Key Question for Wealth Advisors

Your clients expect a strong IRR from the portfolios you manage. But when it comes to permanent life insurance, is IRR the right metric, or does its true value lie in the strategic advantages that traditional investments can’t offer?

- Protection (Solving the Liquidity Problem): The primary value of life insurance is often providing guaranteed, tax-free liquidity exactly when it’s needed to pay estate taxes. This prevents the forced sale of the very assets you manage for your client, especially during a down market .

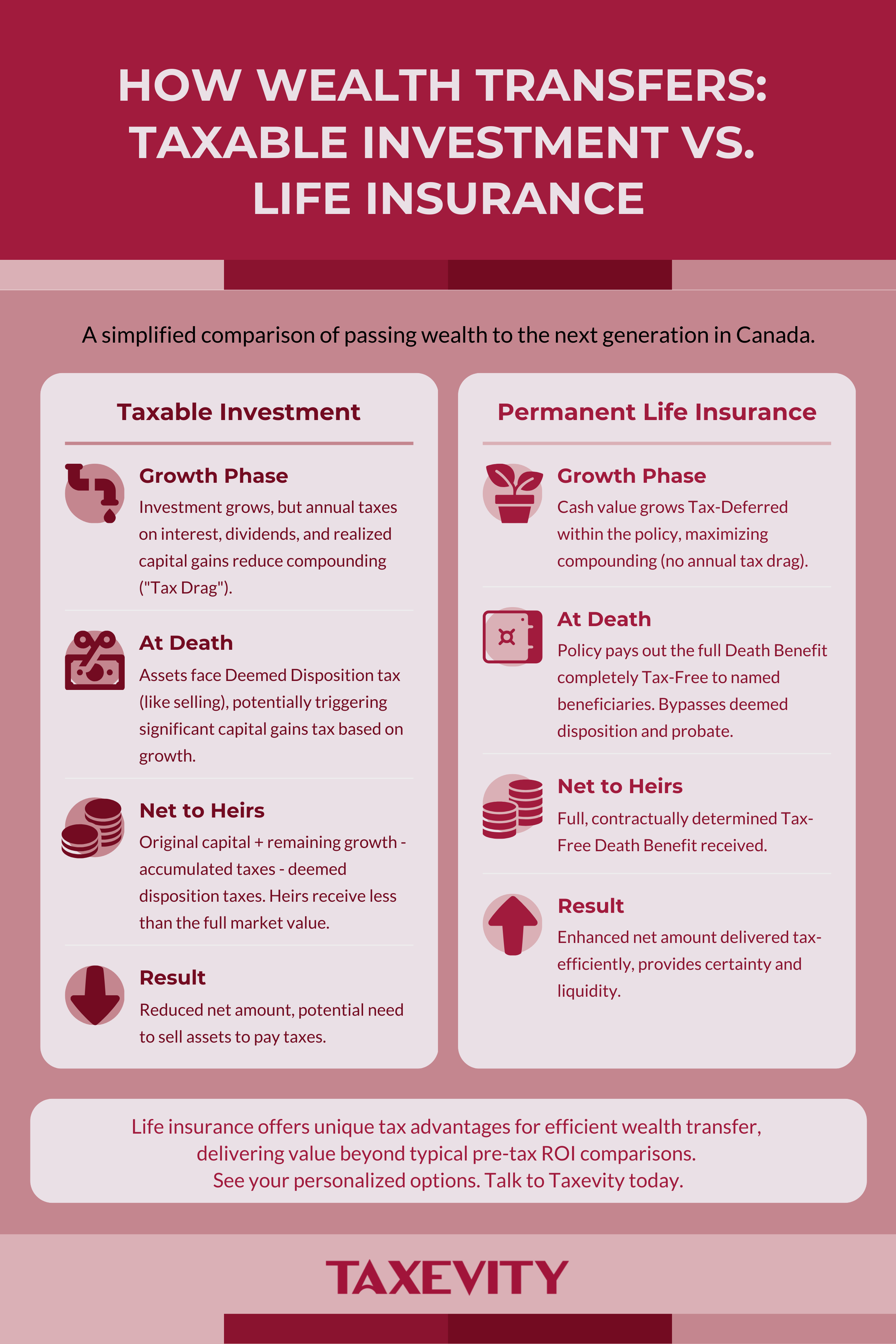

- Growth (Generating “Tax Alpha”): While a policy’s IRR may differ from equities, its true growth power comes from tax alpha. The combination of tax-deferred internal growth and an entirely tax-free death benefit results in a higher after-tax transfer of wealth to the next generation.

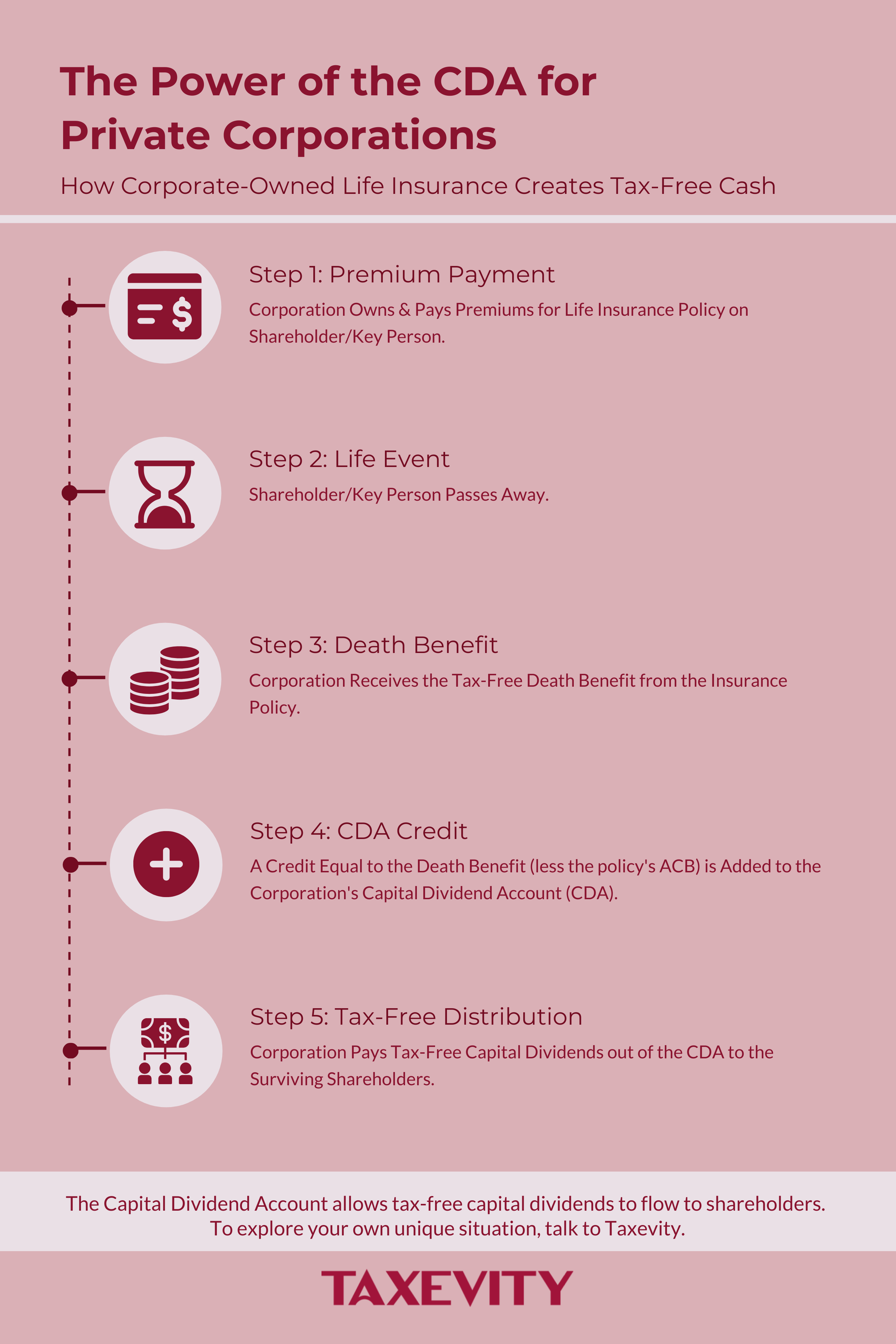

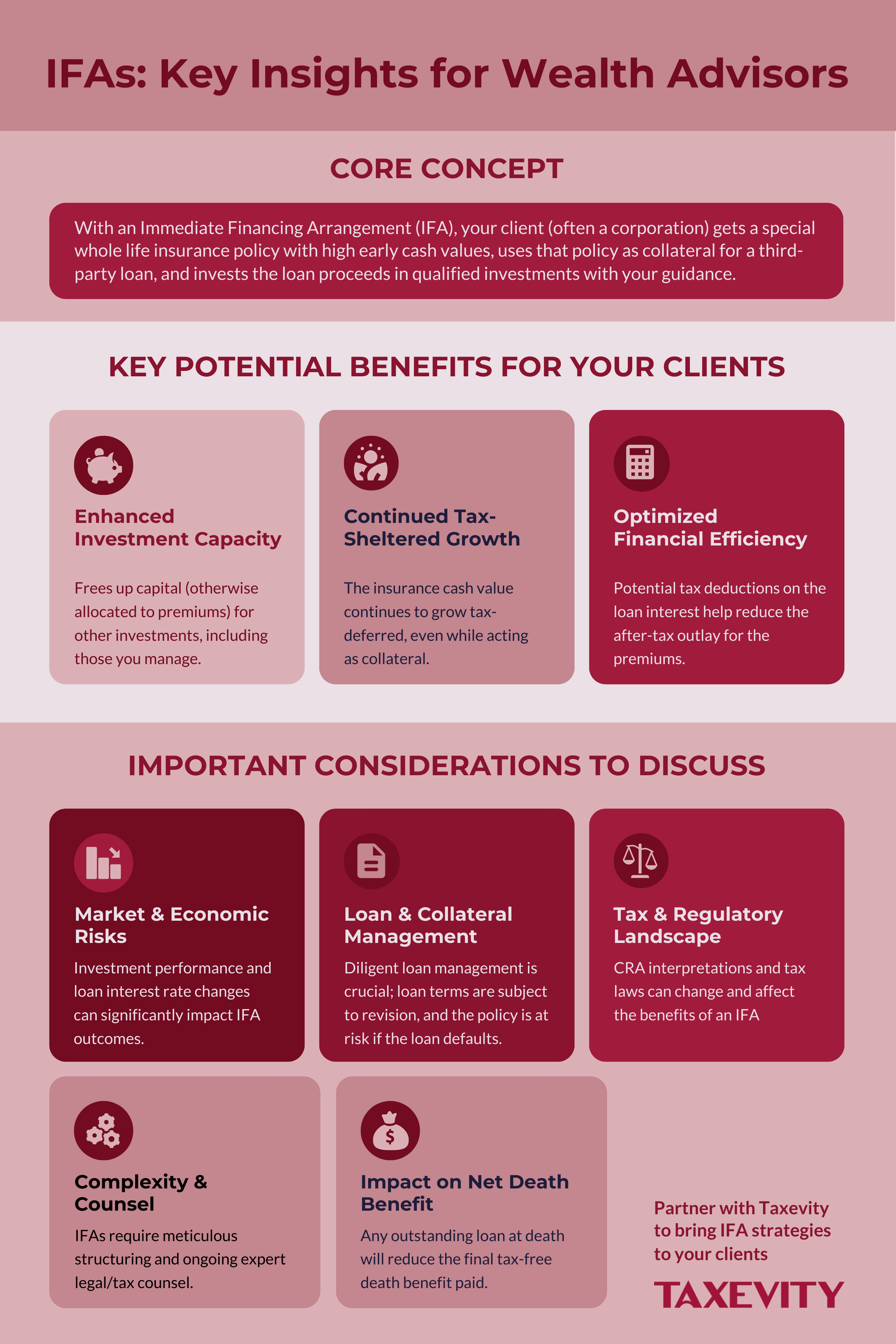

- Corporate & Advanced Strategies: For business owner clients, corporate-owned life insurance unlocks the power of the Capital Dividend Account (CDA) for tax-free wealth extraction. Furthermore, advanced strategies like an Immediate Financing Arrangement (IFA) can be used to leverage the policy to create even greater investment capacity.

As a trusted Wealth Advisor, you’re constantly evaluating financial tools to best serve your clients. The question of “Return on Investment” is important since you have choices. When permanent life insurance enters the discussion, you and your clients may compare the projected growth against other investments as part of due diligence.

The conversation often gravitates towards the Internal Rate of Return (IRR). We know that in the event of an early death, the after-tax IRR of a permanent life insurance policy can be exceptionally high, delivering significant tax-free capital. Long-term planning shifts the focus. When modeling to life expectancy and beyond, a policy’s after-tax IRR often compares favourably to after-tax fixed-income returns. Yet, it might not initially appear to match the growth potential your clients seek from the broader investments you manage for them. This is a common objection, and a fair starting point for discussion.

Is a direct, pre-tax IRR comparison the full story, though? Does it inadvertently overlook the unique strategic advantages and the true net value that permanent life insurance can bring to a sophisticated wealth plan, especially in Canada? This post looks deeper, moving beyond simplistic ROI metrics to explore the multifaceted roles life insurance can play – addressing complex client situations and, in turn, enhancing your advisory practice.

Page Contents

- 1 Defining “True Net Value” in the Context of Life Insurance

- 2 Understanding the “Why”: The Regulatory Intent & Its Implications for Strategy

- 3 Reframing the Value: The Strategic Pillars (Protection, Growth, Impact)

- 4 Corporate Strategies: Unlocking Significant Value for Business Owner Clients

- 5 Advanced Strategy: Immediate Financing Arrangements (IFAs)

- 6 Life Insurance: A Complementary, Not Competitive, Tool in Your Toolkit

- 7 Partnering for Sophisticated Solutions

Defining “True Net Value” in the Context of Life Insurance

Before looking into specific strategies, let’s clarify the meaning of “true net value.” This concept encourages a holistic view, looking beyond headline growth rates to the actual, ultimate financial benefit received by your client or their beneficiaries after all relevant factors are considered. For life insurance, this includes:

- After-Tax Outcomes: The tax-free nature of the death benefit in Canada is important. Comparing this to investments where gains are taxed (either during life or at death via deemed disposition) is critical to understanding how much real value remains.

- Impact of Fees and Costs: While life insurance has premium costs, these are weighed against the benefits received and compared to other investment costs (e.g., MERs, trading fees).

- Probate Efficiency: Proceeds from a life insurance policy with a named beneficiary (other than the estate) bypass the estate administration process and associated probate fees, preserving more capital for heirs.

- Liquidity Benefits: Life insurance death benefits provide quick, tax-free cash. This avoids the potential “cost” of forced liquidation of other assets (e.g., selling at a discount in a down market) to cover taxes or other urgent estate needs.

- Certainty and Guarantees: The contractual guarantees in many permanent policies offer a level of financial certainty that market-based investments cannot, protecting overall net worth, especially in volatile times.

Understanding “true net value” allows you to guide your clients towards decisions that maximize what they or their estate ultimately receive and can use.

Understanding the “Why”: The Regulatory Intent & Its Implications for Strategy

Grounding our understanding in the Canadian regulatory landscape is essential. Tax law is intentionally structured for life insurance to serve primarily as a protective tool. The “exempt test” under the Income Tax Act ensures policies remain focused on insurance rather than morphing into pure investment vehicles. Rather than a limitation, this is a clarification of purpose: life insurance is designed differently and deserves to be evaluated differently.

Key Tax Rules & Their Strategic Significance for Your Clients (And Your Planning):

Understanding these rules isn’t just about compliance; it’s about identifying opportunities to help your clients:

- Accumulation Limits (MTAR): The Maximum Tax Actuarial Reserve (MTAR) limits the amount of tax-exempt savings that can accumulate within a policy, preventing its use for investing.

- Taxation of Lifetime Access: While the cash value within a policy grows tax-deferred, withdrawals above the policy’s Adjusted Cost Basis (ACB) are generally taxed as income. Policy loans are treated differently but can also have tax implications.

- Contribution Timing Rules (e.g., 250% Test): This “anti-dump-in” rule prevents large lump-sum contributions later in the policy’s life primarily for tax-sheltering purposes, a further difference from typical investment accounts.

The takeaway for advisors? Viewing life insurance through the same lens as a conventional investment misses its fundamental tax advantages and intended role in risk management and wealth transfer.

Reframing the Value: The Strategic Pillars (Protection, Growth, Impact)

If not just for ROI, then what is the value proposition for your clients? It centres on three pillars that address core HNW concerns:

1. PROTECTION: Delivering Certainty and Control in an Uncertain World

- Beyond the IRR – The Liquidity Argument: For HNW clients, a key concern is often estate liquidity. Life insurance provides a guaranteed tax-free cash sum precisely when needed to cover taxes (like the deemed disposition of registered assets or capital gains on a business/cottage), equalize an estate, or fund a buy-sell agreement. This avoids the forced sale of assets in potentially unfavourable market conditions – a value often lost in straight IRR comparisons.

- Advisor Consideration: How often do clients hold illiquid assets (private equity, real estate, a business) that could create significant tax liabilities at death? Life insurance could easily be the most cost-effective solution.

- The “Unmeasurable ROI” of Peace of Mind & Grandparenting: The certainty of a tax-free payout, governed by grandparenting rules (rules in effect when the policy is issued generally apply for life), offers rare stability against future tax changes. This is a powerful benefit in an ever-evolving financial landscape.

- Example: Your client’s estate faces a $1M tax bill. Markets are down 25%. Without insurance, they might need to liquidate $1.33M+ of investments (plus potential capital gains tax on that sale). With insurance, $1M is delivered tax-free, preserving the estate’s core assets. This is a scenario where your foresight in recommending insurance shines.

2. GROWTH: A Unique Tax-Advantaged Environment for Wealth Accumulation & Transfer

- The Tax Alpha Argument: While not aiming to beat the pre-tax returns of high-growth equities, the tax-deferred growth within a policy and the entirely tax-free death benefit create significant “tax alpha.” This is especially potent for intergenerational wealth transfer.

- Advisor Consideration: For clients in high tax brackets, the tax drag on non-registered investments can be substantial. Life insurance offers a compelling option for long-term wealth accumulation and transfer, improving the true net value to heirs.

- Addressing Cost Concerns: Yes, premiums are a “cost”, but what are your clients buying? Certainty, unparalleled tax advantages, a guaranteed payout, and potentially stable growth insulated from market volatility (especially with the smoothing in whole life). It’s about value, not just cost.

- Concept: Illustrate to your client the long-term difference between capital growing in a taxable non-registered account (eroded annually by taxes on interest, dividends, and capital gains, then subject to deemed disposition at death) versus accumulating tax-sheltered in an insurance policy and paid out entirely tax-free. The net amount to beneficiaries can be dramatically different.

3. IMPACT: Amplifying Philanthropic Goals & Legacy

- Leveraging for Legacy: Life insurance allows clients to make a significantly larger charitable gift than might be feasible from their existing capital base.

- Advisor Consideration: For charitably-inclined clients, this can be a powerful way to fulfill their philanthropic vision and create a lasting legacy, positioning you as an advisor who understands their holistic goals.

- Example: A client wishes to support their favourite charity significantly upon their passing and also manage a large anticipated estate tax liability. By naming the charity as a beneficiary for a portion of a life insurance policy’s death benefit (e.g., 5-10% of a multi-million dollar policy), they create a substantial future gift. This strategy can also provide a charitable donation tax credit to the estate, which can then be used to offset taxes payable on other assets, such as those arising from deemed disposition of RRSPs/RRIFs or capital gains.

Corporate Strategies: Unlocking Significant Value for Business Owner Clients

For your incorporated professional and business owner clients, life insurance offers unique advantages that are often misunderstood or overlooked:

- Buy-Sell Agreement Funding: Provides tax-free funds via the Capital Dividend Account (CDA) to facilitate a smooth and tax-efficient buyout of a deceased shareholder’s interest.

- Key Person Protection & Debt Coverage: Safeguards the business against the financial impact of losing a key individual.

- Tax-Efficient Access via Collateral Loans: Corporations can often borrow against policy cash values, providing access to capital for opportunities or needs without triggering personal tax on withdrawals.

- The Power of the CDA: The ability to flow the tax-free death benefit out to surviving shareholders as tax-free capital dividends is a cornerstone of corporate estate planning.

- Advisor Consideration: Are your business owner clients aware of how corporate-owned life insurance can solve critical succession and tax-efficiency challenges, far beyond what personal investments can achieve?

Advanced Strategy: Immediate Financing Arrangements (IFAs)

For clients seeking to maximize the utility of their insurance premiums and enhance their investment capacity, an Immediate Financing Arrangement (IFA) offers a sophisticated leveraging opportunity. This strategy is particularly relevant for high-net-worth individuals and their corporations.

Concept: An IFA involves acquiring a permanent life insurance policy (often corporately owned for HNW business owners) designed for high early cash surrender values (CSV). Simultaneously, a third-party loan is arranged, typically for up to 100% of the CSV, with the policy assigned as collateral. These loan proceeds are then available for the client or their corporation to deploy into other qualified investments, potentially generating higher returns than available within the policy itself.

Key Potential Benefits:

- Enhanced Investment Capacity: Frees up capital that would otherwise be tied to insurance premiums, allowing for diversified investments that can generate taxable income and potentially higher overall returns.

- Continued Tax-Sheltered Policy Growth: The cash value within the life insurance policy continues to grow on a tax-deferred basis, even while it serves as collateral for the loan, creating a dual-asset growth opportunity.

- Optimized Cash Flow & Tax Efficiency: If structured correctly to meet CRA guidelines, the interest paid on the IFA loan may be tax-deductible for the corporation or individual (depending on the use of funds). This, combined with returns from external investments, can significantly reduce the net cost of the insurance over time.

Important Considerations for Advisors: IFAs are complex and carry significant risks that must be thoroughly assessed and explained to clients:

- Market & Economic Risks: The external investments funded by the loan may underperform, or rising interest rates could increase borrowing costs, negatively impacting the IFA’s net benefit.

- Loan & Collateral Management: Loan terms are subject to renewal and lender policies; the insurance policy is at risk if the loan cannot be serviced or is called.

- Tax & Regulatory Landscape: Changes in tax laws or CRA interpretations regarding interest deductibility or the treatment of leveraged insurance strategies could alter an IFA’s effectiveness.

An IFA demands meticulous structuring and ongoing management, requiring collaboration between you, an insurance specialist, and the client’s legal/tax counsel. It is not a “set it and forget it” strategy, and the impact on the net death benefit if the loan is outstanding at death must be clearly understood.

For a more detailed exploration of this strategy and how to integrate it into your practice, see our post: Integrating IFAs into Your Wealth Advisory Practice.

Life Insurance: A Complementary, Not Competitive, Tool in Your Toolkit

Permanent life insurance isn’t meant to replace traditional investments. It’s a complementary tool designed to address specific risks and achieve specific objectives that other assets cannot – particularly around certainty, tax efficiency at death, and estate preservation. The value is most apparent when viewed as part of a holistic wealth strategy, not an isolated ROI comparison.

By understanding these nuances of life insurance, you can more effectively:

- Address client (and your own) objections regarding ROI.

- Identify opportunities where life insurance can solve complex client problems.

- Enhance your value proposition by offering more comprehensive and strategic advice.

To help you educate your clients on these concepts from their perspective, we are also preparing a complementary articles.

Partnering for Sophisticated Solutions

At Taxevity, we specialize in collaborating with independent Wealth Advisors. We help demystify complex insurance strategies and structure solutions that align with your clients’ broader objectives for Protection, Growth, and Impact. We prepare proprietary Insurance Options report for your review and we then make refinements. When you are satisfied, we show your clients in a meeting you host.

Wealth Advisors: Are you looking to deepen your understanding of how smart life insurance solutions can benefit your HNW clients and address some of their toughest questions? Let’s connect to explore how a partnership can equip you with the specialized insights and tools to navigate these conversations effectively.