(Part of the IFA Master Curriculum)

Key Question for Accountants

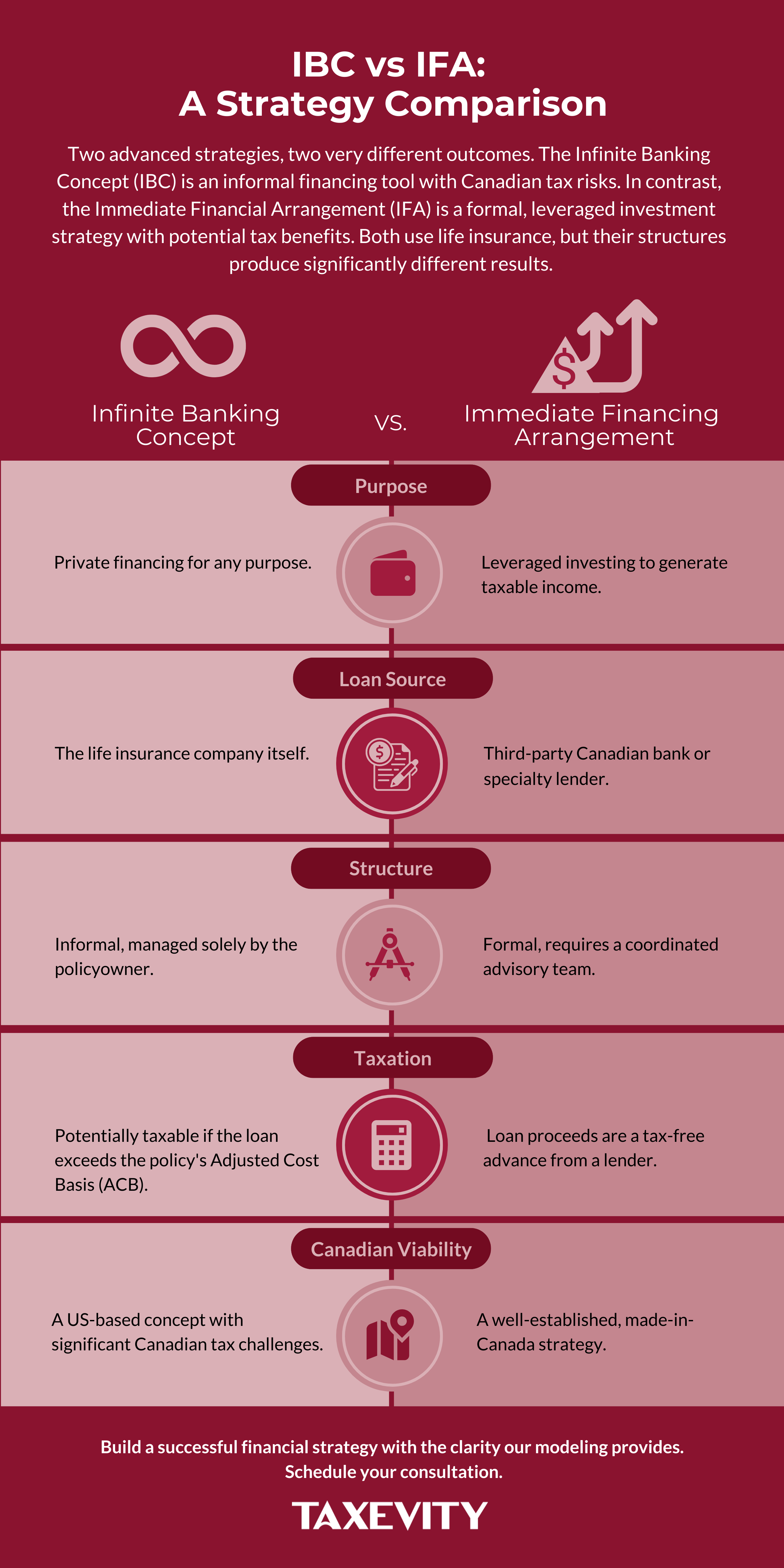

When a client asks about using their life insurance as a private bank, how do you help them distinguish between a heavily marketed concept with significant tax risks and a formal, professionally managed strategy?

- The Tax Trap: The Infinite Banking Concept (IBC) uses policy loans that can trigger a taxable disposition to the extent the loan exceeds the policy’s Adjusted Cost Basis (ACB). As a policy matures, its ACB generally falls to zero, creating a significant “tax trap” that is often downplayed by proponents.

- The Institutional Alternative: An Immediate Financing Arrangement (IFA) is a formal, made-in-Canada strategy that uses a third-party collateral loan from a bank or specialty lender. These loan proceeds are a tax-free advance from the lender used specifically for leveraged investing to generate taxable income.

- Professional Diligence: Your advisory role is to ground the conversation in the verifiable facts of the Income Tax Act, protecting clients from misinformation. The IFA’s transparent, team-based structure ensures you can act as a key gatekeeper, providing a system of checks and balances that informal strategies lack.

As a trusted accountant, you have likely had clients ask about the Infinite Banking Concept (IBC). It’s a powerful marketing term for a strategy that promises financial control by allowing individuals to “become their own banker”. Given its direct-to-consumer appeal, your clients may be hearing about it and will naturally turn to you for an objective opinion.

This guide is designed to help you navigate that conversation. We’ll use the well-known Infinite Banking Concept as our baseline to explore its mechanics, risks, and Canadian tax implications. Then, we will contrast it with a more formal, institutional strategy: the Immediate Financing Arrangement (IFA). While both leverage permanent life insurance, they are fundamentally different tools designed for vastly different purposes.

- The Infinite Banking Concept (IBC) is a first-party, private financing philosophy that faces significant tax headwinds in Canada that are often misunderstood or downplayed by its proponents. For a balanced look at this strategy, see our overview of Infinite Banking in Canada.

- An Immediate Financing Arrangement (IFA) is a formal, third-party leveraged investment strategy built around specific provisions of the Canadian Income Tax Act. For a detailed overview, see our Foundational Guide to Immediate Financing Arrangements (IFAs).

Page Contents

- 1 The Shared Foundation: What Both Strategies Have in Common

- 2 The Mechanics: How Each Strategy Works

- 3 Side-by-Side Comparison: Key Distinctions

- 4 A Comprehensive Risk Assessment

- 5 Profile of the Ideal Client

- 6 The Accountant’s Advisory Role: Guiding the Client

- 7 Questions for Your Review

- 8 A Collaborative Approach

Before digging into their differences, it’s important to understand that both IBC and the IFA are built on the same foundation.

First, both strategies use participating whole life insurance as their core asset. However, these are not standard-issue policies. For either strategy to be effective, the policy must be specially engineered with a high proportion of “paid-up additions” (PUAs) to maximize the growth of cash value in the early years.

Second, both are leveraging strategies at heart. They are designed for clients who have a clear reason for permanent insurance (such as estate planning) and are comfortable with the concept of using debt as a tool to enhance their financial position, whether for private financing (IBC) or for leveraged investing (IFA).

The Mechanics: How Each Strategy Works

While they share a foundation, the transactional flow of each strategy is profoundly different.

The Baseline: The Infinite Banking Concept (IBC) Process

The IBC process is less formal and is managed primarily between the policyowner and their insurance company. It starts with the purchase of a specially “overfunded” participating whole life policy. After a period of making premium payments, the owner can access their cash value by requesting a policy loan directly from the insurer. This is a contractual right that requires no credit check. As a private transaction, a policy loan is not reported to credit bureaus and will not affect the client’s credit rating.

The use of these funds is entirely at the owner’s discretion, as is the repayment schedule. Proponents of IBC highlight the “uninterrupted compounding” effect, where the policy’s gross cash value continues to earn dividends even while a loan is outstanding. Any unpaid loan balance at death is simply deducted from the death benefit.

The Alternative: The Immediate Financing Arrangement (IFA) Process

The IFA is a multi-step, institutional process that requires a coordinated team of specialists, including Taxevity for the insurance, a wealth advisor, a lawyer, and you, the accountant, all overseen by an integrator. An IFA begins with the acquisition of a similar high-early-cash-value life insurance policy. However, instead of borrowing from the insurer, a collateral loan is taken from a restricted financial institution such as a bank or specialized lender.

Once the loan is approved, the policy is formally assigned to the lender as security. The process then follows a precise annual cycle: the client pays the insurance premium, and upon receipt, the lender advances a loan for up to 100% of that premium. These loan proceeds are immediately invested in an income-producing portfolio to satisfy CRA requirements for interest deductibility. On an ongoing monthly basis, the client services the loan interest while the principal is typically repaid from the tax-free death benefit.

Side-by-Side Comparison: Key Distinctions

| Feature | Infinite Banking Concept (IBC) | Immediate Financing Arrangement (IFA) |

| Loan Source | The life insurance company itself | Third-party Canadian bank or specialty lender |

| Loan Type | Policy Loan | Collateral Loan |

| Primary Purpose | Private financing for any purpose | Leveraged investing to generate taxable income |

| Loan Approval | Contractual right, no financial underwriting | Requires financial underwriting (credit check, financials) |

| Interest Rate | Variable, set by the insurer | Variable, typically Prime + spread |

| Interest Deductibility | Generally not deductible, as funds are often used for personal purposes | Typically deductible, as the loan is used to invest with a reasonable expectation of profit |

| Taxation of Loan | Potentially taxable as income to the extent the loan exceeds the policy’s Adjusted Cost Basis (ACB), which eventually becomes zero | Loan proceeds are a tax-free advance from a lender |

| Structure | Informal, managed solely by the policyowner | Formal, requires a coordinated advisory team |

| Canadian Viability | A US-based concept with significant Canadian tax challenges and risks | A well-established, made-in-Canada strategy supported by major banks and insurers |

A Comprehensive Risk Assessment

A prudent analysis requires looking beyond the benefits to the distinct risk profiles of each strategy.

Financial and Market Risks

For IBC, the risks are more internal. The long-term rate of return within a whole life policy may be lower than other investment classes, creating an opportunity cost. Furthermore, the interest charged by the insurer on policy loans acts as a direct drag on the policy’s net growth. Since these loan rates are set by the insurer for a ‘captive audience’, they may not be competitive with other lenders.

For an IFA, the primary financial risks are external. A significant rise in the prime rate can increase loan servicing costs. Poor performance of the external investment can reduce the total effectiveness of the strategy, though rarely eliminates it.

Lender and Credit Risks

IBC has virtually no lender risk, as the policy loan is a contractual right. The only counterparty risk is the solvency of the insurance company itself, which is an extremely low probability in Canada’s highly regulated environment.

The IFA structure introduces counterparty risk from the third-party lender. The loan is typically subject to annual review, and the bank could theoretically change the terms or issue a margin call if the value of the collateral (the policy’s CSV and the investment portfolio) declines significantly.

Tax and Regulatory Risks

The tax risks are where the two strategies diverge most critically.

For IBC, the single greatest risk in Canada is the tax treatment of policy loans. Under the Income Tax Act, a policy loan is a disposition that becomes taxable income to the extent it exceeds the policy’s Adjusted Cost Basis (ACB). As a policy matures, its ACB can fall to zero, creating a significant “tax trap” where all or most of the loan becomes taxable. This is often misunderstood or downplayed by proponents, creating a major risk of misinformation for clients.

With an IFA, the main risk is a potential CRA challenge to the deductibility of interest if the use of funds is not meticulously documented. There is also a legislative risk that the government could change the rules governing leveraged insurance, as they did with the “10-8” strategy in 2013. IFAs are structured much more prudently, however.

Profile of the Ideal Client

The Ideal IBC Client

The ideal IBC client is a disciplined, long-term saver who values financial control and liquidity over maximizing returns. They may be a business owner who needs periodic access to capital or someone seeking a stable financial asset that is uncorrelated to the stock market. There is no formal minimum premium. The most important characteristic is that they are fully aware of and have a plan to manage the long-term Canadian tax risks associated with policy loans and the ACB.

The Ideal IFA Client

The ideal IFA client is an incorporated professional, successful business owner, or high-net-worth individual, typically between the ages of 40 and 70. They have a high taxable income, strong and predictable cash flow, and a clear reason for a large amount of permanent life insurance for objectives like estate planning. Lender requirements effectively create a minimum premium commitment of $50,000 or more per year for ten years. Crucially, they are comfortable with the concept of leverage and have a cohesive advisory team.

The Accountant’s Advisory Role: Guiding the Client

As the accountant, your role is to provide an objective lens through which clients can evaluate these complex strategies.

- The Advisory Team Imperative: An IFA, by its very nature, requires a collaborative team of specialists. The involvement of a private banker, a wealth advisor, and an accountant provides a system of checks and balances. In contrast, IBC is often marketed and sold directly to consumers by a single insurance advisor, creating a risk of asymmetrical information. The IFA’s team-based structure, as detailed in The IFA Core Advisory Team: A Requirement for Success, is a critical safeguard.

- Ownership, Scale, and Suitability: IBCs, with no formal minimums, is more often personally-owned and positioned as a personal or family cash management philosophy. IFAs are most commonly implemented within a corporation, driven by the large scale and the objective of creating tax-deductible expenses.

- The Prudent Accountant’s Stance: The marketing of IBCs can sometimes prime clients to believe they have discovered a “secret” that traditional advisors, including their accountant, either don’t understand or wrongly disparage. This can create a challenging dynamic. Your role is not to dismiss the client’s interest but to ground the conversation in the objective, verifiable facts of the Income Tax Act. Highlighting the specific, long-term ACB tax trap is not a matter of opinion but of professional diligence. The IFA, while complex, operates within a more transparent and regulated institutional framework, with you, the client’s own accountant, acting as a key gatekeeper.

Questions for Your Review

When a client brings one of these strategies to you, here are some key questions to consider:

- ACB Tracking and Loan Differentiation: What is the process for tracking the policy’s Adjusted Cost Basis (ACB) over its entire life? How can we clearly differentiate for the client (and the CRA) the fundamental tax difference between a policy loan (IBC), which can trigger a taxable disposition, and a third-party collateral loan (IFA)?

- Substantiating “Reasonable Expectation of Profit”: For an IFA, how will we meticulously document the “reasonable expectation of profit” from the invested loan proceeds to ensure the ongoing deductibility of interest, especially in a flat or volatile market?

- Corporate IFA and Passive Income Rules: If the IFA is held corporately, how will the investment income affect the corporation’s adjusted aggregate investment income (AAII) and its potential to grind down the small business deduction (SBD)?

- This is why IFAs are ideally held in holdcos.

A Collaborative Approach

Your role in scrutinizing these strategies is indispensable. If your clients are exploring leveraged insurance, a detailed, objective analysis is required to protect their interests. We specialize in collaborating with accountants to provide the actuarial and insurance expertise needed to ensure these structures are sound, suitable, and sustainable.

Contact us to discuss how our collaborative approach can support your analysis and bring clarity to your clients’ financial decisions.