(Part of the IFA Master Curriculum)

Key Question for Accountants

How can you confidently guide your high-net-worth clients through the complexities of leveraged insurance, ensuring you recommend the right strategy—IFA for accumulation or IRP for decumulation—at the right time?

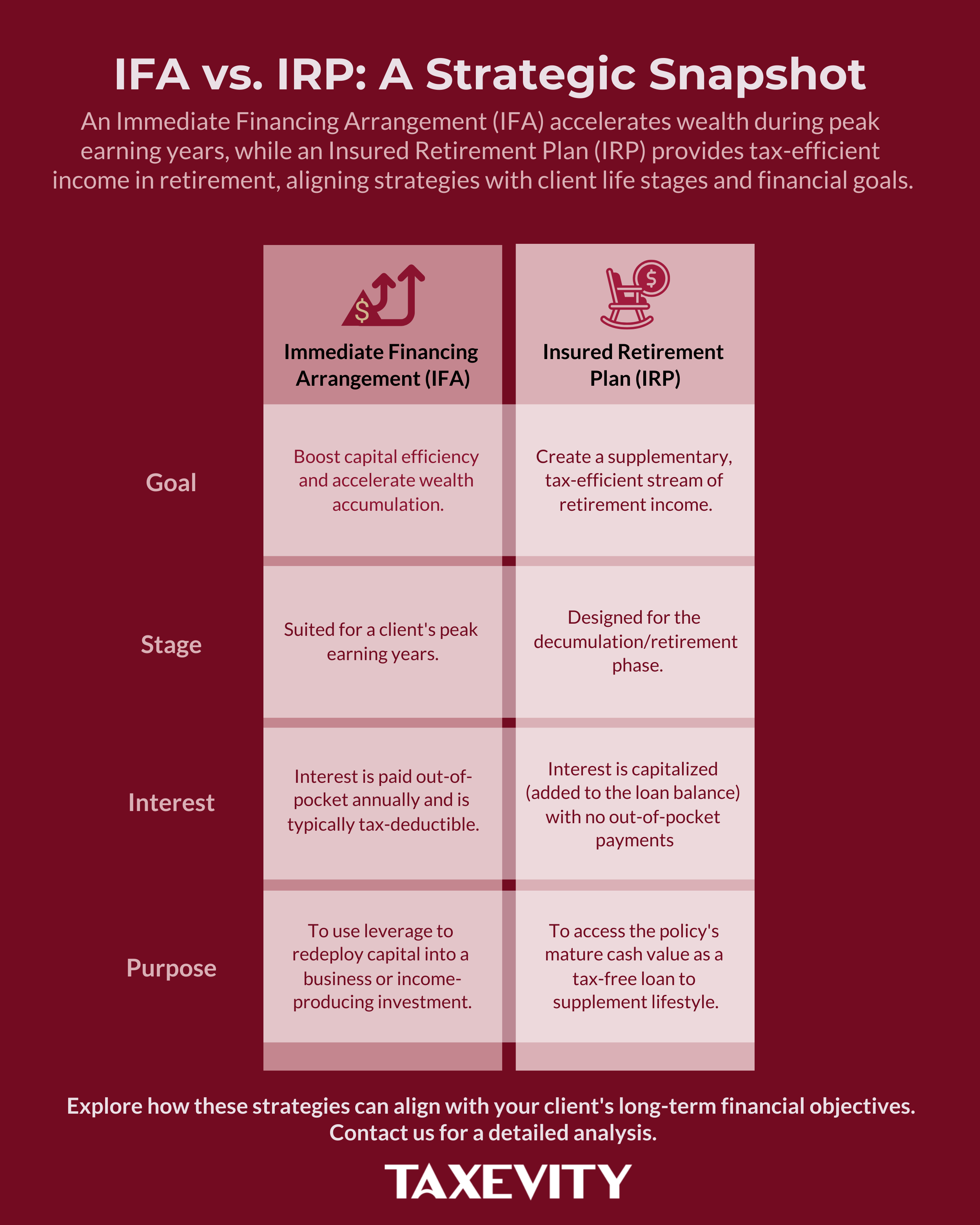

- The Core Distinction: An Immediate Financing Arrangement (IFA) is an accumulation strategy designed to accelerate wealth during a client’s peak earning years , while an Insured Retirement Plan (IRP) is a decumulation strategy used to create tax-efficient cash flow in retirement.

- The Critical Mechanics: The fundamental difference lies in the financial outcome. An IFA is engineered to create immediate tax-deductible interest payments to reduce the net cost of borrowing during high-income years. Conversely, an IRP defers leveraging until retirement and allows interest to be capitalized—added to the loan balance—preserving cash flow for the retiree.

- The Lifecycle Strategy: For the most sophisticated clients, the optimal approach is often a sequential one where a single life insurance policy transitions from an IFA during the accumulation phase to an IRP for decumulation, offering a lifetime of tax advantages and maximizing the utility of one asset.

For the right client—typically a high-income professional or business owner—leveraged insurance strategies can be powerful tools for wealth accumulation and estate preservation. As their trusted accountant, you are in a unique position to help them navigate the complexities of these advanced plans.

Two of the most prominent strategies you’ll encounter are the Immediate Financing Arrangement (IFA) and the Insured Retirement Plan (IRP). While both are built on a foundation of permanent life insurance, they serve fundamentally different purposes at different stages of a client’s financial life.

Understanding their distinct mechanics, risks, and ideal client profiles is critical to providing sound advice. This guide provides a detailed comparison to help you determine which strategy—or sequence of strategies—is the right fit for your client.

Page Contents

- 1 The Core Distinction: Accumulation vs. Decumulation

- 2 Shared Foundations, Different Blueprints

- 3 Deconstructing the Immediate Financing Arrangement (IFA)

- 4 Deconstructing the Insured Retirement Plan (IRP)

- 5 The Lifecycle Strategy: Combining the IFA and IRP

- 6 Key Questions for Client Discussions

- 7 Key Risks: An Accountant’s Perspective

- 8 Your Role as a Strategic Advisor

The Core Distinction: Accumulation vs. Decumulation

The simplest way to differentiate the two strategies is by their primary objective:

- An IFA is an accumulation strategy. It’s designed for a client’s peak earning years. The core purpose is to enhance capital efficiency by using a life insurance policy to secure immediate leverage. The borrowed funds are then redeployed into a business or income-producing investment to accelerate wealth creation.

- An IRP is a decumulation strategy. It’s designed for retirement. The goal is to create a supplementary, tax-efficient stream of cash flow by borrowing against the mature cash value of a policy that has been funded over many years.

They are not necessarily mutually exclusive. For the right client, they can be two phases of a cohesive, long-term plan.

While their objectives diverge, the IFA and IRP are built upon the same structural foundation. Understanding these commonalities is key to appreciating their differences.

Permanent Life Insurance Core: Both strategies require a permanent life insurance policy (typically whole life) as the foundational asset. A legitimate reason for this insurance, such as estate planning or risk management, is a prerequisite for both.

Third-Party Leverage: Both use a collateral loan from a third-party financial institution (generally a bank or specialized lender) to access the policy’s cash surrender value (CSV).

Tax-Free Death Benefit: Both provide a tax-free death benefit that is used to pay the outstanding loan, with the remainder going to beneficiaries quickly and tax-free.

Corporate Asset for Personal Benefit: When a corporate-owned policy is used as collateral for a loan that personally benefits a shareholder (as in a Corporate IRP or some personal-use IFA structures), a guarantee fee may be deemed to be payable the corporation. This is a critical consideration to ensure proper compensation for the personal use of a corporate asset and to maintain a clear audit trail. The determination of whether a guarantee fee should be paid, and how much (typically 1% of the outstanding loan balance annually) is done by the accountant, CRA does not have an official ruling. It depends on whether or not the loan is being obtained at a better rate by the corporation than would be possible personally by the shareholder.

The fundamental difference lies in the financial outcome they are engineered to produce: an IFA creates tax-deductible interest payments to reduce the net cost of borrowing during high-income years, while an IRP creates tax-free personal cash flow by accessing capital as a tax-free loan during retirement.

Deconstructing the Immediate Financing Arrangement (IFA)

The IFA is a corporate finance tool engineered to solve the opportunity cost of funding a large permanent life insurance policy.

Transactional Mechanics

- The Foundation: A corporation acquires a permanent life insurance policy and pays the first annual premium with corporate, non-borrowed funds. The policy is typically structured for High Early Cash Value (HECV) to maximize the collateral available for borrowing in the initial years.

- The Collateral Loan: The policy is immediately assigned as collateral to a third-party lender in exchange for a revolving line of credit.

- The Leverage: The corporation draws on the line of credit, borrowing back up to 100% of the premium paid. This loan advance is a tax-free receipt of capital.

- The Redeployment: For this strategy, the borrowed capital must be used for the purpose of earning income from a business or property (e.g., reinvesting in operations, purchasing income-producing assets). This is a critical step for ensuring tax-deductibility.

- The Servicing: The corporation makes two ongoing payments: the annual policy premium and the monthly or annual interest on the loan. The loan interest is not capitalized.

- The Endgame: The loan is typically repaid from the tax-free death benefit. The net proceeds create a large credit to the corporation’s Capital Dividend Account (CDA), allowing for tax-free distributions to shareholders.

The Ideal IFA Candidate

An IFA is a niche strategy best suited for a high-net-worth individual, incorporated professional, or business owner who:

- Is in their peak earning years with high, stable cash flow to service both premiums and loan interest.

- Has a viable, income-producing use for the borrowed funds.

- Is comfortable with the risks of a long-term leveraged strategy.

- Has sufficient corporate income to make the tax deductions meaningful.

Deconstructing the Insured Retirement Plan (IRP)

The IRP is a versatile retirement funding concept that can be structured personally or corporately, depending on the client’s circumstances.

Transactional Mechanics

- The Accumulation Phase: Over many years (10-20+), premiums are paid into a permanent life insurance policy to build a substantial tax-sheltered cash surrender value (CSV). This can be a Personal IRP (funded with personal after-tax dollars) or a Corporate IRP (funded with more efficient, lower-taxed corporate dollars). While a policy designed for maximum long-term value is ideal, a policy with a High Early Cash Value can also be used, particularly if an IFA is contemplated first.

- The Decumulation Phase: Premiums are structured to cease by retirement (e.g., using a guaranteed 10-pay or 20-pay policy). The mature policy is then assigned as collateral to a third-party lender to secure a line of credit.

- The Tax-Free Income: The retiree draws on the line of credit to supplement their lifestyle. These loan advances are received tax-free and do not impact income-tested benefits like Old Age Security (OAS).

- Interest Capitalization: Unlike an IFA, the loan interest is capitalized—it is added to the loan balance annually. The retiree is not required to make out-of-pocket interest payments, preserving their cash flow.

- The Endgame: Upon death, the policy’s tax-free death benefit first repays the accumulated loan and capitalized interest. The remaining net death benefit is paid tax-free to the named beneficiaries (personal IRP) or to the corporation, creating a CDA credit (corporate IRP).

The Ideal IRP Candidate

An IRP is best suited for a client who:

- Is a high-income earner who has consistently maximized their RRSP and TFSA contributions.

- Has a long time horizon (15+ years) before retirement to allow the policy’s cash value to grow.

- Seeks a tax-efficient income stream in retirement to supplement fully taxable sources like RRIFs and CPP.

- If incorporated, can benefit from funding the strategy with corporate surplus.

The Lifecycle Strategy: Combining the IFA and IRP

For the most sophisticated clients, the “IFA vs. IRP” question is a false dichotomy. The optimal approach can be a sequential one that transitions from accumulation to decumulation.

- Phase 1: The IFA Years (Accumulation). During their working years, the client uses a corporate or personal IFA to accelerate wealth creation, benefiting from tax-deductible leverage and tax-sheltered growth.

- Phase 2: The Transition (Retirement). At retirement, the IFA loan is paid off. This may be funded by the liquidation of the investments acquired with the loan proceeds or through a separate liquidity event, such as the sale of a business. This leaves a mature, unencumbered life insurance policy.

- Phase 3: The IRP Years (Decumulation). A new collateral loan is established against the same policy under an IRP structure. The client then draws funds as needed to fund their retirement, with the loan and capitalized interest being repaid at death via the death benefit. The amount and timing of these loan advances are flexible.

A critical consideration in this lifecycle approach is the design of the underlying insurance policy. An IFA is best served by a policy structured for High Early Cash Value (HECV) to maximize immediate borrowing capacity. Conversely, a standalone IRP is often optimized with a policy designed for maximum long-term cash value. When planning for a potential lifecycle strategy, a HECV policy is typically used. While this may be slightly suboptimal for the IRP phase compared to a policy designed purely for that purpose, it provides crucial flexibility. For a client whose future is uncertain, choosing a HECV policy keeps both options open.

This lifecycle approach allows a single insurance asset to serve two distinct strategic purposes across a client’s financial life, with the policy design reflecting a deliberate choice between optimization and flexibility.

Key Questions for Client Discussions

To help determine the right path for your client, consider these practical questions:

For an IFA Strategy:

- Purpose Test: “Where, specifically, will the borrowed funds be invested, and what is the reasonable expectation of after-tax return?”

- Capacity Test: “Does the corporation have the consistent cash flow to service both the annual premium and the variable loan interest, even if interest rates rise by 2-3%?”

- Foundation Test: “Is the primary need for the insurance itself, with the leverage being a secondary benefit?”

For an IRP Strategy:

- Priority Test: “Have you already maximized your RRSP and TFSA contributions for the foreseeable future?”

- Patience Test: “Are you comfortable with a strategy where the primary financial benefit will not be realized for 15 years or more?”

- Objective Test: “Is the goal to supplement a comfortable retirement or to fund a basic one? This helps clarify the role of the IRP’s tax-free income.”

Key Risks: An Accountant’s Perspective

Your role as an advisor is to help clients understand that these are not risk-free strategies.

| Risk Category | Immediate Financing Arrangement (IFA) | Insured Retirement Plan (IRP) |

| Interest Rate Risk | High. A rate increase directly raises the annual out-of-pocket interest cost, squeezing cash flow and profitability. | High. A rate increase accelerates the growth of the capitalized loan, eroding the net death benefit payable to heirs over the long term. |

| Performance Risk | Medium. The risk is tied to the policy’s long-term dividend performance, which impacts the CSV available for the loan. Underperformance can be mitigated by taking smaller loans. | Medium. The risk is tied to the policy’s long-term dividend performance, which impacts the CSV available for the loan. Underperformance can be mitigated by taking smaller loans. |

| Lender & Credit Risk | High. The loan is a demand facility. The lender can change terms, call the loan, or increase collateral requirements, creating liquidity pressure. | High. The same lender risks apply, potentially disrupting a crucial income stream for a retiree. |

| Legislative & Tax Risk | High. Dependent on current rules for interest deductibility and the CDA. Adverse changes could eliminate the strategy’s core benefits. | High. Dependent on the tax-free nature of collateral loans and the CDA (if corporately owned). Adverse changes could undermine the entire retirement plan. |

Your due diligence in stress-testing these risks and ensuring meticulous compliance, particularly for the IFA’s interest deductibility, is paramount to your client’s success.

Your Role as a Strategic Advisor

As an accountant, your clients rely on you for an objective, independent perspective on complex financial strategies. Whether you are reviewing a proposal a client has received or proactively identifying opportunities, understanding the nuances between an IFA and an IRP is crucial.

If you or your client are exploring these strategies, book a private chat with us to see how a second opinion or detailed analysis can bring clarity to a specific proposal. We specialize in working with accountants and other financial professionals to structure these powerful tools optimally to align with your client’s long-term goals and changing circumstances.