(Part of the Taxevity Navigator Series and the IFA Master Curriculum)

Key Question for Accountants

How can your corporate clients use an Immediate Financing Arrangement (IFA) not just to acquire life insurance, but to actively create tax-free distributions to shareholders that unlock trapped corporate capital?

- The Mechanism: The strategy uses an a permanent life insurance policy as collateral for a third-party loan which is then invested. Upon death, the CDA is credited based on the gross death benefit before the loan is repaid, creating a “Surplus CDA Capacity” post-loan repayment that can be used to extract other corporate assets tax-free.

- Your Critical Role: Your involvement is crucial for managing tax compliance, particularly in tracing the borrowed funds from the IFA to an eligible income-producing use to support interest deductibility.

- The Associated Risks: It is essential to advise clients that the strategy’s power comes from leverage. The underlying IFA loan introduces significant, long-term risks, including interest rate volatility and lender discretion.

This guide provides accountants with a detailed analysis of the IFA-Enhanced CDA, a sophisticated Canadian corporate tax and estate planning strategy. It integrates a corporate-owned life insurance policy with an Immediate Financing Arrangement (IFA) to unlock and magnify the value of a corporation’s Capital Dividend Account (CDA).

The strategy’s central mechanism uses leverage to generate a significant CDA credit that exceeds the net death benefit received by the corporation after loan repayment. This creation of a Surplus CDA Capacity offers a unique opportunity to distribute otherwise “trapped” corporate retained earnings to shareholders on a completely tax-free basis. The primary benefits are a dramatic enhancement of estate liquidity to cover final tax liabilities and a highly effective method for wealth transfer.

However, these substantial benefits are counterbalanced by significant, interconnected risks. An IFA is a long-term leveraged strategy, exposing the corporation to financial risks like interest rate volatility. Critically, it also introduces lender risk; since the IFA loan is typically a demand facility subject to annual review, a change in the corporation’s financial health—or the lender’s own policies—could jeopardize the entire arrangement. From a regulatory perspective, the strategy requires meticulous adherence to the Income Tax Act to ensure interest deductibility and withstand potential scrutiny under the General Anti-Avoidance Rule (GAAR).

Consequently, the ideal candidate for the IFA-enhanced CDA strategy is specific and sophisticated: a Canadian-Controlled Private Corporation (CCPC) with substantial retained earnings, a solid underlying reason for permanent life insurance, a high tolerance for leverage and complexity, and a stable, long-term financial outlook.

This guide demonstrates that while the strategy offers extraordinary potential, its implementation demands a coordinated team of expert advisors—tax, insurance, investment, and legal—to navigate the complexities. For accountants, this guide is designed to complement your research and due diligence by providing a consolidated overview of key legislative provisions, Canada Revenue Agency (CRA) administrative positions, and relevant court decisions as of mid-2025.

Page Contents

- 1 Section 1: Foundational Pillars of the Strategy

- 2 Section 2: The Synergy: Generating Surplus CDA Capacity

- 3 Section 3: A Multi-Faceted Analysis of Benefits

- 4 Section 4: A Prudent Assessment of Risks and Mitigation

- 5 Section 5: Strategic Alternatives and Comparative Analysis

- 6 Section 6: Conclusion and Strategic Recommendations

Section 1: Foundational Pillars of the Strategy

Understanding the IFA-enhanced CDA strategy begins with a detailed examination of its two foundational pillars: the Capital Dividend Account (CDA) and the Immediate Financing Arrangement (IFA). Each is a complex financial and tax instrument governed by specific provisions of the Income Tax Act (ITA) and established market practices. This section provides the necessary technical groundwork for these components before we analyze their powerful synergy.

1.1 The Capital Dividend Account (CDA)

The Capital Dividend Account (CDA) is a unique feature of the Canadian tax system, exclusive to private corporations. It is not a bank account holding cash but a notional account that permits the tax-free distribution of specific corporate surpluses to Canadian-resident shareholders.

The Principle of Tax Integration

The CDA is underpinned by the principle of tax integration, which strives to ensure a shareholder pays approximately the same total tax on income earned by and distributed through a corporation as they would have if they earned it personally. While the dividend tax credit system mitigates the double taxation of regular income, the CDA addresses specific tax-free amounts.

Receipts that would be tax-free to an individual—such as the non-taxable portion of a capital gain or life insurance proceeds—would lose that character if taxed as regular dividends when earned by a corporation. The CDA mechanism preserves their nature, allowing these amounts to flow through the corporation to its shareholders without attracting an additional layer of tax.

Defining the Notional Account & The Role of Life Insurance

Defined in subsection 89(1) of the ITA, the CDA balance is a cumulative calculation. The primary additions include:

- The Non-Taxable Portion of Net Capital Gains: 50% of a corporation’s net capital gains are added to the CDA.

- Life Insurance Proceeds: The death benefit from a life insurance policy received by the corporation, net of the policy’s Adjusted Cost Basis (ACB), is added to the CDA. This is the engine of the IFA-enhanced CDA strategy.

- Capital Dividends Received: Capital dividends from other corporations are added to a recipient corporation’s CDA, preserving their tax-free character.

Accountants must advise clients that the CDA balance is dynamic. A CDA credit from a capital gain in one year can be reduced or eliminated by a capital loss in a subsequent year. This reality creates a strategic imperative: a corporation should generally elect to pay out a capital dividend soon after a material balance is created to avoid the risk of having this tax-free capacity eroded.

The Formal Election Process

Distributing a capital dividend is not automatic and requires strict adherence to CRA procedures. The process involves:

- A Directors’ Resolution: The board must pass a resolution authorizing the dividend payment and the capital dividend election.

- Filing Form T2054: The corporation must file Form T2054, Election for a Capital Dividend Under Subsection 83(2), on or before the day the dividend is paid or becomes payable.

- Supporting Documentation: The election must be accompanied by a certified copy of the resolution and a detailed schedule calculating the CDA balance (the CRA provides Schedule 89 for this purpose).

Precision is paramount. An election that exceeds the CDA balance triggers a punitive Part III tax of 60% on the excess. Given this penalty, the best practice is to maintain meticulous, ongoing CDA calculations.

1.2: The Immediate Financing Arrangement (IFA)

An Immediate Financing Arrangement (IFA) is not a product but a sophisticated leveraged strategy. At its core, an IFA involves the coordinated purchase of a permanent life insurance policy and the securing of a collateral loan from a third party lender. The mechanics are as follows:

- The corporation purchases a permanent life insurance policy designed for high early-year cash surrender value (CSV).

- After paying the first premium, the policy is collaterally assigned to a lender. The corporation remains the policyowner; the lender simply holds rights to the policy’s value as security.

- The lender advances a loan, typically up to 100% of the CSV or premium.

- The loan proceeds are returned to the corporation, restoring liquidity for reinvestment.

- The corporation pays the loan interest monthly while the capital works in two places: growing tax-sheltered within the policy and earning returns in the business or an investment portfolio designed to generate income (a requirement for accessing tax deductions based on the loan interest paid).

- The corporation applies potential tax deductions based on the loan interest paid and part of the premiums paid to their annual income.

1.3 Policy Design, Lender’s Perspective, and Suitability

The success of an IFA depends heavily on the underlying life insurance policy. The strategy requires a permanent policy, with whole life being the preferred vehicle. Lenders favour its predictable and stable CSV growth, which gives them the confidence to offer higher leverage compared to the more volatile CSV of a universal life policy.

Analyzing an IFA from the lender’s perspective reveals its true nature: the IFA is fundamentally a credit product. These are typically structured as demand credit facilities, meaning the lender can review the arrangement annually and demand repayment at any time. Lenders also impose substantial minimums—often requiring annual premiums of $50,000 to $100,000 or more—which confines this strategy to a specific high-net-worth client base.

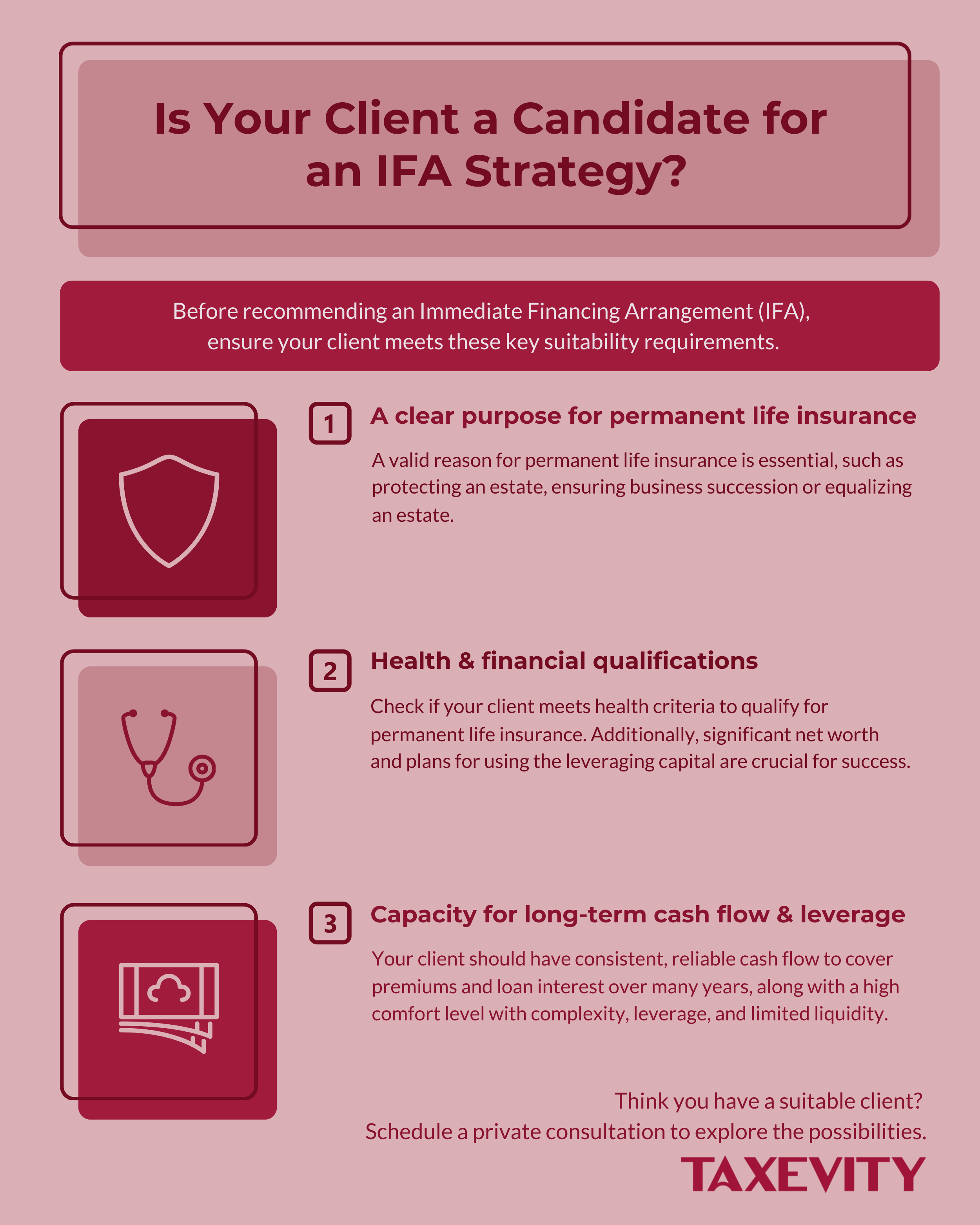

This risk profile means the ideal candidate for a corporate IFA is a business owner or incorporated professional who meets a strict set of criteria. They must have:

- A legitimate reason for permanent life insurance (e.g., estate protection, succession planning).

- The health to qualify for that insurance.

- Significant net worth and a clear purpose for the leveraged capital.

- Strong, predictable cash flow to service premiums and variable loan interest for decades.

- A high tolerance for leverage, complexity, and long-term illiquidity.

Section 2: The Synergy: Generating Surplus CDA Capacity

While the CDA and IFA are powerful tools on their own, their true potential is unlocked when they are combined. The synergy between them creates a solution to one of the most persistent problems in Canadian private corporate tax planning: the extraction of trapped corporate wealth. The IFA-enhanced CDA provides liquidity and fundamentally transforms the tax character of existing corporate assets, creating a uniquely powerful planning opportunity.

2.1 The Problem: Trapped Corporate Capital

Many successful Canadian-controlled private corporations (CCPCs) face the challenge of accumulating significant retained earnings. While a sign of profitability, this capital becomes “trapped”. Extracting these funds for personal use by shareholders typically requires paying a salary or a dividend, both subject to high marginal personal tax rates. This tax friction creates a strong disincentive to distribute profits, leading to large pools of capital sitting within corporate structures, often invested in assets that are themselves taxed at high rates (for example, 50.17% in Ontario).

2.2 The Solution: Mechanics of Value Creation

The IFA-enhanced CDA strategy directly confronts the trapped capital problem by creating a large tax-free distribution capacity that can be applied to the retained earnings. The step-by-step process integrates the two pillars into a seamless, long-term plan:

- Policy and Loan: The corporation purchases a permanent life insurance policy and, after paying the first premium, immediately assigns it as collateral to secure an IFA loan.

- Capital Redeployment: The loan proceeds restore the corporation’s liquidity, allowing the capital to be reinvested in the business or another income-producing purpose.

- Loan Servicing: The corporation makes ongoing interest payments on the IFA loan.

- Deductions: The corporation makes use of the potential tax deductions based on the loan interest and part of the premiums.

- Death and Payout: Upon the death of the life insured, the insurance company pays the full, tax-free death benefit to the corporation.

- Loan Repayment: The corporation uses the death benefit proceeds to repay the outstanding IFA loan balance.

- CDA Credit: Simultaneously, the corporation’s CDA is credited with an amount equal to the full death benefit received, less the policy’s Adjusted Cost Basis (ACB). The calculation is performed on the gross death benefit, before the loan repayment.

- Tax-Free Distribution: The full CDA credit can be used to provide tax-free dividends to shareholders based on two components: the death benefit minus the loan and other corporate assets up to the remaining CDA room available.

2.3 The Key Insight: Quantifying the Surplus CDA Capacity

The mismatch between the net cash retained by the corporation and the CDA credit it generates is the core of the strategy. This is not a “loophole” but a logical outcome of applying two distinct sets of rules: the CDA calculation rules under the Income Tax Act and the commercial terms of a third-party loan.

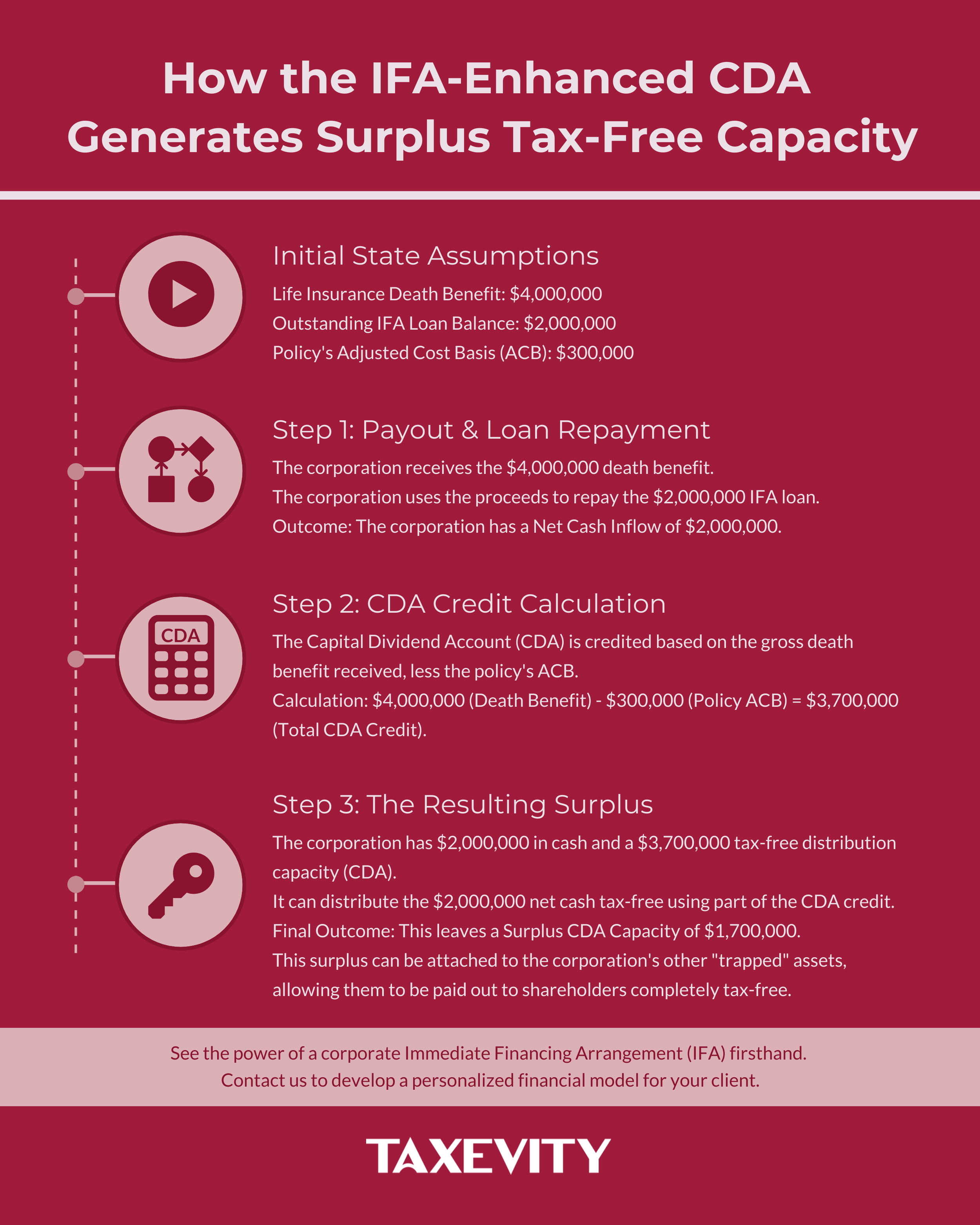

Let’s use a numerical example to clarify this powerful mechanism. Assume the following at the time of the insured’s death:

- Life Insurance Death Benefit: $4,000,000

- Policy’s Adjusted Cost Basis (ACB): $300,000

- Outstanding IFA Loan Balance: $2,000,000

The financial and tax consequences for the corporation are:

1. Net Cash Inflow:

- $4,000,000 (Death Benefit Received)

- $2,000,000 (IFA Loan Repayment)

- = $2,000,000 (Net Cash Retained)

2. CDA Credit Created:

- $4,000,000 (Death Benefit Received)

- $300,000 (Policy ACB)

- = $3,700,000 (CDA Credit)

The corporation has $2,000,000 in cash from the death benefit but has generated a CDA balance of $3,700,000. It can use $2,000,000 of this credit to distribute the net insurance proceeds tax-free.

This leaves a Surplus CDA Capacity of $1,700,000.

This surplus can now be attached to the corporation’s other assets—its trapped retained earnings. The corporation can now distribute up to $1,700,000 of those other assets to its shareholders as a tax-free capital dividend, a distribution that would have otherwise attracted a significant tax liability. The leverage creates a form of tax arbitrage, transforming the character of a taxable corporate asset into a tax-free distribution.

Section 3: A Multi-Faceted Analysis of Benefits

The synergistic combination of an IFA and the CDA yields a range of powerful benefits that extend beyond simple tax savings. These can be categorized into primary, secondary, and tertiary benefits, each addressing a specific challenge faced by owners of private Canadian corporations.

3.1 Primary Benefit: Tax-Efficient Extraction of Retained Earnings

The core value proposition of the IFA-enhanced CDA strategy is its ability to facilitate the tax-efficient extraction of corporate retained earnings. By generating a Surplus CDA Capacity, the strategy creates a tax-free distribution capacity that exceeds the net cash received from the insurance policy itself.

This surplus capacity can then be used to pay capital dividends from the corporation’s other assets, effectively sheltering trapped capital that would otherwise be subject to high personal dividend tax rates, which can approach 50% depending on the shareholder’s province and the type of dividend. For a shareholder in a high tax bracket, this represents a direct and substantial preservation of wealth.

3.2 Secondary Benefits: Enhanced Estate Liquidity and Business Succession

Beyond direct tax savings, the IFA strategy provides crucial secondary benefits related to liquidity and succession planning.

- Funding Final Tax Liabilities: Upon death, the deemed disposition of a shareholder’s assets can trigger a massive capital gains tax liability, often leaving an estate “asset-rich but cash-poor”. The IFA-enhanced CDA strategy reverses this problem. The tax-free death benefit injects cash into the corporation precisely when needed, and the CDA mechanism provides the legal means to flow this liquidity to the estate to pay the final tax bill without a forced sale of core assets.

- Funding Shareholder Agreements: The strategy is exceptionally well-suited to funding buy-sell provisions in a shareholder agreement. The insurance proceeds provide the immediate cash for the corporation to redeem the deceased’s shares from their estate. The CDA credit then adds another layer of efficiency by allowing a portion of the redemption price to be designated as a tax-free capital dividend, significantly reducing the taxable dividend component for the estate.

3.3 Tertiary Benefits: Capital Preservation, Dual Asset Growth and Tax Deductions

Finally, the strategy offers valuable tertiary benefits for the ongoing financial management of the corporation.

- Capital Preservation: An IFA allows the corporation to acquire a large permanent life insurance policy—a crucial estate planning tool—without permanently draining working capital. The loan facility recycles premium payments back into the corporation, allowing that capital to remain productive.

- Dual Asset Performance: The structure enables the corporation to benefit from the performance of two distinct asset classes simultaneously: the tax-sheltered growth of the whole life insurance policy and the returns from the asset portfolio acquired with the leveraged loan proceeds.

- Tax Deductions: A properly structured IFA provides significant tax deductions that help offset the cost of the strategy, which is effectively the total paid in interest for the loan over time.

Section 4: A Prudent Assessment of Risks and Mitigation

While the IFA-enhanced CDA strategy offers compelling benefits, it is a highly leveraged, long-term arrangement with significant and interconnected risks. A failure to proactively manage these risks can lead to severe financial consequences. An expert-level analysis requires moving beyond a simple list of potential problems to understand their interplay and the corresponding mitigation tactics. The risks fall into three domains: financial, lender, and tax/regulatory.

4.1 Financial and Market Risks

These risks relate to the performance of the underlying financial instruments and broader market conditions.

- Interest Rate Volatility: The IFA loan rate is almost always variable, tied to a benchmark like the prime rate. A sustained increase in interest rates can dramatically escalate servicing costs. Mitigation involves stress-testing the financial model with various rate scenarios. (At Taxevity, we build our models using projected loan rates that are higher than current rates to test for resilience).

- Long-Term Commitment: IFAs are designed to be held for decades. Unwinding the structure prematurely is complex and can be costly, potentially triggering taxes on policy gains or asset sales needed to repay the loan.

4.2 Lender and Collateral Risks

These risks stem from the IFA’s nature as a credit facility, subject to the lender’s discretion.

- Demand Nature of Loan: A critical and often underappreciated risk is that IFA loans are demand facilities. Lenders typically conduct an annual review of the borrower’s financial health. If the corporation’s profitability declines, breaches a covenant, or the bank’s internal policies change, the lender can demand repayment at any time, potentially forcing a fire sale of other assets.

- Margin Calls: If policy performance lags and the CSV does not grow as projected, a collateral shortfall can develop relative to the loan balance. This could prompt the lender to issue a “margin call” for additional collateral or a partial loan repayment.

4.3 Tax and Regulatory Risks

An IFA operates within a complex tax framework, requiring strict compliance.

- Interest Deductibility (ITA s. 20(1)(c)): A key benefit is the potential tax deductibility of the loan interest. This is not automatic. It requires that the borrowed funds be used to earn income from a business or property, a standard that necessitates meticulous and unbroken tracing of the funds. For a detailed explanation, see our Accountant Companion: Navigating Canadian Interest Deductibility for Investment Loans.

- General Anti-Avoidance Rule (GAAR): An IFA may be subject to GAAR scrutiny. A defense rests on demonstrating a bona fide non-tax purpose for the insurance (e.g., funding a buy-sell agreement). This distinguishes it from strategies the CRA has deemed abusive, such as the now-defunct “10-8” policies. A well-structured IFA relies on the intended interaction of several long-standing provisions of the Act, whereas the risk of a GAAR challenge is highest where the arrangement appears artificial—for instance, a highly liquid corporation with no clear insurance need implementing an IFA solely to extract passive earnings.

- Mandatory Disclosure Rules: Expanded rules for “reportable” or “notifiable” transactions may require the strategy to be reported to the CRA on Form RC312, increasing transparency and the likelihood of review.

- Non-Resident Shareholders: A capital dividend paid to a non-resident is subject to Part XIII withholding tax (typically 25%, subject to reduction by a tax treaty). This “wastes” the CDA’s value. Corporations with non-resident shareholders require careful structuring, such as creating separate share classes, to target capital dividends exclusively to Canadian residents.

Section 5: Strategic Alternatives and Comparative Analysis

Providing a balanced analysis involves benchmarking the IFA-enhanced CDA strategy against other common options. This comparison highlights the unique trade-offs of the IFA approach in terms of risk, complexity, capital efficiency, and tax effectiveness.

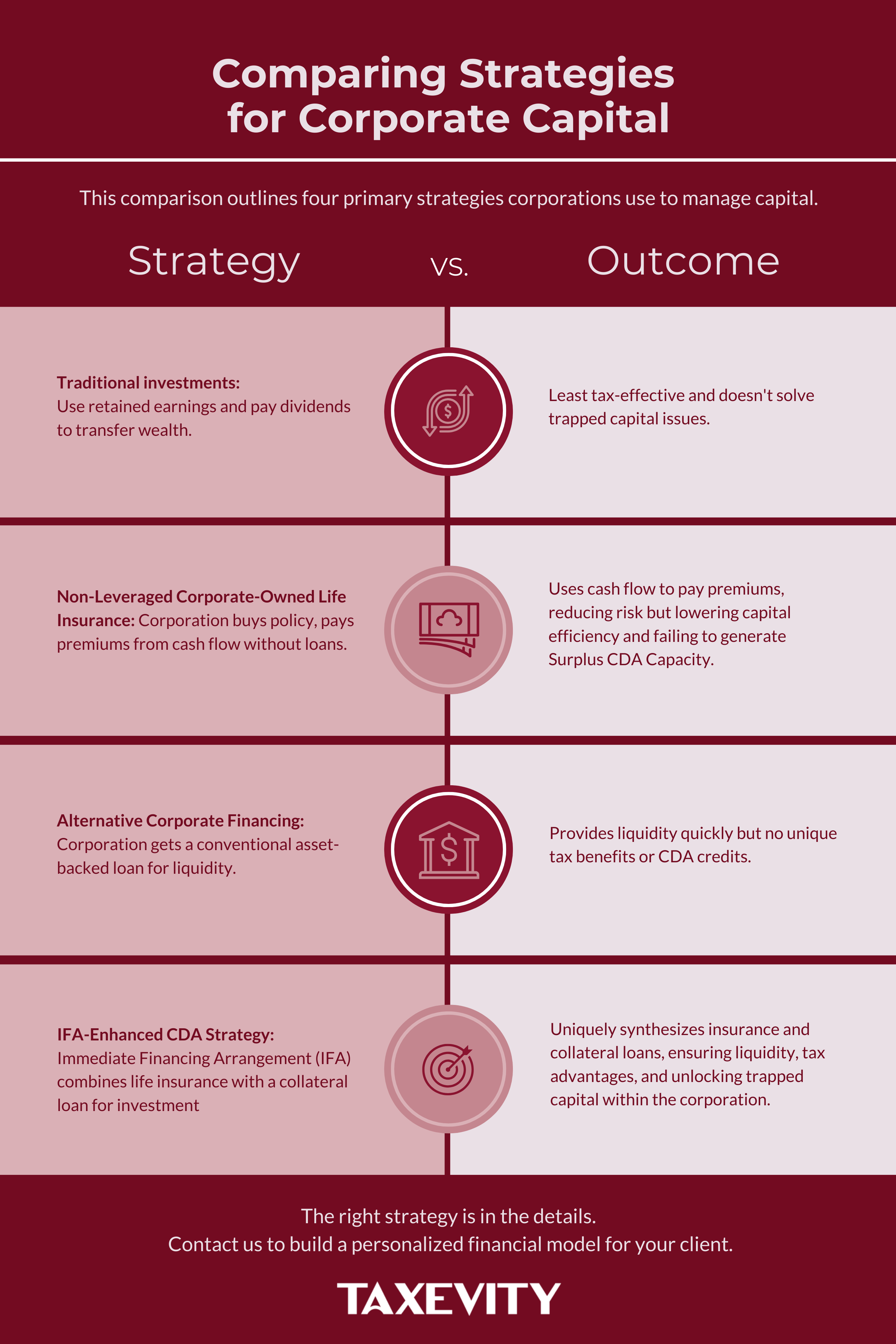

5.1 Traditional Corporate Investments and Dividend Distributions

- Description: This is the baseline scenario where the corporation invests its retained earnings in a traditional portfolio (stocks, bonds, real estate) and pays dividends to transfer wealth.

- Comparison: This is the least tax-effective strategy. Passive investment income is taxed at high corporate rates, and the after-tax capital is taxed again when distributed to shareholders as dividends which are taxed at high personal rates. This double layer of taxation results in significant value erosion and fails to solve the trapped capital problem.

5.2 Alternative Corporate Financing for Liquidity

- Description: The corporation seeks liquidity through conventional financing, such as securing a bank loan against corporate assets.

- Comparison: These methods are effective for providing immediate operational or investment capital. However, they are pure credit instruments and offer none of the unique tax advantages of the IFA-enhanced CDA strategy. They do not involve a life insurance policy and therefore create no tax-sheltered growth, no tax-free death benefit, and, critically, no CDA credit. They solve a short-term liquidity problem but do nothing to address the long-term challenge of tax-efficient wealth extraction.

5.3 Non-Leveraged Corporate-Owned Life Insurance

- Description: The corporation purchases a permanent life insurance policy, paying the annual premiums from its cash flow. There is no leverage and no third-party loan.

- Comparison: This approach is significantly less risky, as it eliminates all lender and leverage risk. However, it is far less capital-efficient, as premiums are a permanent drain on liquidity. While still highly tax-effective for transferring the value of the insurance proceeds via the CDA, it crucially creates no Surplus CDA Capacity. It provides no mechanism to shelter the corporation’s other trapped capital from dividend tax.

In summary, the IFA-enhanced CDA strategy occupies a unique niche. It is the only strategy that simultaneously provides permanent life insurance, offers immediate liquidity through leverage, and creates a powerful mechanism for the tax-free extraction of other trapped corporate capital. Other options are either less tax-effective, solve a different problem entirely, or are less risky but also less powerful.

Section 6: Conclusion and Strategic Recommendations

The IFA-enhanced CDA strategy represents one of the most potent, yet complex, tax and estate planning tools available to owners of private Canadian corporations. Its ability to transform highly-taxed trapped capital into tax-free distributions is a significant advantage, but its efficacy is matched by its risk profile and stringent implementation requirements.

6.1 Summary of Findings: A Powerful but Complex Tool

This guide’s analysis confirms that the strategy is an exceptionally powerful tool for wealth transfer. The core strength comes from the creation of a Surplus CDA Capacity, which provides a direct solution to the “trapped capital” problem. The benefits are multi-faceted, ranging from tax efficiency and estate liquidity to capital preservation.

However, these benefits do not come without risk. The strategy is a decades-long leveraged commitment sensitive to interest rates, policy performance, and lender discretion. The legal and tax framework is equally complex, demanding meticulous record-keeping and a clear, defensible non-tax purpose to withstand potential GAAR scrutiny.

Therefore, the strategy is not a universal solution but a specialized instrument for a select clientele: a Canadian-Controlled Private Corporation with a legitimate need for insurance, substantial trapped capital, strong and predictable cash flow, and a high tolerance for complexity and leverage.

6.2 Professional Guidance and Implementation Checklist

Implementing an IFA-enhanced CDA strategy requires the integrated advice of a coordinated team of independent professionals. Each expert plays a distinct and critical role in ensuring the strategy is structured correctly, managed effectively, and aligned with the client’s overall financial objectives.

- The Role of the Insurance Specialist (Taxevity): The process begins with our foundational insurance and IFA modeling. We use our proprietary models to conduct rigorous stress tests, projecting outcomes under various scenarios (e.g., changing interest rates and insurance dividend scales). The resulting financial projections form the basis upon which the other advisors conduct their analysis.

- The Role of the Accountant: The client’s accountant is essential for tax compliance and administration. Their key responsibilities include establishing a clear and unbroken accounting trail to trace the flow of borrowed funds to an eligible income-producing use, which is critical for supporting the deductibility of loan interest. They will also manage the CDA balance calculations and ensure the proper filing of the T2054 election form.

- The Role of the Tax Lawyer: The tax lawyer provides critical legal oversight. Their primary functions include reviewing the third-party IFA loan agreement—paying close attention to demand features, collateral requirements, and default provisions—and preparing a formal memorandum analyzing the strategy under the GAAR framework. This analysis, which articulates the bona fide non-tax purposes of the transactions, is vital for defending the strategy in the event of a CRA challenge.

- The Role of the Wealth Advisor: The wealth advisor assesses how the leveraged capital fits within the client’s broader investment strategy and risk tolerance. They are responsible for advising on the deployment of the loan proceeds into an appropriate portfolio of income-producing assets that aligns with the requirements for interest deductibility.

By adhering to this rigorous and disciplined team approach, advisors can help the right client harness the extraordinary power of the IFA-enhanced CDA strategy. For corporations and shareholders who meet this profile, the first step is the detailed financial modeling that Taxevity provides. To learn how we can help you and your client make an informed decision, schedule a consultation.

Further Reading