Key Question for Wealth Advisors

How can you solve a common client objection to life insurance—the high opportunity cost of premiums—while also enhancing their wealth plan, deepening your relationship, and potentially growing your AUM?

- A “Win-Win” for the Client: An Immediate Financing Arrangement (IFA) solves the “insurance vs. investment” dilemma. Your client gets valuable permanent life insurance for estate protection while a collateral loan provides immediate capital for other investments.

- A “Win-Win” for Your Practice: Integrating an IFA can differentiate your practice, strengthen client relationships, and potentially increase your Assets Under Management (AUM) if you invest the loan proceeds. It positions you as a holistic, strategic advisor.

- Your Role as “Quarterback”: You are often best positioned to lead the collaborative team. Your key role is to ensure the investment of the loan proceeds aligns with the client’s risk tolerance and meets the CRA’s “purpose of earning income” test for interest deductibility.

As a wealth advisor, you likely understand the importance of permanent life insurance for your high-net-worth clients, especially for managing significant tax liabilities at death (e.g., from deemed dispositions). Yet, clients often hesitate. They may see whole life returns as low compared to market investments, dislike the lack of investment choice, or simply resist tying up significant capital in premiums when they see other attractive investment opportunities. Universal Life offers choice, but MERs can be high, and managing those assets takes extra effort.

What if you could help clients secure valuable insurance protection while freeing up capital for the investments they desire – potentially managed by you? An Immediate Financing Arrangement (IFA) integrated with whole life insurance offers precisely this solution.

Page Contents

- 1 The IFA Opportunity: A Win-Win-Win

- 2 How It Works & Your Role Investing the Proceeds

- 3 Your Role as Quarterback: Coordination is Key

- 4 Addressing Common Pitfalls and Wealth Advisor Concerns

- 5 Ensuring Investment Eligibility for Tax Deductibility

- 6 Client Suitability Profile

- 7 Partnering with Taxevity: Your Insurance Specialist

- 8 Elevate Your Practice and Client Outcomes

The IFA Opportunity: A Win-Win-Win

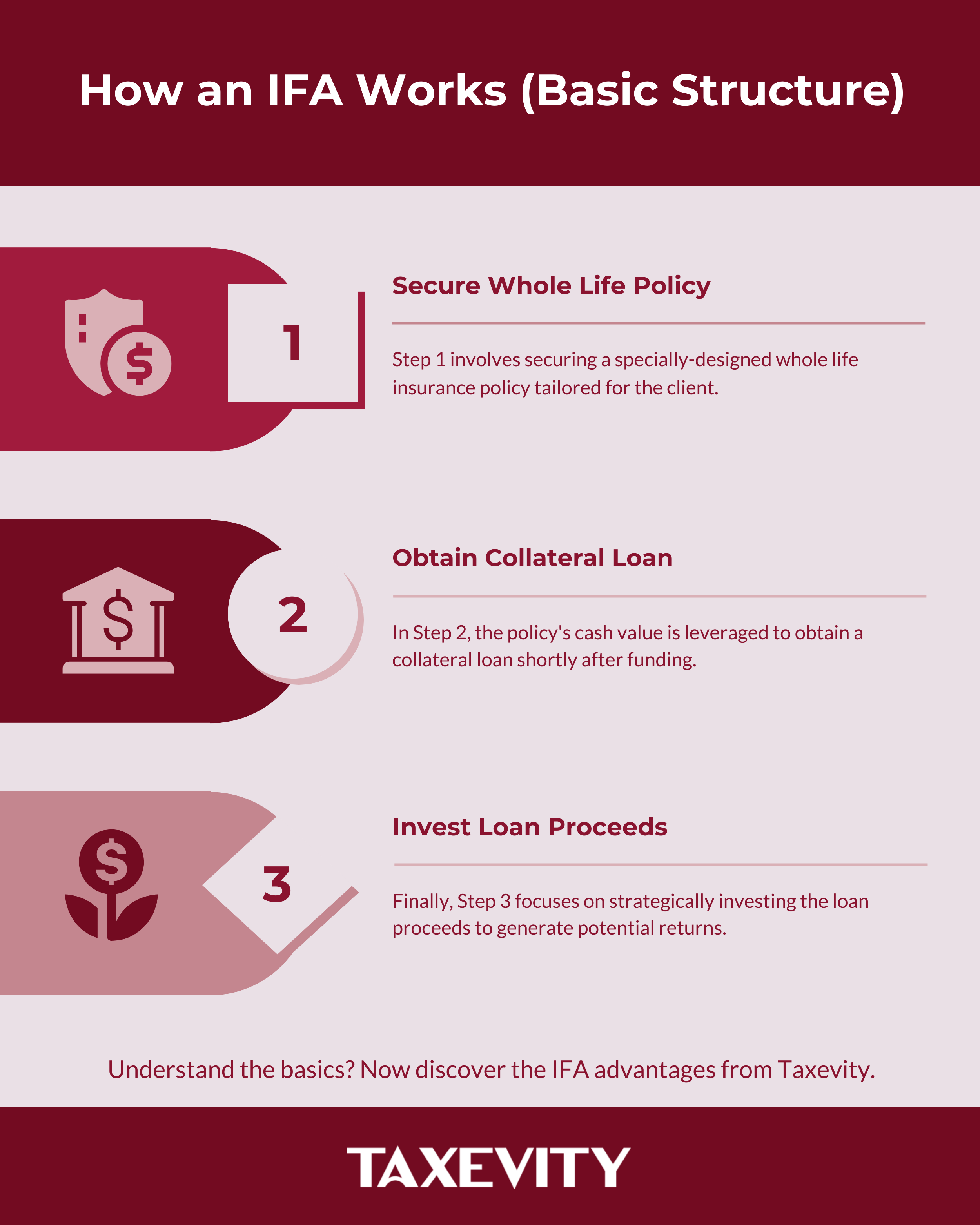

An IFA leverages the cash value of a specially-designed whole life policy as collateral for a third-party loan. The loan proceeds are then used to invest. This creates compelling benefits:

- For your Client:

- Gets Life Insurance: Addresses estate preservation, wealth transfer, or other long-term goals requiring permanent insurance (Protection).

- Accesses Capital: Frees up corporate or personal capital via the loan for desired investments (real estate, market securities, private equity, etc.) (Growth).

- Potential Tax Efficiency: Loan interest may be tax-deductible if used for eligible income-producing investments. A portion of the insurance premium (NCPI) might also be deductible under specific conditions.

- For You, the Advisor:

- Solves a Client Problem: Addresses the “insurance vs. investment” dilemma, demonstrating strategic value.

- Deepens Relationships: Positions you as a holistic advisor considering all facets of a client’s wealth, including risk management and tax efficiency.

- Potential for Increased AUM: Investing loan proceeds in assets you manage can directly grow your book. Even if some clients invest in assets you do not offer (e.g., private real estate), you’ve facilitated a key part of the client’s overall plan.

- Competitive Differentiation: Offering sophisticated, integrated solutions like IFAs can set your practice apart and protect your client relationships from competitors.

- Proactive Planning: Helps ensure clients aren’t underinsured or leaving tax efficiencies untapped.

How It Works & Your Role Investing the Proceeds

The basic IFA structure involves securing the whole life policy, obtaining the collateral loan immediately after funding the first premium, and then strategically deploying the loan proceeds. (Refer to our post on Funding Real Estate Investments Through Whole Life Insurance).

Crucially, as the wealth advisor, you often play a key role in investing the loan proceeds. This requires careful consideration to align with the IFA strategy’s goals and tax implications.

Evolution from 10-8 leveraging

Modern IFAs evolved from the earlier universal life “10-8” (or “10/8”) strategy, which faced CRA scrutiny and was shut down in the 2013 federal budget. Today’s IFAs, when structured carefully with specially-designed whole life insurance, are generally accepted and built on a more transparent and sustainable foundation.

Your Role as Quarterback: Coordination is Key

Successfully implementing an IFA requires a coordinated team approach involving the client, you (the wealth advisor), their accountant, and our insurance expertise at Taxevity. You are often best positioned to act as the “quarterback,” ensuring:

- Strategic Alignment: The IFA fits within the client’s overall financial plan and risk tolerance.

- Investment Suitability: The investments chosen for the loan proceeds are appropriate for the client and ideally meet criteria for potential interest deductibility.

- Communication: Facilitating clear communication and information flow between all parties.

- Ongoing Monitoring: Reviewing the strategy periodically alongside the client’s other investments and goals.

Addressing Common Pitfalls and Wealth Advisor Concerns

- Handling “Outside” Investments: What if the client uses the IFA loan for an investment you don’t directly manage, like their own operating business or private real estate? You still add significant value by facilitating the insurance and financing structure, coordinating with the team, and managing the client’s other assets more effectively now that a major planning need is addressed efficiently. The funds likely wouldn’t have been on your book regardless.

- Countering Misleading Pitches: Clients may encounter IFA proposals that look “too good to be true,” glossing over risks or using unrealistic assumptions. Partnering with Taxevity allows you to provide objective analysis and ensure your clients make informed decisions.

- Investment Return vs. Loan Cost: Advisors sometimes ask: What if the after-tax investment return doesn’t exceed the after-tax loan cost? It’s crucial to remember the IFA is more than just investment arbitrage. While negative spreads can occur (especially short-term or if rates rise), the strategy’s long-term value integrates the policy’s tax-sheltered cash value growth, potential dividends, and the substantial tax-free death benefit. These insurance components often significantly enhance the total outcome beyond the simple investment vs. loan cost comparison. Ensure clients understand this broader, long-term perspective.

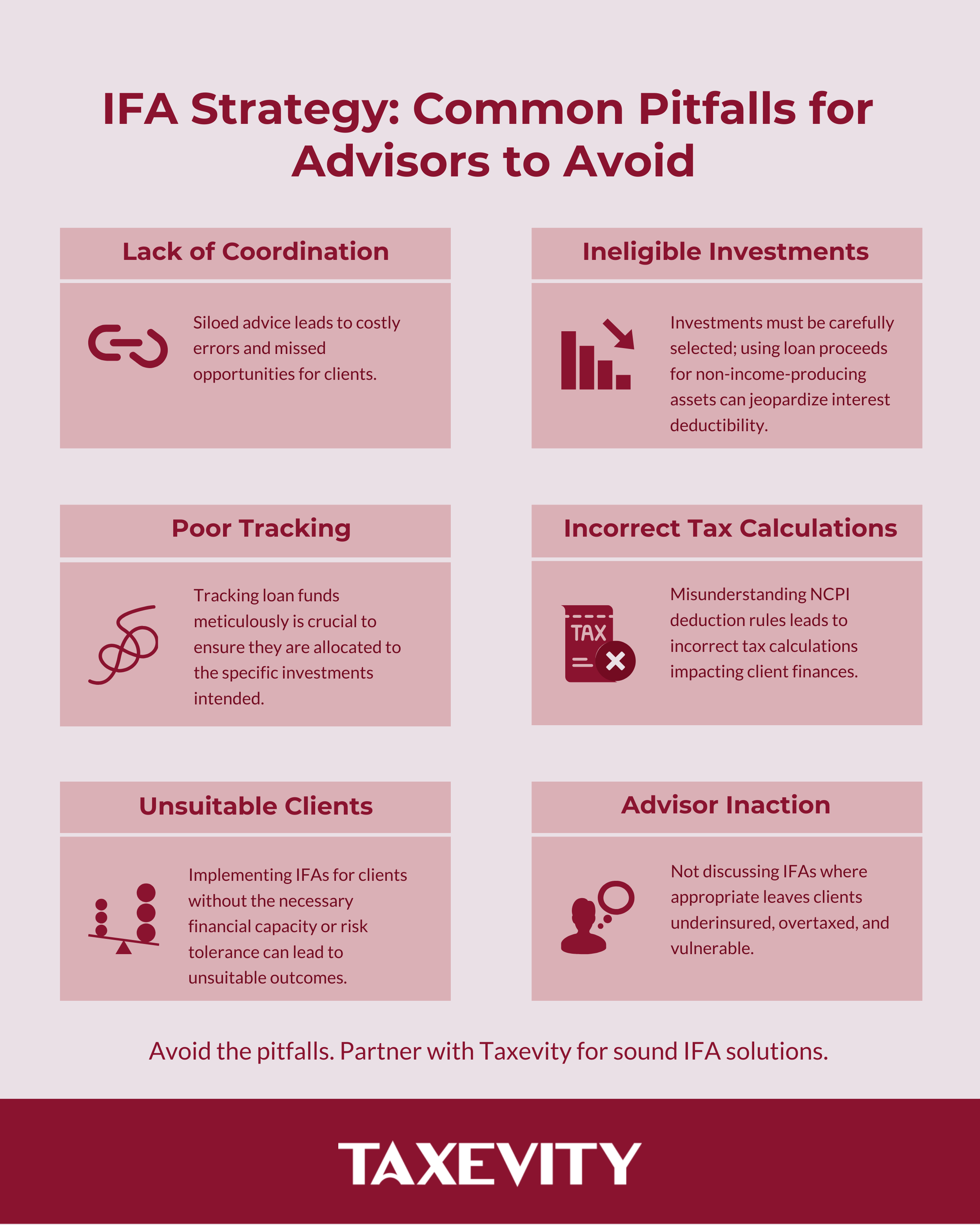

- Common Pitfalls to Avoid:

- Lack of Coordination: Siloed advice leads to errors and missed opportunities.

- Ineligible Investments: Using loan proceeds for non-income-producing assets, jeopardizing interest deductibility. (Requires careful selection and documentation).

- Poor Tracking: Failing to meticulously trace loan funds to the specific investment.

- Incorrect Tax Calculations: Misunderstanding the NCPI deduction rules.

- Unsuitable Clients: Implementing IFAs for clients lacking the financial capacity, risk tolerance, or long-term perspective.

- Advisor Inaction: Not discussing IFAs where appropriate can leave clients underinsured, overtaxed, and vulnerable to competitors.

Ensuring Investment Eligibility for Tax Deductibility

A key consideration, especially when you manage the investment of the loan proceeds, is ensuring eligibility for potential interest deductibility (ITA 20(1)(c)(i)).

- Focus on Income: The primary purpose must be to earn taxable income (interest, dividends). Relying solely on capital gains is generally insufficient in the CRA’s view.

- Eligible Assets: Typically include dividend-paying stocks, interest-bearing securities, income-producing mutual funds/ETFs, rental properties, etc.

- Handling ROC: Advise clients that Return of Capital distributions should generally be reinvested or used to pay down the loan to maintain deductibility for that portion of the loan.

For more details, read our detailed companion for wealth advisors on Charting Interest Deductibility for Leveraged Investing in Canada.

Client Suitability Profile

IFAs are best suited for your clients who generally meet criteria including:

- Incorporated professionals or business owners, or high-net-worth individuals with strong cash flow.

- Long-term investment horizon (15+ years).

- Existing need or clear planning rationale for permanent life insurance.

- Sufficient taxable income to utilize deductions.

- Appropriate risk tolerance for leverage.

Partnering with Taxevity: Your Insurance Specialist

Navigating the insurance complexities, policy structuring, lender negotiations, and specific tax rules related to IFAs requires specialized expertise. Taxevity acts as your dedicated insurance and IFA specialist partner:

- Insurance Expertise: Deep knowledge of whole life policy design for optimal IFA performance.

- Structuring & Implementation: Handling the detailed application, underwriting, and collateral assignment process.

- Objective Analysis: Providing clear, compliant illustrations and proposal reviews.

- Collaborative Approach: Working seamlessly with you and the client’s accountant.

- Actuarial Insight: Leveraging our background for sophisticated solutions.

We empower you to bring this powerful strategy to your qualified clients confidently.

Elevate Your Practice and Client Outcomes

Integrating IFAs into your toolkit allows you to address complex client needs holistically, unlock trapped capital for investment, enhance tax efficiency, and provide essential insurance protection. By quarterbacking the process and collaborating with the family team at Taxevity, you can deliver exceptional value, strengthen client relationships, and differentiate your practice.

Contact Taxevity to explore how IFAs can benefit your specific high-net-worth clients or to discuss a collaborative approach on a case. Let’s help your clients achieve their goals for Protection, Growth, and Impact.