(Part of the IFA Master Curriculum)

Key Question for Accountants

When advising a client on an Immediate Financing Arrangement (IFA), how do you stress-test the strategy against economic volatility to ensure it aligns with their long-term financial resilience?

- The Core Tension: An IFA’s performance is dictated by the relationship between its two distinct engines: the gradual smoothed growth of the foundational whole life insurance policy and the potentially volatile cost of the variable-rate collateral loan, which is tied to the prime rate.

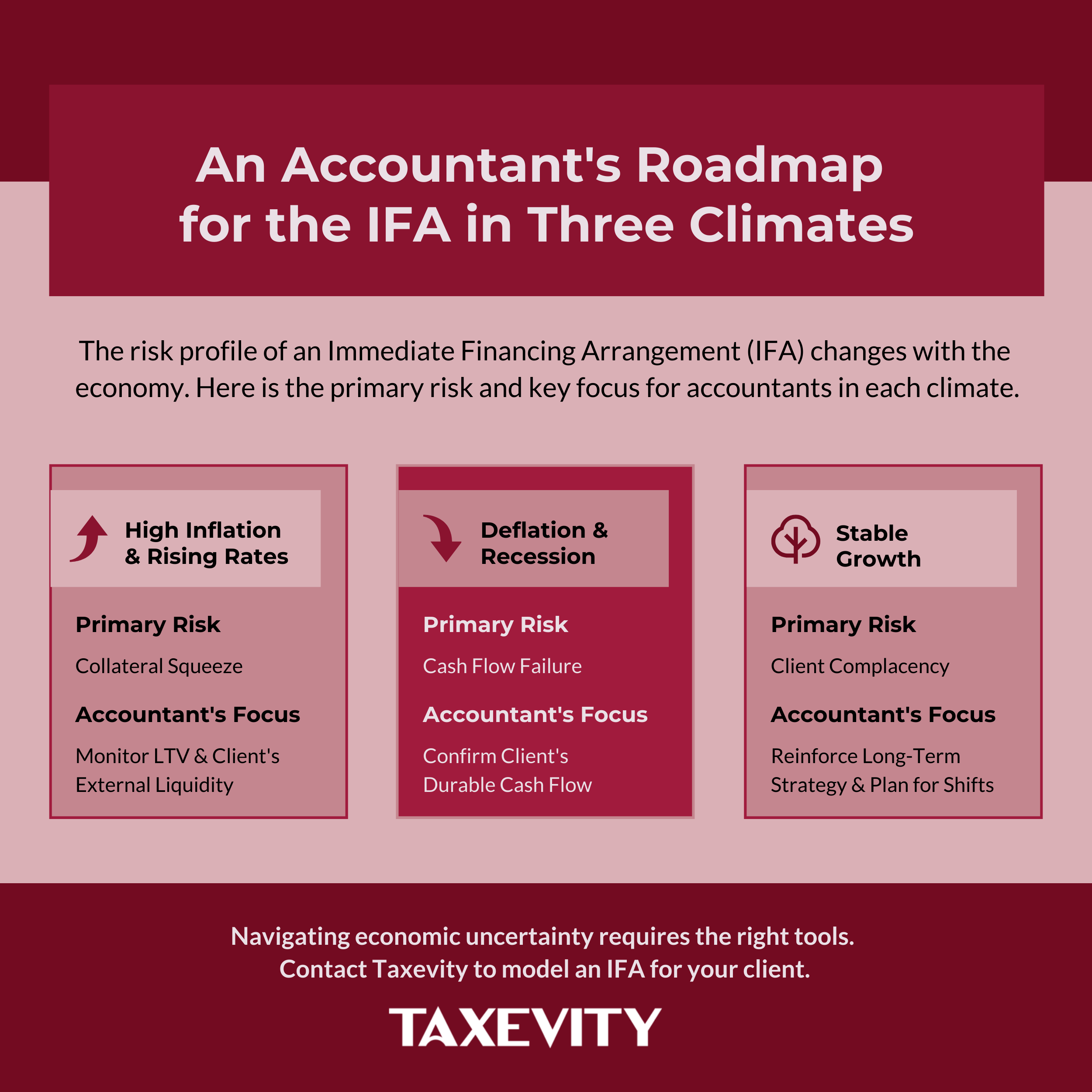

- Climate-Specific Risks: This tension creates predictable strains in different economic climates, shifting the primary risk from a “collateral squeeze” in a high-rate environment to the client’s own “cash flow failure” during a recession , where declining income threatens their ability to service premiums and loan interest.

- The Decisive Factor: Ultimately, the IFA’s survival through economic cycles depends less on the structure itself and more on the client’s pre-existing financial fortitude , including their access to external liquidity and durable cash flow to fund the strategy during periods of stress.

An Immediate Financing Arrangement (IFA) is a long-term strategy, but its performance is perpetually tested by short-term economic volatility. For an accountant advising a client, understanding how an IFA behaves under different economic pressures is fundamental to providing sound guidance. The strategy flexes and strains in predictable ways depending on the prevailing climate.

Page Contents

- 1 1. High and Rising Interest Rates: The Ultimate Stress Test

- 2 2. High Inflation: A Shift from Growth to Preservation

- 3 3. Recession and Economic Downturn: A Test of Fortitude

- 4 The Long-Term View: A Strategy Built to Endure Cycles

- 5 Client Conversation Points & Summary

- 6 Conclusion: The Accountant’s Role in Holistic Stress-Testing

Deconstructing the IFA’s Core Components

Before analyzing the performance, it’s essential to recall the IFA’s two core engines:

- The Stabilizing Engine: Whole Life. The foundational asset is a participating whole life insurance policy. Its value grows through a combination of guaranteed cash values and non-guaranteed dividends from the insurer’s “participating account”—a massive, conservatively managed portfolio. The key feature is that the return from this account, the Dividend Scale Interest Rate (DSIR), is “smoothed” over many years. It responds with a significant lag to market changes.

- The Volatile Engine: The Variable-Rate Loan. The strategy is powered by a collateral loan from a third-party lender. This loan is almost always tied to the prime rate, meaning its cost changes immediately in response to monetary policy.

The conflict between these two engines—the slow-moving policy growth and the fast-moving loan cost—is the fundamental tension that dictates the IFA’s performance in any economic climate.

1. High and Rising Interest Rates: The Ultimate Stress Test

A rising interest rate environment, typically driven by a central bank fighting inflation, represents the most acute challenge for an IFA.

- The Impact: The cost of the collateral loan increases immediately, compressing the spread between the cost of borrowing and the return on the redeployed capital. This places a direct strain on the client’s cash flow.

- The Primary Risk: Reduced Cash Flow. While the larger loan interest payments result in a larger potential tax deduction, this only provides a partial offset and is entirely dependent on the client having sufficient taxable income to absorb it. Meanwhile, the benefit of higher rates on the insurer’s bond portfolio takes years to filter through to the policy’s dividend.

- Strategic Implication: The transition from a low-rate to a high-rate environment can be the IFA’s most vulnerable phase. As a defensive measure, a client can choose to temporarily stop taking new annual loans, or take smaller ones. This contains the size of the loan and mitigates cash flow strain, helping to weather the period of stress.

2. High Inflation: A Shift from Growth to Preservation

High inflation has a corrosive effect on the real value of the IFA’s components and almost invariably triggers a rising-rate response from the central bank.

- The Impact: While the foundational life insurance protection remains a critical benefit, the IFA’s function as an active financial tool can shift from wealth creation to liquidity access. The loan proceeds can be used to acquire inflation-hedging assets like real estate or commodities. However, during these periods, which typically last a few years, the strategy may be generating a negative real (inflation-adjusted) return, as the policy’s nominal growth may be lower than the rate of inflation.

- The Primary Risk: The Inevitable Rate Response. High inflation cannot be analyzed in isolation. It is the cause that leads to the effect of rising interest rates. Therefore, a client in an inflationary period must be prepared to manage the cash flow strain described in the high-rate environment.

- Strategic Implication: The IFA becomes a defensive tool by providing liquidity (via the loan) that can be redeployed into hard assets that may better preserve their value during inflation. It helps mitigate the erosive effects of inflation on a client’s overall balance sheet, rather than acting as an offensive tool for growing wealth in real terms.

3. Recession and Economic Downturn: A Test of Fortitude

A recession presents a paradoxical test. The IFA’s collateral is resilient, but its leveraged structure is vulnerable.

- The Impact: The foundational asset—the whole life policy—is a key strength. Its CSV is insulated from direct market crashes, providing a stable collateral base that is far superior to a volatile securities portfolio. This stability reduces the risk of a collateral-driven margin call.

- The Primary Risk: Cash Flow Failure. While the collateral is stable, the client’s ability to meet their obligations is not. A recession is characterized by declining business revenue and investment income. This directly threatens the client’s ability to service the two non-negotiable costs of the IFA: the annual premium and the loan interest. Furthermore, with lower taxable income, the value of the strategy’s tax deductions diminishes significantly, increasing the after-tax cost of the loan at a particularly challenging time.

- Strategic Implication: The IFA’s survival through a recession is almost entirely dependent on the borrower’s pre-existing financial fortitude. They must have sufficient external liquidity and durable cash flow to continue funding the strategy even in the absence of positive investment returns or meaningful tax deductions.

The Long-Term View: A Strategy Built to Endure Cycles

Economic climates are temporary, but the IFA is a multi-decade strategy. While analyzing performance during periods of stress is critical, viewing that performance through a long-term lens is equally important. Over a 20-year, 30-year, or longer horizon, periods of high and low interest rates will likely occur, with their respective pressures and benefits tending to balance out over time.

The foundational participating whole life policy acts as a unique, volatility-dampening component of your client’s overall net worth. The “smoothing” of the dividend scale means it does not suffer from the sharp declines of equity markets, providing a stabilizing effect. Furthermore, the core purpose of the strategy—the life insurance protection—becomes even more critical during volatile times. When the value of other estate assets like a business or a stock portfolio may be depressed, a portion of the full, tax-free death benefit provides essential liquidity and certainty when it is needed most.

Client Conversation Points & Summary

This section translates the technical analysis into a quick-reference table and practical questions to help frame your discussions with clients.

Summary of IFA Performance in Different Climates

| Economic Climate | Primary Impact on IFA | Key Risk to Manage | Strategic Focus |

| High/Rising Rates | Immediate increase in loan costs | Collateral Squeeze | Cash Flow Management |

| High Inflation | Negative real returns | Inevitable Rate Response | Liquidity for Hedging |

| Recession | Negative real returns and decreased cash flow | Client Cash Flow Failure | External Liquidity |

Key Questions for Your Client

- For a High-Rate or High Inflation Climate: “Your borrowing costs could increase significantly. Do you have sufficient, durable cash flow from your business or other investments to cover higher interest payments without financial strain?”

- For a Recession: “Let’s look at your financials from 2020. How did your business revenue hold up, and what was the impact on your personal cash flow? That gives us a real-world baseline for your ability to handle the fixed costs of this strategy during a downturn.”

Conclusion: The Accountant’s Role in Holistic Stress-Testing

The performance of an IFA is less about predicting the economic weather and more about ensuring your client has the financial equivalent of an all-weather vehicle. An IFA should not be analyzed in a vacuum. A prudent review involves looking at your client’s entire financial situation—their business, their investments, and their cash flow—to understand how the IFA interacts with these other components during volatile times.

A key service an accountant can provide is to encourage a review of how the client has weathered past financial storms. While formal stress tests prepared by a financial planner are valuable, a practical discussion about how the client’s business and cash flow fared during the COVID-19 pandemic or the 2008 financial crisis can be just as insightful. This moves the discussion from abstract models to a real-world assessment of the client’s demonstrated financial and emotional resilience.

At Taxevity, we support this critical due diligence by building our models on a foundation of conservative assumptions, such as using dividend scales that are lower and loan rates that are higher than current levels. By quantifying the impact of these challenging scenarios from the outset, you can help your client make a fully informed decision, confident in the resilience required for long-term success.

Understanding how an IFA will perform under pressure is the cornerstone of responsible financial advice. If you are reviewing an IFA proposal that lacks this multi-variable stress test, we can model these scenarios for you using the specifics of that proposal. This allows you to provide your client with a clear-eyed view of their capacity to withstand a realistic worst-case scenario. We invite you to contact us.