(Part of the IFA Master Curriculum)

Key Question for DIY Investors

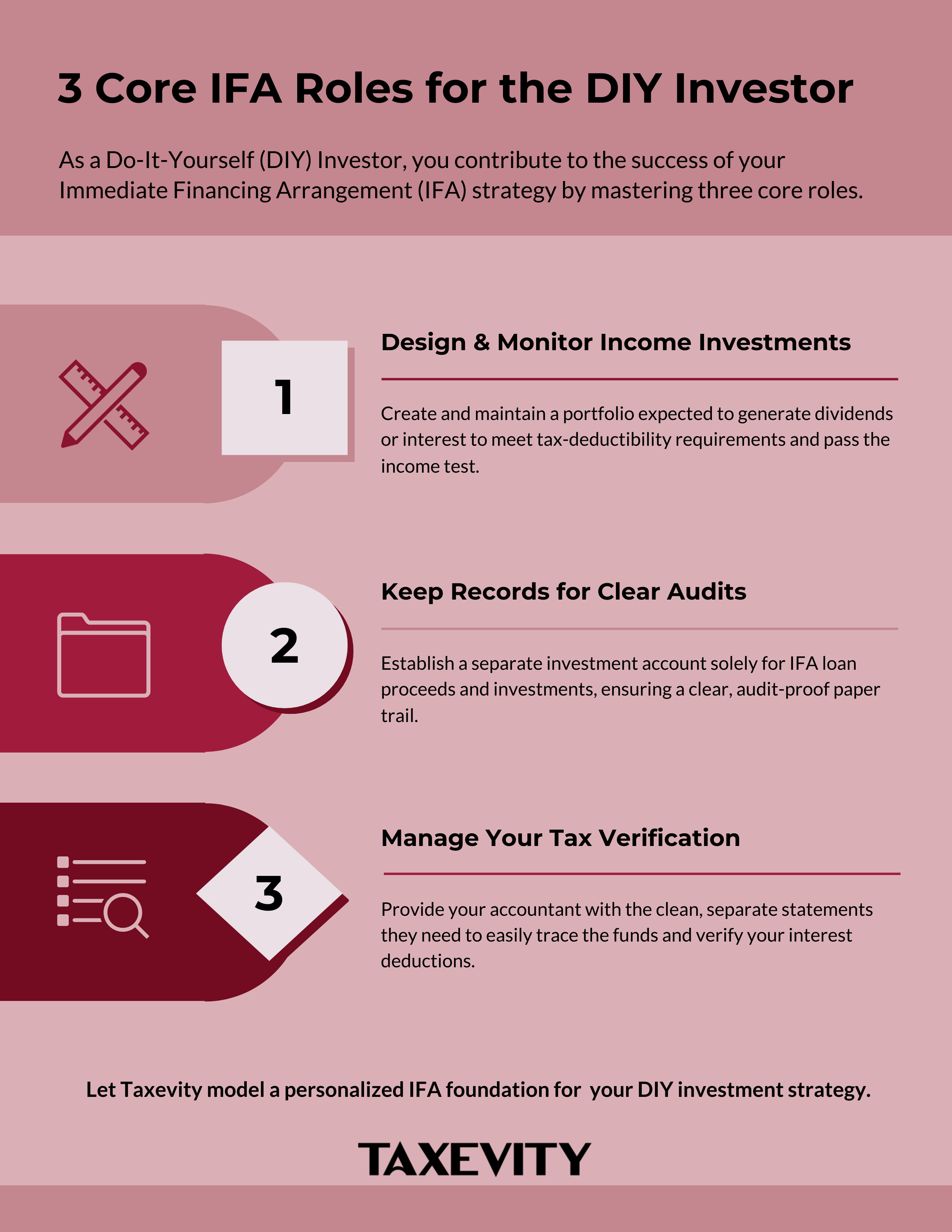

As a “Do-It-Yourself” investor taking on the “Wealth Advisor” role in an Immediate Financing Arrangement (IFA) , how do you successfully manage the strategy and ensure your accountant can verify your critical interest deductions?

- The Management Role: A common pitfall is assuming your accountant is managing the strategy when their role is purely verification of past actions. As the “DIY IFA Manager”, you are responsible for investment selection, risk management, and creating the clean paper trail your accountant needs.

- The Core Responsibilities: You must actively design a portfolio with a “reasonable expectation of producing income” (not just capital gains). You must also maintain meticulous records, using a separate, non-co-mingled investment account to create an undeniable paper trail.

- The Path to Verification: A practical workflow involves creating an Investment Policy Statement (IPS), having your accountant review it before you invest, executing the plan in the separate account, and providing clean annual statements. This makes it easy for your accountant to verify the “use of funds” and calculate your deduction.

As a “Do-It-Yourself” investor, you’ve likely built your wealth through sophisticated, self-directed strategies and are comfortable mastering new, complex financial concepts.

When you explore an Immediate Financing Arrangement (IFA), you might see a potential roadblock. We consistently emphasize the importance of your IFA Core Advisory Team a collaborative group of independent experts that includes an Architect (Taxevity), an Accountant, a Legal Advocate, and a Wealth Advisor.

What happens when you are the Wealth Advisor?

The good news is that an IFA can still be a powerful strategy for a DIY investor.

Your drive for self-sufficiency is what makes you a successful investor. An IFA is no different—it’s another complex system to master. This guide is a playbook to help you understand and prepare for the specific roles you’ll fill. The key to success is moving from “DIY investor” to “DIY IFA Manager”, which involves clarifying a few key aspects.

Page Contents

- 1 The Critical Difference: Verification vs. Management

- 2 Responsibility 1: Ensuring Tax-Deductibility (The “Income Test”)

- 3 Responsibility 2: Meticulous Record-Keeping (The “Audit Test”)

- 4 Responsibility 3: Acting as the “Integrator”

- 5 A 4-Step Workflow for the DIY “Wealth Advisor”

- 6 A Note on Finding the Right Wealth Advisor

- 7 Your Strategy, Your Choice

The Critical Difference: Verification vs. Management

One of the most common pitfalls in a DIY-led IFA is a simple lack of clarity on roles—specifically, assuming your accountant is managing parts of the strategy when their role is purely verification.

- Your Accountant’s Role (Verification): Your accountant is your tax specialist. Their primary job is to verify that the strategy is implemented correctly for tax purposes. They will advise on tax implications, such as the impact on your Capital Dividend Account (CDA) or passive income rules. At year-end, they will use the documents you provide to verify the use of funds and calculate your interest deduction. They verify past actions.

- Your “Wealth Advisor” Role (Management): This is the proactive role. You are solely responsible for investment selection, execution, and risk management. You must create the clean paper trail your accountant needs before they can do their job. You are responsible for future actions and their consequences.

When you act as your own wealth advisor, you are responsible for mastering the following jobs. As we’ll see, for the DIY investor who prefers to delegate certain tasks, help is available.

Responsibility 1: Ensuring Tax-Deductibility (The “Income Test”)

This is the most critical hurdle. For the IFA loan interest to be deductible, the Income Tax Act requires that the borrowed funds are used for the purpose of earning income from property (e.g., dividends, interest, active business income, or rent). An expectation of capital gains alone is not sufficient.

- Your Action: You must design and maintain an investment portfolio that has a “reasonable expectation of producing income.” This isn’t a passive requirement; it’s an active, ongoing test. While using an IFA for investment real estate is possible, this guide focuses on the common DIY strategy of managing a liquid investment portfolio. In either case, you must be able to defend the income-producing nature of your assets to your accountant and, if necessary, the CRA. For stocks, generally speaking, if one doesn’t explicitly say it will not pay dividends, it may qualify.

- The Risk: If you invest purely for growth or in non-income-producing assets, your accountant will be unable to verify the “use of funds” requirement, and the interest deduction could be denied.

For more details, read Your Personal Companion: Understanding Interest Deductibility in Canada.

Responsibility 2: Meticulous Record-Keeping (The “Audit Test”)

This is the non-negotiable foundation of the strategy. The burden of proof for tax deductibility rests entirely on you, the taxpayer. If you are ever audited, “I’m not sure where the money went” is not an acceptable answer.

- Your Action: The best practice is absolute separation. You must open a new, separate investment account used only for the IFA loan proceeds and the resulting investments. You cannot co-mingle these funds with any other corporate or personal money. This creates a clean, undeniable paper trail that traces the loan from the lender directly to the income-producing investments.

- The Risk: Co-mingling funds makes it difficult, if not impossible, for your accountant to verify the direct link between the loan and the investments. This “flawed structuring” invites scrutiny and puts your tax deductions at risk.

Responsibility 3: Acting as the “Integrator”

Finally, by acting as your own Wealth Advisor, you also automatically take on the role of the Integrator for your entire Core Advisory Team.

- Your Action: You are the one responsible for scheduling calls with your advisory team, passing documents from the lender to the accountant, getting the legal opinion from your lawyer, and ensuring the insurance, legal, tax, and investment components all work together seamlessly.

- The Risk: This is a significant administrative and project-management responsibility. If communication falters or you fail to coordinate the experts, a critical step (like perfecting the loan security) could be missed, or your accountant might not get the documents they need, jeopardizing the strategy.

A 4-Step Workflow for the DIY “Wealth Advisor”

So, how do you put this into practice? Here is a simple workflow to follow.

- Create Your Investment Policy Statement (IPS). Before you invest a dollar, write down your plan. This document should state:

- Objective: “To invest the IFA loan proceeds to earn income from property (dividends/interest/rent) in compliance with the Income Tax Act.”

- Eligible Investments: (e.g., “A portfolio of Canadian dividend-paying equities, fixed-income ETFs,” etc.)

- Stating Your Investment Philosophy: “My philosophy for this portfolio is a passive, long-term, buy-and-hold strategy using low-cost, income-producing ETFs, aligned with my risk tolerance.”

- Share the IPS with Your Accountant. This is the “verification” step. Ask them, “If I follow this plan exactly, will it meet the ‘use of funds’ requirement for interest deductibility?” This allows them to give proactive advice before any mistakes are made.

- Execute the Plan. Open the new, separate account. Deposit the loan proceeds. Purchase the investments according to your IPS. Do not use this account for anything else.

- Provide Annual Statements. At year-end, give your accountant the loan statements and the clean, separate investment account statements. This makes their job easy—they can clearly trace the funds, verify the income, and calculate your deduction.

A Note on Finding the Right Wealth Advisor

A wealth advisor reading this might ask, “Why is an insurance architect encouraging clients to manage a complex leveraged strategy on their own?”

This is a fair question, and the answer clarifies our role. Our goal is not to replace advisors. Our goal is to be educators and architects who help make the IFA structure successful.

We recognize two realities from our work:

- Investors firmly committed to the DIY path are not looking for a wealth advisor. For them, this guidance is essential.

- An IFA requires specific expertise in leveraged strategies and tax-efficient corporate investing that few wealth advisors have. A generalist unfamiliar with nuances of IFAs can, unfortunately, be a point of failure in the core advisory team.

Some of our clients are “DIY” by default—not because they refuse to delegate, but because they haven’t found the right partner.

If you read the responsibilities above and decide you do not want to take on that risk and workload, we can help. As part of our process, we can introduce you to qualified wealth advisors who understand the complexities of IFAs and are pre-vetted to collaborate effectively.

Your Strategy, Your Choice

Whether you are a committed DIY investor or you’re looking for the right wealth advisor to manage the investment component, the key is clarity. A successful Immediate Financing Arrangement depends on every role being filled by a niche expert who understands their specific responsibilities.

It’s not just about your skill in picking investments; it’s about the discipline to build and maintain a structure that supports the tax and legal requirements of the IFA.

As your Insurance Architect, our role is to design an insurance foundation for your IFA that integrates well into your overall plan.

Related Articles

- The IFA Core Advisory Team: Your Core Advisory Team for Success

- The Wealth Advisor’s Role on the IFA Core Advisory Team

- The Accountant’s Role on the IFA Core Advisory Team

- Mindset & Temperament: The “Soft Skills” for a Leveraged Strategy

- Stress-Testing IFAs: Understanding Correlated Market Risks

If you are ready to explore how an IFA fits with your financial strategy, we’ll create personalized internally-developed models and answer your questions when you schedule a consultation. We’ll help you map out your Core Advisory Team—whether you’re the Wealth Advisor or you’re looking for an introduction to one.