Key Question for Canadians

When getting a mortgage, your bank will likely offer you “mortgage protection insurance”. But is this your best option, or does a personally-owned term life insurance policy offer better value, flexibility, and control for you and your family?

- You Control the Benefit: With bank mortgage insurance, the payout goes directly to the lender to pay off the mortgage. With a personal term life policy, the tax-free funds go to your chosen beneficiaries, giving them the flexibility to decide how best to use the money .

- You Get Better Value: Bank mortgage insurance coverage typically decreases as you pay down your loan, while the premium often stays the same. A personal term policy provides a level amount of coverage for a level premium, giving you more consistent value.

- Your Policy is Portable and Flexible: Unlike bank insurance, which is tied to your mortgage, a personal policy stays with you if you switch lenders. Most personal term policies also include a crucial conversion option, allowing you to switch to permanent coverage later without new medical exams.

When arranging a mortgage in Canada, you’ll likely encounter the term “mortgage insurance.” It’s crucial to understand this term covers two very different products:

- Mortgage Default Insurance: Often mandatory if your down payment is less than 20%. Provided by organizations like CMHC, Sagen, or Canada Guaranty, it protects the lender if you default on payments. This is not life or health insurance for you.

- Mortgage Protection Insurance: This is optional life, disability, or critical illness insurance offered by banks and other lenders, tied directly to your mortgage. It’s designed to pay the lender if something happens to you. This type of insurance, often called creditor insurance, is what we’ll compare to personal insurance policies you own yourself.

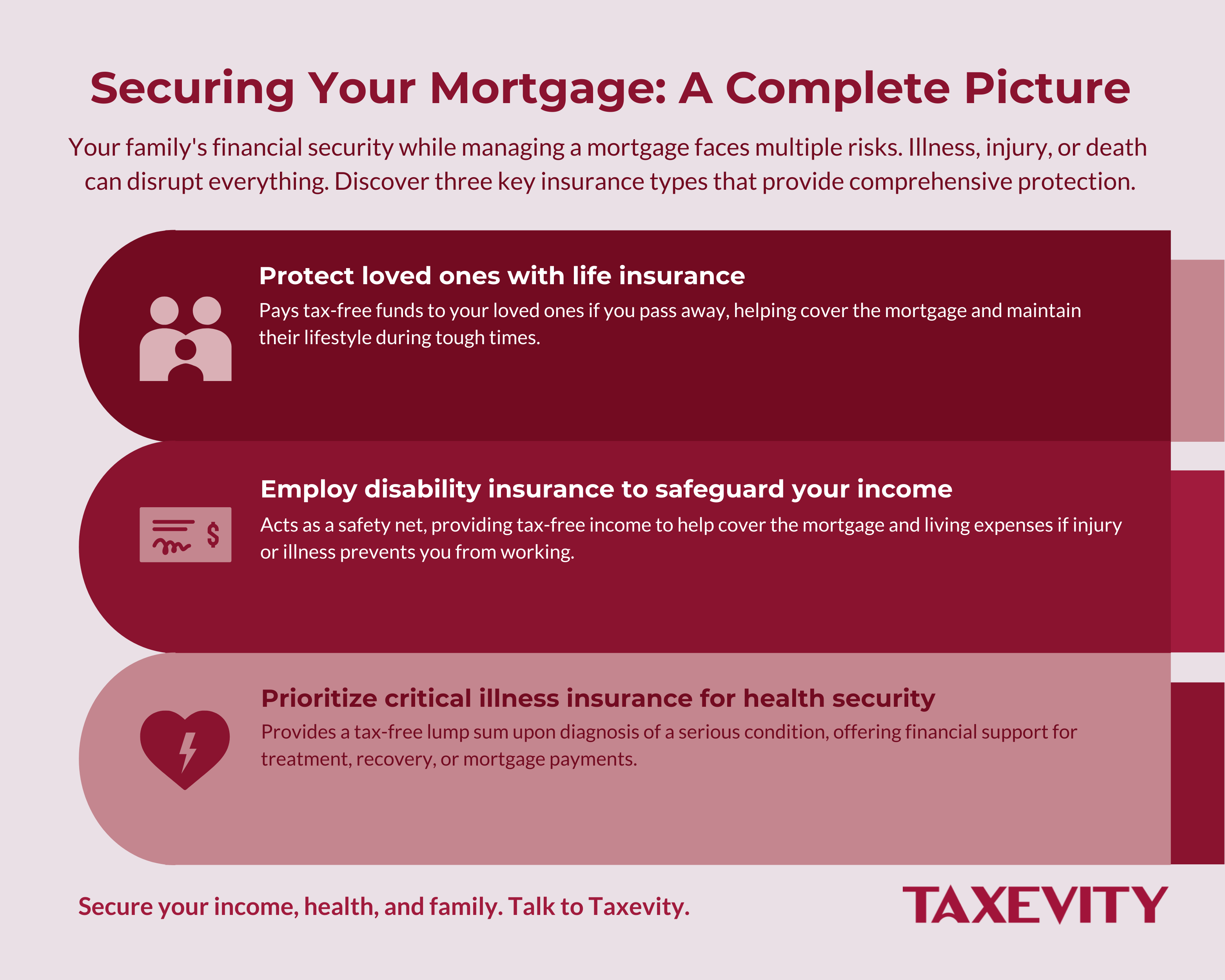

Protecting your ability to meet mortgage payments is vital. Your capacity to earn an income is arguably your most valuable financial asset. An illness or injury preventing you from working is statistically more likely than premature death during your working years. That’s why considering Disability Insurance (DI) and Critical Illness Insurance (CII) is fundamental – how would the mortgage get paid if you, or potentially your spouse or partner, couldn’t rely on your income? Often, insuring both partners adequately with personal policies is essential. Relying solely on potentially insufficient group insurance from work can be risky, as coverage may be too low, is tied to employment, lacks conversion options, or has non-guaranteed rates.

Life insurance also plays a vital role in ensuring loved ones aren’t burdened with mortgage debt. Let’s compare creditor insurance from the bank with a personal term life policy.

Page Contents

- 1 Creditor Insurance: The Bank’s Option

- 2 Personal Term Life Insurance: Your Option

- 3 Key Differences at a Glance

- 4 The Critical Difference: Why Conversion Matters

- 5 Beyond Death: Protecting Your Income (Disability & Critical Illness Insurance)

- 6 What About Singles?

- 7 Insurance is Not Just About Price

- 8 Where Should You Get Insurance Advice?

- 9 Take Control of Your Protection

Creditor Insurance: The Bank’s Option

This is the optional life/health insurance tied to your mortgage.

- Who it Protects: Primarily, it protects the lender. If you die, the insurance pays the outstanding mortgage balance directly to them.

- The Profit Centre: Banks often offer this insurance as a profit centre, charging you retail premiums for coverage that protects their loan, despite already having your home as collateral.

- Decreasing Benefit, Level Cost: Coverage typically declines as you pay down your mortgage, but your premium often remains level.

- Lack of Portability: Tied to that specific mortgage. Switch lenders, and the insurance usually ends. You must reapply, potentially at higher rates, and qualification could be difficult or impossible if your health has changed.

- No Conversion: Generally cannot be converted to a permanent life insurance policy.

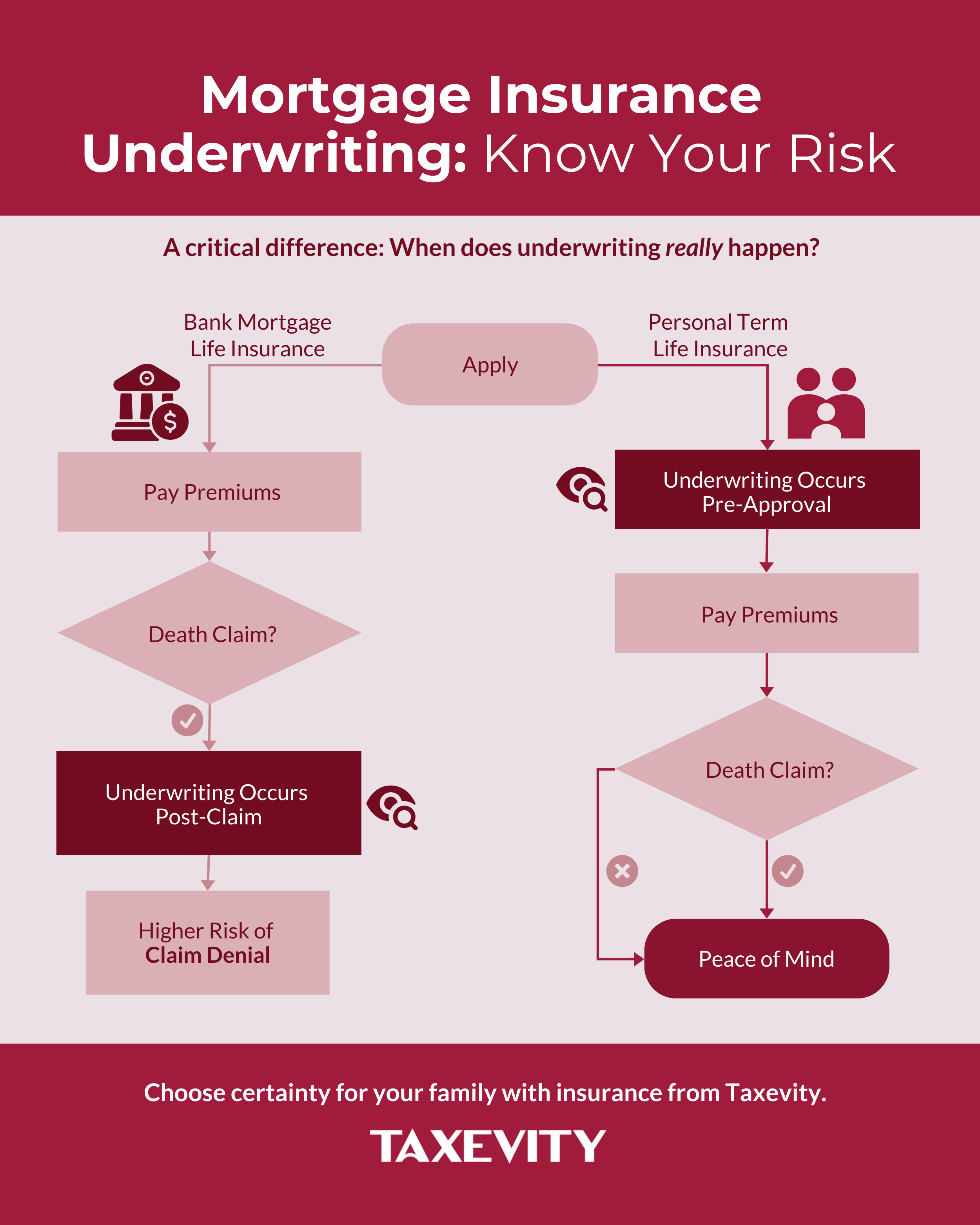

- Convenience Factor: Applying can seem easy – sometimes just checking a box.

- Post-Claims Underwriting Risk: A major concern. Banks often perform full underwriting after a claim is submitted. You could pay premiums for years, only for your family to find the claim denied due to medical history discovered after the fact, leaving them unprotected when they need it most.

Personal Term Life Insurance: Your Option

This is a policy you purchase independently from an insurance company.

- Who it Protects: It protects your chosen beneficiaries.

- Control & Flexibility: Beneficiaries receive the full, level death benefit tax-free. They decide how best to use the funds – pay off the mortgage, cover debts, replace income, invest, handle final expenses, or even make charitable donations.

- Coverage Amount: You choose the coverage amount, which can be higher than the mortgage balance to cover other family needs or goals.

- Level Benefit, Level Cost: Typically offers a level death benefit for a level premium guaranteed for the term (e.g., 10, 20, 30 years).

- Portability: Belongs to you and stays with you, regardless of your mortgage lender or whether you move.

- Upfront Underwriting: Insurance companies underwrite before issuing the policy. This provides certainty – once approved, you know you are covered. (Digital tools and AI-assistance are making this process faster and more convenient than traditional paper applications).

- The Conversion Privilege: Most include the vital right to convert to a permanent policy later, without new medical exams.

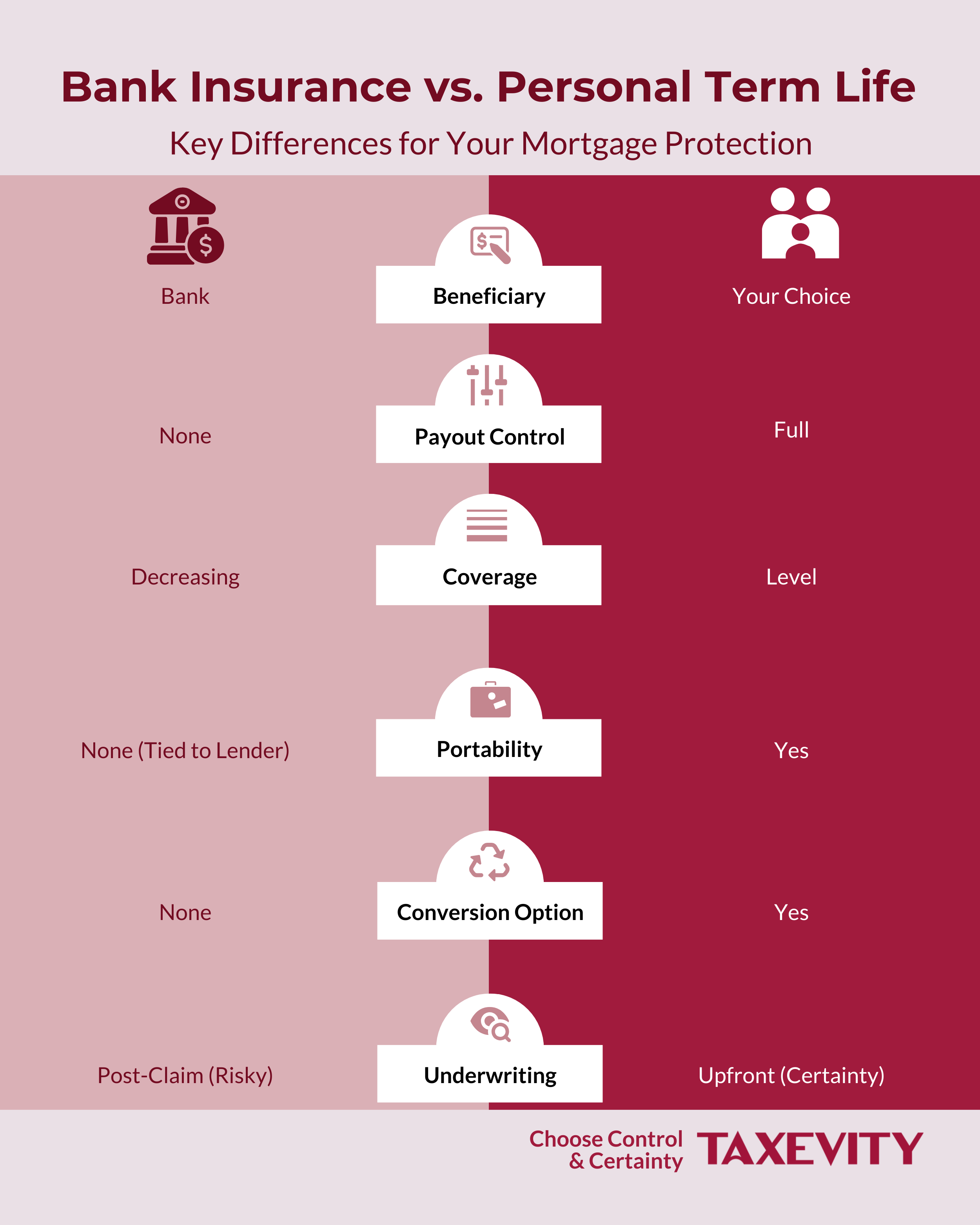

Key Differences at a Glance

| Feature | Bank Creditor Insurance | Personal Term Life Insurance |

| Type | Mortgage Protection (Creditor) | Personal Life Insurance |

| Beneficiary | The Lender | Your chosen beneficiaries |

| Payout Control | None (goes directly to lender) | Full control by beneficiaries |

| Coverage Amount | Decreases as mortgage is paid | Stays level (amount chosen by you) |

| Premium Value | Often pays the same for less coverage | Level premium for level coverage |

| Portability | Tied to the lender/mortgage | Independent, stays with you |

| Conversion | Typically no option | Usually convertible to permanent policy |

| Underwriting | Often Post-Claim (Risk of denial) | Upfront (Provides certainty) |

The Critical Difference: Why Conversion Matters

The conversion option provides invaluable future flexibility. While term insurance covers temporary needs (like a mortgage), your goals may evolve towards maximizing after-tax wealth, estate planning, or philanthropy. Permanent life insurance serves these longer-term goals. The conversion privilege contractually guarantees your ability to secure permanent coverage later, based on your original health, regardless of future health changes. It keeps your options open for the different financial person you’ll become decades from now.

Beyond Death: Protecting Your Income (Disability & Critical Illness Insurance)

Remember, a disability or critical illness can halt your income.

- Disability Insurance (DI): Replaces income if you can’t work.

- Critical Illness Insurance (CII): Provides a lump sum upon diagnosis of a covered condition for expenses during recovery.

These coverages address the more probable risks and are essential parts of your safety net.

What About Singles?

Insurance remains relevant:

- Disability Insurance & Critical Illness Insurance: Protects your income.

- Life Insurance: Can cover debts (including the mortgage), final expenses, leave an inheritance to family or friends, or lock in future insurability via conversion.

Insurance is Not Just About Price

Don’t shop on price alone. Consider intangibles:

- Quality: Carrier financial strength.

- Flexibility: Features like conversion, guarantees.

- Value: Right features for the premium.

Often, higher quality doesn’t cost much more but offers greater peace of mind.

Where Should You Get Insurance Advice?

You can get insurance online directly from an insurer but if something goes wrong, who’s your advocate? You can get price quotes from a comparison site that shops the market, but what about personalized attention?

At Taxevity Insurance, we’re an independent family team. We only offer products from a small group of carefully-selected insurers.

Take Control of Your Protection

For mortgage protection life insurance, personal term policies generally offer superior value, control, flexibility, and certainty compared to bank creditor insurance. Also, ensure your income is protected with adequate Disability and Critical Illness insurance. Take control with personalized, independent advice. Contact Taxevity today.