(Part of the IFA Master Curriculum)

Key Question for Accountants

Beyond market fluctuations, how do you scrutinize an Immediate Financing Arrangement (IFA) for the foundational risks that can cause it to fail at inception?

- The Suitability Test: The first step is to vet the client’s profile. A suitable candidate must have a legitimate reason for the insurance, possess strong cash flow sufficient to cover all costs without relying on investment returns, and have enough taxable income to benefit from the deductions.

- The Structural Integrity: Next, you must review the proposed structure. A diligent insurer selection process is key, as is a critical review of the financial projections. A proposal that only shows a single, best-case scenario without modeling adverse conditions is a significant red flag.

- The Unified Team: Finally, a successful IFA demands seamless collaboration between independent experts. A breakdown in communication between the insurance specialist, accountant, wealth advisor, and lawyer can fatally compromise the entire structure.

This article is Part 2 of our IFA Risk Management Deep Dive Series.

Part 1: A Foundational Guide to IFA Risk Management for Accountants

While market volatility is a well-known threat to an Immediate Financing Arrangement (IFA), the most dangerous pitfalls are frequently embedded in the strategy at its very inception. Critical mistakes made during the client suitability and design phase can predetermine an IFA’s failure.

As your client’s accountant, your review at this early stage is critical. This guide dissects the main categories of foundational risk.

Page Contents

1. The Suitability Mismatch

An IFA is designed for a narrow demographic. When recommended outside of this profile, the risk of failure increases exponentially. The table below outlines the key criteria for a suitable candidate.

| Suitability Factor | Ideal Candidate Profile | Red Flag / Unsuitable Candidate |

| Reason for Insurance | Has a legitimate, pre-existing reason for permanent life insurance. | The IFA is positioned primarily as a “tax strategy”. |

| Cash Flow | Possesses strong, stable cash flow sufficient to cover all costs without relying on investment returns. | Cash flow is highly variable, or the strategy is only affordable based on optimistic projections. |

| Taxable Income | Has sufficient current or projected corporate taxable income to use the tax deductions. | The corporation is in a loss position, has minimal passive income, or the individual lacks high personal income at top marginal rates. |

| Risk Tolerance | Has a high-risk tolerance and a clear understanding of long-term leverage. | Is philosophically uncomfortable with debt or has a low tolerance for market volatility. |

2. Flawed Structural Design

Even for a suitable client, an IFA can be crippled from the start by poor structural design of its core components.

- A Superficial Insurer Selection Process: Choosing the right insurer is a nuanced decision. Factors like the size and age of an insurer’s participating account, their historical dividend performance, and their corporate structure (mutual vs. stock) all have long-term implications. The key is a diligent process that weighs these trade-offs rather than defaulting to the most convenient choice.

- Over-emphasizing Early Cash Value: A potential risk is selecting an insurer or policy design solely based on the highest possible early cash surrender value (CSV), while downplaying other important factors like prospects for long-term policy dividends or the insurer’s financial strength. While maximizing early CSV is important to minimize the collateral gap, it is only one variable in a complex, multi-decade strategy.

- Incomplete and Overly Optimistic Projections: An IFA proposal that only shows a single, favourable, best-case scenario is a significant warning sign. A responsible analysis must look beyond generic proposals and model multiple adverse scenarios, such as a sustained increase in the prime lending rate or an ongoing reduction in the insurer’s dividend scale.

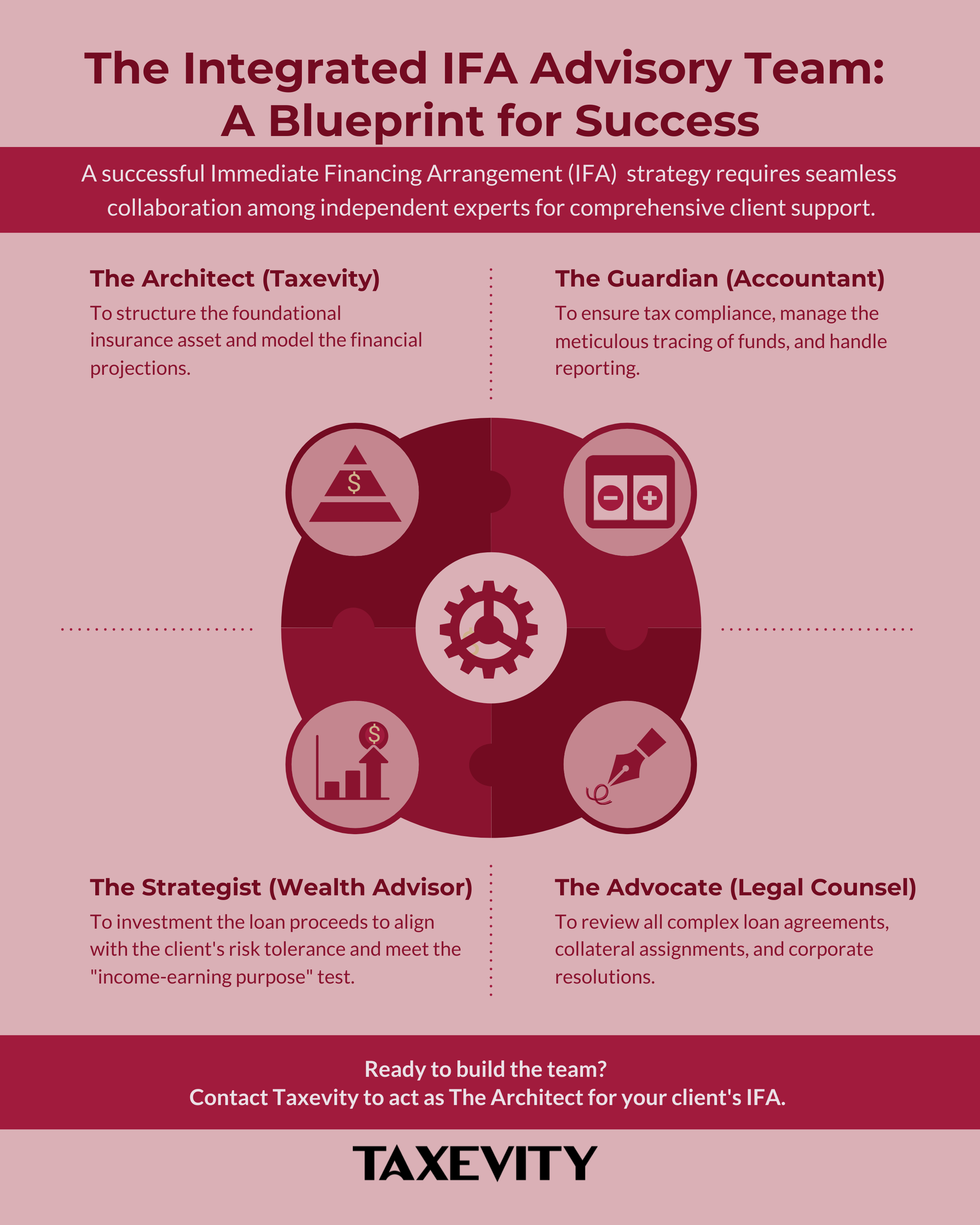

3. The Fractured Advisory Team

An IFA demands the seamless collaboration of the client’s team of independent experts.

A breakdown in communication or a lack of IFA-specific expertise in any one of these areas can compromise the entire structure.

The team must include:

- The Architect (Taxevity): To structure the foundational insurance asset and model the financial projections.

- The Guardian (You, the Accountant): To ensure tax compliance, manage the meticulous tracing of funds, and handle reporting.

- The Strategist (Wealth Advisor): To manage the investment of the loan proceeds in a manner that aligns with the client’s risk tolerance and meets the “income-earning purpose” test.

- The Advocate (Legal Counsel): To review all complex loan agreements, collateral assignments, and corporate resolutions.

4. Operational Realities: A Multi-Decade Commitment

Beyond the initial setup, it’s important to prepare clients for the long-term operational realities of an IFA.

- Administrative Complexity: While the complexity is highest at setup, an IFA is not a “set-and-forget” strategy. It requires ongoing annual reviews and diligent record-keeping for decades. This administrative routine is manageable but requires discipline from the client and their advisory team.

- CRA Audit Potential: Even when an IFA is well-structured and properly documented, its complexity can increase the likelihood of a CRA review or audit compared to simpler structures. The “pain” of an audit can be significantly reduced with meticulous record-keeping from day one, which is a key area where your guidance is invaluable.

Conclusion: Your Vital Role at Inception

Your rigorous, skeptical review at the outset is one of the most valuable services you can provide. By pressure-testing suitability, structure, and the client’s readiness for the long-term commitment, you can identify fatal flaws before a single dollar is committed.

If you are currently reviewing an IFA proposal for a client and would like a second opinion, we can help you formulate key questions for the other advisors. We invite you to contact us.

Next in This Series: Stress-Testing IFAs: Modeling Correlated Market Risks for Your Clients (Coming Soon)