Key Question for Canadians

How can you break the information asymmetry of a complex insurance proposal and instantly spot red flags before you commit to a deep professional review?

- The End of Asymmetry: In the past, evaluating a strategy meant relying entirely on the advisor proposing it, but you can now use advanced AI tools to perform a basic judgment of any proposal yourself.

- The “Skeptical Actuary” Prompt: By instructing AI to adopt the persona of a “skeptical Canadian Insurance Actuary”, you can force the tool to look past marketing claims and identify specific failure points or risks hidden in the fine print.

- The Sanity Check: While AI provides only a rough sketch rather than a verified blueprint, it effectively validates whether a proposal is a robust strategy or merely a sales presentation by exposing gaps between verbal promises and the data.

In our previous post, The 4 Feasibility Gates: Why We Reject Most Insurance Proposals, we outlined the rigorous criteria we use to quickly filter out strategies that are not suitable for you.

In the past, information asymmetry meant that your primary way to evaluate a complex insurance strategy was by relying heavily on the advisor proposing it.

Today, you have powerful tools at your fingertips. While we always recommend a professional Insurance Feasibility Audit for high-stakes decisions, you can use modern AI tools like ChatGPT or Gemini to provide a basic judgement of any proposal you receive.

Here is how you can use technology to verify if your proposal is robust or if it is merely a sales presentation.

Page Contents

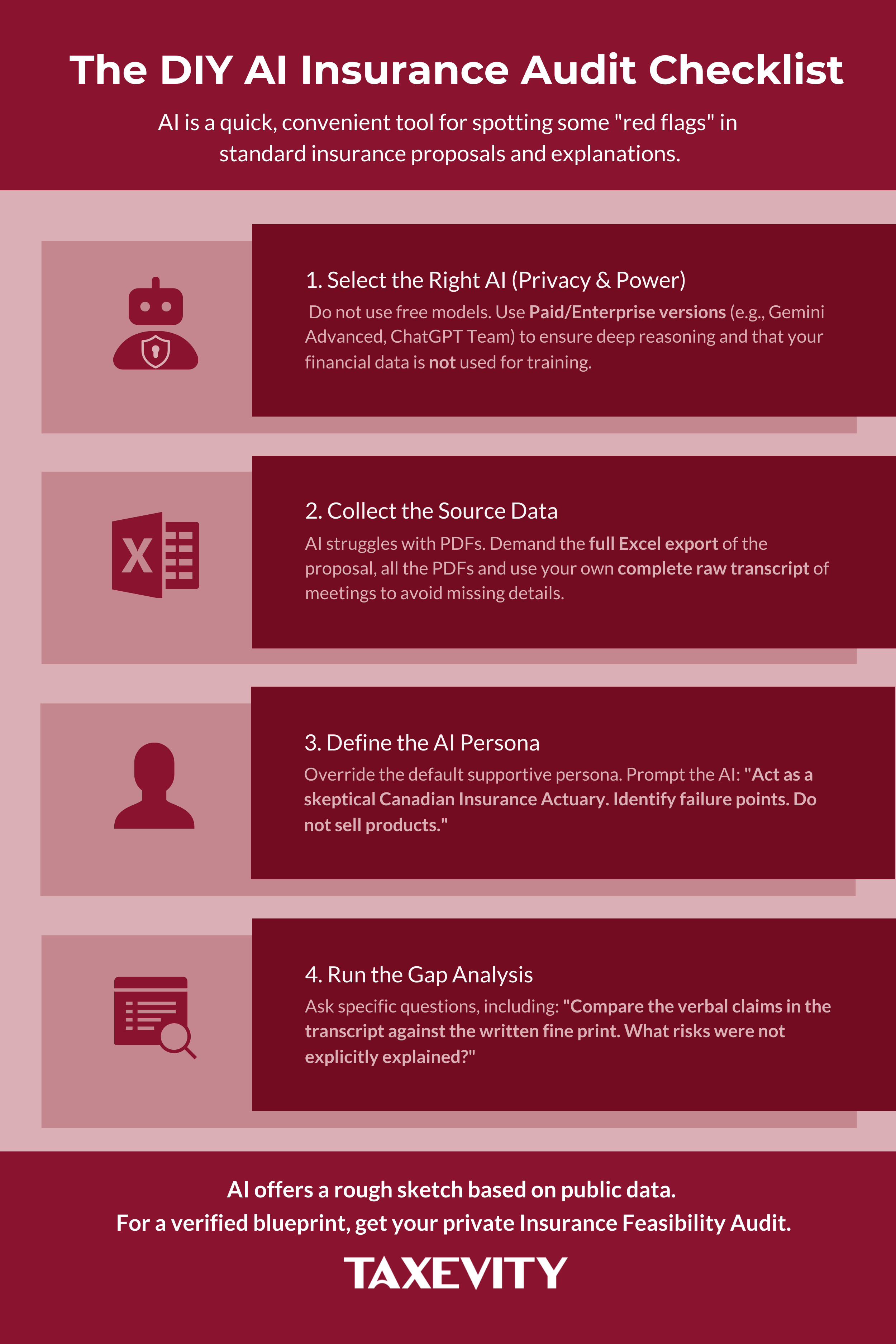

The Toolkit: Use the Right AI

Not all AI models are safe for financial analysis. For this audit, do not use free, basic versions.

- Use Advanced Paid Models: Use Gemini Advanced or ChatGPT Plus (Team/Enterprise). These models have better reasoning capabilities and, critically, often allow you to opt out of having your data used for training.

- Privacy First: Before uploading any transcripts or PDFs, ensure you have redacted personally identifiable information (SIN, address, specific account numbers) or confirmed the model’s privacy settings.

The Setup: Data Collection

Before you prompt the AI, you need accurate data. The biggest discrepancies we find are often between what clients were told verbally and what they received in writing.

- Record, Don’t Just Listen: Memory is fallible; transcripts are not. Your advisor may already use an AI note-taker. You should too. Ask for permission to record the meeting for your own records.

- Own the Record: Do not accept the advisor’s offer to send you their transcript. You may only get an edited summary. You need an instant, independent, raw record you control.

- Get the Excel File: AI struggles to read data tables inside PDFs (Optical Character Recognition errors). Ask your advisor for the Excel export of the illustration values.

- The Red Flag: If an advisor refuses to provide the Excel data, claiming it’s “proprietary” or “not available”, be very cautious. Scrutiny should be welcomed, not blocked.

How to Prompt: Context and Persona

You cannot simply upload a PDF illustration and ask “Is this good”? The AI doesn’t know you. You must provide the context and, crucially, the Persona you want the AI to adopt.

1. Set the Context:

“I am a high-net-worth business owner in Ontario, Canada. I have an incorporated operating company with stable surplus. I am conservative with debt. I am considering the attached insurance proposal.”

2. Assign the Persona:

To get the most objective analysis, tell the AI to stop acting like a helpful assistant and start acting like a risk manager.

“Act as a skeptical Canadian Insurance Actuary and Risk Manager. Your job is to identify failure points, not to sell products. Critique the following proposal.”

The 3 Core Prompts

Once the context and persona are set, try these specific prompts to peer behind the sales curtain:

1. The Gap Analysis

“Compare the verbal claims in this transcript against the attached insurance illustration/Excel data. What risks or limitations are mentioned in the fine print but were not explicitly explained in the meeting?”

2. The Alternatives Check

“I was proposed this insurance strategy to [insert goal: e.g., reduce corporate tax]. What are non-insurance alternatives available to achieve a similar goal? How do their liquidity and risk profiles compare to this insurance strategy?”

3. The Fairness Test (and a Warning)

“Based on standard financial planning principles in Canada, does this proposal appear to present a balanced view? What’s missing?”

⚠️ AI Warning: Terminology Differences

Insurance terminology varies significantly across advisors, insurers, and products. This inconsistency often confuses AI models, since they are frequently trained on international datasets where definitions differ.

A common example of this ambiguity is the use of “cash value”:

- “Total Cash Value” (or “Cash Value”): The gross amount of money accumulating inside a permanent life insurance policy.

- “Net Cash Surrender Value” (or “Cash Surrender Value”): The actual amount you receive if you cancel your coverage. This is calculated after deducting surrender charges, fees, and possible market value adjustments, but before taxes.

The Trap: In the early years, these numbers can be vastly different. In a meeting, an advisor might casually say “Cash Value” when they technically mean “Cash Surrender Value”. Conversely, you might mix up the terms, and the advisor may not correct you to avoid being nitpicky. This polite lack of precision creates a false sense of liquidity and confuses any AI interpreting the meeting transcript, leading the model to hallucinate that you have full access to funds that are not available in reality.

The Limits of AI (And Where We Come In)

AI is excellent at analyzing text and definitions. It cannot, however, act as your Architect.

- The Echo Chamber Effect: AI models are trained on internet data. If 90% of the online content regarding a strategy is marketing material, the AI may inadvertently treat that marketing as fact.

- AI cannot run market comparisons: AI cannot access live carrier software to see if a different product from a different insurer would perform better.

- AI cannot judge temperament: AI doesn’t know if you will panic when market conditions change.

At Taxevity, we create our own tools and perform our own research because we believe in mastery, not templates. While AI can audit the data, it cannot engineer the design. We publish our findings so that our expertise can be judged by you—and by the AI you use to verify us

Next in the Series: Insurance Peace of Mind: Numbers are Meaningless Without Comfort (coming soon)