(Part of the IFA Master Curriculum)

Key Question for Business Owners

Your business is successful, but is its value trapped on a corporate balance sheet? How can you access your hard-earned wealth for your family’s future without facing a massive tax bill?

- A Strategy with a Powerful Secondary Benefit: While the foundational purpose of corporate-owned life insurance is for protection, implementing a sophisticated strategy called an Immediate Financing Arrangement (IFA) provides a powerful secondary benefit: a key to unlock the wealth trapped in your company.

- How It Works: This strategy uses a corporately-owned insurance policy as collateral for a loan immediately after purchase, which restores the cash flow used to pay the premiums to your business. Upon your passing, this structure creates an IFA-Enhanced Capital Dividend Account (CDA) Credit, providing significant tax-free withdrawal capacity from your corporation, as well as tax-free funds from the life insurance death benefit.

- What It Achieves: This surplus of tax-free funds can then be paid out of the company to your estate, providing the capital needed to fund your succession plan, secure your family’s future, or ensure your children receive a fair inheritance.

As a successful business owner, you’ve poured years into building your company’s value. That value is reflected in your corporation’s retained earnings—a number on a balance sheet that represents your success. But there’s a frustrating catch: that wealth is often trapped. Taking a large sum out for yourself could mean paying a massive personal tax bill, and it can feel like your success is locked away from you .

For many business owners, corporate-owned life insurance is a cornerstone of financial planning, providing essential protection for succession plans and other estate needs. Beyond this primary protective role, the policy can become the key to unlocking your trapped wealth when used within a sophisticated strategy called an Immediate Financing Arrangement (IFA).

An IFA is a formal loan arrangement where your company uses a life insurance policy on you as collateral, a process which restores cash flow that would have been tied up in premiums back to your business . When structured correctly, this strategy leads to an IFA-Enhanced Capital Dividend Account (CDA) Credit at death—a powerful tool that creates a way for your family to access your hard-earned corporate wealth completely tax-free.

Page Contents

The CDA: Your Corporation’s Tax-Free Withdrawal Account

Think of your company’s Capital Dividend Account (CDA) as a special tax-free withdrawal account. When your company sells an asset for a capital gain, or when it receives a life insurance payout, a credit is added to this account. You can distribute money from this account to yourself personally as capital dividends without paying any personal tax.

The problem? You need cash in the corporation to make the withdrawal. For most growing businesses, that cash is already working.

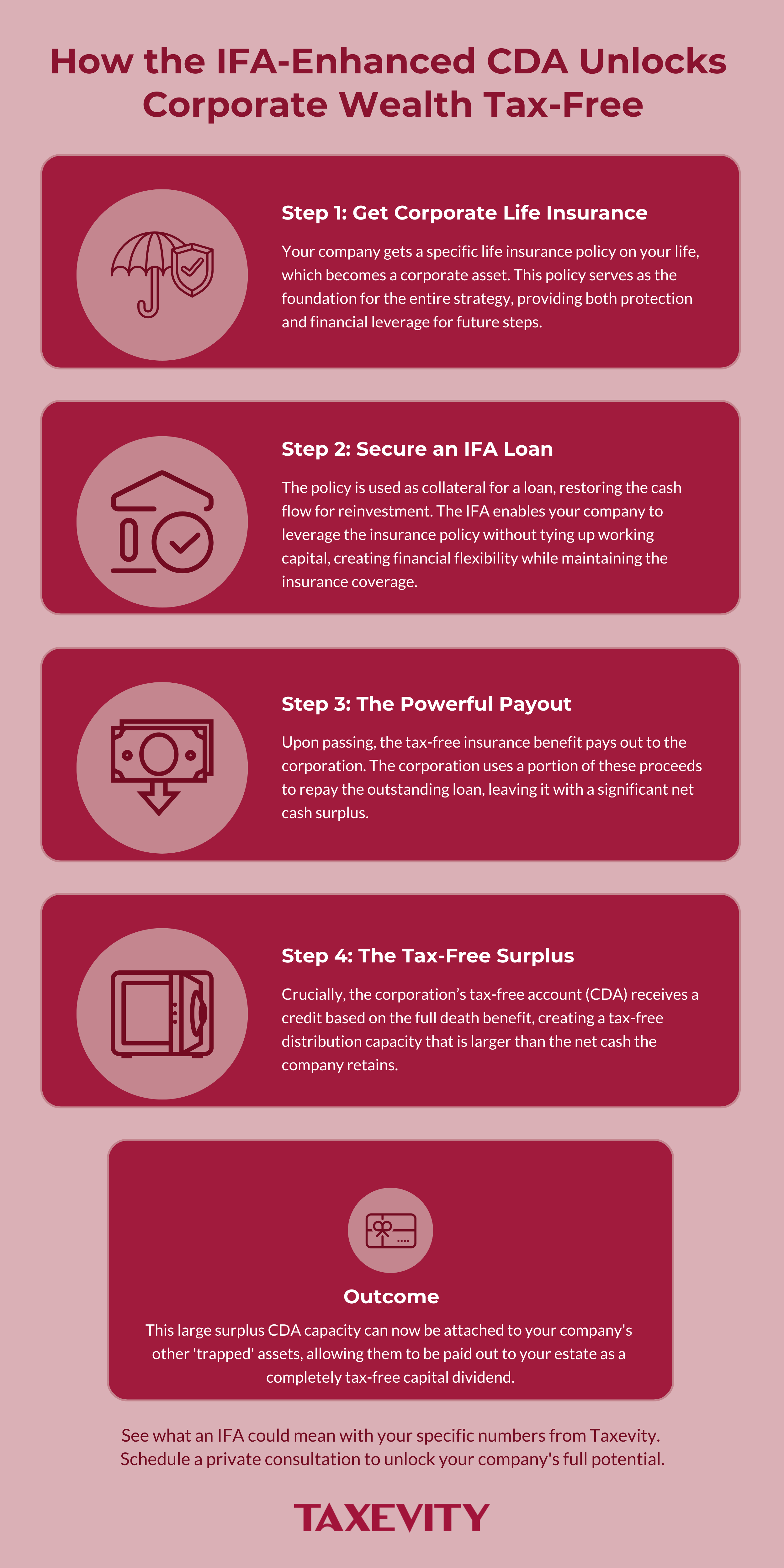

How the IFA-Enhanced CDA Unlocks the Door

The IFA-enhanced CDA strategy provides the liquidity to solve this problem. Here’s how it works in simple terms:

- Your company gets a specific type of life insurance policy, typically on your life. This is a corporate asset that builds value over time.

- It uses the policy as collateral for a loan. This is the Immediate Financing Arrangement (IFA). An IFA isn’t just any loan; it’s a formal arrangement with a major financial institution that uses your corporate life insurance as security. The loan restores the corporation’s cash flow, which is then used to invest and generate further income, a key requirement of the strategy.

- The loan generates tax deductions. With the IFA strategy, the loan is used to invest in something that generates income generally a tweaked traditional portfolio or your own business. This makes the loan interest tax-deductible and part of the premium for the life insurance policy can become tax-deductible too.

- Upon your passing, a powerful transaction occurs. The insurance pays out to the corporation, which repays the loan. Because of how tax laws work, the corporation’s CDA account gets a credit that is much larger than the net cash it receives.

To illustrate, consider this example:

- Life Insurance Death Benefit: $4,000,000

- Outstanding IFA Loan Balance: $2,000,000

- Policy’s Adjusted Cost Basis (ACB): $300,000

Financial & Tax Consequences:

- Net Cash Inflow: The corporation receives $4,000,000, repays the $2,000,000 loan, and is left with $2,000,000 in net cash.

- CDA Credit Created: The CDA is credited with $4,000,000 (Death Benefit) minus $300,000 (ACB), for a total credit of $3,700,000.

The corporation now has $2,000,000 in cash and a $3,700,000 tax-free distribution capacity. After distributing the $2M from the death benefit tax-free, it is left with a Surplus CDA Capacity of $1,700,000. This surplus can now be used for the corporation’s other “trapped” assets, allowing them to be paid out to the estate as a completely tax-free capital dividend.

What This Means for You and Your Family

This is a powerful financial tool for achieving your biggest goals:

- Fund Your Future: Access significant capital from your business for personal investments or retirement without a massive tax bill.

- Secure Your Succession Plan: Provide the cash needed for the next generation or your business partners to take over the business smoothly, without having to sell off company assets.

- Equalize Your Estate: Ensure your children receive their inheritance fairly, even if some are involved in the business and others are not. The tax-free cash can balance the distribution of assets.

Is This Right for Your Business?

The IFA-enhanced CDA is a sophisticated, long-term strategy for established corporations with strong cash flow. It involves leverage and complexity, and it requires a coordinated team of independent niche specialists to implement correctly.

It’s also important to understand the scale of this strategy. Because IFAs involve major lenders and significant life insurance policies, they typically require a minimum annual premium of $50,000 to $100,000, often for 10 years or more.

If you’re a business owner with insurance needs who sees your wealth growing on paper but feels like you can’t access it, an IFA could be the key you’ve been seeking.

To learn more, you can read our general overview of IFAs. For a complete technical breakdown, we recommend directing your accountant to our foundational guide on the topic.

When you’re ready to explore if the IFA-enhanced CDA strategy can help you unlock your corporate wealth, schedule a private consultation.