(Part of the IFA Master Curriculum)

Key Question for Accountants

When your client proposes using an existing life insurance policy for an Immediate Financing Arrangement (IFA), how do you guide the conversation from “can we do this?” to the more critical strategic question: “should we do this?”

- The Foundational Risk: Using an existing policy for an IFA introduces new lender and interest rate risks that can jeopardize the policy’s original protective mission. Your primary role is to stress-test if the client is comfortable layering leverage risk on top of a foundational asset likely originally intended for purposes like estate planning or key person protection.

- The Efficiency Trade-Off: Lenders view a life insurance policy as collateral, and their primary concern is its quality and predictability. A new policy can be purpose-built to maximize high, early-year cash values, minimizing the “collateral gap” and the need for other client assets to be pledged. An older policy was likely not structured this way and may be seen as less efficient collateral from the lender’s perspective.

- The Decisive Factor: The ultimate recommendation hinges on a single consideration: the client’s health. If the client’s health has declined, the guaranteed insurability of the existing policy is the most valuable asset, overriding any structural inefficiencies. For a healthy client, however, a new, purpose-built policy or a term conversion generally provides superior financial efficiency and strategic alignment.

When your client considers an Immediate Financing Arrangement (IFA), a common and logical question arises: “Can I use my current life insurance policy as the collateral?” This question represents a critical advisory moment.

The decision ultimately rests with the lender. A pre-existing permanent life insurance policy can be the foundational asset for an IFA loan, provided the Cash Surrender Value (CSV) is sufficient and growing, and the insurer is on the lender’s approved list. This feasibility raises a more critical strategic question for accountants and their clients: not whether you can, but whether you should.

This analysis provides a framework for accountants to guide clients through this complex decision, focusing on the original policy’s purpose, the lender’s perspective, key financial trade-offs, and the required due diligence.

Page Contents

- 1 First, Revisit the Original Purpose

- 2 The Lender’s Perspective: What Makes a Policy Good Collateral?

- 3 The Central Trade-Off: Existing Policy vs. New Policy

- 4 Guiding the Client Conversation

- 5 An Alternative Path: The Term Conversion Option

- 6 The Due Diligence Process: A Checklist for Accountants

- 7 Strategic Recommendation: When Does an Existing Policy Make Sense?

Key Questions to Ask Your Client

- Original Purpose: Why was the original policy put in place, and is that need still relevant today?

- Insurability: How has your health changed since that policy was issued?

- Policy Type: Is the existing policy a term or permanent plan? Does the term policy have conversion options?

- Risk Tolerance: Are you comfortable adding lender and interest rate risk to this foundational asset?

First, Revisit the Original Purpose

Before analyzing a policy as collateral, the first step is to confirm why it was purchased. Life insurance is rarely (and should not be) put in place without a specific objective, such as estate planning, income replacement, key person protection, or funding a buy-sell agreement.

Assigning the policy as collateral for an IFA introduces new layers of complexity and risk—primarily lender and interest rate risk—that could jeopardize its original mission. It’s essential to ask: Is the original reason for this policy still valid? If so, is your client comfortable layering leverage risk on top of a foundational protection asset? In most cases, the wisest course of action may be to leave the existing policy untouched to fulfill its intended role and acquire a new, separate policy specifically for the IFA.

The Lender’s Perspective: What Makes a Policy Good Collateral?

An IFA is an asset-based lending strategy. The lender’s primary concern is the quality, stability, and predictability of the collateral—the life insurance policy. Their underwriting process goes beyond simply confirming the policy exists to scrutinizing it to determine the loan-to-value (LTV) ratio they are willing to extend.

The non-negotiable requirement is that the policy must be a form of permanent insurance that builds a CSV. Term life insurance, with no cash value, is unsuitable on its own. Within permanent insurance, lenders have a clear preference:

- Participating (Par) Whole Life Insurance: This is overwhelmingly the preferred vehicle. As we’ve discussed in our article on Why Whole Life is the Engine for an IFA, lenders favour its contractually guaranteed minimum cash values, guaranteed premiums, and predictable growth. The stability of this asset allows lenders to offer the highest LTV ratios, often 90-100% of the policy’s CSV.

- Universal Life (UL) Insurance: While a UL policy can be used, lenders view it as more complex due to the potential volatility of the policy’s underlying investment accounts. The cash value growth is not guaranteed. To mitigate this risk, a lender may offer a lower LTV (e.g., 50% for an equity-linked UL) or impose restrictions on the investment choices, often requiring lower-yielding, GIC-type investments that can reduce the policy’s potential returns.

The crucial metric is the CSV trajectory. A policy designed specifically for an IFA is engineered to maximize high, early-year cash values. This minimizes the “collateral gap”—the initial shortfall where the loan value exceeds the policy’s cash surrender value—thereby reducing the need for the client to pledge other assets temporarily, if the client wants to borrow back all of the premiums they pay.

An existing policy, purchased years ago for estate planning, was likely not structured this way and may have used UL. Its CSV growth is likely slower, perhaps optimized for higher cash values in later years, leading to a less efficient form of collateral from a lender’s perspective.

The Central Trade-Off: Existing Policy vs. New Policy

Guiding a client requires a balanced comparison across several key domains. Using an existing policy seems simpler, but often introduces financial inefficiencies that a new, purpose-built policy avoids.

| Decision Factor | IFA with an Existing Policy | IFA with a New Policy |

| Underwriting & Insurability | ++ Bypasses new medical underwriting; preserves existing guarantees. Critical if health has declined. | — Requires full new underwriting. Risk of rating or decline. New contestability period. |

| Financial Performance (CSV) | – Likely has a slower CSV growth trajectory, not optimized for early-year values. | ++ Can be structured for high early CSV growth, providing loans immediately. |

| Capital Efficiency (Collateral) | — A larger initial “collateral gap” will likely require posting more external collateral. | + Designed to minimize the collateral gap, preserving the policyowner’s other assets. |

| Premium Cost | + Annual premium is based on a younger age and may be significantly lower. | – Annual premium is based on current (older) age and may be substantially higher. |

| Corporate Tax Optimization (CDA) | o The IFA-Enhanced CDA credit is available, but a lower death benefit may limit its ultimate scale. | + The death benefit can be sized to enhance the CDA credit. |

| Tax Treatment (Exempt Test) | ++ May be ‘grandparented’ under pre-2017 rules, potentially allowing for faster tax-exempt growth. | o Subject to more restrictive current (post-2017) tax legislation. |

| Speed & Simplicity | + Faster to implement as the policy is already in force. | – Slower process due to the time required for insurance underwriting and policy issue. |

Guiding the Client Conversation

As their accountant, you are uniquely positioned to frame this old vs new decision objectively. Here is a practical framework for your next client meeting:

- Start with the “Why”: Begin by reviewing the original purpose of the existing policy. Ask, “Let’s confirm the job we hired this policy to do. Is that job still a top priority?”

- Stress-Test the Risk: Frame the new risks clearly. “By using this policy for an IFA, we are introducing lender risk and interest rate risk. Are you comfortable with this asset having to serve two purposes, one of which includes leverage?”

- Quantify the Inefficiency: Once you have the in-force illustration, you can make the trade-off tangible. “Using your current policy means we’ll need to post approximately $X of other assets as collateral for the first Y years. A new policy would be designed to minimize this.”

- Explore the Third Option: Always investigate the term conversion possibility. “Before we decide, let’s check if your old term policies have a conversion option. They could give us the best of both worlds: guaranteed insurability with an optimized structure.”

An Alternative Path: The Term Conversion Option

For some clients, a third option may exist that bridges the gap between using an old policy and buying a new one. Your client may own a term life insurance policy with a conversion privilege. This feature allows the policyowner to convert some or all of the term coverage into a permanent policy offered by the insurer without new medical underwriting.

This can be a powerful solution if the insurer allows conversion to a whole life policy designed for high early cash values and allowing Additional Deposit Options (ADOs)—flexible, over-and-above premium payments that significantly accelerate the growth of the policy’s cash value. If available, a conversion secures the client’s insurability while allowing for the creation of a new, financially optimized policy perfectly suited for an IFA. It’s a critical avenue to explore before committing to leveraging a less-efficient, older permanent policy.

The Due Diligence Process: A Checklist for Accountants

To leverage an existing policy, the client must navigate a structured process involving policy analysis, lender engagement, and legal assignment. As their trusted advisor, your role is to ensure they ask the right questions at each stage.

1. Initial Policy Assessment:

The first step is to obtain a current in-force illustration from the insurance provider. With the client’s authorization, Taxevity can often request this on their behalf. This document is mandatory for any lender’s assessment and projects the future growth of the CSV and death benefit.

- Key Question: How large is the projected collateral gap? How much external, liquid collateral will the client need to pledge, and for how long?

2. Lender Engagement & Underwriting:

Engage with lenders who have specialized insurance lending programs, as outlined in our Guide to Selecting an IFA Lender. They understand the nuances of the strategy and the legal framework. The lender will conduct a full review of both the borrower’s financial strength and the policy’s quality.

- Key Question: Based on this specific policy and insurer, what LTV ratio will the lender offer on the existing policy? How does this compare to the LTV on a new, optimized whole life policy?

3. Collateral Assignment:

Upon loan approval, the policy is legally assigned to the lender as collateral. It is crucial to clarify that the lender becomes the collateral assignee, not the beneficiary. Their claim is limited to the outstanding loan balance; the remaining death benefit flows to the named beneficiaries.

- Key Question: Does the client understand that this assignment creates a long-term partnership with the lender, subject to annual reviews and shifts in lender procedures, as outlined in our Foundational Guide to IFA Risk Management?

Strategic Recommendation: When Does an Existing Policy Make Sense?

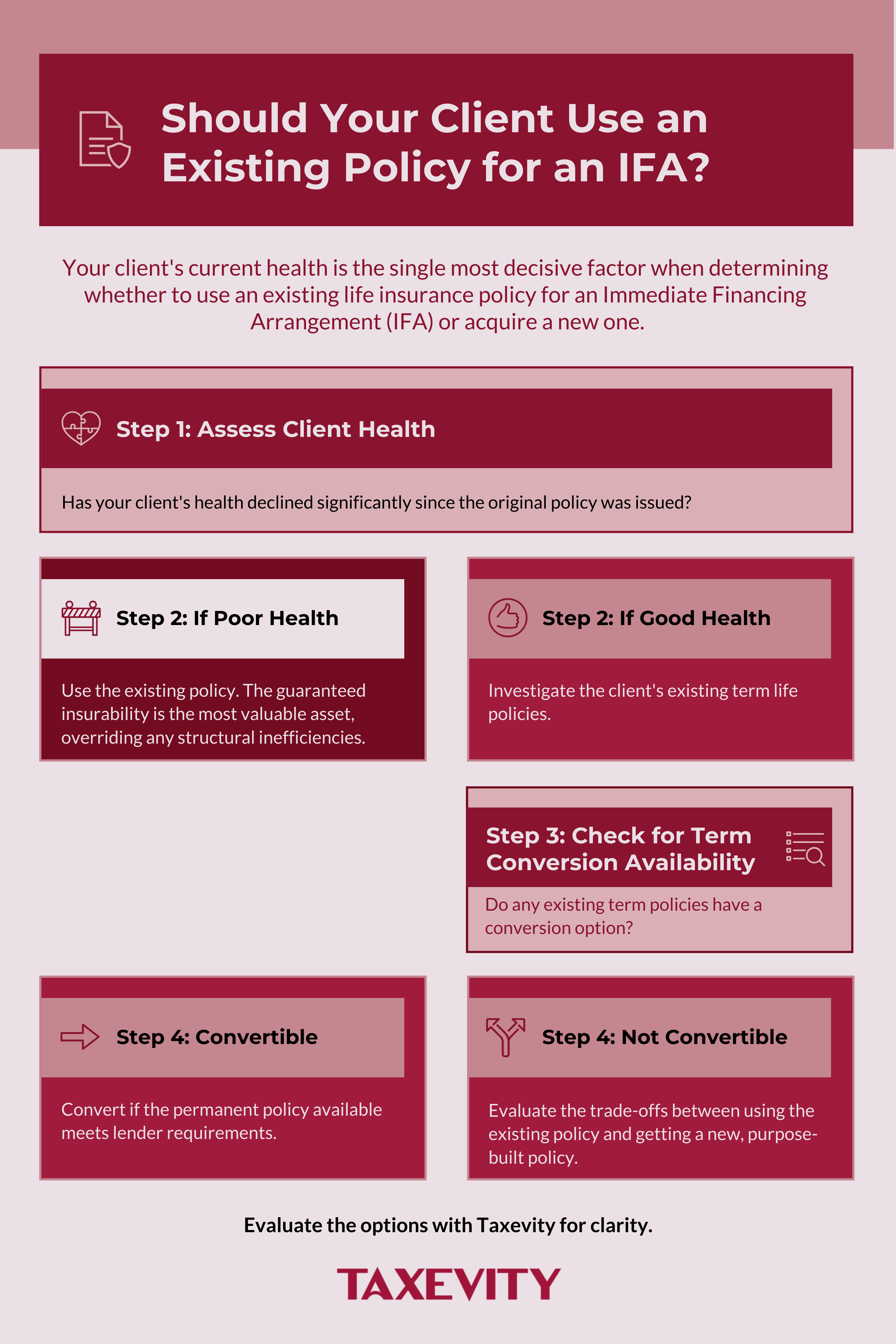

The decision primarily hinges on a single, primary consideration: the insured’s health.

An existing policy is likely the superior, and perhaps only, choice if the client’s health has deteriorated to a point where new insurance is either impossible to obtain or would be prohibitively expensive. In this scenario, the guaranteed insurability of the existing policy is the most valuable asset, overriding any financial or structural inefficiencies.

Conversely, a new policy is the strategically-optimal choice if the client is in good health and the primary objective is optimizing capital efficiency, minimal reliance on external collateral, and precise alignment with long-term goals like enhancing the Capital Dividend Account (CDA) for corporate clients. A new policy allows for a bespoke design that serves the dual masters of robust insurance protection and efficient collateral for the lender.

Furthermore, the a non-optimized policy can introduces the risk of a collateral call. While the loan interest is paid annually to maintain deductibility, the lender still conducts an annual review. In the case of many Universal Life policies, the CSV can decline depending on market conditions, meaning the loan-to-value ratio could breach its limit. This would force the client to pay down a portion of the loan principal or pledge other assets to secure the lender’s position. A policy designed for an IFA eliminates this risk, because an appropriately structured whole life policy cannot have CSV decreases.

Practice Tip: A Decision Tree Framework

For a quick assessment, visualize a decision tree. The first branch is Client Health. If poor, the path leads directly to using the Existing Policy. If good, the next branch is Term Conversion Availability. If yes, that could be the optimal path. If no, you arrive at the final analysis: weighing the trade-offs in the Existing vs. New Policy table.

In summary, while leveraging an existing policy is feasible, it is a nuanced decision. The client’s health is the primary determinant. If new insurance is not an option, the existing policy is invaluable. However, for a healthy client, a new, bespoke policy or a term conversion generally provides superior financial efficiency and strategic alignment. Your role is to help the client weigh the certainty of insurability against the costs of inefficiency.

From Theory to Practice

Understanding the nuances of leveraging an existing life insurance policy is a critical step in advising clients on advanced financial strategies. Applying these concepts to a specific client’s situation can unlock significant value and reinforce your role as a trusted advisor.

We invite you to book a call at your convenience to model a client scenario and analyze whether their existing policy is the right engine for an IFA.