Key Question for Canadians

You wouldn’t buy a $5M home without an inspection. Why sign a $5M insurance contract based on a static illustration? Stress-test the design with an Insurance Feasibility Audit.

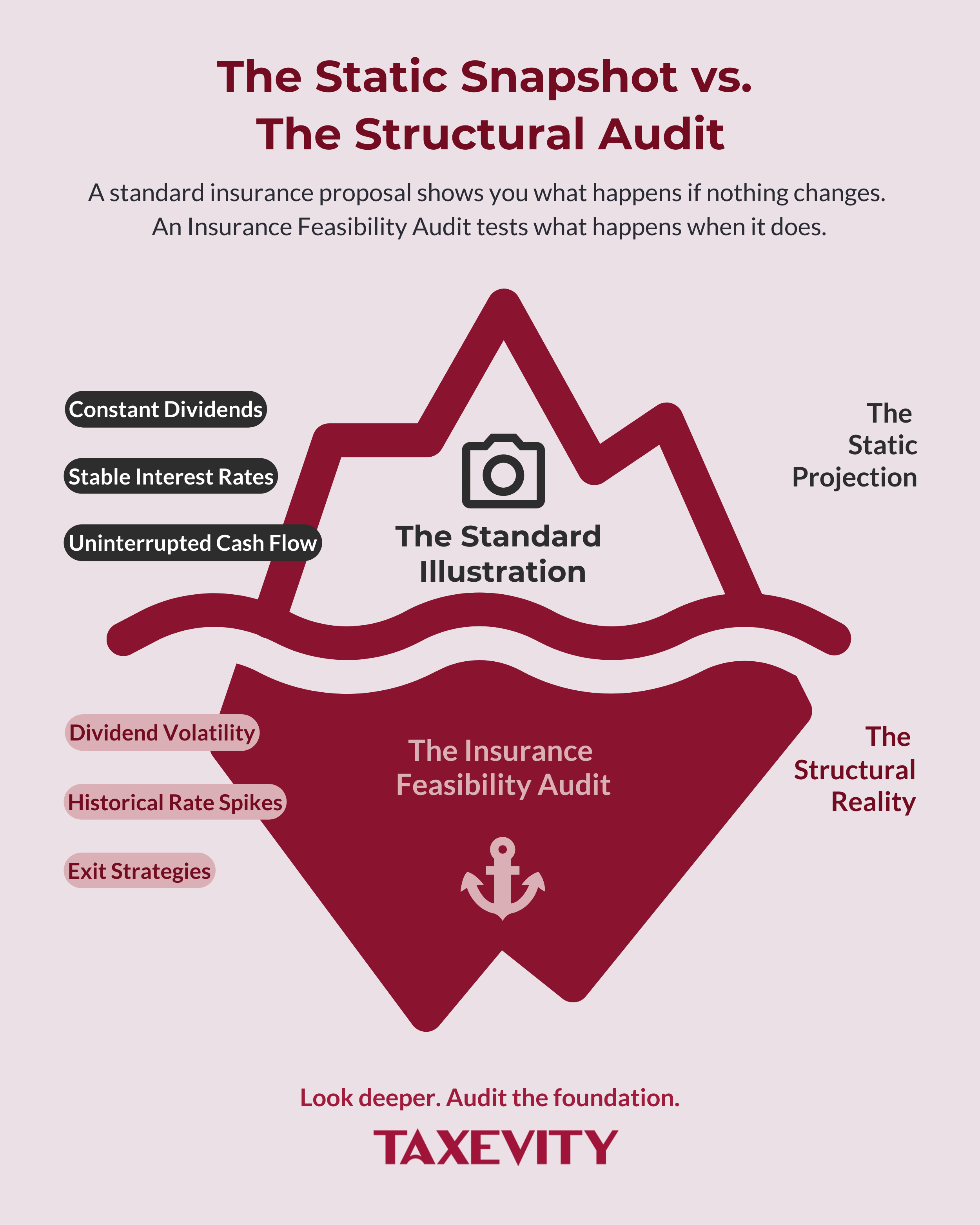

- The Static Projection Risk: Standard illustrations are compliance documents that rely on a static snapshot of a dynamic world.

- The Validation Gap: Seeking second opinions from standard sources is often ineffective because they lack the proprietary software required to audit the engineering or hold specific biases that prevent an objective stress test.

- The Structural Solution: Instead of collecting opinions, an Insurance Feasibility Audit builds an independent Reference Model to stress-test the viability of the strategy against reality of changing conditions.

Imagine you are purchasing a heritage home for $5 million.

The façade is stunning. The location is perfect. The price seems fair. Before you sign the deed, however, you would insist on a structural inspection. You would want to know if the foundation is cracking, if the wiring is outdated, or if the roof will fail in five years.

You wouldn’t rely solely on the assurances of the vendor. You would bring in an independent expert to verify the integrity of the structure.

Yet, when successful business owners and professionals purchase life insurance policies with face values of $5 million, $10 million, or more, they often skip this step. They sign a 50-year contract based on a spreadsheet illustration provided by an insurance advisor, without checking the structural integrity of the design.

At Taxevity, we believe your financial foundation deserves the same rigorous due diligence as your physical assets.

Page Contents

- 1 The Problem: Your Proposal is a Static Projection

- 2 The Opportunity: Get More Value for The Same Dollar

- 3 The 7 Common Validation Methods (And Why They Miss the Mark)

- 3.1 1. The Smart Peer (The Cocktail Party Check)

- 3.2 2. The AI Chat (The Rough Sketch)

- 3.3 3. The Presenting Advisor (Self-Validation)

- 3.4 4. The Wealth Advisor (The Investment View)

- 3.5 5. The Fee-Only Financial Planner (The Philosophy View)

- 3.6 6. The Competing (or Incumbent) Insurance Advisor

- 3.7 7. The Accountant (The Tax View)

- 4 The Solution: The Structural Audit

- 5 Get Clarity Before You Decide

The Problem: Your Proposal is a Static Projection

If you are currently holding a Concept Presentation for an Immediate Financing Arrangement (IFA) or a Corporate Estate Bond, you are likely viewing a static model.

Standard industry illustrations are compliance documents. Even if the assumptions used are conservative, they show you how the product works if conditions remain static. They typically assume:

- Constant Dividends: The dividend scale is projected to remain constant for 50 years.

- Stable Interest Rates: Loan rates hover at a single level indefinitely.

- Uninterrupted Cash Flow: Capital is always available on time for all the premiums.

It is a static snapshot of a dynamic world.

In the architectural world, a blueprint that doesn’t account for wind, snow loads, or soil shifting isn’t a design; it is a point of failure. Similarly, an insurance-based strategy that only works in stable conditions is not a plan—it is a gamble.

The Opportunity: Get More Value for The Same Dollar

In most industries, you pay more to get more. If you hire a senior tax expert, you expect to pay a higher hourly rate than for a junior associate. You pay a premium for their experience, specialized designations, and niche expertise.

In the Canadian life insurance market, you face a unique reality that works in your favour.

The price is set strictly by the carrier.

Whether you get the policy from a website, bank-owned firm, an investment-focused advisor, a celebrity insurance marketer or a specialist insurance advisor, your premium is identical. Your policy contract is identical. Your product performance is identical.

This means the additional cost of hiring a specialist is effectively zero.

At Taxevity we:

- Build proprietary modeling tools

- Publish educational content to share our expertise (like this blog)

- Rigorously stress-test the design against Bad Weather scenarios.

The 7 Common Validation Methods (And Why They Miss the Mark)

When you receive a insurance proposal—complex or overly simplified—you naturally want to validate it. However, the standard channels for due diligence often fail because the reviewers lack the specific tools, experience or independence required to audit the engineering.

In Your Insurance Proposal: Where to Get a Real Second Opinion (coming soon), we will give you the specific scripts to help these advisors overcome these biases. First, you need to understand why they have them.

Here are the seven most common places you might try to validate a proposal, and the specific blind spot of each.

1. The Smart Peer (The Cocktail Party Check)

- The Approach: You ask a colleague or friend who did something similar.

- The Risk: Anecdotal Bias: Your peer shares their “win” or “loss” based on a sample size of one. A complex interplay of variables—such as unique health history, financial situation, and temperment—led to the outcome. Their opinion paints an unreasonably positive (or negative) picture that may be factually true for them, but statistically irrelevant for you.

2. The AI Chat (The Rough Sketch)

- The Approach: You upload the PDFs, emails and transcripts to ChatGPT or Gemini (as we discuss in The DIY Feasibility Audit: How to Use AI to Judge Your Insurance Proposal).

- The Risk: Hallucination & Generality. AI is a powerful tool for breaking information asymmetry. It can spot definitions and general inconsistencies. However, it is trained on public internet data, which often confuses marketing claims with actuarial facts. AI is a useful marketing filter, but is not a structural engineer.

3. The Presenting Advisor (Self-Validation)

- The Approach: You ask the insurance advisor who prepared the proposal, “Are you sure this is safe?”

- The Risk: Design Bias. The advisor has already committed to this specific design to solve your problem. They selected the insurer, the funding strategy, and the assumptions that make the concept look attractive. While they likely believe in their recommendation, asking them to critique it is ineffective. They may be validating the logic of their sale, not stress-testing the mechanics of failure.

4. The Wealth Advisor (The Investment View)

- The Approach: You show the insurance proposal to your independent wealth advisor who is investing your capital.

- The Risk: Portfolio-Centric Bias. Your advisor is the guardian of your current liquidity and market growth. Naturally, they may view premiums as idle capital and focus on the opportunity cost of the investment. While this critique is essential for balancing your portfolio, it can overlook the off-balance-sheet benefits unique to insurance—such as the after-tax internal rate of return (IRR) to the estate or the creation of tax-free liquidity through the Capital Dividend Account (CDA).

5. The Fee-Only Financial Planner (The Philosophy View)

- The Approach: You pay an independent financial planner for a neutral opinion.

- The Risk: Lifestyle Focus vs. Surplus Optimization. While excellent at cash flow modeling, they often focus on lifestyle needs rather than corporate surplus optimization. This can lead to a “Buy Term” bias that ignores the tax-sheltered advantages of corporate permanent insurance for HNW business owners. Like the wealth advisor, they often lack the carrier-specific software to properly audit the chassis of the policy under different scenarios.

6. The Competing (or Incumbent) Insurance Advisor

- The Approach: You take the proposal to a different insurance advisor for a second opinion.

- The Risk: Opportunity Bias (Incumbent or Competitor). Whether you ask a new insurance advisor or your current one (who didn’t bring you the idea), the incentive is often to find a fatal flaw to protect their territory or win your business. They are not necessarily auditing for feasibility; they are auditing for a sales opportunity.

7. The Accountant (The Tax View)

- The Approach: You send the PDFs and emails to your independent accountant.

- The Risk: Wrong Tools. Your accountant is likely your most trusted advisor, and for good reason. However, while they understand the tax implications of the strategy (e.g., CDA credits, NCPI), they rarely have access to the insurance carrier’s software. They can verify if the tax law is applied correctly, but they cannot stress-test what happens to the policy performance drops or how other products compare.

The Solution: The Structural Audit

The common validation options leave you with a gap. You have plenty of opinions, but no engineering.

At Taxevity, we bridge this gap with the Insurance Feasibility Audit.

We move beyond concept presentations and sales illustrations to build a Reference Model—an independent stress test.

We take the raw inputs—your accountant’s tax rates, your wealth advisor’s return expectations—and instead of optimizing them to make the insurance look good, we stress-test them to see where the insurance breaks. This independent model passes your proposal through four distinct gates described in The 4 Feasibility Gates: Why We Reject Most Insurance Proposals:

- Medical Feasibility: Can you actually get the coverage at the price quoted?

- Financial Feasibility: Do you have “True Surplus” capital, or just cash flow?

- Temperament Feasibility: Can you sleep at night if the strategy underperforms for 3 years?

- Strategic Feasibility: Does this product actually solve your problem?

If a strategy fails any of these gates, we recommend rejecting it—even if the math looks perfect.

Get Clarity Before You Decide

If you have doubts about an insurance proposal, pause.

Remember the house inspection. You are about to make a decision that will impact your family and your business for generations. Ensure your structure is sound.

Book Your Insurance Feasibility Audit

Next in the Series: The 4 Feasibility Gates: Why We Reject Most Insurance Proposals