(Part of the IFA Master Curriculum)

Key Question for Accountants

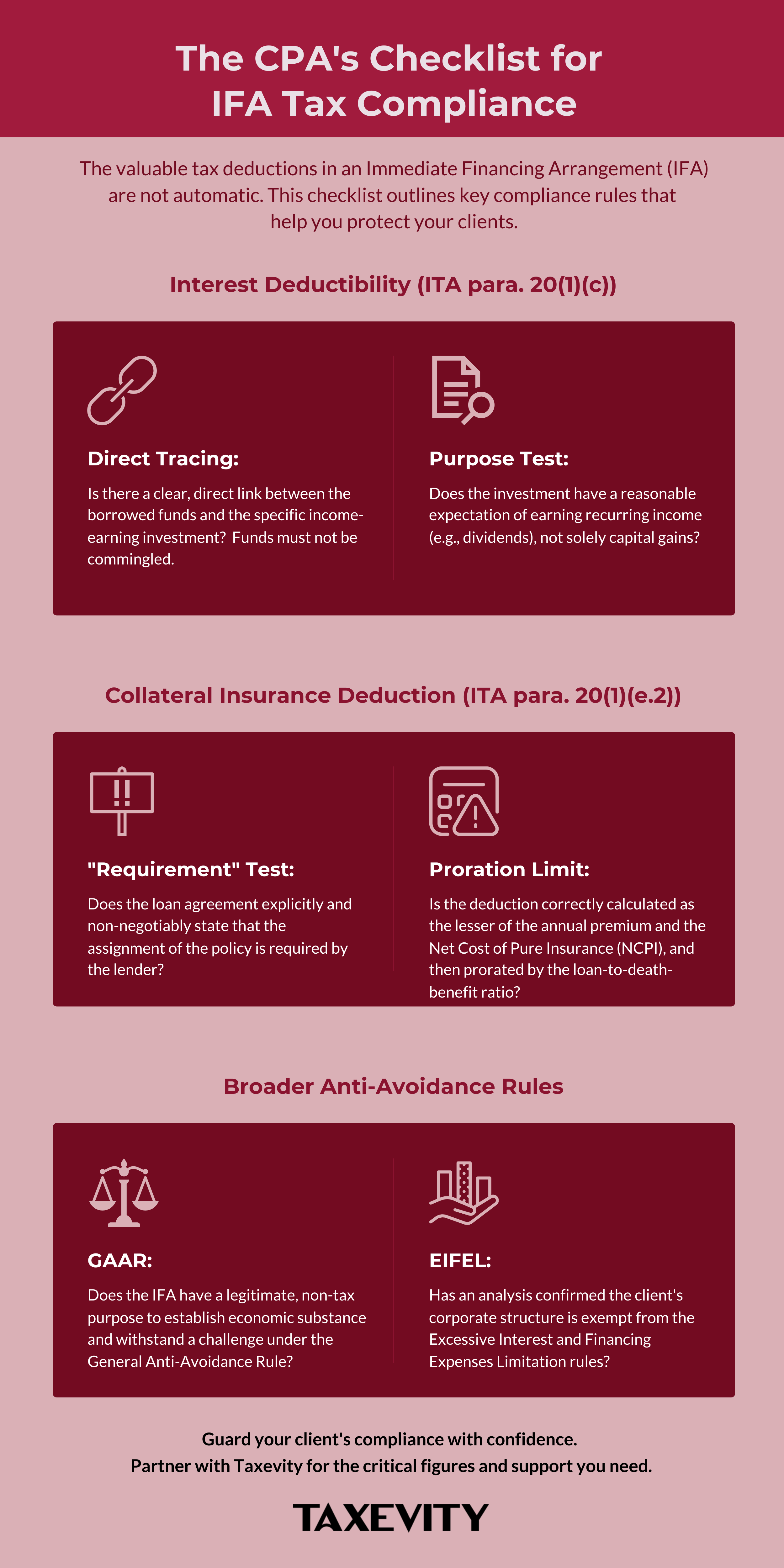

The tax deductions are what make an Immediate Financing Arrangement (IFA) so powerful, but they are not automatic. As the guardian of compliance, how do you ensure the IFA structure is robust enough to withstand CRA scrutiny?

- Interest Deductibility (ITA 20(1)(c)): The central pillar is the interest deduction, which requires passing two key tests. You must ensure meticulous “tracing” of funds from the loan to the investment (with no commingling) and confirm the investment has a “reasonable expectation of earning income” like dividends, not solely capital gains.

- Collateral Insurance Deduction (ITA 20(1)(e.2)): This secondary deduction is more restrictive. The loan agreement must explicitly and non-negotiably require the policy as collateral. Furthermore, the deduction is limited by a proration formula based on the loan-to-death-benefit ratio, a detail often overlooked in illustrations.

- Anti-Avoidance Rules (GAAR & EIFEL): Beyond specific deductions, the IFA must have a legitimate, non-tax purpose to establish “economic substance” and withstand a GAAR challenge. A specific analysis is also required to confirm the client’s corporate structure is exempt from the complex EIFEL rules.

This article is Part 5 of our IFA Risk Management Deep Dive Series.

Part 1: A Foundational Guide to IFA Risk Management for Accountants

Part 2: Flawed IFA Structuring: An Accountant’s Guide to Foundational Risks

Part 3: Stress-Testing IFAs: Modeling Correlated Market Risks for Your Clients

Part 4: Deconstructing IFA Lender and Credit Risk

The tax efficiency of an Immediate Financing Arrangement (IFA) is what makes it such a powerful strategy. The ability to deduct loan interest and a portion of the insurance cost can significantly enhance a client’s after-tax wealth. However, these valuable tax benefits are not automatic; they are governed by strict and complex rules within the Income Tax Act.

For a suitable client, navigating these rules is the key to unlocking the strategy’s full potential. A failure to meticulously comply can lead to a reassessment by the Canada Revenue Agency (CRA), the denial of deductions, and significant tax liabilities. For you as the accountant, proactive compliance and rigorous documentation are paramount. This is where your role is most critical and where you can provide immense value.

This guide provides a CPA’s review of the key tax compliance requirements and risks.

Page Contents

1. The Perilous Path to Interest Deductibility (ITA para. 20(1)(c))

The ability to deduct the interest paid on the IFA loan is often the central pillar of the strategy’s financial projections. For a more detailed analysis, please see our Accountant’s Companion to Interest Deductibility.

- The Rule: For interest to be deductible, the borrowed money must be used for the purpose of earning income from a business or property.

- The Pitfall: Broken Tracing and Failed Purpose Test. This is one of the most common and critical tax pitfalls.

- Tracing: The CRA and Canadian courts have consistently held that there must be a clear, direct, and current link—or “tracing”—between the borrowed funds and the specific income-earning investment. If the client commingles the loan proceeds with other personal or corporate funds, even temporarily, the direct link is broken, and the CRA can deny the interest deduction. Meticulous record-keeping, often involving separate bank and investment accounts exclusively for the IFA loan proceeds, is essential.

- Purpose Test: The “purpose test” requires that the investment made with the borrowed funds has a reasonable expectation of earning income, which the CRA generally interprets as recurring income like interest or dividends, not solely capital gains. Investing the loan proceeds in speculative, non-dividend-paying stocks or a business that consistently generates losses could lead the CRA to challenge the deductibility of the interest.

2. The Collateral Insurance Deduction Trap (ITA para. 20(1)(e.2))

A secondary tax benefit often promoted in IFA illustrations is the ability to deduct a portion of the life insurance premiums themselves. This deduction is even more restrictive than the interest deduction.

- The Rule: The policy must be assigned as collateral to a “restricted financial institution” (like a bank), the interest on the underlying loan must itself be deductible, and, critically, the loan agreement must explicitly state that the assignment of the policy is required by the lender as a condition of the loan.

- The Pitfalls:

- “Requirement” Test Failure: A potential point of failure is when the loan documentation is ambiguous or suggests that the policy was merely one of several collateral options or was pledged voluntarily by the borrower. The CRA can deny the deduction if the requirement is not explicit and non-negotiable.

- Proration Limitation: The amount of the deduction is capped at the lesser of the annual premium payable and the policy’s Net Cost of Pure Insurance (NCPI). Furthermore, this capped amount is then prorated by the ratio of the outstanding loan balance to the policy’s total death benefit. IFA explanations may overstate the value of this deduction by failing to account for this proration, especially in the later years of the policy.

It’s also important to note that the Collateral Insurance Deduction (CID) is a calculation that you, as the accountant, make annually. To enable this, Taxevity provides the necessary figures each year, saving you and your client valuable time.

3. The Spectres of GAAR and EIFEL

Beyond the specific deduction rules, two broader sets of anti-avoidance rules can apply to an IFA.

- The General Anti-Avoidance Rule (GAAR): The GAAR is the CRA’s ultimate tool to combat tax planning that, while technically compliant, is deemed to violate the spirit of the law. The new “economic substance” test could pose a threat to IFAs that appear to be undertaken almost exclusively to generate tax deductions with little other non-tax purpose. This is a key reason our process always begins with establishing a legitimate, non-tax reason for the life insurance and modeling outcomes using conservative, realistic assumptions.

- Excessive Interest and Financing Expenses Limitation (EIFEL): The new EIFEL rules can limit the amount of interest a corporation can deduct. While many common IFA structures involving Canadian-controlled private corporations (CCPCs) dealing only with other Canadian corporations are exempt, the rules are complex. A specific analysis is required to confirm that a client’s corporate structure falls within the exemptions and that interest deductibility will not be limited.

Conclusion: Your Role as the Guardian of Compliance

While other advisors focus on the insurance structure or investment returns, your role as the accountant is to be the guardian of tax compliance. This involves proactively advising the client on setting up the necessary tracking systems from day one and maintaining the discipline required to withstand potential CRA scrutiny for decades to come.

By understanding these rules, you can help your clients avoid the pitfalls and successfully access the significant tax advantages that a well-structured IFA offers. Your diligence in this area protects the long-term integrity of the entire strategy and provides immense value.

If you are currently reviewing an IFA proposal for a client and would like a second opinion on the structure and its tax risks, we can help. We can review the proposal, identify areas that may require more scrutiny, and help you formulate key questions for the other advisors. We invite you to contact us.

Next in This Series: The Unwinding Dilemma: Calculating the True After-Tax Cost of a Premature IFA Exit (Coming Soon)