(Part of the Taxevity Navigator Series and the IFA Master Curriculum)

Key Question for Accountants

When your client asks, “What’s the catch?” with an Immediate Financing Arrangement (IFA) proposal, how do you provide an objective analysis that moves beyond the sales illustration to identify the key structural, market, and tax risks?

- The Foundational Flaws: The first level of due diligence involves vetting risks at inception. This includes ensuring the client can comfortably afford the carrying costs without relying on investment returns, that the policy is optimized for early cash value, and that a coordinated advisory team is in place.

- The Compounding Risks: The next level involves stress-testing how risks can become dangerously correlated. This includes the lender’s power to call the loan or increase collateral requirements, which can compound the effects of rising interest rates and poor investment performance.

- The Compliance and Exit Traps: Finally, you must highlight that tax deductions are not automatic and require meticulous fund tracing to withstand CRA scrutiny. Furthermore, unwinding the strategy prematurely can be a painful process, potentially triggering a “double tax event” on both the investment and policy dispositions.

As a trusted advisor, your clients rely on you to vet complex financial strategies, stress-test their assumptions, and protect them from unseen risks. The Immediate Financing Arrangement (IFA) is a sophisticated strategy that may cross your desk.

While an IFA can offer significant advantages in capital efficiency and estate planning for the right high-net-worth client, its structure is a delicate balance of leverage, life insurance, and market performance. When a client asks, “What’s the catch?” they are turning to you for an objective analysis.

This guide examines the mechanics of the strategy to provide a foundational framework for due diligence. This is the insider’s briefing designed to equip you, their accountant, with the critical questions and analytical tools needed to navigate the risks of this multi-decade commitment. For accountants seeking more details about the IFA structure itself, please see our Foundational Guide to Immediate Financing Arrangements.

Page Contents

- 1 The IFA Framework – A Foundation of Interdependent Risk

- 2 Foundational Pitfalls – How IFAs Fail at Inception

- 3 The Cascade of Failure – How Market Risks Compound

- 4 The Lender’s Prerogative – Counterparty & Credit Risk

- 5 Navigating CRA Scrutiny – Key Tax Pitfalls

- 6 The Unwinding Dilema – The High Cost of an Early Exit

- 7 Conclusion: Your Role in Creating Better Client Outcomes

The IFA Framework – A Foundation of Interdependent Risk

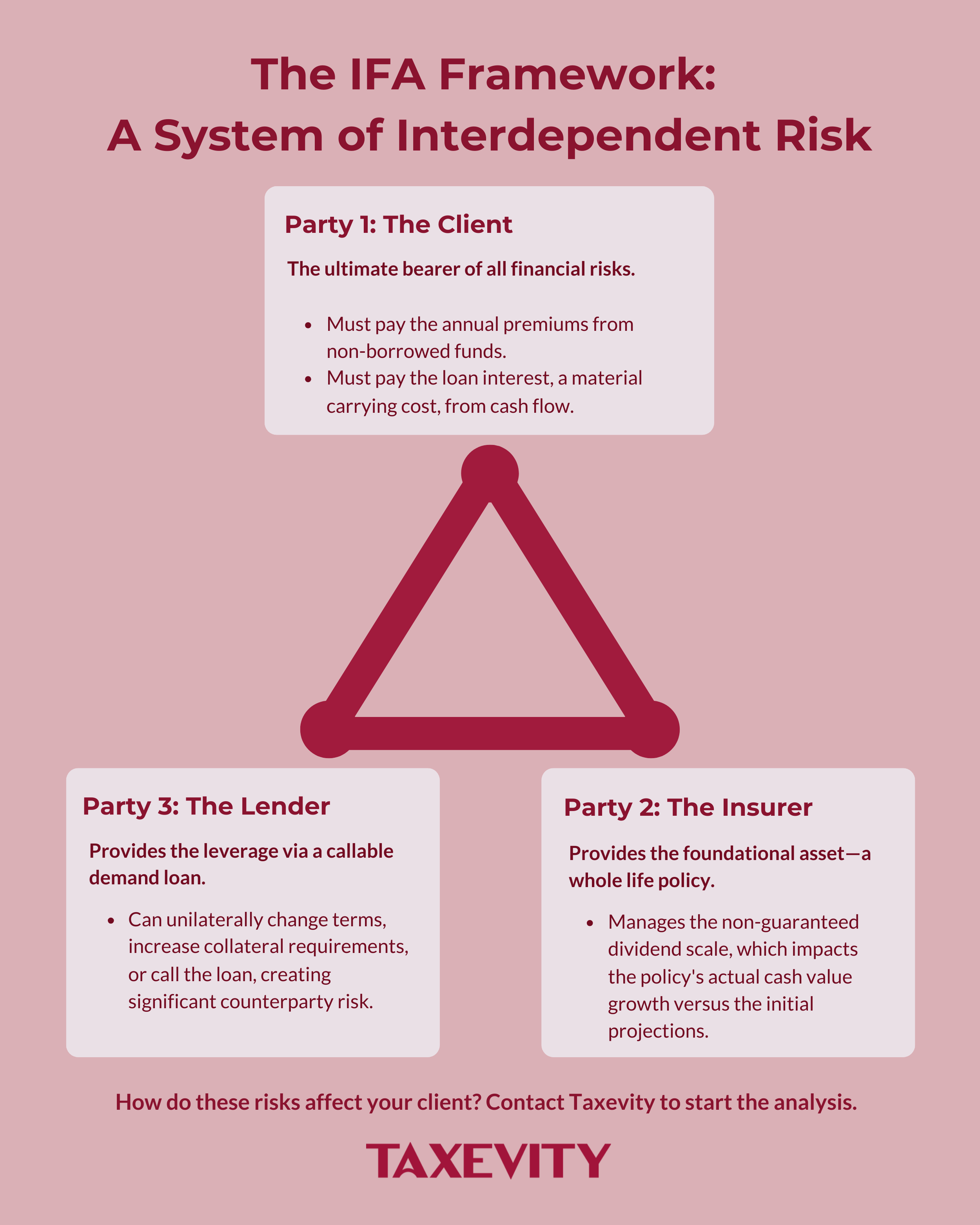

An IFA is not a product; it’s a multi-layered strategy built on an interdependent triangle of three parties: the client, the insurer, and the lender.

The client assumes nearly all the risk, while the insurer can change performance expectations and the lender can change the terms of the leverage. Understanding this relationship is the first step in risk assessment.

- The Client (Corporation or Individual): The ultimate bearer of all financial risks, responsible for paying annual premiums and servicing the loan interest from their own cash flow.

- The Insurer: Provides the foundational asset—a whole life policy. The insurer’s management of its dividend scale directly impacts the policy’s cash value growth.

- The Lender: Provides the leverage via a demand line of credit, retaining the power to change terms, increase collateral requirements, or even call the loan.

The strategy’s mechanics follow a rigid annual cycle:

- Premium Payment: The client pays the full premium with non-borrowed funds.

- Loan Advance: The client immediately borrows back up to 100% of the premium or cash surrender value, secured by the policy’s cash surrender value.

- Capital Redeployment: The borrowed funds are invested in an income-earning asset to establish the basis for interest deductibility.

- Debt Servicing: The client makes regular, out-of-pocket interest payments on the loan.

This cycle doesn’t immediately create new net worth; the process restructures it. A client who pays a $100,000 premium and borrows it back has simply exchanged cash for a leveraged insurance asset and an offsetting liability. The potential for wealth creation comes from the successful performance of the redeployed capital over and above the after-tax cost of borrowing. It’s important to note the capital is used in two ways simultaneously: besides the potential returns from investing the loan proceeds, there is also the tax-sheltered growth within the life insurance policy itself. Even if the leveraged investment performs poorly, your client still owns the valuable insurance asset, acquired at a lower after-tax cost due to the available tax deductions, which when structured correctly pays off the loan principal at death.

IFA Myth vs. The Accountant’s Reality

| IFA Myth | The Accountant’s Reality |

| “It’s a way to get cheap life insurance.” | “It’s a complex leverage strategy with material carrying costs and market risks.” |

| “The loan is guaranteed.” | “The loan is a demand facility that is reviewed annually and can be called by the lender.” |

| “The tax deductions are automatic.” | “The deductions require strict compliance with ITA rules and sufficient taxable income to be of value.” |

| “The projection shows what I’ll get.” | “The projections are based on non-guaranteed assumptions that must be stress-tested.” |

Foundational Pitfalls – How IFAs Fail at Inception

Many IFA failures are predetermined by critical mistakes made during the client evaluation and structuring phase.

- The Suitability Mismatch: The IFA is designed for a narrow demographic. A critical red flag is when a client cannot comfortably afford the ongoing costs without relying on the investment returns. Furthermore, the client must have sufficient current or future taxable income to actually benefit from the interest and premium deductions the strategy can generate.

- Flawed Structural Design: An insufficient insurer selection process, a policy not optimized for early cash value, or the presentation of overly optimistic projections are all signs of a weak foundation.

- The Fractured Advisory Team: A successful IFA demands a seamless, integrated (but independent) team consisting of a wealth advisor, a lawyer, an accountant, and an insurance specialist. A breakdown in communication can compromise the structure.

The Cascade of Failure – How Market Risks Compound

In a crisis, the key market risks of an IFA—rising interest rates, poor investment performance, and cuts to the insurer’s dividend scale—do not occur in isolation. They often become dangerously correlated, creating a “perfect storm” where higher loan costs, a falling investment portfolio, and a weakening collateral base can hit your client all at once.

The Lender’s Prerogative – Counterparty & Credit Risk

The client is a borrower subject to the bank’s policies, which can change. The loan is legally “callable on demand,” and the lender can unilaterally change terms, such as increasing collateral requirements. A drop in the policy’s cash value could trigger a collateral call, forcing the client to pledge more assets, pay down the loan, or collapse the strategy.

The strategy’s tax efficiency hinges on deductions that are not automatic.

- Meticulous “tracing” of funds is required to prove the loan was used for an income-earning purpose.

- The loan agreement must explicitly require the policy as collateral for the premium deduction to be valid.

- An IFA that lacks economic substance beyond the tax benefits could be challenged under GAAR.

- The new Excessive Interest and Financing Expenses Limitation (EIFEL) rules may also apply to some clients. The rules are complex and require a specific analysis to confirm that interest deductibility is not limited.

The Unwinding Dilema – The High Cost of an Early Exit

Unwinding an IFA prematurely can be a complex and financially painful process. It can trigger a double tax event: capital gains tax on the investment disposition and income tax on the policy disposition. This can eliminate any benefit the strategy was supposed to create, all while stripping the client of the valuable insurance coverage.

Conclusion: Your Role in Creating Better Client Outcomes

An IFA is a financial venture that requires active, expert management. As your client’s trusted financial gatekeeper, your role is not merely to be a wise skeptic, but to be the partner who unbundles the complexity. By stress-testing the proposal and ensuring the structure aligns with your client’s true capacity, you empower them to make a fully informed decision, strengthening your relationship as their most trusted advisor.

If you are currently reviewing an IFA proposal for a client and would like a second opinion on its structure and risks, we can help. We can review the proposal, identify areas that may require more scrutiny, and help you formulate key questions for the other advisors. Contact us to start the conversation.

The IFA Risk Management Deep Dive Series

This foundational guide is the first part of our comprehensive series on IFA risk. For a more granular analysis of each specific area of risk, please see the articles below:

- Part 2: Foundational Risks – Flawed IFA Structuring: An Accountant’s Guide to Foundational Risks

- Part 3: Market Risks – Stress-Testing IFAs: Modeling Correlated Market Risks for Your Clients

- Part 4: Lender Risks – Deconstructing IFA Lender and Credit Risk

- Part 5: Tax Risks – A CPA’s Review of IFA Tax Compliance

- Part 6: Exit Risks – The Unwinding Dilemma: Calculating the True After-Tax Cost of a Premature IFA Exit