(Part of the IFA Master Curriculum)

Key Question for Accountants

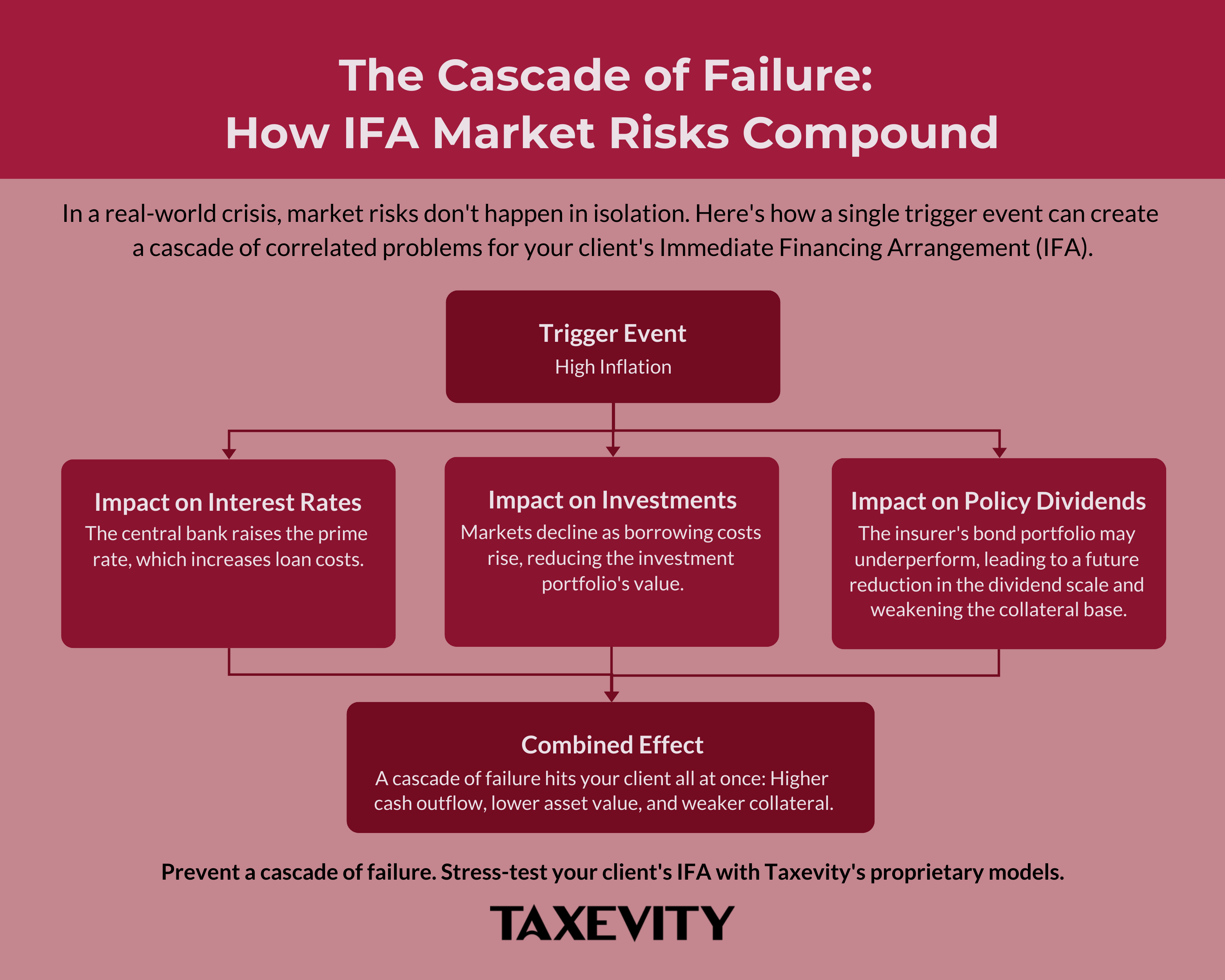

Standard IFA illustrations often show risks in isolation. As an accountant performing due diligence, how do you analyze the “cascade of failure” where seemingly separate risks become dangerously correlated, such as the market risks of rising interest rates, poor investment returns, and changing policy dividends?

- The Negative Spread: The first layer of risk is rising interest rates on the variable-rate loan cause the after-tax cost of borrowing to exceed the after-tax return from the leveraged investment portfolio.

- The Weakening Collateral: Simultaneously, a reduction in the insurer’s non-guaranteed dividend scale can slow the growth of the policy’s cash value. This weakens the collateral base securing the loan, increasing the risk of a collateral call from the lender.

- The Correlated Cascade: In a real-world crisis, these risks are linked. A single trigger event, like high inflation, can create a cascade where higher loan costs, lower investment values, and a weaker collateral base hit your client all at once, making multi-variable stress-testing essential.

This article is Part 3 of our IFA Risk Management Deep Dive Series.

Part 1: A Foundational Guide to IFA Risk Management for Accountants

Part 2: Flawed IFA Structuring: An Accountant’s Guide to Foundational Risks

Once an IFA is properly structured for a suitable client, it becomes exposed to the unpredictable realities of financial markets. The static, linear projections in sales illustrations can create a false sense of security, failing to capture the real-world volatility that can destabilize the arrangement over its multi-decade lifespan.

As the accountant, your role in risk management extends to helping your client understand these external market risks and how to prepare for them. The key is to move beyond viewing each risk in isolation and instead analyze how they can become dangerously correlated in a crisis.

This guide explores the three primary market risks—interest rates, investment performance, and policy dividends—and explains why stress-testing their combined impact is essential.

Page Contents

1. Interest Rate Risk: The Variable Rate Sword

The loan component of an IFA is almost universally structured with a variable interest rate, typically priced as the lender’s Prime Rate plus a spread. This direct link to the prevailing interest rate environment makes the strategy highly vulnerable to monetary policy shifts and inflationary cycles.

- The Pitfall: Rising Interest Rates. If the prime rate rises significantly, the cost of servicing the loan can escalate dramatically.

2. Investment Performance Risk: The Leverage Effect

Leverage provides the potential for amplified gains, but it also creates the risk of magnified losses. The ultimate success of the IFA is therefore contingent on the performance of the assets purchased with the borrowed funds.

- The Pitfall: Underperformance. The client bears 100% of the investment downside. A prolonged market downturn or a poor investment choice can lead to a temporary or permanent depletion of capital, since the client must continue to service the loan. It’s important to remember that the loan is secured by the stable, non-depreciating cash value of the whole life policy, which is a key advantage of this diversified strategy. However, the investment portfolio itself is at risk. This risk is particularly acute if the borrowed funds are invested in a single, concentrated position (such as the client’s own business) rather than a diversified portfolio. The client must have the financial capacity to service the loan interest from external sources, without relying on the investments to pay for their own financing.

3. Policy Performance Risk: The Dividend Scale Variable

The life insurance policy at the heart of the IFA is not a static asset. The growth of its cash surrender value (CSV), which forms the collateral base, is dependent on the annual dividend scale declared by the life insurance company. These dividends are not guaranteed.

- The Pitfall: A Slowdown in CSV Growth. A reduction in the insurer’s dividend scale has a direct and detrimental impact on the health of the IFA. It creates two significant problems:

- Jeopardizing the “Premium Offset”: Many long-term IFA illustrations assume that after an initial period, policy dividends will become large enough to cover the annual premium payments internally. A dividend scale reduction can delay this “offset” point by many years, or prevent it from ever being reached, forcing the client to pay premiums out-of-pocket for much longer than anticipated.

- Weakening the Collateral Base: Slower CSV growth means less additional collateral is generated each year which decreases how much leveraged cash is available to invest. With the power of compounding becoming most powerful in the final years, any delay can materially affect projected performance.

In a real-world economic crisis, these three market risks rarely occur in isolation. Instead, they can become dangerously correlated. The table below illustrates how a single event can create a cascade of negative outcomes.

| Trigger Event | Impact on Interest Rates | Impact on Investments | Impact on Policy Dividends | Combined Effect on IFA |

| High Inflation | Central bank raises prime rate, increasing loan costs. | Markets decline as borrowing costs rise, reducing portfolio value. | Insurer’s bond portfolio may underperform, leading to a future reduction in the dividend scale. | A Cascade of Failure: Higher cash outflow, lower asset value, and weaker collateral, all at once. |

A robust due diligence process demands a multi-variable stress test that models the combined impact of these correlated risks. By asking, “What happens if interest rates rise by 2% while the market is down 20% and the dividend scale is cut by 1%?”, you can help your client understand the strategy’s resilience. While adverse conditions are unlikely to be permanent, the structure must be robust enough to survive these periods of stress until a market correction occurs.

Conclusion: The Mandate for Multi-Variable Stress-Testing

To properly advise a client, look beyond the standard, single-variable sensitivity analysis provided in projections using generic tools. A responsible analysis models the combined impact of these correlated risks.

At Taxevity, we use our own internally-developed models to provide this deeper level of insight. If you are reviewing an IFA proposal that lacks this multi-variable stress test, we can model these scenarios for you using the specifics of that proposal until you are satisfied. This allows you to provide your client with a clear-eyed view of their capacity to withstand a realistic worst-case scenario. We invite you to contact us.

Next in This Series: Deconstructing IFA Lender and Credit Risk