Key Question for Accountants

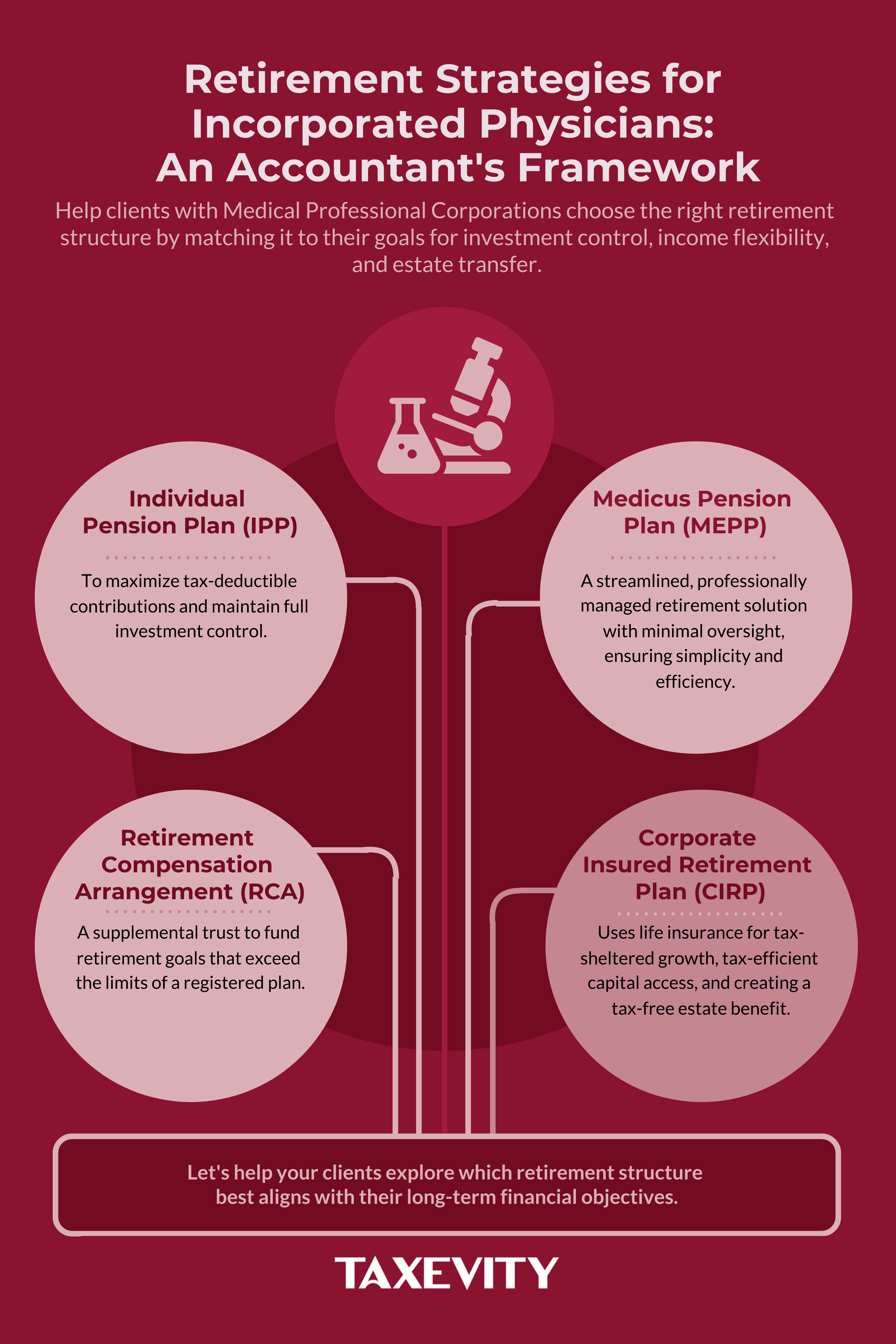

When your incorporated physician clients are presented with conflicting claims about various retirement strategies (like Medicus, IPPs, RCAs, and CIRPs), how do you cut through the hype and provide a clear, objective framework that guides them to the optimal solution for their long-term goals?

- Beyond the Deduction: A comprehensive analysis moves beyond the immediate corporate tax deduction. The most strategic differences between these plans are found in how the accumulated wealth is accessed in a tax-efficient manner and the net value ultimately transferred to an estate.

- A Strategic Framework: The most effective way to compare these options is by focusing on three core factors: the power of tax-sheltered growth, the tax-efficiency of accessing funds, and the degree of flexibility, control, and estate impact each provides. This framework clarifies whether a client should prioritize investment control (IPP), tax-free estate benefits (CIRP), or simplicity (Medicus).

- The Layered Solution: These strategies are not always mutually exclusive. The optimal solution is often a layered approach that uses a foundational registered plan (IPP or MEPP) for tax-deductible contributions, supplemented by a CIRP to provide tax-efficient liquidity and enhance the final estate value through the Capital Dividend Account (CDA).

For most Canadians, retirement planning begins and ends with a personally-funded Registered Retirement Savings Plan (RRSP). However, for your incorporated physician clients, a more powerful set of tools is available: strategies that use corporate dollars to build wealth for retirement.

Funding retirement through the corporation is generally more efficient, as it uses capital that has not yet been subjected to high personal income tax rates. This opens the door to accumulating wealth more rapidly within various tax-sheltered structures. The challenge lies in navigating the complex landscape of these corporate options. Your clients often receive siloed advice on the recently introduced Medicus Pension Plan, alongside established tools like Individual Pension Plans (IPPs), Retirement Compensation Arrangements (RCAs), and Corporate Insured Retirement Plans (CIRPs).

This guide provides a strategic framework to cut through the noise. It compares these four options, not just on their features, but on their fundamental fit for a client’s long-term goals, empowering you to facilitate a more informed decision.

Page Contents

- 1 The Core Considerations: Beyond the Initial Tax Deduction

- 2 Analyzing the Medicus Pension Plan (MEPP)

- 3 Analyzing the Individual Pension Plan (IPP)

- 4 Analyzing the Retirement Compensation Arrangement (RCA)

- 5 Analyzing the Corporate Insured Retirement Plan (CIRP)

- 6 What About HOOPP?

- 7 Structuring a Comprehensive Solution: A Layered Approach

- 8 Guiding the Client Conversation: Key Questions

- 9 Enhanced Head-to-Head Comparison

The Core Considerations: Beyond the Initial Tax Deduction

A common talking point for registered plans is the immediate tax-deductibility of corporate contributions, which provide deductions against a low corporate tax rate (e.g., 9-12%). A comprehensive analysis requires looking beyond this single data point. The more strategic questions revolve around three core factors:

- The Power of Tax-Sheltered Growth: All these strategies allow capital to accumulate in a tax-deferred environment, avoiding the annual tax drag on passive corporate investments and significantly enhancing long-term compound growth.

- The Tax-Efficiency of Retirement Access: The primary difference lies in how that accumulated value is accessed. Is it withdrawn as fully taxable income, or can it be accessed in a more tax-efficient manner?

- Flexibility, Control, and Estate Impact: The degree of control over investments, flexibility in accessing capital, and the net value transferred to an estate vary dramatically between these options.

Analyzing the Medicus Pension Plan (MEPP)

The Medicus Pension Plan is a multi-employer defined benefit pension plan (MEPP) for physicians, launched by Scotiabank in early 2022 through MD Financial Management. To help you guide your clients in their evaluation, we prepared A Doctor’s Guide to the Medicus Pension Plan: 7 Questions to Ask.

Key Features

- Simplicity & Governance: Medicus offers a hands-off approach. The plan has a formal governance structure, with 50% member representation on the Administrative Board that oversees the plan.

- Survivor Benefits: The plan provides survivor benefits, including a lifetime pension for a surviving spouse and a guarantee period.

Strategic Considerations

- Verifiable Context: When performing due diligence, it is worth noting verifiable public information. For example, in March 2024, a $700 million lawsuit was filed against Scotiabank by Blue Pier Administration Corp., alleging the Medicus plan was developed using confidential information. The allegation has not been proven in court.

- Lack of Track Record & Cost Transparency: As a new plan, Medicus has no long-term, verifiable track record for investment performance or member service. Furthermore, unlike an IPP where fees are transparent, the all-in costs within a pooled plan like Medicus can be opaque, making direct comparison difficult.

- Creditor Protection: As a registered pension trust, assets within the plan are generally protected from the claims of corporate creditors.

- Mandatory Retirement Income: Like all registered pension plans, pension payments must begin by the end of the year the member turns 71, creating a new taxable income stream the client may not need at that time.

- Opportunity Cost: Capital contributed to the plan is locked in and inaccessible until retirement, representing a significant opportunity cost.

- Treatment at Death:

- If a single person passes away during the first 15 years after income starts (called a guarantee period), 100% of their pension payments go to either a named beneficiary or their estate until the end of that fifteen year period.

- Example 1: Person A retired at age 65 and starts drawing pension income through Medicus. They pass away at age 70. For the following 10 years that are left in the 15 year guarantee period, their estate gets their full pension payments.

- Example 2: Person B retired at 65 and starts drawing pension income through Medicus. They pass away at age 81. The guarantee period is over by the time they pass away, so payments end. Any remaining value in their pension plan is absorbed by Medicus.

- If a married person passes away during the first 10 years after income starts, 100% of their pension payments go to their spouse until the end of that ten year period. After those ten years, their spouse receives 60% for the rest of their life.

- If both the pensioner and their spouse pass away during the first ten years, 100% of their pension payments go to either a named beneficiary or their estate until the end of that ten year guarantee period.

- As noted above, when pension payments end, the remaining value goes to Medicus.

- If a single person passes away during the first 15 years after income starts (called a guarantee period), 100% of their pension payments go to either a named beneficiary or their estate until the end of that fifteen year period.

Analyzing the Individual Pension Plan (IPP)

Individual Pension Plans are well-established private, defined-benefit pension plans for a single member.

Key Features

- Maximized Tax-Deductible Contributions: An IPP allows for large, tax-deductible corporate contributions, accelerating the accumulation of tax-sheltered retirement assets.

- Investment Control & Survivor Benefits: The plan member has full control over the investment strategy. Like other pension plans, IPPs can be structured to provide spousal survivor pensions and guarantee periods.

- Estate Asset: If the member dies prematurely, the remaining capital value is paid to their beneficiaries or estate as a taxable asset.

Strategic Considerations

- Funding Volatility: A market downturn can create a funding deficit, allowing the corporation to make larger, tax-deductible “catch-up” contributions—a strategic opportunity for clients with strong corporate cash flow. Conversely, strong returns can create a surplus, reducing or eliminating contribution room.

- Creditor Protection: Assets held within the IPP trust are generally shielded from the claims of corporate creditors, a significant advantage for incorporated professionals.

- Taxable Retirement Income & Mandatory Start: The IPP creates a fully taxable stream of retirement income which must begin by age 71. This income is eligible for pension income splitting.

- Opportunity Cost: Like a MEPP, funds are locked in until retirement, limiting the client’s ability to access corporate capital for other needs.

Analyzing the Retirement Compensation Arrangement (RCA)

An RCA is a long-standing, non-registered trust arrangement used to fund retirement benefits that exceed the limits of registered plans.

Key Features

- Supplemental Retirement Funding: The primary use of an RCA is to tax-efficiently set aside corporate funds for high-income earners whose retirement goals exceed what an IPP can provide.

- Contribution Deductibility: Corporate contributions to the RCA trust are tax-deductible.

Strategic Considerations

- The 50% Refundable Tax & Opportunity Cost: The core mechanic of an RCA involves 50% of all contributions being remitted to the CRA as a refundable tax. This creates a significant opportunity cost on half the capital, which cannot be invested.

- Creditor Protection: Like an IPP, assets held in an RCA trust are generally protected from corporate creditors.

- Taxable Benefits & Flexible Start: All payments from the RCA are fully taxable (though eligible for pension income splitting). However, there is no mandated age at which income must begin, if ever.

Analyzing the Corporate Insured Retirement Plan (CIRP)

The CIRP is a strategy using a corporate-owned, cash-value life insurance policy as a tax-sheltered growth vehicle.

Key Features

- Tax-Sheltered Growth: The cash value within the policy grows on a tax-deferred basis, and this growth is generally not considered passive income, which helps preserve the Small Business Deduction (SBD).

- Tax-Efficient Access to Capital: The strategy allows for access to the accumulated policy value via a collateral loan. While the loan proceeds are received tax-free and the loan interest is generally capitalized, the structure typically requires the shareholder to pay an annual guarantee fee to the corporation to avoid a taxable shareholder benefit.

- Tax-Free Estate Benefit: Upon death, the insurance proceeds are paid to the corporation tax-free and create a significant credit to the Capital Dividend Account (CDA), allowing capital to be distributed to the estate tax-free, net of the outstanding loan.

Strategic Considerations

- No Contribution Deduction: Premiums are paid with after-tax corporate dollars, representing a strategic trade-off of a small, immediate tax benefit for long-term tax efficiency and flexibility.

- Creditor Protection: The level of creditor protection depends on the corporate structure. A policy held in an operating company may be exposed to that company’s creditors. To achieve robust protection, the policy is typically placed within a separate holding company.

- Opportunity Cost & Capital Efficiency: While premiums represent an opportunity cost, this can be significantly mitigated. The policy’s cash value can be accessed at any time via collateral loan for other needs. Furthermore, an IFA-Enhanced CIRP can be structured to use the same corporate capital for two purposes simultaneously, dramatically improving capital efficiency.

- No Mandatory Retirement Income: There is no requirement to start taking income at any specific age, or at all.

What About HOOPP?

For Ontario-based clients, the Healthcare of Ontario Pension Plan (HOOPP) is a relevant alternative. As one of Canada’s largest and most successful not-for-profit MEPPs, it is now open to physicians operating through their own MPC. While it offers a strong track record, it is an Ontario-specific plan, raising portability concerns for clients who may move. Like other registered plans, it requires income to begin by age 71 and offers no direct estate value beyond survivor benefits.

Structuring a Comprehensive Solution: A Layered Approach

These strategies are not always mutually exclusive. The optimal solution is often a layered approach built around a foundational choice, supplemented by other tools:

- The Foundational Choice (IPP vs. MEPP): The first step is to choose a primary registered pension plan to maximize tax-deductible contributions. This is a direct choice between a customized plan with full control (IPP) and a simplified, managed group plan (Medicus/HOOPP).

- Supplemental Savings (RCA): If a client’s retirement income goals exceed what a registered plan can provide, an RCA can be layered on top to fund the difference.

- Tax, Estate & Liquidity Planning (CIRP): The CIRP is best viewed not as a direct competitor to pension plans, but as a strategic layer to provide tax-efficient liquidity, enhance estate value through the CDA, and fund other corporate goals.

Guiding the Client Conversation: Key Questions

To help your physician clients determine the best structure for their needs, consider framing your discussion around these strategic questions:

- Control vs. Simplicity: How important is it for you to control the investment strategy versus having a hands-off, managed solution?

- Access to Capital: Do you foresee needing access to your corporate capital for opportunities or personal needs before retirement?

- Income Flexibility: In retirement, do you prefer a predictable, mandatory income stream starting at age 71, or the flexibility to draw income only when you need it?

- Legacy and Estate Goals: Is maximizing the tax-efficient transfer of wealth to your heirs a primary objective for you?

Enhanced Head-to-Head Comparison

| Feature | Medicus (MEPP) | IPP | RCA | CIRP |

| Plan Type | Registered DB Pension | Registered DB Pension | Non-Registered Trust | Non-Registered Strategy |

| Contribution Deductibility | Yes (Corp. Rate) | Yes (Corp. Rate) | Yes (Corp. Rate) | No |

| Mandatory Income Start | By Age 71 | By Age 71 | No | No |

| Tax-Sheltered Growth | Yes | Yes | Partially (50% tax) | Yes |

| Investment Control | None | Full Control | Full Control | Varies by policy |

| Creditor Protection | Strong (Trust) | Strong (Trust) | Strong (Trust) | Complex (Requires Holdco) |

| Key Risks | Sponsor/Plan Risk | Market/Funding Risk | Opportunity Cost Risk | Leverage/Tax Risk |

| Estate Benefit | Survivor Pension | Taxable Residual Value | Taxable Residual Value | Tax-Free Death Benefit & CDA Credit |

From Advisor to Integrator: Your Role in the Decision

As the accountant, you can facilitate an objective analysis by insisting that proponents for each strategy provide proposals based on a consistent set of assumptions. This integrated approach elevates your role to that of a strategic coordinator, helping to align the chosen financial tools with the client’s long-term objectives.

To discuss how we can support you in this process, we invite you to schedule a chat.