ |

| A Contractually Guaranteed Income | ⚪️ | ⚪️ | ⚪️ |

| Guaranteed Inflation Protection | ⚪️ | ⚪️ | ⚪️ |

| Transparent, Itemized Cost Reporting | ⚪️ | ⚪️ | ⚪️ |

| Avoiding Governance & Sponsor Risks | ⚪️ | ⚪️ | ⚪️ |

Your Decision: Prioritizing Simplicity vs. Control

The Medicus Pension Plan is built for a physician who prioritizes simplicity above all else. This is a valid choice, but as this checklist clarifies, that simplicity comes with significant trade-offs in control, access, guarantees, and estate value.

Often, a layered approach is the optimal solution. This might involve using an RRSP or IPP to maximize tax-deductible contributions while retaining control, supplemented by a Corporate Insurance Retirement Plan to provide tax-efficient liquidity and create a tax-free legacy.

To see a direct, head-to-head comparison of all four major corporate retirement strategies, please see our Accountant’s Guide to Medicus vs. IPP vs. CIRP vs. RCA or get personalized answers by scheduling a chat.