(Part of the IFA Master Curriculum)

Key Question for Canadians

If an Immediate Financing Arrangement (IFA) is such a powerful financial strategy, why isn’t it suitable for everyone? What are the key requirements to be a good candidate?

- A Clear Insurance Need: The strategy is a way to finance an insurance policy, not a reason to buy one. A successful IFA must be built on a pre-existing, legitimate reason for permanent life insurance, such as for estate preservation or to fund a buy-sell agreement.

- Significant Financial Capacity: An IFA is designed for high-net-worth individuals and profitable corporations. Lenders typically require the ability to pay substantial annual premiums (often $50,000 to $100,000 or more) for a decade or longer.

- The Right Mindset: This is a multi-decade leveraging strategy. A suitable candidate must have the risk tolerance to borrow to invest and the discipline to manage the strategy through market fluctuations and rising interest rates.

When you first hear about a financial strategy that offers significant tax advantages and the ability to grow your wealth in two places at once, it’s natural to be skeptical. If you’ve heard about the Immediate Financing Arrangement (IFA) and thought it sounded “too good to be true”, asking “Why isn’t everyone doing this?” is smart.

This guide provides a straightforward answer to that question. We’ll demystify the IFA, touch on what makes it different from other strategies, and outline exactly why this specialized tool is for specific circumstances, not a universal solution.

Page Contents

What is an IFA in Simple Terms?

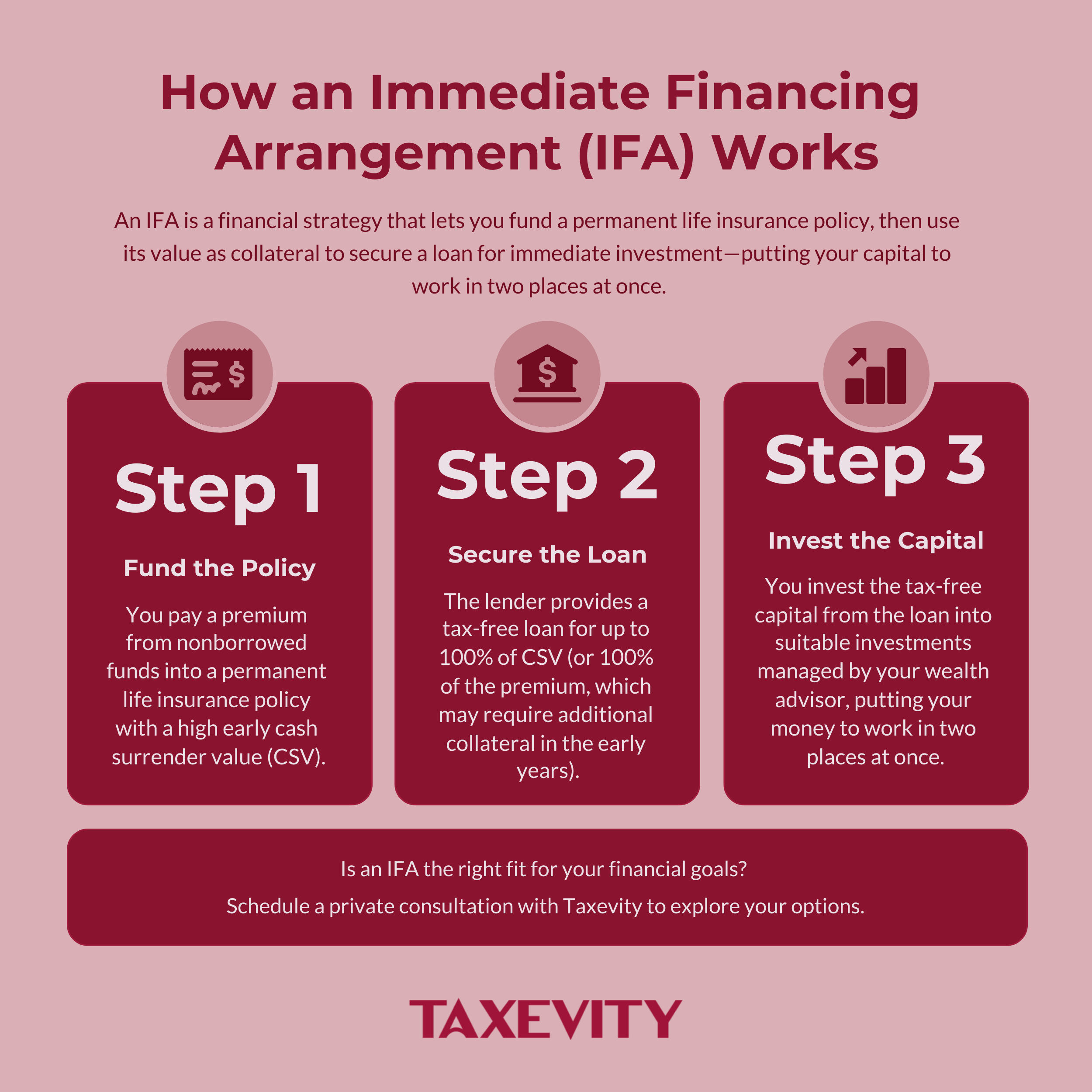

At its core, an IFA is a strategy where the cash surrender value (CSV) of a permanent life insurance policy is used as collateral to secure a loan from a major financial institution. The process typically works like this:

- You pay a premium into your life insurance policy, which immediately establishes a cash surrender value.

- A lender provides a loan for up to 100% of the premium you paid. This loan is secured by the CSV in your policy (and sometimes by additional collateral, depending on the structure).

- You can then invest that freed-up capital, for example, in a suitable portfolio managed by your wealth advisor.

This process repeats annually. The result: you have the full insurance coverage for your estate, while your capital is freed up to work for you.

For a more detailed understanding, see our Foundational Guide to IFAs.

Clearing the Air: IFA vs. Infinite Banking vs. HELOCs

The term “leveraging insurance” can be confusing because it’s used to describe different strategies.

- IFA vs. Infinite Banking: While both use life insurance, they are very different. A made-in-Canada IFA uses a commercial loan from a third-party lender (e.g., a bank) for the purpose of investing. “Infinite Banking” is a vaguely-defined concept imported from the US that typically relies on taking policy loans, often for personal spending and repayment. It does not work all that well under Canadian tax regulations.

- IFA vs. HELOC (Home Equity Line of Credit): While both are forms of secured lending, an IFA loan uses a corporate or personally owned life insurance policy as collateral, while a HELOC is secured by your home. The Loan-to-Value (LTV) ratio is also typically much higher with an IFA—often 90-100% of the policy’s cash surrender value, without additional collateral.

The Four Main Reasons an IFA Isn’t for Everyone

Here is the straightforward answer to why this strategy is not more common.

- Reason for Insurance: The foundation of an IFA is a genuine reason for permanent life insurance, such as estate planning.

- Minimum Scale: Lenders require significant annual premiums (typically $50,000 or more for 10 years) to meet their minimum loan requirements.

- Comfort with Leverage: An IFA is built on the concept of borrowing to invest. This requires a long-term perspective and the emotional fortitude to stay the course during market downturns. If you are philosophically uncomfortable with debt, an IFA is not for you.

- A Cohesive Advisory Team: An IFA requires seamless coordination and expertise. At Taxevity, we work with your accountant and other advisors since a lack of collaboration on the team can compromise the strategy’s success.

Addressing the Fine Print: A Look at Key Risks

A balanced look means examining the potential downsides. Here are the key risks we review with clients:

- Interest Rate Volatility: A sharp rise in interest rates can reduce the positive spread between your investment returns and the after-tax cost of the loan. Our projections model a higher-than-current loan rate to build confidence in the strategy’s resilience.

- Lender & Loan Risk: We can make introductions to major Canadian financial institutions that have dedicated IFA programs. However, any commercial loan has renewal terms and conditions for you and your other advisors to understand.

- Policy Performance: Our projections are built on conservative assumptions, using a whole life dividend scale below the insurer’s current scale to stress-test the plan against underperformance.

- The Exit Strategy: An IFA is designed to be a lifelong strategy. While you can unwind it early, doing so can be complex and trigger taxes if you sell the investments made with the loan proceeds, negating many of the benefits. A long-term commitment is essential.

Our Forthright Approach

Our goal is to provide a complete picture—the pros, the cons, the costs, and the risks. An informed decision is the best decision. For a suitable candidate, an IFA is a powerful wealth-creation tool. For others, a different strategy is a better fit.

We show options side-by-side and make revisions to enable you to decide the best path for your financial journey. If you believe an IFA might be a good fit for you and want to see how it compares to other options, we invite you to have an exploratory conversation with us.