Key Question for Physicians

As a physician, how can you make your capital work in two places at once, using your life insurance not just for protection but as a tool to accelerate wealth growth?

- The Strategy: An Immediate Financing Arrangement (IFA) is a strategy where you use the cash value in your permanent life insurance policy as collateral to secure a loan. The loan proceeds are then used for other investments, like in your practice or real estate.

- The Foundational Tool: The preferred “engine” for an IFA is a participating whole life insurance policy. Its stable and predictable cash value growth is highly valued by lenders, often allowing you to borrow up to 100% of its value.

- The Strategic Purpose: This approach allows you to maintain your foundational insurance Protection for your family and estate, while actively pursuing Growth through leveraged investments and expanding your capacity for Impact.

In the Beyond MD podcast, Dr. Yatin Chadha covers a range of financial topics to enhance real-world financial literacy. As featured guests in Episode 91 (Apple | Spotify | YouTube), we explored Immediate Financing Arrangements (IFAs) – a powerful insurance leveraging strategy helping physicians accelerate wealth building. This 5-part blog series expands on our discussion, providing deeper insights into how IFAs can support your goals for protection, growth, and impact.

Page Contents

Leveraging Life Insurance for Investment: What is an IFA?

As a physician, you’re adept at diagnosing complex issues and implementing precise solutions. The world of advanced financial planning also has its own set of sophisticated tools, and one such strategy is the Immediate Financing Arrangement (IFA).

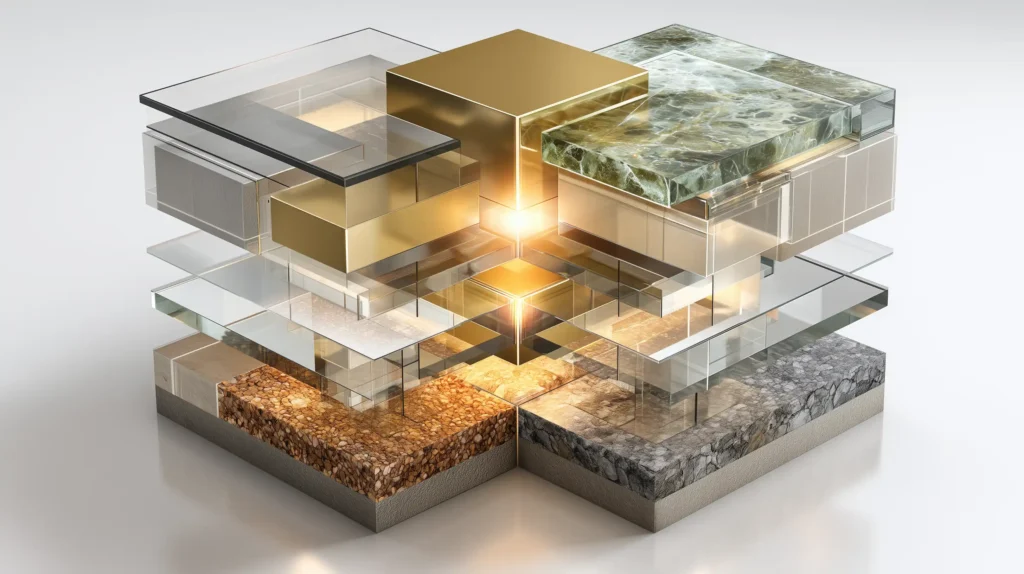

At its core, an IFA allows you to use the cash value in your permanent life insurance policy as collateral to secure a loan from a third-party financial institution. The loan proceeds can then be used for various investments outside of your insurance policy, which may include your medical practice, real estate, or other market opportunities. Essentially, an IFA enables your capital to work in two places simultaneously:

- Inside the protection of your life insurance policy, where the cash value continues to grow tax-sheltered.

- Outside your policy, through the investments made with the borrowed funds.

For busy physicians, an IFA can be an attractive option to make your assets work harder without disrupting the foundational security your life insurance provides. It’s about smartly leveraging an existing asset – your policy – to potentially accelerate wealth growth and expand your financial capacity.

The Bedrock of an IFA: Why Whole Life Insurance is Key

To implement an IFA, a permanent life insurance policy is essential. There are two main types: Universal Life and Whole Life. While both offer lifelong protection and a cash value component, whole life insurance is the preferred vehicle for an IFA strategy. Here’s why:

- Predictability and Stability: With Whole Life insurance, the insurance company manages the policy’s investments within a participating account. This generally results in more predictable, smoother growth of your cash value over time. Lenders appreciate this stability, as the Cash Surrender Value (CSV) – the amount you’d get if you walked away from the policy and a key metric for them – is less prone to market volatility.

- Higher Leverage Potential: Due to this predictability, lenders are often willing to lend up to 100% of the CSV of a whole life policy, without additional collateral.

- Contrast with Universal Life (UL):

- Universal Life policies offer you, the policyholder, more control over how the cash value is invested. You might choose options like mutual funds, market indexes or Guaranteed Investment Accounts (GIAs).

- While this flexibility can be appealing, it can also lead to greater volatility. If these investments underperform, the cash value can fluctuate significantly.

- Even if lenders accept UL as collateral, they may only loan against GIAs, which often have lower annual returns, reducing the long-term growth.

As we discussed with Dr. Chadha, the structure of the whole life policy is also crucial. Whole life policies designed with high early cash values are particularly well-suited for IFAs. These policies are structured so that a larger portion of your premiums contributes to the cash value in the initial years, providing more immediate collateral for the loan.

Aligning IFAs with Your Financial Goals: Protection, Growth, and Impact

At Taxevity, our philosophy centres on helping clients achieve their financial objectives through the smart use of insurance, focusing on three key pillars:

- Protection: Your permanent life insurance policy, the foundation of the IFA, continues to provide crucial financial protection for your family, your practice, or your estate. This core benefit remains intact.

- Growth: The IFA directly supports this pillar by providing access to capital that can be invested to grow your wealth outside the insurance policy. This could mean expanding your medical practice, investing in income-producing real estate, or diversifying your investment portfolio.

- Impact: By potentially accelerating wealth growth, an IFA can also expand your capacity for philanthropic giving or enable you to pursue larger legacy-building projects sooner than you might have otherwise.

An IFA, when structured correctly and aligned with your overall financial plan, can be a sophisticated way to enhance your financial position while maintaining the security of life insurance.

In the next part of this series, we’ll explore who an IFA is best suited for and the critical questions physicians should ask themselves before considering this strategy.

Stay tuned for Part 2: Is This Strategy Right for Your Practice & Personal Wealth?

Here’s the full series on Mastering IFAs for Physicians:

Part 1: Leveraging Life Insurance for Investment (this post)

Part 2: Is This Strategy Right for Your Practice & Personal Wealth?

Part 3: Policy Structure & The Loan Explained

Part 4: Is This Strategy Right for Your Practice & Personal Wealth?

Part 5: Policy Structure & The Loan Explained

Deepen Your Understanding & Explore Your Options

We encourage you to hear the foundational discussion on IFAs from our interview on Beyond MD with Dr. Yatin Chadha (Episode 91). You can listen on your preferred platform: Apple | Spotify | YouTube.

Physicians, if you’re ready to explore how an IFA could fit your financial strategy and help you achieve your goals, we invite you to contact Taxevity for a personalized consultation.