(Part of the IFA Master Curriculum)

Key Question for Legal Counsel

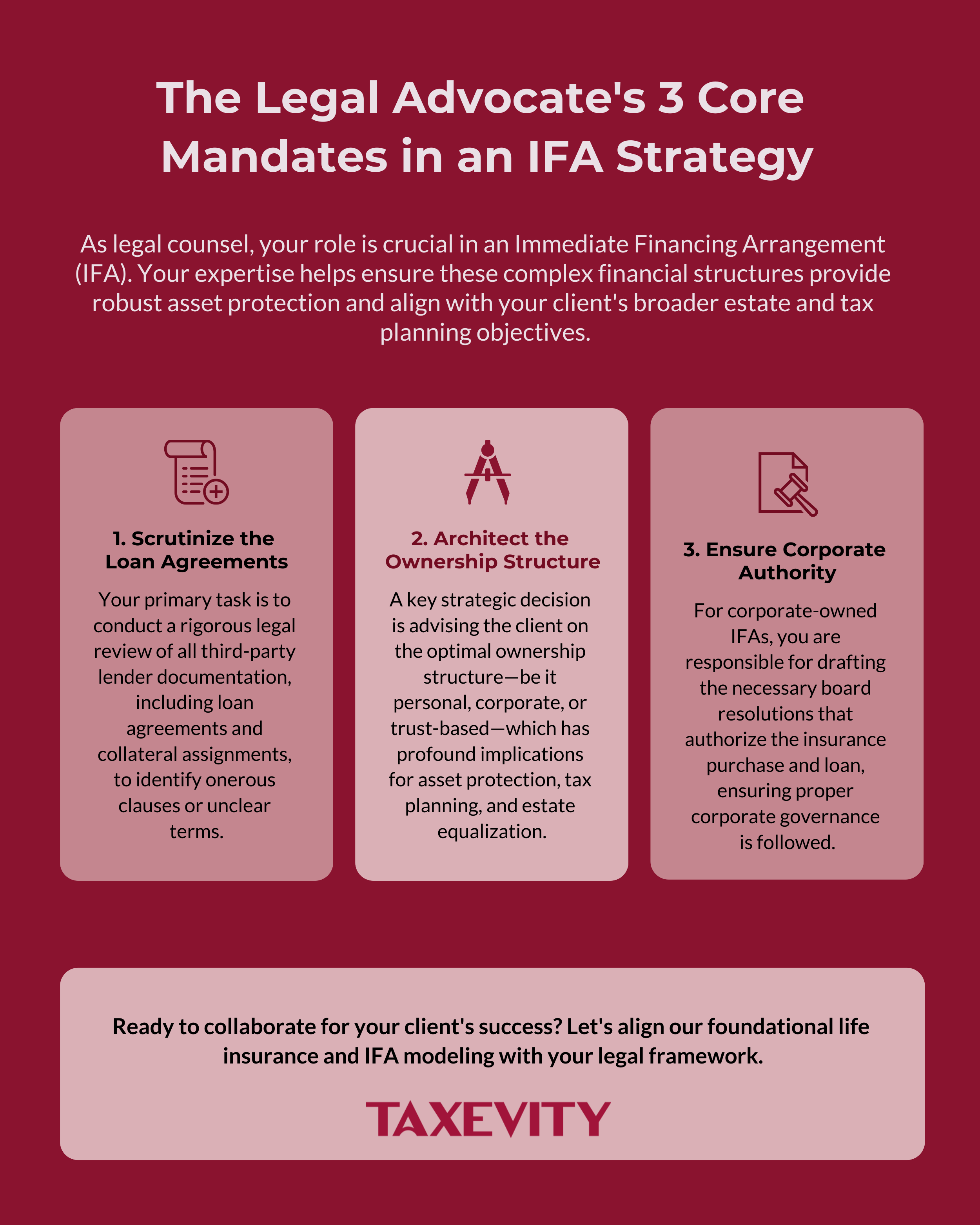

When your HNW client undertakes an Immediate Financing Arrangement (IFA), how do you protect them from contractual risks, structural flaws, and unintended estate consequences?

- The Contractual Review: Your primary task is a rigorous legal review of all third-party lender documentation, including loan agreements and collateral assignments, to identify onerous clauses or unclear terms that put your client at a disadvantage.

- The Corporate Mandate: For corporate-owned IFAs, you are responsible for drafting the necessary board resolutions that authorize the insurance acquisition and the loan, ensuring proper corporate governance is followed and the directors are protected.

- The Ownership Architecture: A key strategic decision is advising the client on the optimal ownership structure—be it personal, corporate, or trust-based. This choice has profound implications for asset protection, tax planning, and estate equalization.

For a high-net-worth client undertaking an Immediate Financing Arrangement (IFA), the financial and tax components often take centre stage. However, the entire strategy is built upon a series of binding legal agreements. As their legal counsel, you are the Advocate responsible for the integrity of this legal foundation.

Your role on the client’s Core Advisory Team is to protect them from contractual risks, structural flaws, and unintended estate consequences. While our main hub post, The IFA Core Advisory Team: A Requirement for Success, outlines the full team, this guide is focused specifically on your critical function as the Legal Advocate.

Your Mandate: Architect of the Legal Structure

While the insurance specialist architects the policy, you architect the legal framework that holds the entire IFA together. Your proactive counsel is essential to prevent future complications.

- Rigorous Contract Review: Your primary task is to conduct a thorough legal review of all documentation from the third-party lender, including the loan agreement, collateral assignment forms, and any personal or corporate guarantees. You are looking for onerous clauses, unclear terms, or anything that puts your client at a disadvantage.

- Optimizing Ownership Structure: A key strategic decision is who—or what—will own the life insurance policy. You must advise the client on the significant legal and tax differences between personal ownership, corporate ownership (Opco vs. Holdco), or ownership within a trust. This decision has profound implications for asset protection, tax-free capital distributions via the Capital Dividend Account (CDA), and estate equalization.

- Ensuring Corporate Authority: For corporate-owned IFAs, you are responsible for drafting the necessary board of directors’ resolutions to authorize the insurance purchase, the loan, and the collateral assignment. This ensures proper corporate governance is followed and protects the directors.

A Collaborative Function

Your role is deeply interdependent with the other members of the advisory team.

- You must collaborate with the Accountant (see the Guardian’s role) to ensure the chosen ownership structure aligns with the client’s tax planning objectives.

- You work with the Insurance Specialist (see the Architect’s role) to ensure the policy application and beneficiary designations accurately reflect the intended legal structure.

- Your review of the loan agreement provides critical information for the entire team regarding the terms of the leverage.

Conclusion: Providing Certainty and Peace of Mind

By meticulously managing the legal components of an IFA, you do more than just draft documents; you provide the client with certainty and peace of mind. You ensure that the strategy will function as intended, both during their lifetime and for their estate. Your expertise protects the hard work of the entire advisory team and the financial future of the client.

At Taxevity, we design the insurance and financial models that serve as the engine of the IFA. We rely on and value the expertise of diligent legal professionals like you to build the sound legal framework required for success.

Ready to collaborate? If your client is considering an IFA, we invite you to contact us. Let’s ensure the financial and legal architectures are perfectly aligned.