(Part of the IFA Master Curriculum)

Key Question for Accountants

When a client wants to amplify their philanthropy, how can you, as their accountant, verify that a leveraged strategy using life insurance is structured correctly to maximize their impact while ensuring full tax compliance?

- The Capital Challenge: High-net-worth clients often want to increase their charitable giving but are hesitant to liquidate their primary business or investment assets to do so. The core challenge is creating a dedicated philanthropic funding stream without disrupting their existing financial structure.

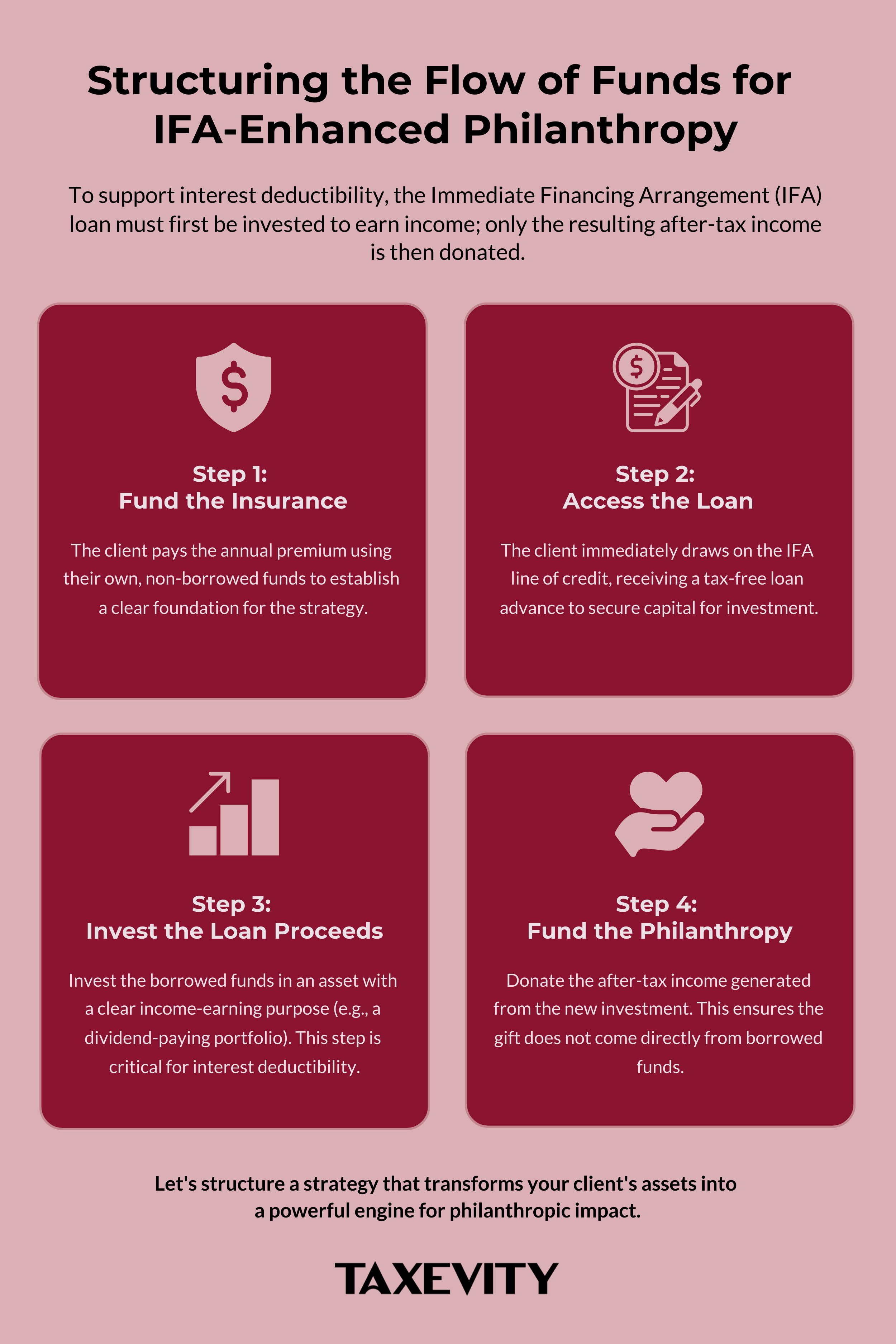

- The Philanthropic Engine: An Immediate Financing Arrangement (IFA) can transform a protective life insurance policy into a “philanthropic engine”. To maintain compliance, the flow of funds is critical: borrowed capital must first be invested for an “income-earning purpose”, and only the after-tax income from that new investment is donated, thereby protecting the deductibility of the loan interest.

- The Multiplier Effect: This structure allows a single dollar to perform “multiple duties simultaneously”. The client achieves three key outcomes: the life insurance provides essential protection , the leveraged investment creates a new growing asset , and the income from that asset funds a significant philanthropic impact, all while preserving their estate.

For many successful business owners and high-net-worth families, philanthropy is not an afterthought; it’s a core component of their financial plan and personal legacy. As their accountant, you are in a unique position to advise on tax-efficient giving strategies. This article serves as a research companion to explore this sophisticated strategy, outlining a framework for how it can amplify a client’s capacity for impact. As is standard professional practice, the next step is to apply your own due diligence and reference the Income Tax Act to ensure the structure is properly tailored to each client’s unique financial situation.

This is the concept of IFA-Enhanced Philanthropy. By integrating an Immediate Financing Arrangement (IFA) with a strategic charitable giving plan, it’s possible to transform the capital allocated to life insurance—a protective asset—into a dynamic engine for both wealth creation and social contribution. This approach allows a single dollar to perform multiple duties simultaneously, representing the apex of capital efficiency.

Page Contents

The Core Concept: From Capital Cost to Philanthropic Engine

Traditionally, life insurance premiums are viewed as a necessary cost to secure a future death benefit. An IFA fundamentally changes this dynamic. As detailed in our Foundational Guide to Immediate Financing Arrangements, the strategy allows your client to secure a revolving line of credit using the policy’s cash surrender value as collateral, borrowing back most or all of the premium each year to reinvest.

This access to liquidity unlocks a powerful opportunity in a philanthropic context. The borrowed funds create a new pool of capital for investment, and the after-tax returns from this new portfolio can then be used to fund your client’s charitable goals.

The result is a multiplier effect:

- Protection: The life insurance policy remains in force, providing essential protection and creating a tax-free death benefit that can enhance the Capital Dividend Account (CDA) for a corporation.

- Growth: The leveraged funds are invested, creating a new, growing asset for the client.

- Impact: The income from this new asset provides a dedicated, tax-efficient funding stream for philanthropy, allowing a client to make a significant impact without liquidating their primary investments or business assets.

A Framework for the Flow of Capital

The economic viability and tax treatment of this strategy hinge on a meticulously executed flow of funds. Understanding this sequence is paramount to providing sound advice. Any deviation could jeopardize key tax deductions and attract scrutiny from the CRA.

A framework used for this strategy is as follows:

- Fund the Insurance: The client pays the annual life insurance premium using their own, non-borrowed funds.

- Access the Loan: The client immediately draws on the IFA line of credit, receiving a tax-free loan advance.

- Invest the Loan Proceeds: This is the critical step. The borrowed funds must be invested in an asset with a clear “income-earning purpose,” such as a portfolio of dividend-paying stocks or income-producing real estate (see our Accountant Companion: Navigating Canadian Interest Deductibility for Investment Loans). This establishes the legal basis for deducting the loan interest and, as you would verify, potentially a portion of the life insurance premium as a collateral insurance deduction.

- Fund the Philanthropy: The after-tax income (e.g., dividends, rental income) generated by the new investment is then used to make the charitable donation to a vehicle like a Donor-Advised Fund (DAF) or directly to a charity.

It is absolutely crucial that the borrowed funds from the IFA are never donated directly to charity. A direct donation would invalidate the income-earning purpose required for interest deductibility. For a deeper dive into the specific tax rules, see our guide on IFA Tax Compliance and Interest Deductibility.

Structuring the Gift: Key Approaches

There are multiple ways to combine an IFA with philanthropy, and the models shown here are not an exhaustive list. The optimal choice depends entirely on the client’s goals for control, timing, and impact.

- The Leveraged Income Stream (For Active Philanthropy): This strategy solves a specific problem for clients who wish to fund ongoing philanthropy from a new capital source without liquidating their core assets. While donating cash income is less tax-efficient than donating appreciated assets in-kind, this model’s value comes from its ability to create a dedicated philanthropic funding stream powered by leverage. By donating the income rather than the underlying asset, the client preserves the “income-earning purpose” link that supports the deductibility of the loan interest. Furthermore, the underlying leveraged asset remains available for other purposes.

- The Estate Donation (For Legacy Philanthropy): In this more conventional approach, a client runs a standard IFA for their own purposes, enjoying potential tax deductions from loan interest and collateral insurance along the way. The philanthropic component happens upon death. This can be structured in two highly effective ways:

- Donating the Net Death Benefit: A charity is named as a beneficiary of a portion of the policy’s net death benefit. It’s critical to remember the lender has first claim on the policy proceeds; the donation is made from the net amount after the loan is repaid. The estate then receives a large tax receipt to reduce taxes on the final return.

- Donating Appreciated Assets: The will directs that appreciated assets from the estate be donated in-kind. This provides a powerful dual benefit: the capital gain on those assets is eliminated, and the estate still receives a donation receipt for the full fair market value.

At a Glance: Comparing Philanthropic IFA Strategies

| Consideration | The Leveraged Income Stream | The Estate Donation |

| Primary Goal | Fund ongoing, active philanthropy | Create a significant legacy gift |

| Timing of Donation | During the client’s lifetime | At death, via the estate |

| Source of Funds | New income from leveraged assets | Net death benefit or estate assets |

| Best For | Clients desiring annual giving without touching core assets. | Clients focused on maximizing their final estate gift and tax credits. |

Strategic Model: The Legacy Multiplier

This advanced model is perfectly suited for clients facing a major liquidity event, such as the sale of a business, which often triggers a significant tax liability.

Scenario: The G. family sells their business for $25 million, triggering a $5 million capital gains tax liability.

- The Challenge: How to pay the $5 million tax bill while achieving their philanthropic goals and preserving their estate for their children.

- The IFA-Enhanced Strategy:

- Eliminate the Tax Liability: The G. family makes an immediate $10 million donation of appreciated securities to a new DAF. Donating the securities in-kind is the crucial first step, as it eliminates the capital gain on those shares while generating a charitable tax receipt for their full fair market value. This provides approximately $5 million in tax credits, helping to offset the tax liability from the business sale.

- Restore the Estate: To replace the $10 million gifted to charity, they purchase a joint-last-to-die permanent life insurance policy with a $10 million death benefit. This aligns with the principles of IFA-Enhanced Estate Equalization.

- Establish the IFA: An IFA is established using the new policy as collateral. The family pays the annual premiums and immediately borrows back the same amount to reinvest, making the funding process for the insurance cash-flow neutral.

- Invest for Deductibility: The borrowed funds are reinvested into their non-registered portfolio to earn income. This reinvestment is the crucial step for supporting the tax-deductibility of the loan interest.

- The Endgame: Upon the death of the second spouse, the policy’s tax-free death benefit (which has grown to a projected $16 million) first repays the outstanding loan. The remaining $10 million is paid, tax-free, to their estate.

Outcome: The G. family offset a $5 million tax bill, made a transformative $10 million gift to charity, and passed on the full, restored $10 million to their heirs.

Key Risks and Considerations

While powerful, this strategy carries inherent risks that require careful management. A comprehensive review is essential, focusing on:

- Interest Rate Risk: A rise in interest rates will increase the cost of servicing the loan, impacting the strategy’s net benefit.

- Investment Performance Risk: The “Leveraged Income Stream” model is dependent on the performance of the invested loan proceeds to fund the donations.

- Complexity and Longevity: This is a long-term strategy that requires a multi-decade commitment from the client and ongoing coordination from the advisory team.

(For a comprehensive analysis, see our Foundational Guide to IFA Risk Management for Accountants).

The Accountant’s Role in a Leveraged Philanthropy Strategy

Given the complexity and the significant tax implications, your role as the accountant is central to the successful implementation of this strategy. You are the key advisor who can:

- Identify the Right Client Profile: Proactively identify clients for whom this strategy may be a fit—typically those with a high net worth, strong cash flow, existing philanthropic goals, and a major liquidity event on the horizon (like a business sale).

- Confirm Tax Compliance: Review the structure to ensure the flow of funds supports the deductibility of loan interest and potential collateral insurance premiums. Critically, you must advise on the optimal asset to donate (cash vs. appreciated securities) and the optimal timing (lifetime vs. estate) in light of the client’s overall tax picture and the changing implications of the Alternative Minimum Tax (AMT).

- Stress-Test the Model: Review the financial models we provide to stress-test the strategy’s resilience against interest rate fluctuations and variable investment returns.

- Coordinate the Advisory Team: Liaise with us as the insurance specialists, legal counsel, and the wealth advisor to ensure all components of the strategy are integrated seamlessly. Your position as a trusted, independent advisor is critical, as outlined in The Accountant’s Role on the IFA Core Advisory Team.

By understanding the architecture of IFA-Enhanced Philanthropy, you can elevate your advisory conversations, moving from tax compliance to legacy creation. As we’ve outlined, there are multiple ways to structure these arrangements, from generating an active, lifetime income stream for charity to creating a final legacy gift from the estate. Applying this framework to a specific client scenario requires a nuanced discussion to select the right path.

If you are exploring how these principles could benefit a client, we invite you to have a peer-level discussion to determine the optimal structure for their unique goals.

Schedule a chat to begin the conversation.