Key Question for Accountants

When a high-net-worth client asks about using an Immediate Financing Arrangement (IFA) to enhance their estate, what critical due diligence must you perform to ensure the strategy is not only viable but also aligned with their long-term financial goals?

- Capital Efficiency: The IFA is not a tool to afford insurance, but rather a strategy to optimize capital for clients who could already comfortably pay the premiums. It allows a single dollar to both secure a life insurance death benefit and be leveraged for immediate investment in a business or portfolio.

- The CDA Surplus: For incorporated clients, a powerful advantage is the “surplus” created in the Capital Dividend Account (CDA). The gross death benefit creates a CDA credit before the loan is repaid, enabling other corporate retained earnings to be distributed tax-free to the estate.

- Lifelong Commitment & Risk: An IFA is a multi-decade financial commitment designed to ideally be unwound at death. A premature exit can trigger significant financial penalties, making it crucial to assess a client’s financial resilience, risk tolerance, and the strength of their collaborative advisory team.

The Immediate Financing Arrangement (IFA) is one of the most powerful financial strategies available to successful Canadian business owners and high-net-worth families. This sophisticated structure allows a single dollar to do two jobs at once: secure a life insurance death benefit for your estate while its value is leveraged to generate immediate investment capital.

Think of an IFA like a high-performance racing car. In the hands of a skilled driver with a professional pit crew, the vehicle can achieve incredible results. This power, however, is matched by immense complexity; this is not a car for a daily commute. Similarly, an IFA is not a product you simply buy. The strategy is a multi-decade financial commitment that requires expert guidance and the right candidate behind the wheel.

Asking the right questions is the first and most critical step. Here are five foundational questions you should ask before committing to an Immediate Financing Arrangement.

Page Contents

1. How Does An IFA Actually Work?

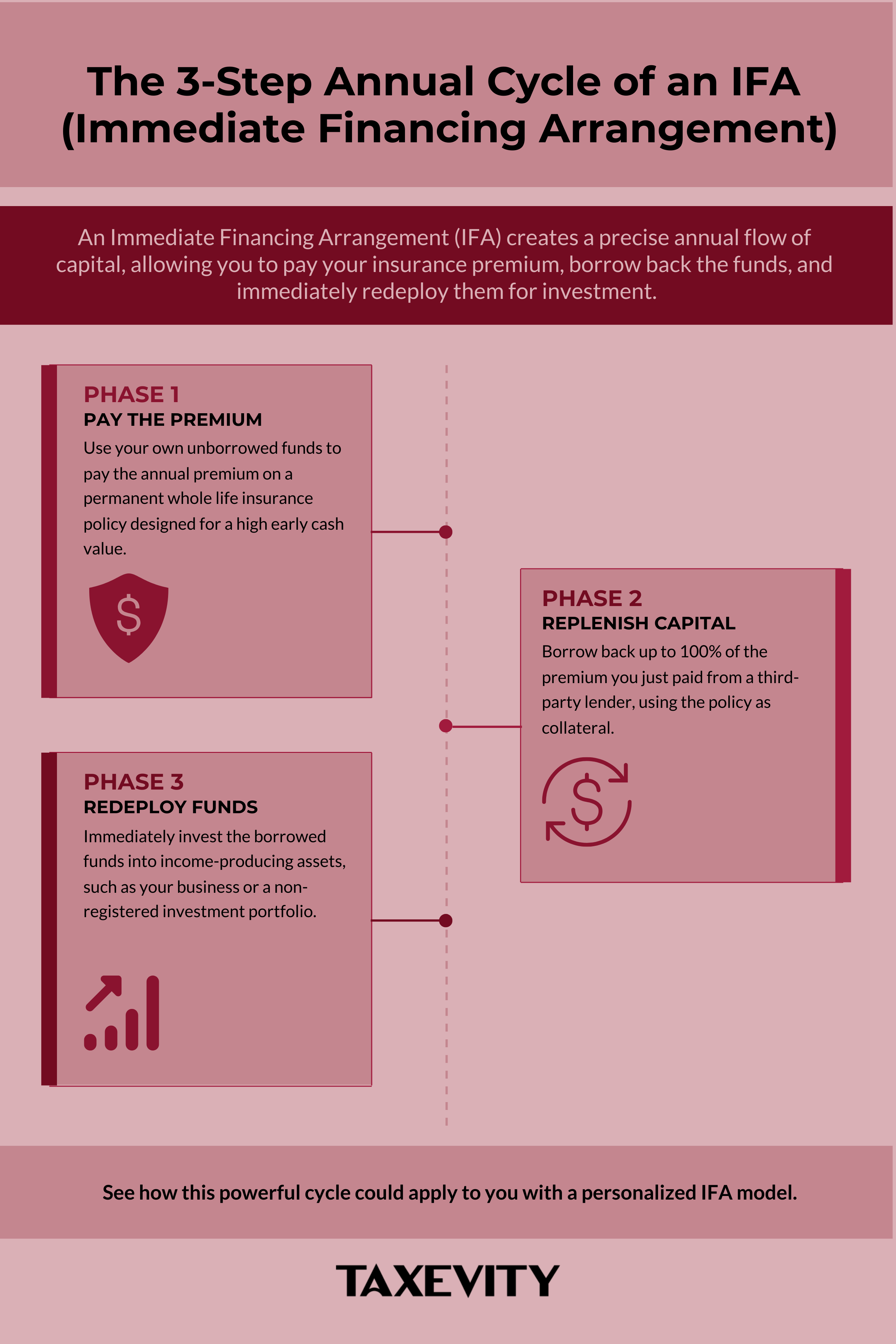

At its core, an IFA is a triangular relationship between you (the policyowner), a life insurance company, and a third-party lender, such as a bank or trust company. After the initial setup, which includes putting the insurance policy in place and assigning it as collateral, the strategy follows a precise three-step annual flow of capital:

- Pay the Premium: You pay the annual premium for a specially designed permanent life insurance policy using your own unborrowed funds. The policy is structured to quickly build a high early cash surrender value (CSV), as this value is the foundation of the entire arrangement.

- Replenish the Capital: After providing proof of your premium payment, you borrow back a significant portion (often up to 100%) of the premium you just paid from a third-party lender.

- Redeploy the Funds: You immediately invest the borrowed funds into an income-producing asset, such as your business operations or a non-registered investment portfolio.

This strict choreography is designed to establish a clear link between the loan and an income-earning purpose. This is critical for the strategy’s potential tax advantages, which can include deducting the loan interest and a portion of the insurance premium known as the Net Cost of Pure Insurance (NCPI). Understanding this mechanical framework is the first step, and for a more detailed explanation, you can review our Foundational Guide to Immediate Financing Arrangements (IFAs) or simpler general overview or overview for business owners.

2. Is An IFA a Good Fit For You?

An IFA is suitable for a very specific demographic. Answering this question requires an honest assessment of your financial resilience, risk tolerance, and long-term goals.

The ideal candidate has several key attributes:

- A Clear Reason for Life Insurance: The starting point is always a legitimate, pre-existing reason for a substantial amount of permanent life insurance to solve a problem like funding a large future tax liability or a corporate buy-sell agreement.

- High and Stable Income: You must have strong, predictable cash flow and be consistently in the highest marginal tax bracket to fully benefit from the potential tax deductions.

- Significant Financial Scale: To be viable, IFAs typically require a minimum annual premium of $50,000 for at least 10 years. Lenders also have net worth requirements, but the real test is your overall financial strength.

- The Right Advisory Team: An IFA is not a DIY strategy. A suitable candidate must have an expert team in place—Taxevity as the Insurance Architect (modeling the strategy and designing the policy), the Accountant (ensuring tax compliance), the Wealth Advisor (managing the investment portfolio), and Legal Counsel (reviewing contracts)—who can collaborate effectively. As we explain in our series on The IFA Core Advisory Team, a lack of coordination is a significant risk.

- A Resilient Temperament: A successful IFA requires more than just financial capacity; it requires the psychological fortitude to uphold a leveraged strategy through decades of economic cycles. Even if the numbers make sense, it’s crucial to honestly assess if your temperament is suited for a leveraged strategy.

Perhaps the most important suitability filter is this: you should not consider an IFA unless you have the financial capacity to pay the entire stream of insurance premiums without borrowing. This seems counterintuitive, but it highlights the strategy’s true purpose. An IFA is not a tool to afford insurance; it’s a tool to optimize the capital efficiency for an individual or a company that could already comfortably afford the premiums.

It’s also important to separate the financing strategy from the reason for life insurance. Even if an IFA isn’t the right fit, the underlying need for coverage to protect your family or business remains valid and may require a more conventional insurance solution.

3. What Are the Tangible Benefits of an IFA?

When structured and managed correctly, an IFA can deliver a powerful combination of benefits that amplify the value of a permanent life insurance policy. For a business owner, this means you can secure necessary insurance to protect your company and family without tying up working capital that could be better used for growth, inventory, or new opportunities.

The most profound advantage for incorporated business owners is the strategy’s interaction with the Capital Dividend Account (CDA). Upon the death of the insured, the full, gross death benefit creates a credit to the CDA before the loan is repaid. This creates a “surplus” CDA capacity—a tax-free distribution allowance that is larger than the net cash the company receives after repaying the loan. This surplus can then be used to distribute other retained earnings from the corporation to your estate, completely tax-free.

In essence, the IFA can transform otherwise taxable corporate assets into tax-free distributions for your heirs. It’s a powerful tool for unlocking wealth that might otherwise be trapped in your company, a concept we detail in our guide: Is Your Wealth Trapped in Your Company? How to Unlock It Tax-Free.

4. What Are the Risks and the Real Costs of an IFA?

The significant upside of an IFA is balanced by a formidable array of interconnected risks. A prudent analysis requires looking at them from every angle.

- Financial Risks: The loan will almost certainly have a variable interest rate, meaning your costs will rise if the prime rate increases.

- Structural Risks: The loan is a “demand” facility, meaning the lender can technically call it at any time.

- Regulatory Risks: The tax benefits of an IFA are based on current laws, which can change. The CRA could also challenge the arrangement, making meticulous record-keeping and a clear investment purpose essential.

These risks are not theoretical. A comprehensive understanding is crucial, which is why we’ve developed A Foundational Guide to IFA Risk Management for Accountants that outlines these challenges in detail.

5. What Is Your Exit Strategy?

An IFA is a lifelong commitment. The strategy is structurally designed to be unwound at one specific moment: the death of the life insured. At that point, the tax-free death benefit is paid out, the lender is repaid, and the remaining proceeds—along with the powerful surplus CDA credit for corporately-owned policies—are distributed to your estate.

What if your circumstances change and you need to exit the strategy early? There only one simple “escape hatch” – using existing savings or retained earnings to pay off the loan. As we detail in our guide to unwinding an IFA, a premature exit by collapsing the insurance policy to repay the loan is a taxable event that can trigger significant financial penalties. Limited viable early exit strategies means it’s best to enter the arrangement with the intention of seeing it through for the rest of your life.

Ultimately, the decision to implement an IFA comes down to a rigorous and honest assessment of these five areas. The strategy’s power is undeniable, but is reserved for the select few whose financial situation, risk tolerance, and long-term objectives are in perfect alignment with its demands. This high-performance strategy is for those who have the right car, the right track, and the right pit crew to see the race through to the end.

Your Next Step

Answering these foundational questions is the first step in a thorough exploration of the IFA strategy. To get an IFA tailored to your specific financial reality, schedule a chat.