Key Question for Physicians

As an incorporated physician, you have significant wealth within your Medical Professional Corporation (MPC). How can you use that corporate capital for new investments and estate planning without triggering a large personal tax bill?

- Tax-Efficient Corporate Investing: An Immediate Financing Arrangement (IFA) allows your MPC to access its retained earnings to fund new investments, like real estate or a stock portfolio. This is done via a corporate loan, avoiding the personal tax bill that comes from paying yourself a large salary or dividend.

- Powerful Estate Preservation: The strategy provides a tax-free death benefit to your corporation. This creates essential liquidity to pay the major tax liabilities your estate will face, such as on the deemed disposition of your MPC shares, preserving the value of your life’s work.

- Enhanced Tax Efficiency: A properly structured IFA offers multiple tax advantages for your MPC, including the potential to deduct loan interest, the tax-sheltered growth of the policy’s cash value, and the ability to distribute funds tax-free to your heirs via the Capital Dividend Account (CDA).

As a successful physician in Canada, you’re likely using a Medical Professional Corporation (MPC) to optimize your income and tax planning. While your practice generates significant active income, building long-term, tax-efficient wealth often involves strategic corporate investing and robust estate planning. However, accessing corporate capital personally for investments can trigger personal taxes, and allocating large sums to traditional insurance options might feel limiting for other investment goals.

An Immediate Financing Arrangement (IFA) offers incorporated physicians a sophisticated strategy to unlock corporate capital tax-efficiently, fund investments, and enhance estate protection, all while leveraging the unique benefits of permanent life insurance.

Page Contents

Why Consider an IFA for Your MPC?

Physicians operating through MPCs face unique financial circumstances where an IFA can be particularly advantageous:

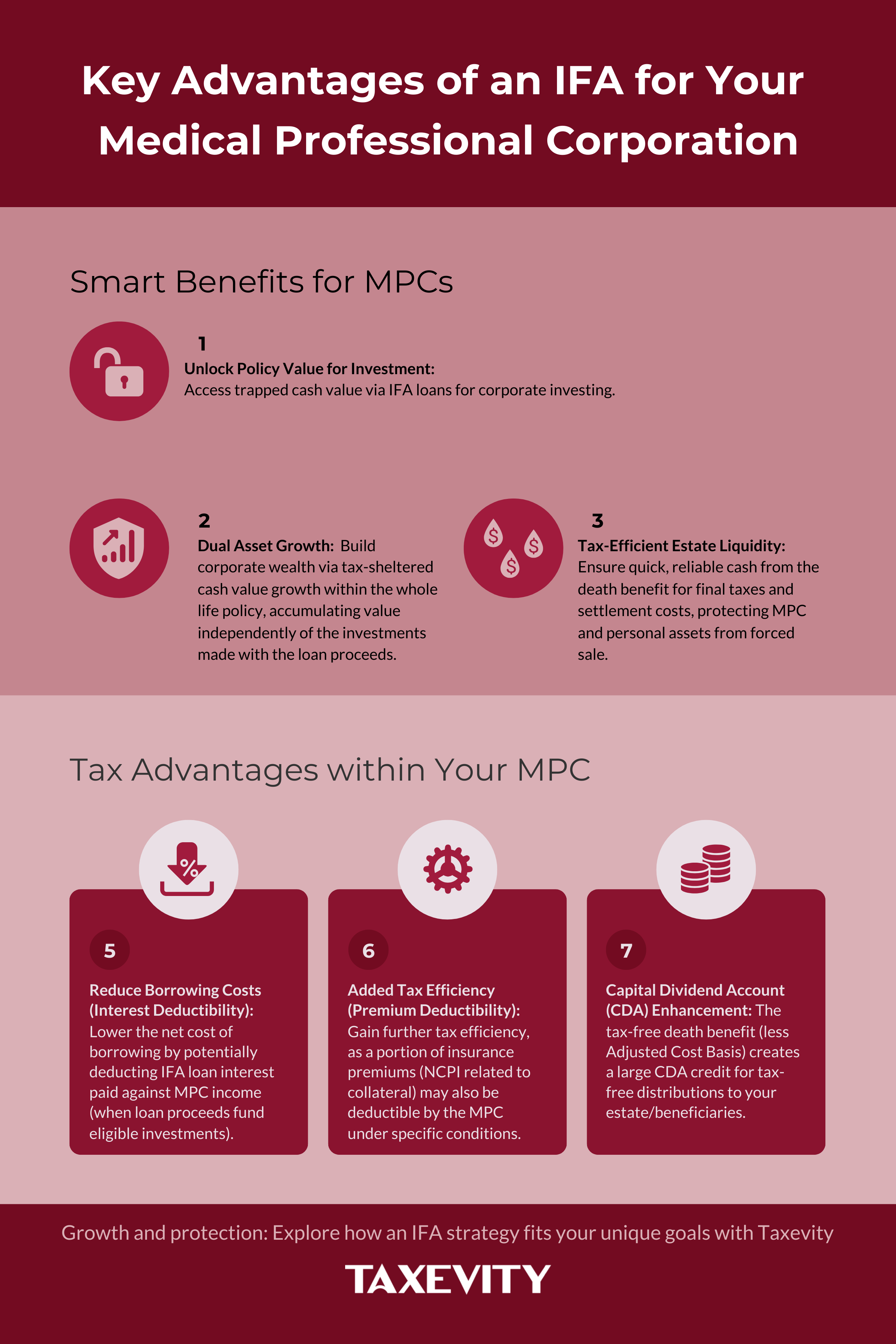

- Tax-Efficient Corporate Investing: Access retained earnings for investment opportunities (like real estate or market portfolios) using corporate funds via the IFA loan, without incurring personal tax associated with drawing large salaries or dividends.

- Enhanced Retirement Funding: Supplement traditional retirement savings with tax-sheltered growth inside a whole life policy, funded efficiently via the IFA structure.

- Estate Preservation: Address significant future tax liabilities arising from the deemed disposition of your practice shares, corporate investments, and other assets upon death. Life insurance provides valuable liquidity.

IFA Mechanics: A Brief Recap

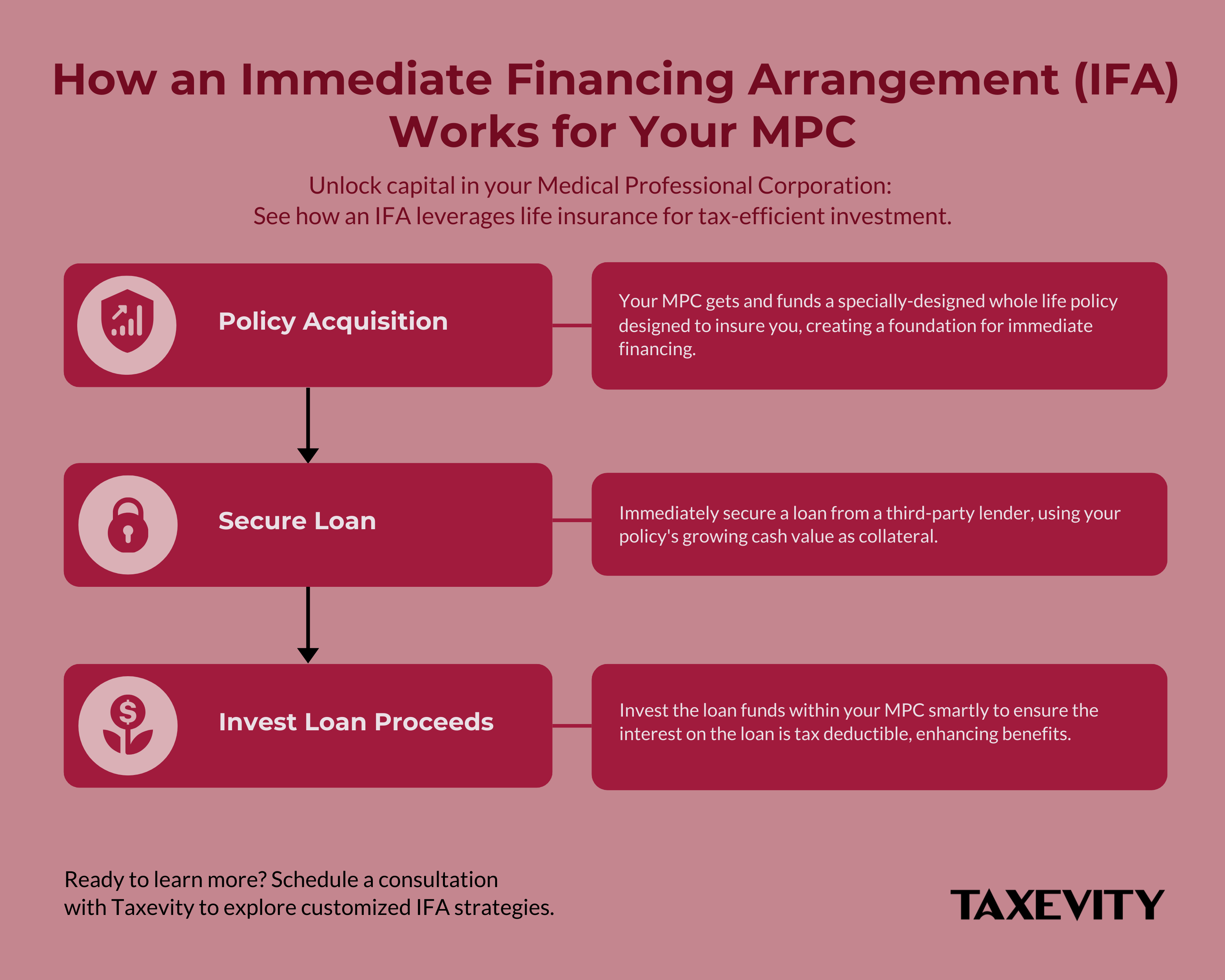

The core IFA strategy involves:

- Your MPC applying for and funding a specially-designed permanent whole life insurance policy insuring you.

- Immediately securing a loan from a third-party lender, using your policy’s growing cash value as collateral.

- Investing the loan proceeds within your MPC in a way that makes the loan interest tax deductible.

For those familiar with our discussion on beyond MD Episode 91, we have a 5-part companion blog series. This in-depth exploration begins with a foundational look at leveraging life insurance with an IFA: Mastering IFAs for Physicians – Part 1. For another detailed example of IFA mechanics in a specific context, you can also visit Funding Real Estate Investments Through Whole Life Insurance.

Specific Considerations for Doctors & MPCs

Applying the core IFA concept within an MPC involves specific considerations:

- Corporate Investment Strategy: How does the IFA fit with managing your MPC’s retained earnings and staying within passive income limits where relevant? The potential tax deductions from the IFA can help offset tax on corporate investment income.

- Cash Flow Planning: Your MPC will need cash to fund for the annual insurance premiums (often payable for 10 years) and the monthly loan interest payments.

- Investment Allocation & Deductibility: Determining the appropriate allocation for the leveraged funds is crucial. Critically, to support potential interest deductibility, these investments must be chosen primarily for the purpose of earning taxable income (e.g., interest, dividends, rental income) acceptable to the CRA. For more details, see Physician Companion: Optimizing Interest Deductibility for Your Medical Practice & Investments. Within this requirement, choices for physicians may include diversified portfolios of public securities or interests in private real estate syndications. Ensure these align with deductibility rules by consulting your accountant.

- Scale and Minimums: IFAs are substantial commitments. Lenders often require minimum loan advances of $500,000 within 10 years, which typically means an annual insurance premium of at least $50,000 for 10 years.

Tax Implications within Your MPC

An IFA offers potential tax advantages when implemented correctly within your corporation:

- Interest Deductibility (ITA 20(1)(c)(i)): If the borrowed funds are directly traced to eligible investments expected to produce taxable income (interest, dividends) for the MPC, the loan interest paid by the MPC may be deductible against corporate income. Meticulous record-keeping is essential.

- Premium Deductibility (NCPI – ITA 20(1)(e.2)): Under specific conditions (including borrowing from a Restricted Financial Institution which requires the policy as collateral), a portion of the insurance premium corresponding to the Net Cost of Pure Insurance (NCPI) attributable to the collateral may be deductible by the MPC.

- Capital Dividend Account (CDA): Upon the insured physician’s death, the life insurance proceeds (less the policy’s Adjusted Cost Basis) are paid tax-free to the MPC, creating a large credit to the CDA. This allows significant funds to be distributed tax-free from the corporation to your estate or beneficiaries, providing liquidity for taxes and enabling tax-efficient wealth transfer.

Case Study: Dr. L, Incorporated Surgeon

- Situation: Dr. L, 50, operates his surgical practice through an MPC with significant retained earnings. He wants to diversify by investing $1,000,000 in a real estate portfolio within the corporation but wishes to avoid drawing large taxable salaries/dividends. He’s also concerned about future estate taxes on his practice value and growing investments.

- Solution: Dr. L’s MPC, guided by Taxevity and his other independent advisors, implements an IFA.

- The MPC applies for a $1,500,000 permanent whole life policy insuring Dr. L, paying annual premiums of $100,000 for 10 years. The policy is designed for high early cash value.

- Immediately after the first premium of $100,000, the MPC secures an IFA loan of $100,000, collateralized by the policy’s cash value of $83,400 and $16,600 of additional collateral. (Note: Subsequent annual loans may rely solely on policy cash value depending on growth and lender terms).

- The loan proceeds are invested by the MPC into a diversified portfolio of income-producing REITs and real estate LPs (he consulted his accountant who confirmed these investments satisfied the criteria for interest deductibility rules).

- Projected Benefits:

- Capital Efficiency: Corporate capital is deployed into passive investments without immediate personal tax leakage.

- Dual Growth: The MPC benefits from tax-sheltered policy growth and potential returns from the real estate portfolio.

- Corporate Tax Deductions: Loan interest (and potentially a portion of the premium via NCPI) paid by the MPC is expected to be deductible, sheltering other corporate investment income.

- Estate Liquidity: At Dr. L’s death (projected at age 85), the estimated $4,000,000 tax-free death benefit generates a CDA credit of $4,000,000 and repays the loan balance of $1,000,000, leaving $3,000,000 credited to the MPC’s CDA. The extra $1,000,000 of CDA credit that wasn’t used to pay out death benefit dollars can be used to extra corporate cash or assets tax-free. This provides tax-free funds to address taxes arising from the deemed disposition of his practice shares and investment portfolio.

Note: This case study is illustrative. Actual results depend on individual factors, policy/investment performance, rates, tax laws, and other factors. Contact Taxevity for Insurance Options tailored to you.

Is an IFA Right for You and Your MPC?

An IFA is typically best suited to physicians with:

- MPC with substantial retained earnings or passive investment income.

- Strong, stable corporate cash flow.

- A long-term investment horizon (15+ years).

- A reason for permanent life insurance (e.g., estate planning, wealth transfer).

- Sufficient corporate taxable income to use the potential deductions.

- An understanding of and tolerance for investment leverage risks.

- A coordinated team of advisors (accountant, wealth advisor, Taxevity).

Understanding the Risks

IFAs involve leverage and require careful consideration of risks, including:

- Investment Risk: The leveraged investments may perform below your projections.

- Interest Rate Risk: Variable loan rates can increase borrowing costs when rates rise.

- Policy Performance: Policy dividends contribute to cash value growth but are not guaranteed.

- Complexity & Long-Term Commitment: IFAs require ongoing management, and unwinding them by selling assets can result in tax implications.

Strategic Wealth Building for Physicians

For physicians operating through MPCs, an Immediate Financing Arrangement can be a powerful tool to unlock corporate capital, enhance investment growth tax-efficiently, and secure long-term estate protection. It requires careful planning, expert structuring, and ongoing management.

Contact Taxevity to discuss whether an IFA strategy aligns with your specific situation and goals for your Medical Professional Corporation. Let us help you explore opportunities for Protection, Growth, and Impact.