(Part of the IFA Master Curriculum) – Testing

Key Question about the Insurance Architect

The Insurance Architect provides the blueprint for a successful Immediate Financing Arrangement (IFA). As a collaborating advisor, what key deliverables should you expect from this specialist to perform your own due diligence with confidence?

- The Custom-Engineered Policy: Expect a policy specifically designed for the IFA —typically a participating whole life policy engineered to maximize early cash surrender value (CSV). This CSV serves as the primary collateral for the loan.

- The Stress-Tested Model: The Architect must provide a sophisticated model that stress-tests the strategy against adverse conditions, such as increases in the prime lending rate or changes to the insurer’s dividend scale. This allows the entire team to understand the potential risks.

- The Collaborative Data: The Architect’s core collaborative function is providing the team with clear, accurate data. This includes precise Net Cost of Pure Insurance (NCPI) figures for the accountant and realistic performance projections for the wealth advisor.

In any complex project, the architect is responsible for the master plan—the blueprint from which everything else is built. For an Immediate Financing Arrangement (IFA), that role is filled by the Insurance & Modeling Specialist.

The life insurance policy within an IFA is not just a prerequisite; it is the engine of the entire strategy. The performance and structure of this policy directly impact the loan amount, the tax deductions, and the long-term viability of the arrangement. This is why the Architect’s role is so critical and requires specialized expertise that goes far beyond standard insurance advice.

This guide details our function as the Architect on your Core Advisory Team, a concept we introduce in our main hub post, The IFA Core Advisory Team: A Requirement for Success.

More Than a Policy: The Architect’s Mandate

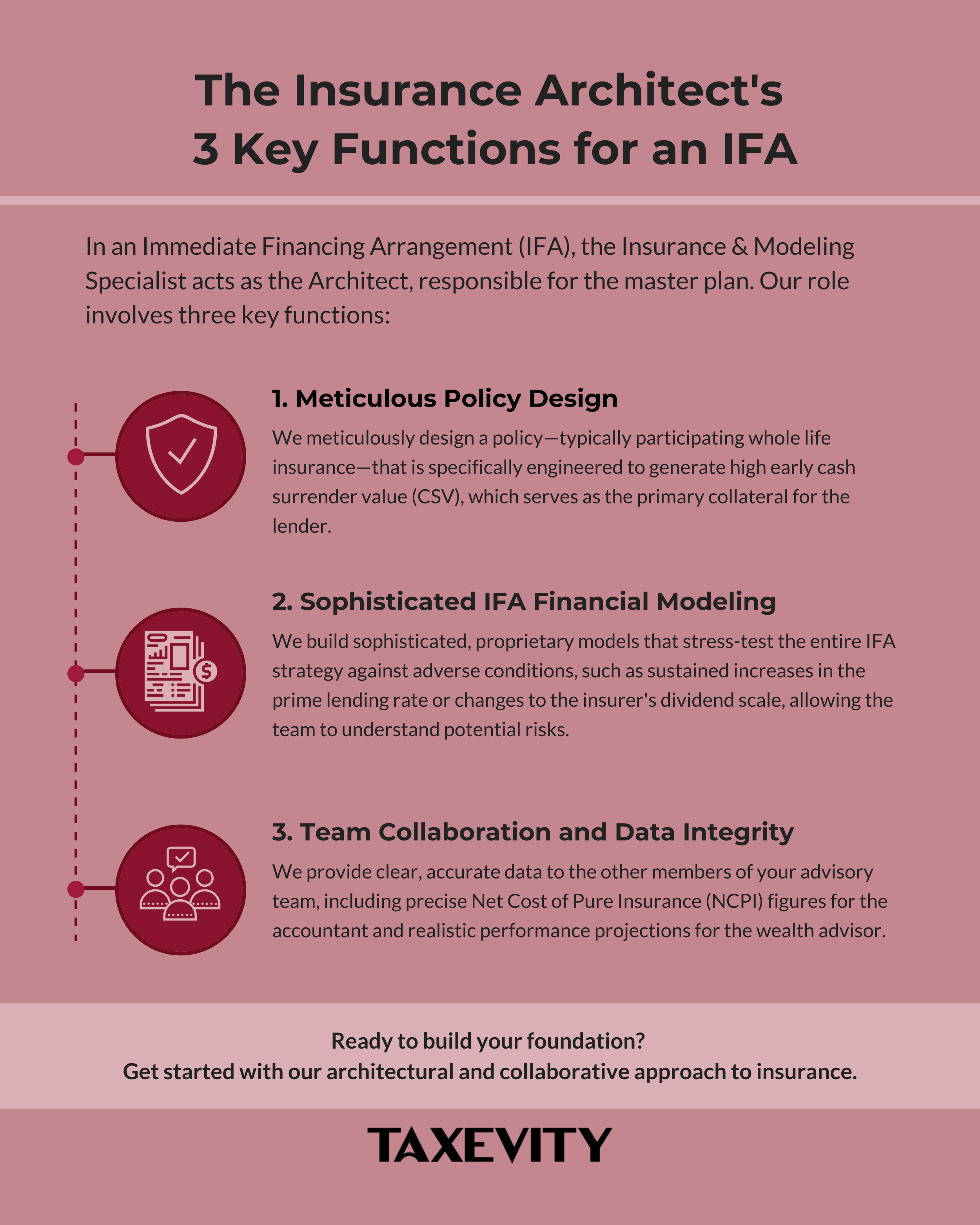

Securing an insurance policy is just one small part of the process. Our role at Taxevity as the Architect is to design, model, and explain the financial engine that drives your IFA. This involves three key functions:

- Meticulous Policy Design: Not all permanent life insurance policies are created equal. An IFA requires a policy—typically participating whole life insurance—that is specifically engineered to generate high early cash surrender value (CSV). This CSV serves as the primary collateral for the lender. We meticulously design the policy’s premium structure to accelerate this CSV growth, creating a robust foundation for the loan and maximizing the capital you can access.

- Sophisticated IFA Financial Modeling: Standard IFA models tend to be generic and often project a best-case scenario. From our actuarial perspective, we build sophisticated, proprietary models that provide a more realistic forecast and more details. We stress-test the entire IFA strategy against adverse conditions, such as sustained increases in the prime lending rate or changes to the insurer’s dividend scale. This rigorous analysis allows you and your team to understand the potential risks and make decisions with your eyes open.

- Team Collaboration and Data Integrity: A successful IFA requires seamless collaboration. As the Architect, we are responsible for providing clear, accurate data to the other members of your advisory team. This includes giving your accountant (the Guardian) the precise Net Cost of Pure Insurance (NCPI) figures they need to calculate the collateral insurance deduction, and providing your wealth advisor (the Strategist) with realistic performance projections to inform their investment plan.

Conclusion: The Non-Negotiable Specialist

Attempting an IFA with a non-specialist or using a generic, off-the-shelf insurance policy is like building a skyscraper on a weak foundation—it is destined to face problems. The design and modeling of the insurance component are too critical to be left to chance.

At Taxevity, our deep actuarial expertise is purpose-built for this role. We design the engine, provide the blueprint, and work in concert with your other trusted advisors to ensure the entire structure is sound, secure, and built for long-term success.

Ready to build your plan? If you or your advisors are exploring how an IFA could fit into your financial strategy, contact us. Let’s discuss how our architectural approach can be the foundation of your success.