Key Question for Canadians

You’re thinking of borrowing to invest to grow your wealth faster. But how do you know if the Canada Revenue Agency (CRA) will let you deduct the loan interest on your taxes?

- The “Purpose Test”: To deduct the interest, your primary goal for borrowing must be to earn taxable income, such as dividends, interest, or rent. Expecting only to sell the investment for a profit later (a capital gain) is generally not enough to qualify.

- Keep a Clear “Paper Trail”: You must be able to prove to the CRA how you used the borrowed money. The best way is to keep a direct trail, like depositing the loan into a separate account and immediately using it to buy the investment.

- Know the Common Exclusions: Interest is generally not deductible for loans used to contribute to registered plans like an RRSP or TFSA, to buy personal assets like your main home, or to directly pay life insurance premiums.

You’re working hard to build your wealth, and perhaps you’re wondering if borrowing money to invest could help you reach your financial goals faster. This strategy, sometimes called “leveraged investing”, can be a powerful tool, but the path comes with important considerations, especially when for your taxes.

This Companion is designed to help you, as a Canadian individual or family, understand when the interest you pay on an investment loan might be tax-deductible. We aim to clarify the rules set out by the Canada Revenue Agency (CRA) so you can have more informed discussions with your financial and tax advisors.

While borrowing to invest offers potential for enhanced growth, it’s wise to balance this opportunity with your overall financial protection and understand how leveraging might affect your capacity for future impact, such as charitable giving. Remember, this guide provides general information as of mid-2025, and the Canadian tax landscape can change. For advice tailored to your unique situation, do also consult with us and your other independent professional advisors.

Page Contents

- 1 The Basics: Can You Deduct Interest on Investment Loans?

- 2 Why Your “Investment Purpose” Is So Important

- 3 Keeping Good Records: Why It’s Crucial

- 4 Common Types of Investments Used When Borrowing

- 5 Important Exclusions: When Interest is Usually Not Deductible

- 6 Using Your Existing Assets as Security (Collateral) for an Investment Loan

- 7 Understanding LTV (Loan-to-Value Ratio)

- 8 Key Risks to Consider Carefully

- 9 Next Steps: Working With Your Professional Advisory Team

What is Borrowing to Invest?

At the core, borrowing to invest means you use borrowed money—like a loan or line of credit—to buy investments. Think of it as using “someone else’s money” to potentially increase how much you can invest beyond your personal savings. This approach is similar to getting a mortgage to buy your home: you use borrowed funds hoping the asset’s value will go up or generate income that’s more than your borrowing costs over time.

The Goal: Potentially Accelerating Your Wealth Growth

The main reason you might consider borrowing to invest is to potentially grow your wealth faster than if you only used your own savings. By using a larger amount of money upfront, any investment gains happen on this bigger amount. Over the long run, this could lead to more significant “compound returns”, where your investment earnings start making their own earnings.

However, borrowing to invest isn’t for everyone. You need to be mentally prepared to handle debt and the bigger ups and downs of the market, just as much as you need to be able to afford the loan payments. Losses can be magnified, not just gains. Leveraged investing is usually a long-term plan. Short-term market drops can hit harder when you’ve borrowed, especially if you have to sell investments at a bad time.

The Basics: Can You Deduct Interest on Investment Loans?

One of the key attractions of borrowing to invest in Canada is the potential to deduct the interest you pay on the investment loan from your income for tax purposes.

The General Rule: Potential for Tax Deductibility

If you borrow money to invest, the interest you pay on that loan might be tax-deductible. This means you could lower your taxable income by the amount of interest you paid, which would reduce your overall tax bill. You usually claim this deduction on Line 22100 (“Carrying charges and interest expenses”) of your T1 General Income Tax and Benefit Return. Being able to deduct interest can make the strategy more attractive because you lower the after-tax cost of borrowing, which can boost your overall return on investment.

The actual “after-tax” cost of borrowing changes based on your marginal tax rate. A higher marginal tax rate usually means more tax savings from the deduction. However, since marginal tax rates can change if your income changes or if tax laws are updated, the real net cost of your loan can vary. This is an important point to discuss with your accountant.

The Crucial Condition: The “Purpose Test”

The key to deducting interest on investment loans is the “purpose test”: you must use the borrowed money primarily for the purpose of earning taxable investment income. This usually includes income like dividends from stocks, interest from bonds and Guaranteed Investment Certificates (GICs), or rental income from properties.

Borrowing money simply with the expectation that the investment’s price will go up (to get a capital gain) generally does not make the interest deductible. A common misconception is that borrowing to purchase investments with the primary goal of capital appreciation (price increases) makes the interest tax-deductible—it generally does not. You must have a reasonable expectation of earning direct, taxable income (like interest, dividends, or rent) from the investment itself. While you might also desire capital growth, relying solely on an expectation of capital gains isn’t enough to pass the purpose test for interest deductibility. Understanding this difference is vital because a mistake can lead to the CRA denying your deductions.

Reasonable Expectation of Income

Even if an investment, like certain growth stocks, isn’t paying dividends right now, the interest on a loan used to buy such shares might still be deductible if there’s a “reasonable expectation” that the investment will produce taxable income in the future. The CRA generally considers interest on money borrowed to buy common shares to be deductible if, when you buy them, there’s a reasonable expectation of future dividend payments. However, if a company has a stated policy that it will not pay dividends, then the interest on money borrowed to buy these shares will likely not be tax-deductible.

This “reasonable expectation” rule gives some flexibility but also adds some uncertainty. You need to choose investments carefully and keep good records of why you invested, especially for stocks that don’t currently pay dividends.

Why Your “Investment Purpose” Is So Important

As we’ve touched on, the reason you borrow to invest is directly tied to whether you can deduct the loan interest.

Direct Link to Tax Deductibility

The CRA requires that you use borrowed money with the specific intent or purpose of making taxable investment income (like dividends, interest, or rental income) for the loan interest to be deductible. The CRA usually looks at the “direct use” of the borrowed money. If you borrow money and immediately use those funds to buy a stock that pays dividends, the connection is clear. However, if the money is used for something else that doesn’t earn income before being invested, establishing a clear trace can be difficult and could put your deduction at risk.

A key tip for maintaining clarity is to avoid mixing borrowed funds with your personal funds. If you deposit borrowed money into an account where such funds mix with your personal savings before being used for different things, tracing the borrowed amount directly to an eligible income-earning investment becomes difficult. To keep a clear audit trail and support the “direct use” rule, consider using a separate bank account just for receiving the loan money and for buying your investments.

Keeping Good Records: Why It’s Crucial

The CRA requires you to keep complete records to support any deductions you claim, including interest on investment loans. It’s your responsibility to provide proof. Without good records, the CRA can disallow your claimed interest deductions, which can mean a higher tax bill, plus interest and possibly penalties.

What Records to Keep? The “Paper Trail”

You need a careful “paper trail” to show the CRA that you used borrowed money for an eligible income-earning purpose and to prove the amount of interest you paid. Key documents include:

- Loan Agreements: Original contracts for any loans or lines of credit used for investments.

- Bank/Brokerage Statements: Statements clearly showing you received borrowed money and used those funds directly to buy specific investments. This might include cancelled cheques or records of electronic fund transfers. As mentioned, using a separate bank account helps.

- Investment Purchase Confirmations: Official trade confirmations for stocks, bonds, mutual funds, or purchase agreements for other types of investments like rental properties.

- Interest Paid Statements: Annual statements from your lender showing how much interest you paid on the loan.

- Investment Income Records: T-slips (like T3s for trust income, T5s for investment income) showing any dividends or interest you received, and records of rental income.

- Rationale for Investment: Especially for shares not currently paying dividends, keep notes, company reports, or analyst comments that support your “reasonable expectation” of future income when you bought them.

How Long to Keep Records?

The CRA generally requires you to keep supporting documents for your tax returns for at least six years from the end of the last tax year they relate to. It’s always a good idea to check current CRA guidelines or ask your accountant.

Common Types of Investments Used When Borrowing

When choosing investments for a leveraged strategy where you want to deduct interest, your main focus must be on their ability to produce taxable income, like interest, dividends, or rental income. This aligns with the CRA’s “purpose test”.

Here are general examples of investments that might qualify, as long as all CRA conditions are met:

- Dividend-Paying Stocks: Shares in companies that consistently pay dividends, or for which you have documented proof of a reasonable expectation of future dividend payments.

- Interest-Bearing Bonds: Government or corporate bonds that make regular interest payments.

- Mutual Funds or ETFs that Distribute Taxable Income: Investment funds that hold a portfolio of income-producing assets (like dividend-paying stocks or bonds) and distribute the earned income (interest, dividends) to their unitholders can qualify.

- Rental Properties: Real estate you buy with the clear intention of making rental income. Mortgage interest on such investment properties is generally deductible against the rental income.

Remember that these are general examples. Whether any specific investment qualifies always depends on meeting the CRA’s “purpose test” in your particular situation. This guide is not investment advice.

A Note on “Return of Capital” (ROC): Some investments, particularly certain mutual funds or ETFs, may make distributions called “Return of Capital.” ROC is generally not considered “income” for the purpose test. If you receive ROC and use those funds for personal expenses (rather than reinvesting or paying down the loan), the CRA might view this as reducing the amount of the loan used to earn income. This could mean you have to reduce your deductible interest proportionally. This is a technical point that needs careful review with your advisors.

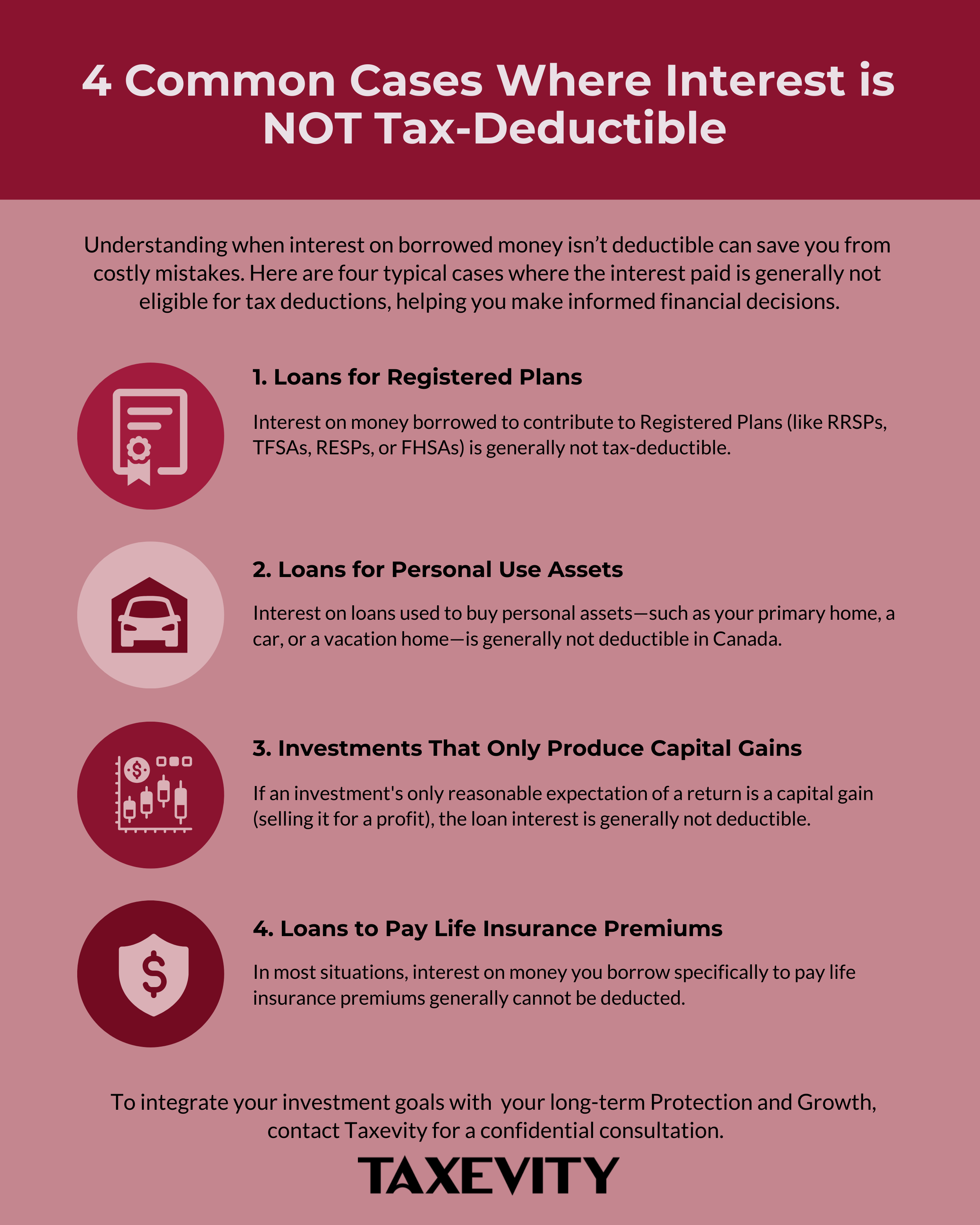

Important Exclusions: When Interest is Usually Not Deductible

There are several common situations where interest you pay on borrowed money is generally not tax-deductible in Canada. Understanding these exclusions is critical.

- Borrowing for Registered Plans: A major exclusion is for loans taken to contribute to registered plans. The interest you pay on money borrowed for these contributions is generally not tax-deductible. The reason is often seen as preventing “double-dipping” on tax benefits, as these plans already offer significant tax advantages. This rule applies to:

- Registered Retirement Savings Plans (RRSPs)

- Tax-Free Savings Accounts (TFSAs)

- Registered Education Savings Plans (RESPs)

- First Home Savings Accounts (FHSAs)

- Borrowing for Personal Use Assets: Interest on loans used to buy assets for personal use and enjoyment (rather than to earn investment income) is typically not tax-deductible. Examples include your primary home (mortgage interest on your main home is generally not deductible in Canada), and personal vehicles.

- Investments that Only Produce Capital Gains: If an investment’s only reasonable potential return is a capital gain (it’s not expected to ever pay dividends, interest, or other forms of taxable income), the interest on money borrowed to buy that investment is generally not deductible.

- Life Insurance Policies: Generally, interest on money you borrow to pay premiums on a life insurance policy is not deductible. There are complex exceptions and related strategies (like using the cash value of a policy as collateral for an investment loan for an Immediate Financing Arrangement (IFA), where the loan itself must meet the purpose test for an external investment), but these warrant a discussion with us.

- Exempt Income: Interest on borrowed money used to earn income that is itself exempt from Canadian tax is also not deductible. For example, if you borrowed to invest in a specific type of bond whose interest income was advertised as tax-free in Canada (these are rare for individuals now), the interest on the loan to buy that bond would not be deductible.

Using Your Existing Assets as Security (Collateral) for an Investment Loan

When you borrow to invest, lenders often require you to pledge an asset as security for the loan. This is called “collateral”.

What is Collateral?

Collateral is an asset that you pledge to a lender. If you fail to repay the loan, the lender has the right to take your collateral and sell it to recover the money you owe. Providing collateral can make lenders more willing to give you credit, often with better interest rates, because it reduces their risk.

Common examples of assets you might use as collateral include:

- Home Equity: Often used via a Home Equity Line of Credit (HELOC) or a second mortgage.

- Other Investments: Your existing portfolio of stocks, bonds, and mutual funds.

- Life Insurance Policies (Cash Value): Permanent life insurance policies (like whole life) that have built up cash surrender value (CSV) can be pledged.

Crucially for tax purposes, the type of collateral you pledge generally does not determine if the interest on your investment loan is deductible. What matters is how you use the borrowed money. So, if you borrow against your home (a personal asset) but use the money for an eligible income-earning investment, the interest may be deductible. Conversely, if you borrow against your investment portfolio (an income-earning asset) but use the money for personal expenses, the interest is not deductible.

Understanding LTV (Loan-to-Value Ratio)

The Loan-to-Value (LTV) ratio compares your loan amount to the appraised value of the asset you’re using as collateral, shown as a percentage. For example, a $60,000 loan using an asset worth $100,000 as collateral has an LTV of 60%.

Lenders use LTV to assess risk: a lower LTV generally means lower risk for them. LTV helps determine the maximum loan amount and can influence interest rates.

- Real Estate: LTV is the loan amount divided by the property’s current appraised market value. For conventional mortgages (buying a home), lenders might offer an LTV up to 80% without mortgage insurance, or up to 95% with insurance. For a HELOC, the loan amount might be up to 65-80% of your home’s equity.

- Investment Portfolios: Lenders assign “lending values” to different securities. Stable assets like GICs might get a 100% lending value, while equities might be 50-75%. Your overall borrowing limit is based on a combined lending value. If your portfolio’s value drops, your LTV ratio goes up, potentially triggering a “margin call” where you must add more funds or the lender might sell some of your pledged assets.

- Life Insurance: When using a life insurance policy’s cash surrender value (CSV) as collateral for a loan from a third-party lender (common in strategies like an Immediate Financing Arrangement), lenders might advance up to 90% or even 100% of the CSV, especially if the policy is designed to build high early cash values. If you take a “policy loan” directly from the insurance company, they typically lend up to 90-95% of the CSV.

Key Risks to Consider Carefully

Borrowing to invest can offer enhanced returns, but it also comes with serious risks:

- Magnified Losses: Leverage makes gains bigger, but it also makes losses bigger. If investments go down, you lose your own money and still have to repay the entire loan plus interest.

- Interest Rate Changes: If your loan has a variable interest rate, rate increases mean higher borrowing costs, eating into profits or worsening losses.

- Debt Exceeding Investment Value: Your investments could fall below what you owe. Selling them wouldn’t cover the debt, and you’d need to make up the difference from other assets or income.

- Margin Calls (if using investments as collateral): A drop in your pledged portfolio’s value can trigger a margin call, requiring you to deposit more cash or collateral quickly. If you can’t, the lender might forcibly sell your investments, often at unfavourable prices.

- Forced Sale / Loss of Collateral: If you can’t make loan payments or meet a margin call, the lender can take and sell your pledged collateral. If you used your home equity, this could mean losing your home.

- Investment Underperformance / Income Risk: There’s no guarantee your investments will perform as expected or generate enough income to cover loan costs. If returns aren’t higher than your after-tax borrowing costs, you’ll lose money.

- Liquidity Risk: You must have enough cash flow for loan payments, regardless of investment performance. Income drops or unexpected expenses could make this difficult.

- Tax Law Changes: Laws about interest deductibility or investment income taxation could change, altering the strategy’s benefits.

These risks are often linked and can worsen each other. The psychological stress of magnified losses can also lead to poor decisions, like panic selling.

Next Steps: Working With Your Professional Advisory Team

This guide is for your general education. It is not financial, tax, or legal advice, and shouldn’t be seen as a recommendation for you to borrow to invest.

The Critical Importance of Your Professional Team

Borrowing to invest is a complex strategy to consider only after thorough discussion and planning with your independent team of qualified professional advisors. They can give personalized guidance tailored to your specific situation.

Key advisors to talk to include:

- Wealth Advisor / Financial Planner: Can assess if leveraged investing suits your overall financial plan, goals, risk tolerance, and timeline, and help choose appropriate investments.

- Tax Advisor: Essential for advice on tax issues, including the “purpose test,” record-keeping for the CRA, and structuring the loan and investments tax-efficiently.

- Taxevity (Insurance Professional): Vital if you’re considering using a life insurance policy as collateral for an Immediate Financing Arrangement, or for risk management within your strategy.

- Lawyer (Potentially): For reviewing complex loan agreements or for estate planning implications.

Ideally, these professionals should work together or at least be aware of the advice given by others on your team.

Key Questions to Ask Your Advisors

Consider asking your advisors:

- Overall Suitability:

- “Given my complete financial situation, goals, age, and risk tolerance, is borrowing to invest a suitable strategy for me right now?”

- “How might this affect my overall financial plan and progress towards other goals like retirement?”

- To Your Wealth Advisor / Financial Planner:

- “Given my risk profile and the need to meet the ‘purpose test,’ what types of investments are appropriate?”

- “What’s the realistic expected return, and what’s the break-even point to cover all costs and taxes?”

- To Your Tax Advisor:

- “Based on the proposed loan and investments, would the interest likely be tax-deductible for me?”

- “What exact records do I need to keep for the CRA?”

- To Taxevity (Your Insurance Professional) (if applicable):

- “Is my life insurance policy suitable as collateral? What are the pros and cons compared to other collateral?”

- “How would a loan against my policy affect its cash value, growth, and death benefit?”

- Loan Specifics (to the Lender, reviewed with your Wealth Advisor):

- “What is the interest rate? Is it fixed or variable? How is it calculated?”

- “What are all the fees for this loan?”

- “If using collateral, what are the LTV requirements and what triggers a margin call?”

A Considered Decision

Borrowing to invest can be a powerful tool, but requires careful planning, understanding of risks, and ongoing management. This is not a “set and forget” strategy; it needs regular review with your advisory team. Your professional team is an essential resource to help you make an informed, well-thought-out decision. To get started, contact us.