Key Question for Canadians

Why does collecting insurance second opinions from your trusted advisors often result in conflicting viewpoints rather than a clear decision?

- The Tooling Gap: Accountants and financial planners rarely have access to the proprietary carrier software required to audit insurance engineering, forcing them to rely on general concepts rather than hard actuarial data.

- The “Guided Inquiry” Solution: To bypass natural biases—such as a wealth advisor’s preference for liquidity or a peer’s anecdotal “win”—you must replace generic questions with specific technical inquiries that force a fact-based response.

- The “Architect” Role: Synthesizing these fragmented viewpoints into a Unified Insurance Option requires capabilities beyond standard tools; it demands an independent Insurance Architect to engineer a design that works for your reality, not just the spreadsheet.

You have an insurance proposal. Now you want the truth.

In What is an Insurance Feasibility Audit? (And Why Your Proposal Needs One), we identified the Seven Common Validation Methods and explained why most of them fail due to bias or a lack of specific tools.

This leaves you in a difficult position. You should seek a second opinion. You should consult your accountant and wealth advisor. However, simply asking them, “What do you think of this proposal?” invites an opinion based on bias.

To get an opinion based on facts, you need a process.

This guide provides a structured approach—from the initial soft-ask to the detailed engineering inquiry—to help you get a clear, unbiased review.

Page Contents

- 1 Phase 0: Preparation (Before You Ask)

- 2 Phase 1: The Soft Ask (For Your Professional Team)

- 3 Phase 2: The Specific Inquiries (Bypassing the Bias)

- 3.1 1. The Smart Peer (The Colleague or Friend)

- 3.2 2. The DIY AI Audit (The Rough Sketch)

- 3.3 3. The Presenting Advisor (The Stress Test Request)

- 3.4 4. The Wealth Advisor / Portfolio Manager

- 3.5 5. The Fee-Only Financial Planner

- 3.6 6. The Incumbent or Competitor Insurance Advisor

- 3.7 7. The Accountant (CPA)

- 4 Phase 3: Synthesizing the Expertise (The Architect’s Role)

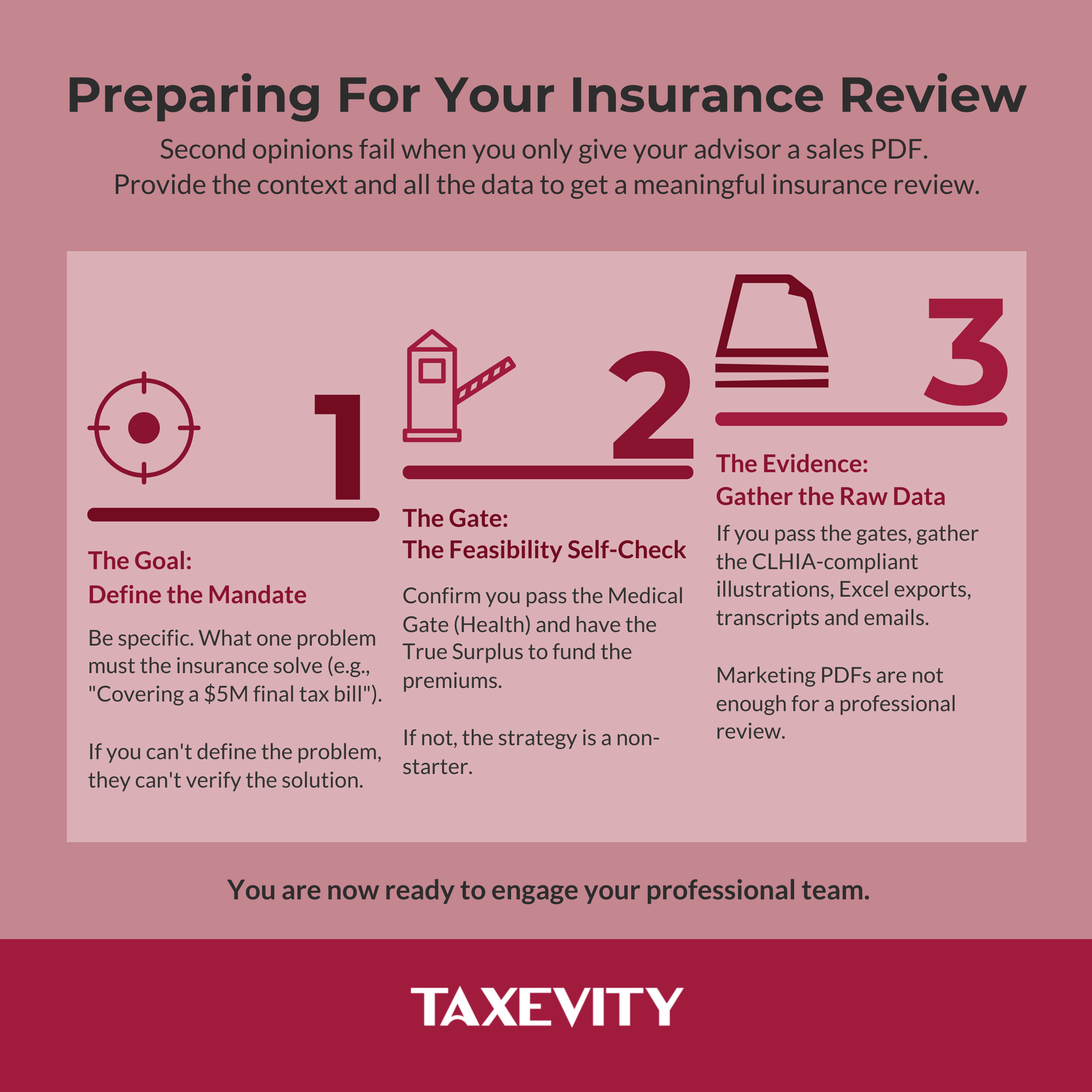

Phase 0: Preparation (Before You Ask)

Don’t send a complex set of files without context. Before you reach out, ensure you have the following ready to look professional and organized:

- Your One Big Reason: Be able to articulate why you are considering this insurance strategy in one sentence (e.g., “I need $5M of estate liquidity to cover capital gains tax” or “I want a tax-sheltered alternative to GICs”).

- The Feasibility Self-Check: Briefly review The 4 Feasibility Gates: Why We Reject Most Insurance Proposals. If you are confident you pass the Medical and Financial gates, you can communicate that confidence to your advisor (e.g., “I’ve already checked, and I have the surplus capital to fund this”).

- The Full Package: Gather PDFs of the concept presentation, the full CLHIA-compliant insurance illustration (ideally with an Excel export showing all the columns and rows), and other material you received (e.g., tax interpretations, emails). If the presenting advisor is unwilling to provide the full illustration or Excel export, or insists on talking to your accountant rather than letting the documents stand on their own, treat that as a significant warning sign.

Phase 1: The Soft Ask (For Your Professional Team)

Note: You can skip this phase for queries to your Peers or AI.

Before sending a stack of PDFs, gauge if your advisor is willing and qualified to review them. This simple email saves you time and reveals their engagement level immediately.

The Script:

“Subject: Quick help with an insurance proposal

Hi [Advisor Name],

I recently received a complex life insurance proposal (a [Strategy Name, e.g., Corporate Estate Bond]) that impacts our [tax/investment] planning.

Before I go further, could I spend 10 minutes with you to get your high-level take? I’m looking for a logic check on how this fits with what you are doing for me, not a full audit.

Do you have experience reviewing these types of strategies?”

The Diagnostic Response:

- “No” / Referral: They might say, “I don’t know enough about insurance, but I can introduce you to X.” This is a good sign. It shows integrity and professional boundaries. If they are unable to make a referral, Taxevity is happy to help.

- “Yes, let’s talk”: This is the ideal response. Proceed to the call.

- Silence: If they are unresponsive to a specific request for help, it may indicate they are overloaded or uninterested. Proceed with caution.

Note on Timing: A proper insurance review takes. If they give you an opinion before looking at the numbers, they are reacting to the concept, not auditing the proposal.

Phase 2: The Specific Inquiries (Bypassing the Bias)

Once you are ready to engage, use these specific inquiries to guide who you’re asking away from their natural biases and toward their area of expertise.

1. The Smart Peer (The Colleague or Friend)

- The Bias (Anecdotal Bias): A peer may share their “win” or “loss”, but it is based on a sample size of one. Their unique health history, financial situation, and timing created an outcome that may be factually true for them, but statistically irrelevant for you.

- The Expertise (Operational Reality): They know the friction of living with the strategy.

- The Example Inquiry:

“I know you’re happy with your strategy. But if you could go back to the day you signed, what is the one thing you wish you understood better?

Have you ever had to post additional collateral or pay unexpected premiums?”

2. The DIY AI Audit (The Rough Sketch)

- The Bias (Hallucinations): AI tools like ChatGPT or Gemini are excellent at reading text but terrible at calculating actuarial tables. They can spot jargon but cannot verify math.

- The Expertise (Marketing Filter): AI is excellent at breaking down complex language into plain English.

- The Approach:

Upload your files (PDFs, Excel) as described in The DIY Feasibility Audit: How to Use AI to Judge Your Insurance Proposal.

Ask the AI: “Explain the ‘Risks’ section of this proposal in plain English. What specific conditions would cause the policy to lapse or the premiums to increase? Identify any definitions that seem vague.”

3. The Presenting Advisor (The Stress Test Request)

- The Bias (Design Optimism): The advisor who sold you the plan is naturally optimistic about their design. They chose the product and configuration, and you likely haven’t seen the runs they discarded to find the one that works.

- The Expertise (Software Access): They have access to illustrate or request new scenarios.

- The Example Inquiry:

“I appreciate the proposal. To make my decision, I need to see the Failure Mode.

Please re-run the illustration with these Stress Test parameters:

- Dividend Scale: Drop it by another 1% in all years.

- Loan Interest Rate: Increase it by 2% starting in Year 1.

- Result: Show me the impact on the Cash Surrender Value. Specifically, what happens if I need to cancel the coverage in Year 8?

I need to know if the strategy implodes under these conditions or just performs slightly worse.”

4. The Wealth Advisor / Portfolio Manager

- The Bias (Investment Bias): They may believe they can generate higher returns or offer more flexibility compared to insurance, leading them to dismiss insurance as inefficient.

- The Expertise (Asset Allocation): They understand the role of investments better than insurance advisors do.

- The Example Inquiry:

“Please do not compare this to our equity portfolio. I know equities have a higher potential upside.

I am considering this policy strictly as a Fixed Income / Bond substitute for my estate.

Please compare the Internal Rate of Return (IRR) on the death benefit (Page X) against a guaranteed bond portfolio or GIC ladder, after tax.

If we need to guarantee $5M of liquidity at life expectancy, is there a more capital-efficient way to do it in our current portfolio with low market risk?”

5. The Fee-Only Financial Planner

- The Bias (Lifestyle vs. Surplus): They are excellent at modeling personal lifestyle needs to ensure premiums don’t limit your cash flow. However, for HNW corporations, the issue is rarely lifestyle but surplus optimization. They may default to a “Buy Term” bias that ignores the tax-sheltered advantages of permanent life insurance.

- The Expertise (Unbiased Math): They have no sales motive and are excellent at holistic cash flow modeling (though they often lack access to the carrier software to run different scenarios).

- The Example Inquiry:

“I understand the philosophy of buying term insurance. However, I have a permanent tax liability (Estate Tax) that will exist after term insurance expires.

Please run the numbers: Is the after-tax benefit to my estate better than a taxable investment account over 30 years, assuming a [X]% tax bracket and [Y]% return?“

6. The Incumbent or Competitor Insurance Advisor

- The Bias (Opportunity Bias): Whether it’s your incumbent advisor (who didn’t bring you the idea) or a new one, they have a financial incentive to find a fatal flaw to protect their territory or win your business.

- The Expertise (Product Mechanics): They know how to optimize the design—and they know how the presenting advisor might have tweaked the numbers to look good.

- The Example Inquiry:

“I am looking for a Stress Test review of this specific proposal.

Constraint: I am not looking to switch advisors or see a new illustration today.

Please look at this design and tell me:

- What are the three biggest risks in this specific contract?

- Are the assumptions (interest rate, dividend scale) realistic compared to historical averages?

- Is the ‘Cost of Insurance’ structure (YRT vs. Level) appropriate for my long-term goal?

If you can identify a fatal flaw, I will consider looking at alternatives. But first, audit this plan.”

7. The Accountant (CPA)

- The Bias (Compliance Focus): They may only check if the calculations look correct, missing the structural risk of the funding strategy.

- The Expertise (Cash Flow & Tax): They know your business’s liquidity better than anyone.

- The Example Inquiry:

“I’m not asking you to audit the insurance product itself. Instead, please look at the Cash Flow page.

- If my business income drops by 20% next year, does this premium schedule put our operating liquidity at risk?

- Do you see any issue with the deductibility of the interest if we use the proposed collateral loan structure?

Please assume the insurance mechanics work as advertised; I want your opinion strictly on the cash flow impact to my OpCo.”

Phase 3: Synthesizing the Expertise (The Architect’s Role)

After gathering feedback, you will likely have valid but competing perspectives from your core team:

- Accountant: “The tax deduction is efficient, but the impact on operating cash flow concerns me.”

- Wealth Advisor: “The returns are lower than our equity portfolio, but the diversification is valuable.”

- Financial Planner: “The strategy looks good in isolation, but the funding commitment conflicts with your retirement liquidity needs.”

This feedback often breaks standard illustration tools by going beyond their limited capabilities.

When your accountant or wealth advisor introduces a complex constraint—like blending corporate retained earnings with specific liquidity ratios—standard tools simply cannot model it.

Furthermore, valid feedback often demands a fundamental shift in the strategy itself, say from an Immediate Financing Arrangement (IFA) to an Estate Bond. We may discover that the original proposal was too aggressive, requiring a pivot to a safer funding model or a product with stronger guarantees to satisfy your real risk tolerance.

A Second Opinion Identifies Problems; A Collaborative Model Solves Them

At this stage, you need an Architect to redesign the blueprint.

Because we develop and test our own internal actuarial models at Taxevity, we can do what standard software cannot. We view “broken” illustrations not as dead ends, but as opportunities to innovate. We are motivated to solve these complex problems because the solutions we engineer for you often become the standard for our future clients and referring advisors.

Here is how we integrate your team’s feedback into a Unified Insurance Option:

1. The Criteria (Gathering Inputs)

We take the specific constraints identified by your team—such as the Accountant’s hard limit on operating cash flow or the Wealth Advisor’s required hurdle rate. These are no longer objections; they are design parameters.

2. The Integration (Re-Engineering)

We re-engineer our proprietary models, adjusting the variables to satisfy these requirements simultaneously. If your accountant demands more liquidity in years 5–10, we adjust the funding structure to satisfy that specific requirement without breaking the long-term growth targets.

3. The Solution (The Unified Design)

The result is a stress-tested design built on your team’s input. It ensures the strategy works for your reality, not just the spreadsheet.

From Expert Feedback to a Unified Design

You have gathered the parts. Now you need an Architect to synthesize different perspectives into a unified, stress-tested design to finalize your structure.

The Feasibility Framework

Master the Methodology

You are reading one part of our 5-stage stress-test for insurance strategies. To fully audit your proposal, review the complete framework:

- Phase 1: The Problem – The Static Trap: Why Proposals Fail

- Understand the hidden risks of static PDFs in a dynamic world.

- Phase 2: The Filter – The 4 Feasibility Gates

- The exact criteria we use to approve or reject a strategy.

- Phase 3: The Tool – The DIY Audit with AI

- How to use Artificial Intelligence to verify your advisor’s math.

- Phase 4: The Psychology – The ‘Sleep-at-Night’ Test

- Why mathematical success is irrelevant if you panic.

- Phase 5: Validation – Where to Get a Second Opinion (This Post)

- Specific scripts to challenge your current advisor.

Ready to move from theory to verification? Book Your Insurance Feasibility Audit