(Part of the IFA Master Curriculum)

Key Question for Accountants

As your client’s accountant, how can you confidently differentiate the modern Immediate Financing Arrangement (IFA) from the failed “10-8” strategy to ensure your due diligence protects them from legislative risk?

- The 10-8’s Core Issue: While the 10-8 was a form of leverage, its profitability depended entirely on tax arbitrage. The strategy used a guaranteed interest rate spread from the insurer itself—an arrangement that created a predictable pre-tax loss by design. The client’s positive return was generated only by the tax deduction , a structure the government ultimately deemed to lack a genuine economic purpose, which led to it being shut down.

- The IFA’s Structural Integrity: A modern IFA is a resilient financing strategy built on the lessons learned from the 10-8’s failure. It is grounded in commercial reality by using an independent, third-party bank for the loan and a fluctuating, market-based interest rate , which gives it a legitimate economic purpose as a leveraging tool.

- Your Due Diligence Focus: Your role is to verify the structure’s integrity through practical due diligence. This involves confirming the lender is an arm’s-length financial institution, the interest rate is tied to a market benchmark, and there is a meticulous plan to trace all loan proceeds to an income-producing investment.

For an accountant who advises high-net-worth clients, the term “leveraged life insurance” can trigger a specific memory: the controversial “10-8” strategy and its ultimate, messy shutdown by the federal government in 2013. That history casts a long shadow, which is why one of the most common and prudent questions we hear from accountants about the Immediate Financing Arrangement (IFA) is, “How do we know this won’t just be another 10-8?”

This is the right question to ask. As we’ve discussed in our guide for accountants, your role is to protect your clients from undue risk, and the thought of recommending a strategy that could be legislated out of existence is a non-starter.

The good news is that the modern IFA is not a sequel. It’s a strategy built on the lessons learned from the 10-8’s failure. Understanding the difference between the two isn’t just an academic exercise; it’s fundamental to recognizing why the IFA is a resilient and defensible financial planning tool, while the 10-8 was a strategy whose design created a tax outcome the government would not permanently tolerate. The key difference lies in a single concept: economic purpose.

Page Contents

The Ghost of 10-8: A Lesson in Tax Arbitrage

The 10-8 strategy was built on a guaranteed interest rate spread. The name came from its most common structure: a client would take a loan from the insurer itself at a guaranteed 10% interest rate. These funds were then used within the life insurance policy, which provided a guaranteed 8% return.

While the numbers may seem contrived today, there was internal logic to the design at the time within the tax rules governing life insurance. However, the arrangement’s viability for the client was entirely dependent on the tax treatment of the loan interest.

On a pre-tax basis, the strategy was designed to produce a predictable 2% annual loss. The client’s net positive return was created by the tax system. The 10% interest paid on the loan was designed to be tax-deductible. For a client in a 50% marginal tax bracket, this turned the 10% pre-tax cost into a 5% after-tax cost. The math then flipped: a 5% after-tax cost against an 8% tax-sheltered return created a risk-free, 3% net positive return.

This structure was legally sound under the rules of the day—so much so that when the CRA attempted to compel insurers to release the names of their 10-8 clients, the industry fought back and won at the Supreme Court, protecting client privacy. The issue was not that the strategy was illegal, but that its outcome was deemed a misuse of the tax act’s provisions. 10-8 was seen as lacking a genuine economic purpose beyond generating a tax benefit, which ultimately led the government to change the law and shut it down.

How the Modern IFA Was Built on the Lessons of the Past

The Immediate Financing Arrangement was designed with the 10-8’s fatal flaws in mind. It is not a tax arbitrage strategy but a leveraging strategy. It allows a client to acquire a valuable permanent life insurance asset for estate planning while freeing up capital for deployment into other productive assets, like their business or an investment portfolio.

Let’s break down the key architectural differences that give the IFA its structural integrity.

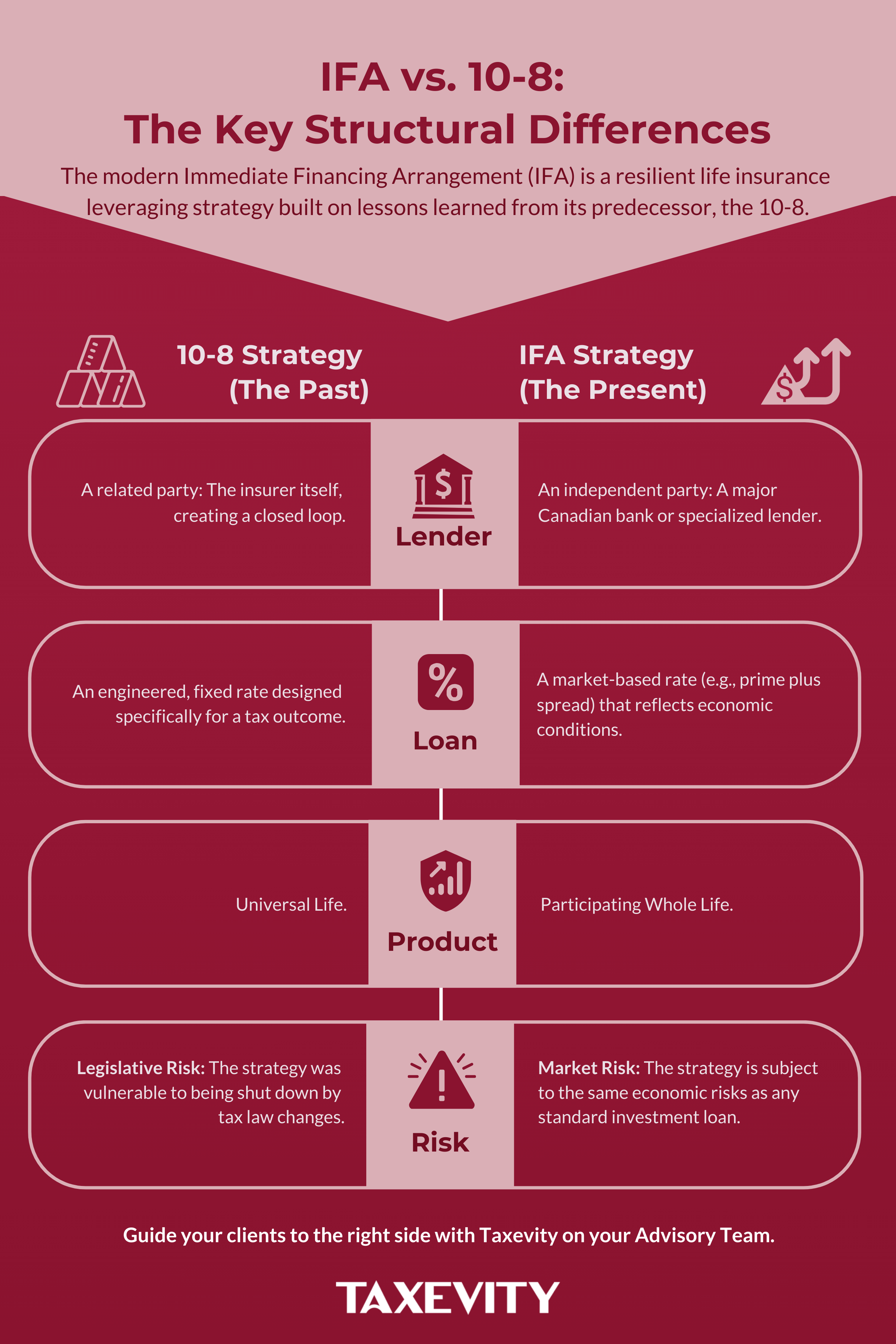

| Feature | 10-8 Strategy (The Past) | Immediate Financing Arrangement (The Present) |

| Lender Relationship | Integrated / Related-Party (The insurer) | Arm’s-Length / Third-Party (A major Canadian bank) |

| Interest Rate | Engineered & Fixed Spread (e.g., 10% minus 2%) | Market-Based & Variable (e.g., Prime + spread) |

| Insurance Vehicle | Universal Life (UL) | Participating Whole Life |

| Source of Client Profitability | Tax Arbitrage (Net return created by the tax deduction) | Economic Performance (Net return created if investment returns exceed borrowing costs) |

| Core Principle | Reliance on a specific interpretation of tax rules | Application of a foundational tax principle (Interest deductibility under para. 20(1)(c)) |

| Primary Risk | Regulatory / Legislative Risk | Economic / Market Risk |

1. The Lender: Arm’s-Length and Commercial

The most critical difference is the lender. A 10-8 loan was typically provided by the insurer. This created a closed-loop system that regulators viewed as an artificial arrangement. In an IFA, the loan is provided by a completely independent, third-party bank, grounding the IFA in the real world of commercial finance.

2. The Interest Rate: Market-Based and Real Economic Risk

The 10-8 relied on a manufactured, guaranteed interest rate spread. The IFA operates on a fluctuating, market-based spread. This introduces genuine economic risk and gives the IFA a legitimate economic purpose—leveraged investing—that the 10-8 fundamentally lacked.

3. The Insurance Vehicle: Stable Collateral vs. Flexible Tool

The 10-8 strategy used Universal Life (UL) policies, whose flexibility was necessary to engineer the guaranteed 2% spread. In contrast, modern IFAs are built on participating whole life insurance. This shift was driven by the move to third-party lending. A commercial bank, focused on risk management, views the stable, predictable cash value growth of a whole life policy as far superior collateral to the more volatile sub-accounts in a UL policy.

4. The Purpose: A Leveraging Strategy, Not a Tax Play

This brings us to the ultimate distinction. The 10-8 was, in the eyes of regulators, a tax avoidance product. The IFA is a financing strategy. Its primary purpose is to solve a capital allocation problem, and the potential tax deduction is a feature of the financing method, not the sole purpose for the arrangement.

Your Role as an Advisor: Guiding Clients with Confidence

The fear of a 10-8 repeat is understandable, but the government didn’t eliminate leveraged insurance; it eliminated a specific structure that was felt to lack sufficient economic substance.

The modern IFA is a fundamentally different and more robust strategy. As an accountant, your role is to help verify that the structure is appropriate and suitable for your client’s specific financial situation. This means focusing on practical due diligence.

An Accountant’s Due Diligence Checklist for any IFA Proposal

- ✔ Lender Legitimacy: Is the lender a major, arm’s-length Canadian financial institution?

- ✔ Market-Based Rate: Is the interest rate clearly tied to a market benchmark (e.g., Prime Rate)?

- ✔ Meticulous Tracing: Is there a clear and documented plan to trace 100% of the loan proceeds to a specific income-producing investment, as detailed in our Accountant’s Companion to Interest Deductibility?

- ✔ Rigorous Stress-Testing: Does modeling showing how the IFA strategy performs under adverse conditions (e.g., rising interest rates, poor market returns)? As we explain in our guide to Stress-Testing IFAs, this is non-negotiable.

- ✔ Genuine Insurance Reason: Is the underlying permanent life insurance policy solving sound estate or business planning issues for the client?

By using this checklist, you can confidently guide your clients, secure in the knowledge that you are not recommending a ghost of strategies past, but a sound financial tool for the present.

Accountant’s FAQ

What is the single most important piece of documentation for an IFA audit?

Meticulous and contemporaneous tracing of the loan proceeds to a specific income-producing investment. A clear audit trail from the loan advance to the investment purchase is non-negotiable.

How does an IFA differ from a standard corporate investment loan?

The primary difference is the collateral. An IFA uses a permanent life insurance policy, which has unique tax advantages (tax-exempt growth, creation of a CDA credit). This makes the IFA a tool for both investment leveraging and long-term estate planning. You can read more in our guide to IFAs versus Conventional Investing.

Is there a risk of the IFA being shut down by a future legislative change?

While no strategy is immune to legislative change, the IFA’s foundation is the same as any standard investment loan: the deductibility of interest on money borrowed to earn income (para. 20(1)(c)). A change that targets IFAs would likely have to be very broad and would impact all leveraged investing, which is a foundational part of the Canadian economy.

Build Your Client’s IFA Advisory Team

Understanding the nuances between past and present leveraged strategies is key to advising your clients with confidence. A successful IFA requires a collaborative team of experts, and as the client’s accountant, you play a critical role.

At Taxevity, we act as the insurance architects on that team. We specialize in working with accountants to design and stress-test IFAs, ensuring they align with your client’s overall financial plan and providing the detailed modeling you need for your due diligence.

Contact us to learn how we can complement your role on the IFA Core Advisory Team.