Key Question for Physicians

As a physician, you can use your Medical Professional Corporation (MPC) to borrow for your practice or for investments. How do you ensure the interest on those loans is tax-deductible?

- The “Purpose Test”: For the loan interest to be deductible, your MPC must use the borrowed funds to earn taxable income. This can be from your medical practice or from an investment portfolio that’s expected to produce dividends or interest, not just capital gains.

- A Clear “Paper Trail”: You must be able to clearly show the CRA where the borrowed money went. The best practice is to use a separate bank account for the loan funds to create a direct link to the practice expense or investment purchase.

- Connect to Your Overall Plan: Understanding interest deductibility is crucial when considering advanced strategies. For example, in an Immediate Financing Arrangement (IFA), the deductibility of interest is key to offsetting passive income that could otherwise affect your Small Business Deduction (SBD).

As an incorporated physician in Canada, you navigate a unique financial landscape. Your Medical Professional Corporation (MPC) is the structure through which you practice medicine and a powerful vehicle for financial planning, wealth accumulation, and achieving your long-term goals. If your MPC is considering or already using borrowed funds—whether for practice expansion, equipment purchases, or building an investment portfolio—understanding the tax deductibility of loan interest is key.

This Companion is designed to help you understand the key Canadian income tax rules that determine when interest paid by your MPC can be deducted, thereby reducing its taxable income. We aim to clarify these often-complex rules so you can make informed strategic decisions and have productive discussions with your specialized advisors.

While this guide offers insights as of mid-2025, tax laws are dynamic. For advice tailored to your specific MPC and personal financial situation, do consult with your accountant and independent wealth advisor. At Taxevity, our goal is to empower you with knowledge to enhance your corporation’s financial protection, foster sustainable growth, and expand your capacity for future impact.

Page Contents

- 1 Corporate Borrowing for Your MPC: Practice vs. Portfolio Investments

- 2 Interest Deductibility for Your MPC: The Core Rules

- 3 Key Tax & Financial Considerations for Incorporated Physicians

- 3.1 A. Managing Passive Income & the Small Business Deduction (SBD)

- 3.2 B. Corporate-Owned Life Insurance (COLI) in Your MPC

- 3.3 C. Shareholder Loans and Personal Guarantees

- 3.4 D. Holding Companies for Physicians

- 3.5 E. Excessive Interest and Financing Expenses Limitation (EIFEL)

- 3.6 F. Meticulous Record-Keeping: Non-Negotiable

- 4 Your Advisory Team of Specialists: A Collaborative Approach

- 5 Smart Borrowing for a Thriving Practice and Secure Future

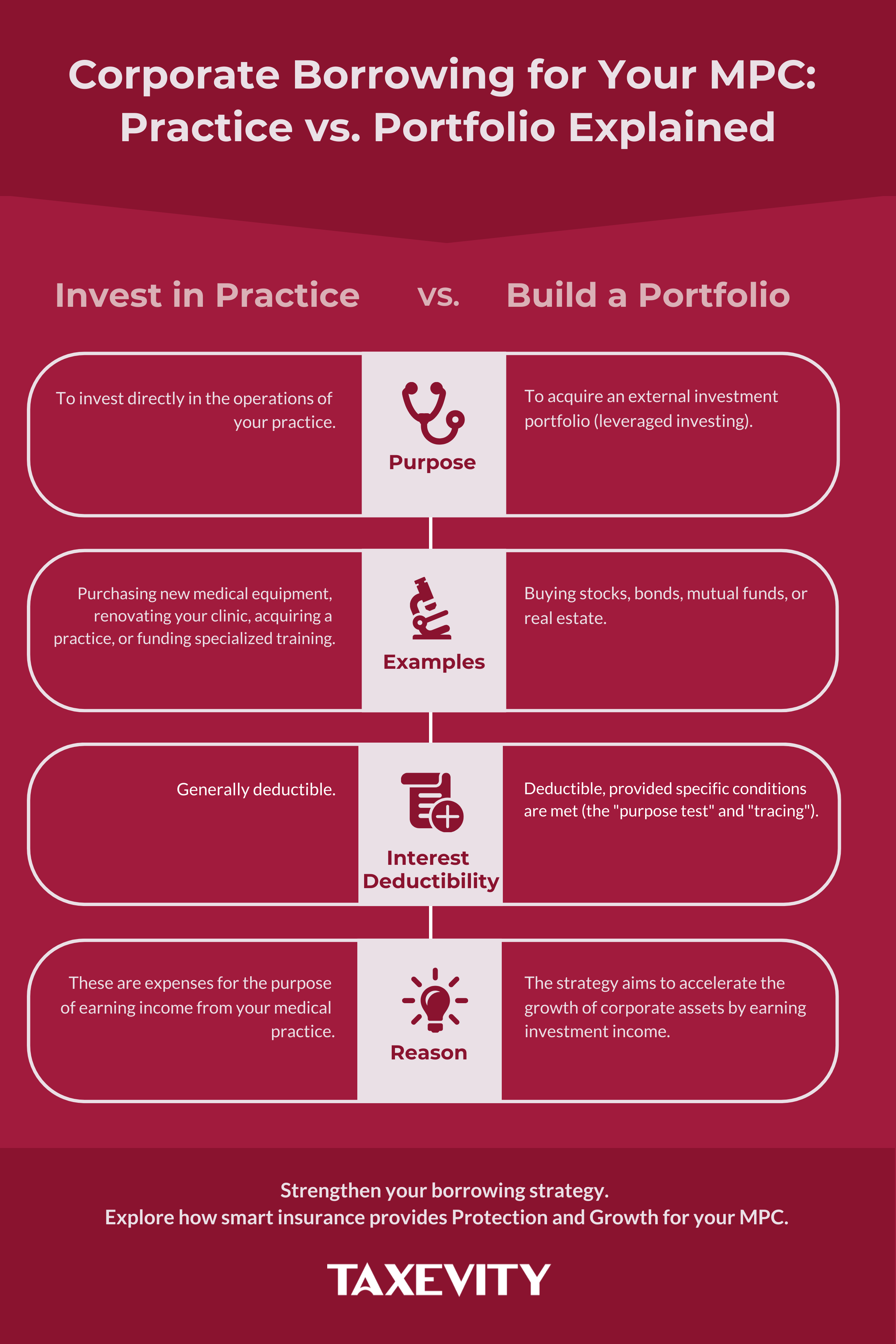

Corporate Borrowing for Your MPC: Practice vs. Portfolio Investments

When your medical professional corporation borrows money, the Canada Revenue Agency (CRA) looks at how those funds are used to determine if the interest paid on the loan is tax-deductible.

- Investing in Your Medical Practice: If your MPC borrows to invest directly in its operations—for example, to purchase new medical equipment, renovate or expand your clinic, acquire a practice, or fund specialized training—the interest on such loans is generally deductible. This is because these expenditures are made for the purpose of earning income from your medical practice.

- Building an Investment Portfolio (Leveraged Investing): Your MPC can also borrow to acquire an external investment portfolio (e.g., stocks, bonds, mutual funds, real estate). This strategy, known as leveraged investing, aims to accelerate the growth of your corporate assets. The interest on these loans can also be deductible, provided specific conditions, detailed below, are met.

A. The Dynamics of Leverage: Amplifying Opportunities and Risks

Using borrowed funds (leverage) allows your MPC to control a larger asset base. If these investments perform well, returns are magnified. However, leverage also amplifies risk. If investments underperform, losses are magnified, and your MPC remains obligated to repay the loan plus interest, potentially impacting its financial protection. A clear understanding of this risk-reward dynamic is crucial before your MPC takes on debt for investment purposes.

Interest Deductibility for Your MPC: The Core Rules

For the interest your MPC pays on a loan to be tax-deductible, the borrowed money must be used for the purpose of earning income from a business (your medical practice) or property (investments). This is often called the “purpose test” under paragraph 20(1)(c) of Canada’s Income Tax Act.

A. The “Purpose Test”: Earning Taxable Income is Essential

- Reasonable Expectation of Income: Your MPC must demonstrate that, at the time an investment is made with borrowed funds, there’s a reasonable expectation that this investment will generate taxable income (e.g., interest, dividends from shares, or rental income).

- Capital Gains are Secondary (for this test): An expectation of only earning capital gains (selling an investment for more than its cost) is generally not sufficient to meet the “purpose test” for interest deductibility. The investment must have the potential to produce an ongoing, taxable income stream.

- Sufficiency of Income: The actual amount of taxable income earned doesn’t necessarily need to exceed the interest expense for the interest to be deductible. A reasonable expectation of some taxable income is usually sufficient.

- CRA’s View on Common Shares: If your MPC invests in common shares that don’t currently pay dividends, the CRA generally permits interest deduction if the investee corporation’s dividend policy is unstated or indicates dividends might be paid in the future. If a company explicitly states it will not pay dividends, deductibility is unlikely.

B. Tracing the Use of Borrowed Funds: A Clear Path is Necessary

Your MPC must be able to clearly show the CRA how the borrowed money was used. This is “tracing”.

- Direct Link: The best approach is to demonstrate a direct link from the borrowed funds to the specific income-earning use (e.g., loan funds deposited into the MPC’s bank account and then used immediately to purchase new clinic equipment or a portfolio of dividend-paying stocks).

- Separate Accounts: It is often recommended that your MPC use a separate bank account and investment account for borrowed funds and the investments acquired with them. This avoids mixing (commingling) these funds with other corporate revenues or personal funds, which can significantly complicate tracing.

- Current Use Matters: Interest deductibility is determined by the current use of the borrowed money. If your MPC changes the use of the funds from an eligible income-earning purpose to an ineligible one, the interest may cease to be deductible from that point forward.

C. Other Key Conditions for Deductibility

- Legal Obligation: Your MPC must have a legal obligation to pay the interest (which is almost always the case).

- Reasonableness: The amount of interest charged must be reasonable, generally reflecting fair market rates.

Key Tax & Financial Considerations for Incorporated Physicians

Protecting your Small Business Deduction requires managing your investment income effectively. Earning too much can result in a higher corporate tax rate.

A. Managing Passive Income & the Small Business Deduction (SBD)

As an incorporated physician, your MPC likely benefits from the Small Business Deduction (SBD), which offers a lower tax rate on active business income up to a certain limit (typically $500,000 federally). However, if your MPC (along with any associated corporations) earns too much “Adjusted Aggregate Investment Income” (AAII) – which includes most passive income like interest and dividends from a corporate investment portfolio – your SBD limit can be reduced or “ground down” if you earn over $50,000 of AAII in a year. $5 of SBD limit is removed per $1 of AAII over that $50,000 threshold. If you earn $150,000 of AAII, you would have no SBD left, and all of the income your MPC earns would be taxed at the highest rate.

B. Corporate-Owned Life Insurance (COLI) in Your MPC

COLI can play several roles in an incorporated physician’s financial plan, including providing collateral for investment loans. Strategies like an Immediate Financing Arrangement (IFA) often utilize COLI; in an IFA, the policy’s cash value is the collateral for a loan, providing funds for your MPC to invest. The policy’s death benefit can later repay the loan without requiring the sale of assets, all while the cash value may have continued to grow on a tax-sheltered basis.

- COLI as Collateral: If your MPC uses a COLI policy as collateral for an investment loan, the deductibility of the loan interest still depends on the “purpose test” – the borrowed funds must be used by the MPC to earn income (e.g., to invest in an external portfolio or in your practice). The COLI itself being collateral doesn’t automatically make the interest deductible.

- Interest to Acquire COLI: If your MPC borrows money specifically to pay the premiums on a COLI policy, that interest is generally not deductible under the main interest deductibility rule (paragraph 20(1)(c)(i)).

- Potential for Limited Premium Deduction (ITA 20(1)(e.2)): In specific situations where COLI is assigned as collateral to a qualifying financial institution for a loan whose interest is otherwise deductible (because the loan was for an eligible income-earning purpose), a portion of the policy’s Net Cost of Pure Insurance (NCPI) may be deductible by the MPC. This is a separate, complex rule.

- COLI for Estate Planning & CDA: The death benefit from a COLI policy is received tax-free by the corporation and can create a significant credit to the Capital Dividend Account (CDA), allowing for tax-free distributions to shareholders (your estate or beneficiaries). This can be invaluable for estate protection and efficiently transferring wealth.

- Loans from MPC to You (Shareholder): If your MPC borrows funds and then lends them to you for personal use, the interest the MPC pays on its loan is generally not deductible.

- Personal Guarantees: Lenders may require a personal guarantee from the physician shareholder for an MPC loan. Be fully aware of the personal financial risk this entails if the MPC defaults.

D. Holding Companies for Physicians

Typically, your MPC (the operating company or “Opco”) earns active business income from your medical practice. The MPC can then pay dividends (often tax-free intercorporate dividends) to a Holdco that you, the physician (or perhaps a family trust), own. The Holdco then holds and manages investments. If the Holdco borrows for its investment activities, the same interest deductibility rules discussed here would apply to the Holdco. This structure can offer enhanced creditor protection for investment assets, shielding them from the potential liabilities of the medical practice, and can also be a tool for income splitting (subject to rules like the Tax on Split Income – TOSI) and estate planning.

E. Excessive Interest and Financing Expenses Limitation (EIFEL)

Most medical professional corporations are CCPCs and are unlikely to be affected by the EIFEL rules, which can limit interest deductibility for larger or more complex corporate structures. Key exemptions typically apply to CCPCs with less than $50 million in taxable capital in Canada or those with net group interest expenses under $1 million. However, if your corporate structure is unusually large or complex, a discussion with your accountant about EIFEL is prudent.

F. Meticulous Record-Keeping: Non-Negotiable

To support any interest deduction claims, your MPC must maintain flawless records:

- Loan agreements.

- Bank and brokerage statements clearly tracing the flow of borrowed funds to the specific income-earning use (practice asset or investment).

- Investment purchase confirmations.

- Corporate resolutions authorizing borrowing and investment strategies.

- Records of all income earned from the investments or practice assets acquired with borrowed funds.

Your Advisory Team of Specialists: A Collaborative Approach

Successfully implementing and managing leveraged strategies within your MPC requires coordinated advice from professionals who understand the specific needs of incorporated physicians:

- Your Accountant (CPA): Crucial for tax advice on interest deductibility tailored to your MPC, managing AAII and SBD implications, EIFEL considerations, and ensuring CRA compliance. For a detailed technical perspective you can share, see our Accountant Companion: Navigating Interest Deductibility for Investment Loans.

- Your Wealth Advisor: Will help align investment strategies with your MPC’s risk tolerance and financial goals, select suitable income-earning investments, and integrate these plans with your personal wealth objectives. For general principles of interest deductibility often discussed with wealth advisors, see our Wealth Advisor Companion: Charting Interest Deductibility for Leveraged Investing.

- Your Insurance Professional (Taxevity can guide you through these specialized strategies): Essential if COLI is part of your strategy for collateral (as in an Immediate Financing Arrangement), risk management, estate planning (enhancing your financial protection and legacy impact), or as part of an Insured Retirement Plan.

- Your Lender: For structuring appropriate loan facilities for your MPC.

- Legal Counsel: To review loan agreements, and shareholder agreements, and advise on corporate structuring for your MPC.

Smart Borrowing for a Thriving Practice and Secure Future

For an incorporated physician, smartly using corporate borrowing can be a powerful tool for both practice growth and wealth accumulation through your MPC. The ability to deduct interest on these loans is a key tax efficiency that can significantly enhance the financial benefits.

However, achieving and maintaining this deductibility requires careful attention to the “purpose test,” meticulous tracing of funds, robust record-keeping, and an understanding of how these strategies interact with other corporate tax rules like the SBD grind.

This Physician’s Companion provides a focused overview. The optimal approach for your MPC will depend on its unique circumstances and your personal financial goals. Engage in detailed discussions with your team of independent specialists, including your family team at Taxevity for insurance-related strategies. Together, we can help you navigate the rules, manage risks, and implement a compliant and effective plan that supports your long-term objectives for financial protection, practice success, investment growth, and lasting impact. To get started, contact us.